Workhorse Group Reports Second Quarter 2023 Results CINCINNATI, August 8, 2023 -- Workhorse Group Inc. (Nasdaq: WKHS) (“Workhorse” or “the Company”), an American technology company with a vision to pioneer the transition to zero emission commercial vehicles, today reported financial results for the second quarter ended June 30, 2023. Management Commentary “Our second quarter performance demonstrates the ongoing progress we are making on our path forward to grow and further position Workhorse for success,” said Workhorse CEO Rick Dauch. “During the quarter, we continued to advance our product roadmaps, ramp up production and expand our commercial relationships. We were pleased to increase production and delivery of our W4 CC vehicles and delivered our first W750 to a customer. The W56 program is also on track to begin production in the third quarter of this year. Our Aerospace business is continuing to make important strides, including signing our first commercial drone purchase order and recording our first sales for HorseFly™ during the second quarter. Aero also was awarded a $900,000 follow-up grant for drone-based sensor work in Mississippi in support of the USDA.” Mr. Dauch continued, “The entire Workhorse team is moving full speed ahead on our operational and strategic initiatives and is intently focused on execution and operating efficiently. We are building a strong foundation and are confident we have established a solid business well positioned for growth and value creation for our shareholders, customers and communities.” Second Quarter 2023 and Recent Operational Highlights Workhorse delivered on its operational priorities in the second quarter: • Received purchase orders for 62 vehicles, including the first two purchase orders for the W56, and delivered 42 Class 4 (W4 CC/W750) vehicles to customers as Workhorse expands its dealer network. • Conducted several customer EV demonstrations, including a full-day field test of the W750 with the City of Los Angeles; showcased the W56 at CALSTART’s electric vehicle event in Washington D.C., highlighting Workhorse’s family of last-mile delivery vehicles. • Received first commercial drone purchase order for HorseFly™ and finalized preparation for drone assembly in Mason, Ohio facility. • Established Burr Truck and Trailer Sales as the first certified Workhorse dealer in New York state and the Northeast region of the country. • Established EVC/Smyrna Truck as Workhorse’s first certified EV dealer and body builder in Georgia. • Western Truck Exchange was also added as a certified Workhorse dealer, expanding the Company’s existing California presence to the Los Angeles metropolitan area.

• Shipped 53 Tropos vehicles which were assembled in Union City year-to-date. The Company expects volumes to increase in the second half of 2023. • Completed Phase 1 implementation of the Company’s ERP system, which will support operational efficiencies as Workhorse ramps up production of its products. Executing Strategic Commercial Vehicle Product Roadmap Workhorse is executing against its strategic product roadmap for its electric vehicle delivery offerings. • W4 CC/W750: During the second quarter, the Company received orders for 60 vehicles and delivered 42 Class 4 vehicles to customers. Expanding the customer product line-up, Workhorse started regular production of the W750 program at its manufacturing facility in Union City, Indiana. • W56: The W56 program remains on track for start of production in September 2023. The Company secured two purchase orders and is poised to capture the significant demand generated since unveiling the production intent vehicle in multiple industry conferences. Workhorse showcased its W56 vehicle to members of Congress, policy makers, and other federal officials at the “Driving the Future: An Electric Vehicle Event” on June 7 in Washington D.C., offering attendees the opportunity to tour and drive the vehicle. • Stables by Workhorse: Workhorse’s Stables operation continues to provide important experience in last mile package delivery service for FedEx Ground and has organically expanded its route assignments. The Company now has five Class 4 EV units in the delivery fleet and expects to add W56 vehicles to the fleet in Q4 2023. The Company is also reviewing options to open a second location in an incentive-supported state to contribute valuable insight for the planned EV transition whitepaper. Progress in Aerospace Commercialization Workhorse achieved notable milestones during the second quarter including: • Signed its first commercial drone purchase order and sales for HorseFly. • Completed demonstrations of simultaneous delivery by multiple aircraft for two potential last mile delivery customers and industry partners. • Held demonstrations for the U.S. military and successfully conducted field testing of the HALO drone internationally. • The Company’s drone engineering, technical design and production facility in Mason, Ohio is ready for drone assembly.

• Completed flying in Arkansas and Mississippi to support the U.S. Department of Agriculture (USDA) government programs for underserved farmers and ranchers. • Received a new $900,000 drone-based scanning grant with the USDA in Mississippi and expect to commence flying in Q3 2023. Second Quarter Financial Results Gross sales for the second quarter of 2023 were recorded at $6.4 million less an allowance of $2.4 million for potential HVIP voucher impact while CARB finalizes Workhorse’s HVIP eligibility. Sales, net of returns and allowances for the second quarter of 2023 were $4.0 million compared to $0.0 million in the same period last year. The increase in sales is primarily due to sales volume of the W4 CC vehicle in the current period. Cost of sales increased to $8.4 million from $3.0 million in the same period last year. The increase in cost of sales was primarily due to a $4.8 million increase in costs related to vehicle sales and a $0.6 million increase in employee compensation and related expenses. Selling, general and administrative (“SG&A”) expenses increased to $14.0 million from $13.0 million in the same period last year. The increase was primarily driven by a $0.5 million increase in employee compensation and related expenses, including non-cash stock-based compensation expense, a $0.4 million increase in professional services, and a $0.5 million increase in other operational expenses. The increase was partially offset by a $0.6 million decrease in legal expenses. Research and development (“R&D”) expenses stayed consistent during the three months ended June 30, 2023 and 2022 at $5.1 million and $5.0 million, respectively. Net interest income was $0.5 million compared to $0.1 million of interest expense in the same period last year. Net interest income in the current year period was driven by interest earned on cash in the Company’s money market investment account. Net loss for the quarter ended June 30, 2023 was $23.0 million compared to net loss of $21.2 million in the same quarter last year. Loss from operations for the second quarter was $23.5 million compared to $21.1 million in the same quarter last year. As of June 30, 2023, the Company had approximately $62.4 million in cash and cash equivalents. 2023 Guidance Based on improved clarity gained from the emerging commercial EV market experience in the first half of the year, Workhorse now expects to generate between $65-85 million in revenue for calendar year 2023 due primarily to two factors: the availability of HVIP vouchers through GreenPower Motor Company for the W4 CC and W750 vehicles in the California market as well as longer than expected certification testing which may delay the W56 production launch by approximately 45 days. “The Workhorse team is ramping up production and deliveries for our products while taking steps to expand our dealer network and ensure we have the financial resources to achieve our strategic goals,” said Workhorse CFO Bob Ginnan. “We have built a strong foundation in all areas of our business and are

confident in our ability to deliver continued revenue growth and enhanced shareholder value in the near-term.” Conference Call Workhorse management will hold a conference call today (August 8, 2023) at 10:00 a.m. Eastern time (7:00 a.m. Pacific time) to discuss these results and answer related questions. U.S. dial-in: 877-407-8289 International dial-in: 201-689-8341 Please call the conference telephone number 10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860. The conference call will be broadcast live and available for replay here and via the Investor Relations section of Workhorse's website. A telephonic replay of the conference call will be available after 1:00 p.m. Eastern time on the same day through August 15, 2023. Toll-free replay number: 877-660-6853 International replay number: 201-612-7415 Replay ID: 13740455 Special Meeting of Stockholders Workhorse is holding a virtual Special Meeting of Stockholders on August 28, 2023 at 10:30 a.m. Eastern Time to vote on increasing the number of authorized shares of Workhorse common stock. Workhorse shareholders of record at the close of business on July 10, 2023 are entitled to vote at or in advance of the Special Meeting. The Workhorse Board of Directors unanimously recommends that shareholders vote “FOR” the proposal today. ISS recommends voting “FOR” this proposal. For more information, please visit www.VoteWKHS.com. About Workhorse Group Inc. Workhorse is a technology company focused on providing ground and air-based electric vehicles to the last-mile delivery sector. As an American original equipment manufacturer, we design and build high performance, battery-electric trucks and drones. Workhorse also develops cloud-based, real-time telematics performance monitoring systems that are fully integrated with our vehicles and enable fleet operators to optimize energy and route efficiency. All Workhorse vehicles are designed to make the movement of people and goods more efficient and less harmful to the environment. For additional information visit workhorse.com. Forward-Looking Statements The discussions in this press release contain forward-looking statements reflecting our current expectations that involve risks and uncertainties. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. When used in this press release,

the words “anticipate,” “expect,” “plan,” “believe,” “seek,” “estimate” and similar expressions are intended to identify forward-looking statements. These are statements that relate to future periods and include, but are not limited to, statements about the features, benefits and performance of our products, our ability to introduce new product offerings and increase revenue from existing products, expected expenses including those related to selling and marketing, product development and general and administrative, our beliefs regarding the health and growth of the market for our products, anticipated increase in our customer base, expansion of our products functionalities, expected revenue levels and sources of revenue, expected impact, if any, of legal proceedings, the adequacy of liquidity and capital resources, and expected growth in business. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from the forward-looking statements contained in this press release. Factors that could cause actual results to differ materially include, but are not limited to: our ability to develop and manufacture our new product portfolio, including the W4 CC, W750, W56 and WNext platforms; our ability to attract and retain customers for our existing and new products; risks associated with obtaining orders and executing upon such orders; the unavailability, reduction, elimination or adverse application of government subsidies, incentives and regulations; supply chain disruptions, including constraints on steel, semiconductors and other material inputs and resulting cost increases impacting our company, our customers, our suppliers or the industry; our ability to capitalize on opportunities to deliver products to meet customer requirements; our limited operations and need to expand and enhance elements of our production process to fulfill product orders; our inability to raise additional capital to fund our operations and business plan; our inability to maintain our listing of our securities on the Nasdaq Capital Market; the ability to protect our intellectual property; market acceptance for our products; our ability to control our expenses; potential competition, including without limitation shifts in technology; volatility in and deterioration of national and international capital markets and economic conditions; global and local business conditions; acts of war (including without limitation the conflict in Ukraine) and/or terrorism; the prices being charged by our competitors; our inability to retain key members of our management team; our inability to satisfy our customer warranty claims; the outcome of any regulatory or legal proceedings; and other risks and uncertainties and other factors discussed from time to time in our filings with the Securities and Exchange Commission ("SEC"), including under the “Risk Factors” section of our filings with the SEC. Forward-looking statements speak only as of the date hereof. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based, except as required by law. Media Contact Aaron Palash / Greg Klassen Joele Frank, Wilkinson Brimmer Katcher 212-355-4449 Investor Relations Contact: Matt Glover and Tom Colton Gateway Investor Relations 949-574-3860 [email protected]

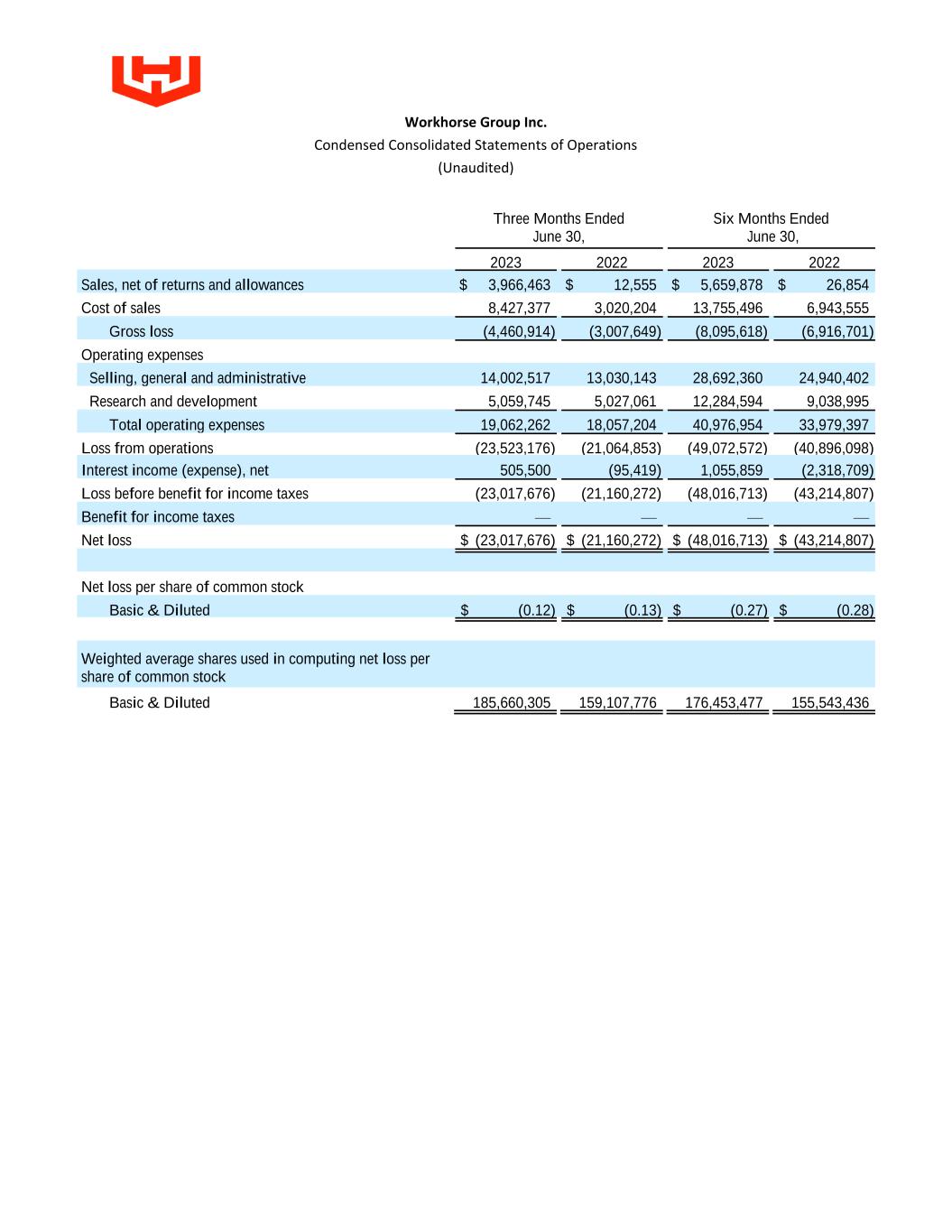

Workhorse Group Inc. Condensed Consolidated Statements of Operations (Unaudited) Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Sales, net of returns and allowances $ 3,966,463 $ 12,555 $ 5,659,878 $ 26,854 Cost of sales 8,427,377 3,020,204 13,755,496 6,943,555 Gross loss (4,460,914) (3,007,649) (8,095,618) (6,916,701) Operating expenses Selling, general and administrative 14,002,517 13,030,143 28,692,360 24,940,402 Research and development 5,059,745 5,027,061 12,284,594 9,038,995 Total operating expenses 19,062,262 18,057,204 40,976,954 33,979,397 Loss from operations (23,523,176) (21,064,853) (49,072,572) (40,896,098) Interest income (expense), net 505,500 (95,419) 1,055,859 (2,318,709) Loss before benefit for income taxes (23,017,676) (21,160,272) (48,016,713) (43,214,807) Benefit for income taxes — — — — Net loss $ (23,017,676) $ (21,160,272) $ (48,016,713) $ (43,214,807) Net loss per share of common stock Basic & Diluted $ (0.12) $ (0.13) $ (0.27) $ (0.28) Weighted average shares used in computing net loss per share of common stock Basic & Diluted 185,660,305 159,107,776 176,453,477 155,543,436

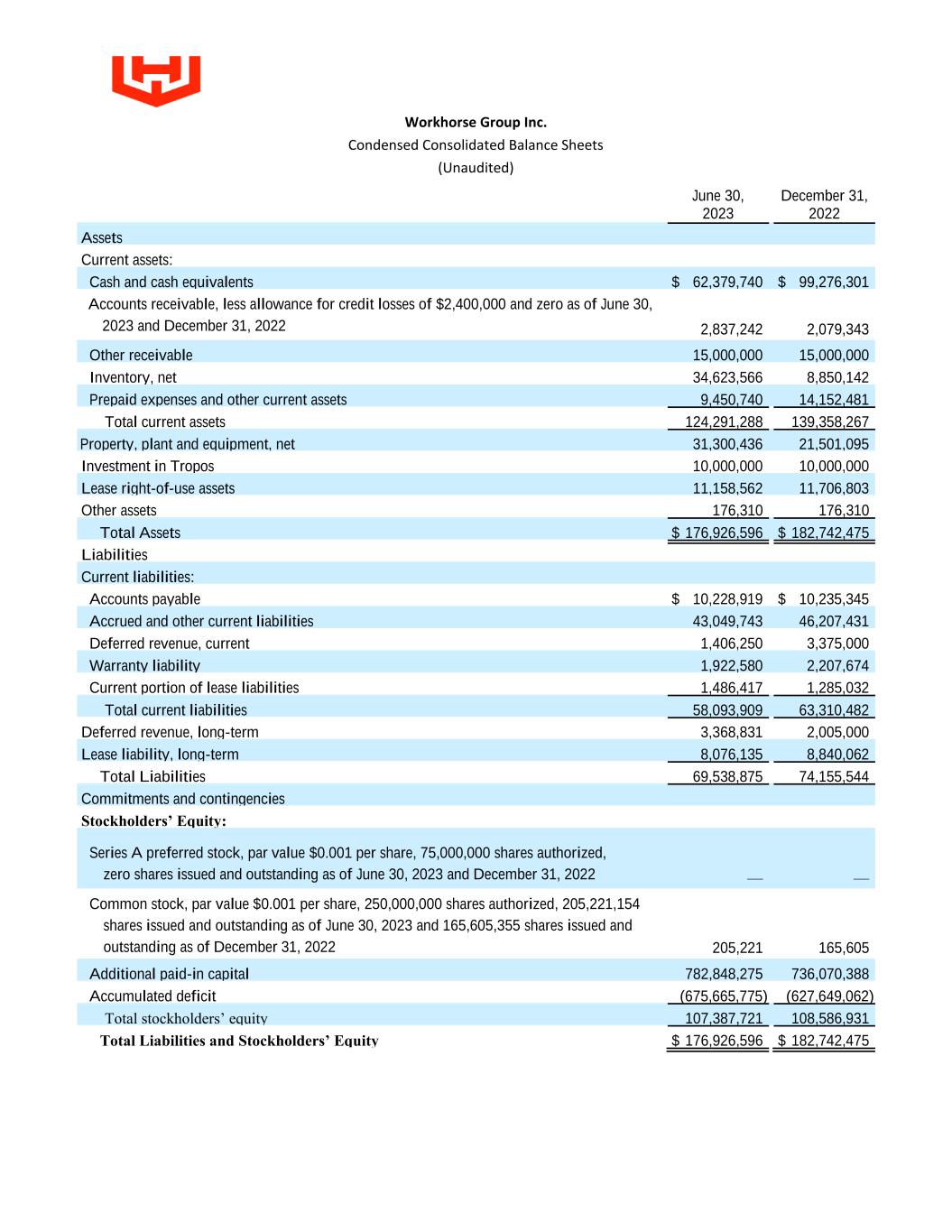

Workhorse Group Inc. Condensed Consolidated Balance Sheets (Unaudited) June 30, 2023 December 31, 2022 Assets Current assets: Cash and cash equivalents $ 62,379,740 $ 99,276,301 Accounts receivable, less allowance for credit losses of $2,400,000 and zero as of June 30, 2023 and December 31, 2022 2,837,242 2,079,343 Other receivable 15,000,000 15,000,000 Inventory, net 34,623,566 8,850,142 Prepaid expenses and other current assets 9,450,740 14,152,481 Total current assets 124,291,288 139,358,267 Property, plant and equipment, net 31,300,436 21,501,095 Investment in Tropos 10,000,000 10,000,000 Lease right-of-use assets 11,158,562 11,706,803 Other assets 176,310 176,310 Total Assets $ 176,926,596 $ 182,742,475 Liabilities Current liabilities: Accounts payable $ 10,228,919 $ 10,235,345 Accrued and other current liabilities 43,049,743 46,207,431 Deferred revenue, current 1,406,250 3,375,000 Warranty liability 1,922,580 2,207,674 Current portion of lease liabilities 1,486,417 1,285,032 Total current liabilities 58,093,909 63,310,482 Deferred revenue, long-term 3,368,831 2,005,000 Lease liability, long-term 8,076,135 8,840,062 Total Liabilities 69,538,875 74,155,544 Commitments and contingencies Stockholders’ Equity: Series A preferred stock, par value $0.001 per share, 75,000,000 shares authorized, zero shares issued and outstanding as of June 30, 2023 and December 31, 2022 — — Common stock, par value $0.001 per share, 250,000,000 shares authorized, 205,221,154 shares issued and outstanding as of June 30, 2023 and 165,605,355 shares issued and outstanding as of December 31, 2022 205,221 165,605 Additional paid-in capital 782,848,275 736,070,388 Accumulated deficit (675,665,775) (627,649,062) Total stockholders’ equity 107,387,721 108,586,931 Total Liabilities and Stockholders’ Equity $ 176,926,596 $ 182,742,475