Workhorse Group Reports First Quarter 2023 Results CINCINNATI, May 15, 2023 -- Workhorse Group Inc. (Nasdaq: WKHS ) (“Workhorse” or “the Company”) an American technology company with a vision to pioneer the transition to zero emission commercial vehicles, today reported financial results for the first quarter ended March 31, 2023. Management Commentary “Following our stabilize, fix and grow turnaround framework, we have rebuilt Workhorse’s foundation and are executing on our product portfolio roadmap, including moving forward with production and deliveries,” said Workhorse CEO Rick Dauch. “In the first quarter, we continued to advance our commercial vehicle programs. The W4 CC is now in regular production, we completed the W750 pilot builds and expect to start production during Q2 2023. We are on track to meet our annual sales targets based on firm and forecasted customer orders.” Mr. Dauch continued, “We also remain on schedule to begin production of the all-new W56 step-van and strip chassis units in the third quarter. We are encouraged by customer feedback we received at recent industry conferences where we unveiled the W56, held test drive sessions, and displayed a services upfitted version of the W4 CC. Additionally, our Aerospace business continues to hold flight demonstrations with prospective government and commercial customers.” Mr. Dauch concluded, “Looking ahead, our focus remains on executing our growth strategy of delivering quality products to our customers. We are making steady progress in expanding our CV dealer network and plan to onboard 8-10 new dealers in 2023. Although we recognize there is still significant work ahead of us, we are confident that the actions we are taking today will establish a platform to drive growth and create value for our shareholders, customers and communities.” First Quarter 2023 and Recent Operational Highlights Since the start of the year, Workhorse made progress across its strategic and operating priorities: Ramped up production of its W4 CC vehicles in its transformed Union City, Indiana plant. The Company is currently producing 16 units/week and plans to ramp up to 25 units/week by Q3. The Company expects to begin production of the W750 in Q2 2023. Successfully unveiled the W56 production intent vehicle at the NTEA Work Truck Show® in Indianapolis in March and featured a fully subscribed ride-and-drive session at the Advanced Clean Transportation Expo in Anaheim, California in May. Delivered 18 Tropos vehicles in Q1 2023, which were assembled in Workhorse’s Union City plant. Volumes for final assembly in the U.S. market are expected to reach about 2,000 units per year once ramp-up is complete. Made strides in Aerospace, having successfully completed a number of demonstrations for potential last-mile delivery customers, industry partners and government agencies and officials.

Executed on Stables & Stalls package delivery routes for FedEx Ground. The Company expects to complete the transition to electrify the Lebanon fleet by the end of Q2 2023. Completed facility improvements at the Company’s drone engineering, technical design and production facility in Mason, Ohio and on track to install an end-of-line dynamometer and paint line in Union City ahead of the W56 launch in Q3 2023. Executing Strategic Commercial Vehicle Product Roadmap Workhorse is making progress on its strategic product roadmap for its electric vehicle delivery offerings: W4 CC/W750: After receiving the GreenPower chassis units at the end of December 2022, Workhorse worked to modify and upgrade these base units to fully meet both internal and commercial industry quality standards. This process took longer than expected to work through a few component delivery issues, specifically light bezels, cab heaters, back panel covers and liners. As a result, the Company delivered 10 trucks during Q1 2023. However, Workhorse expeditiously resolved the issues and is currently delivering an additional 40 trucks from inventory to fulfill a fully executed purchase order. The Company remains on track to meet full year 2023 delivery targets for the year. The initial W750 pilot builds are complete, design changes have been made and suppliers have been sourced. Production and shipment of W750s to customers are expected to begin during Q2, 2023. W56: The W56 program remains on track for start of production in Q3 2023. The Company successfully unveiled the new step-van vehicle at the NTEA Work Truck Show in Indianapolis and had a fully subscribed ride-and-drive session at the ACT Expo in Anaheim, California last week. Both events garnered significant positive feedback from potential customers. WNext: The Company has plans to develop a next-generation vehicle with an accessible low floor frame, improved ride and handling, efficient lightweight systems, and advanced technology. Workhorse will focus on prototype design, test and build in 2023 and 2024 with production planned to begin 2025. Stables & Stalls: Workhorse’s Stables & Stalls provides services and charging infrastructure to support small fleet operators with EV powered fleets. The Company recently renewed its contract to deliver last mile packages for FedEx Ground in Ohio. Workhorse is continuing to review options to open a second operational location in an incentive supported state. Progress in Aerospace Commercialization Workhorse achieved important milestones in its Aerospace business including: Nearing reception of U.S. government purchase order for a FALCON drone system from the US Air Force, for use by the North Spark Defense Laboratory, located at Grand Forks USAF Base in North Dakota.

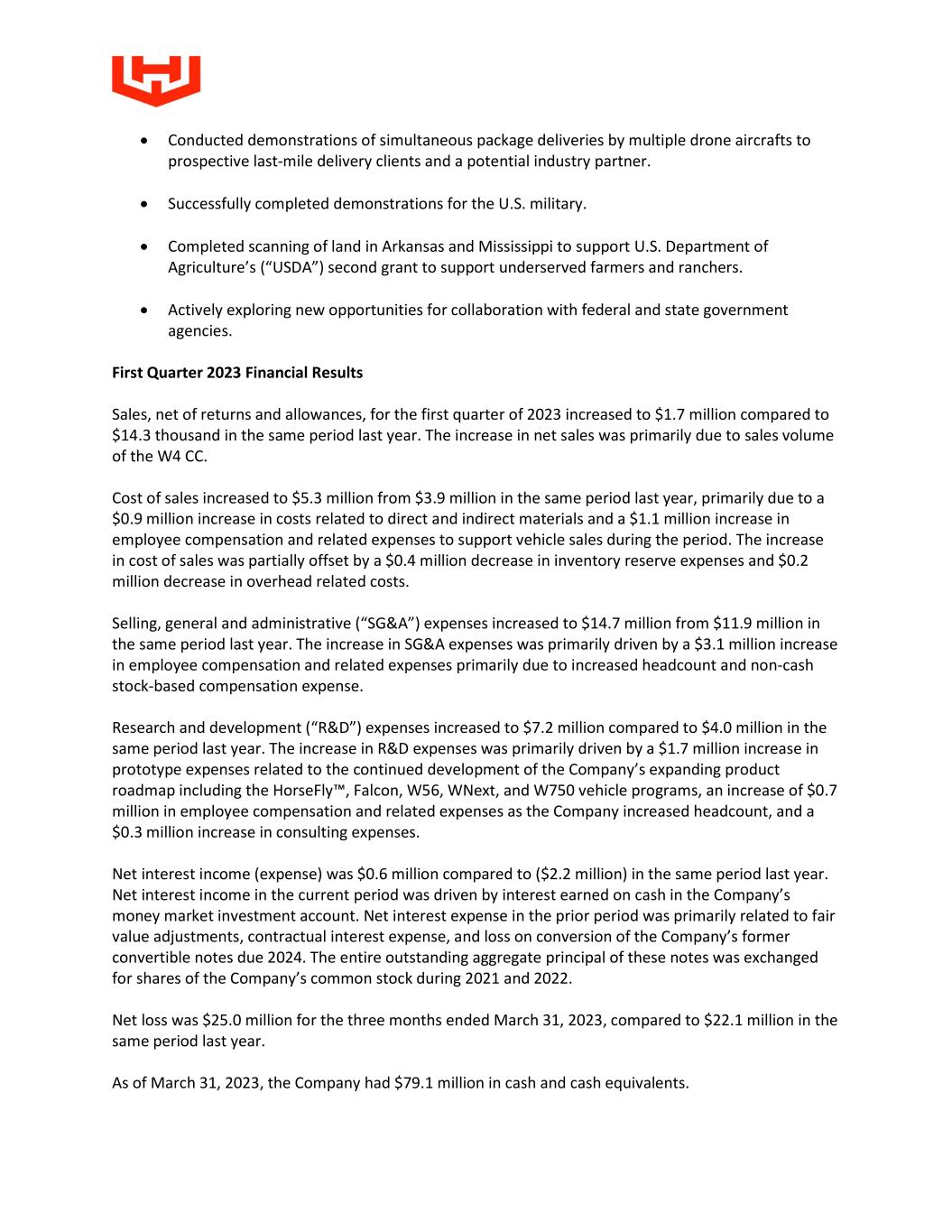

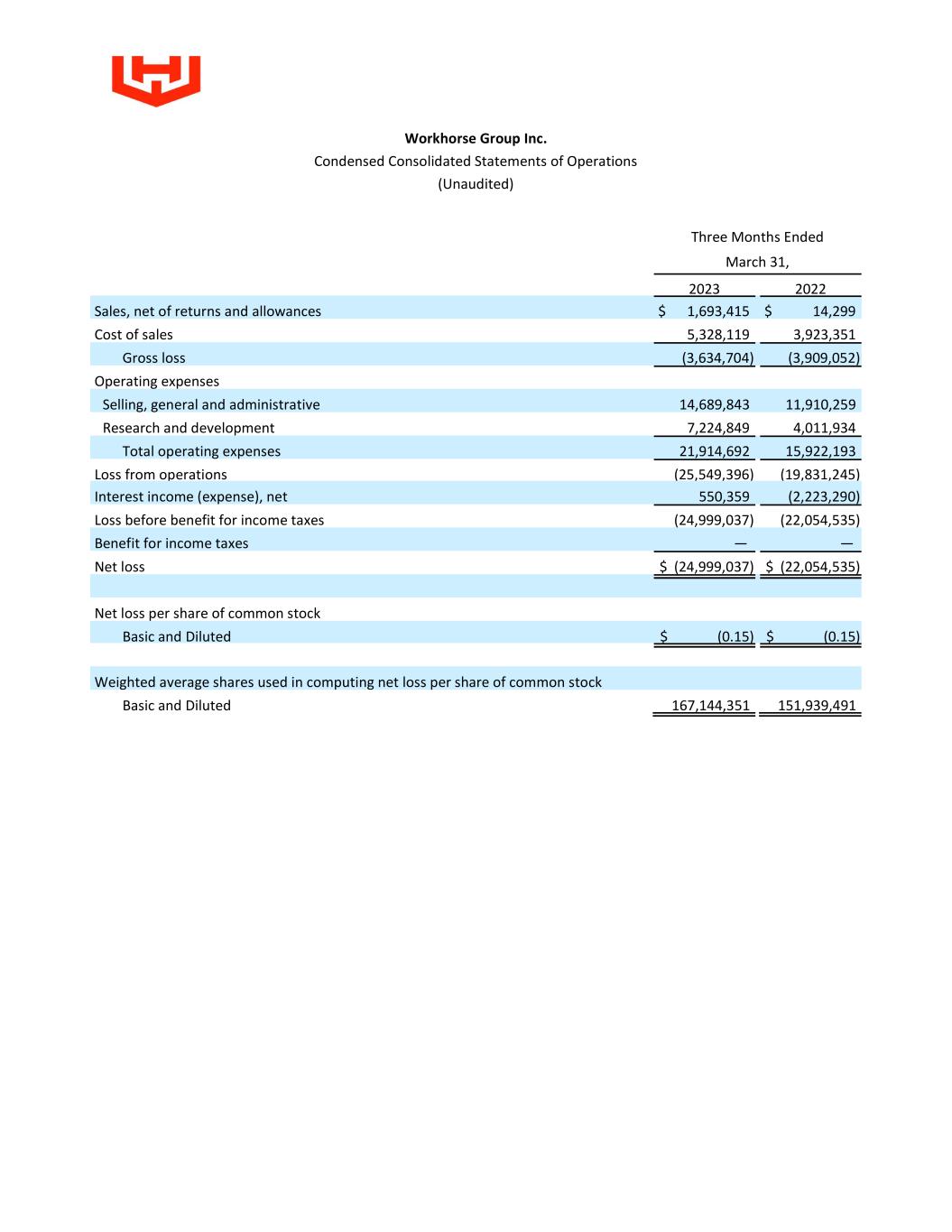

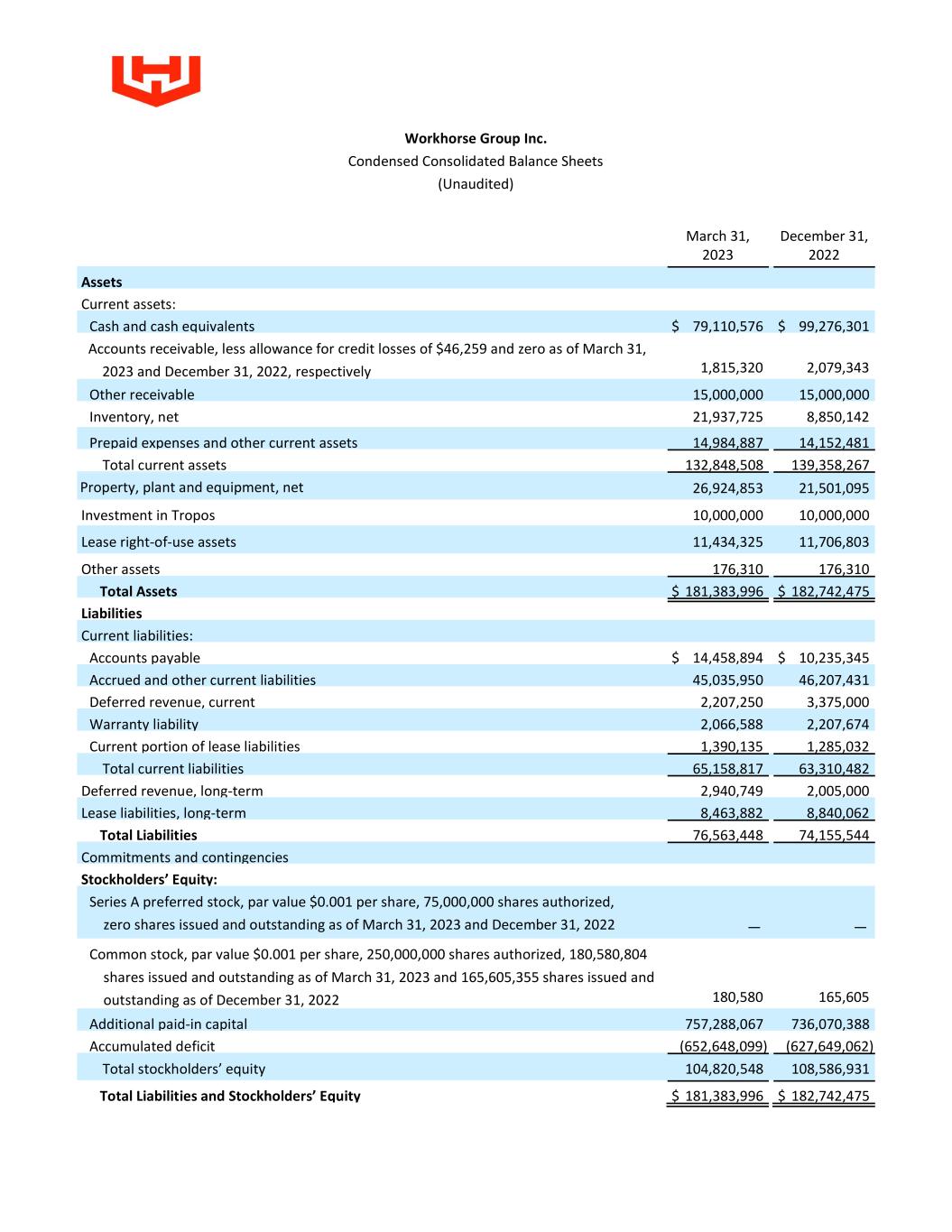

Conducted demonstrations of simultaneous package deliveries by multiple drone aircrafts to prospective last-mile delivery clients and a potential industry partner. Successfully completed demonstrations for the U.S. military. Completed scanning of land in Arkansas and Mississippi to support U.S. Department of Agriculture’s (“USDA”) second grant to support underserved farmers and ranchers. Actively exploring new opportunities for collaboration with federal and state government agencies. First Quarter 2023 Financial Results Sales, net of returns and allowances, for the first quarter of 2023 increased to $1.7 million compared to $14.3 thousand in the same period last year. The increase in net sales was primarily due to sales volume of the W4 CC. Cost of sales increased to $5.3 million from $3.9 million in the same period last year, primarily due to a $0.9 million increase in costs related to direct and indirect materials and a $1.1 million increase in employee compensation and related expenses to support vehicle sales during the period. The increase in cost of sales was partially offset by a $0.4 million decrease in inventory reserve expenses and $0.2 million decrease in overhead related costs. Selling, general and administrative (“SG&A”) expenses increased to $14.7 million from $11.9 million in the same period last year. The increase in SG&A expenses was primarily driven by a $3.1 million increase in employee compensation and related expenses primarily due to increased headcount and non-cash stock-based compensation expense. Research and development (“R&D”) expenses increased to $7.2 million compared to $4.0 million in the same period last year. The increase in R&D expenses was primarily driven by a $1.7 million increase in prototype expenses related to the continued development of the Company’s expanding product roadmap including the HorseFly™, Falcon, W56, WNext, and W750 vehicle programs, an increase of $0.7 million in employee compensation and related expenses as the Company increased headcount, and a $0.3 million increase in consulting expenses. Net interest income (expense) was $0.6 million compared to ($2.2 million) in the same period last year. Net interest income in the current period was driven by interest earned on cash in the Company’s money market investment account. Net interest expense in the prior period was primarily related to fair value adjustments, contractual interest expense, and loss on conversion of the Company’s former convertible notes due 2024. The entire outstanding aggregate principal of these notes was exchanged for shares of the Company’s common stock during 2021 and 2022. Net loss was $25.0 million for the three months ended March 31, 2023, compared to $22.1 million in the same period last year. As of March 31, 2023, the Company had $79.1 million in cash and cash equivalents.

2023 Guidance Workhorse is reaffirming its outlook and expects to generate between $75-125 million in revenue in 2023. “The Workhorse team is focused on execution and financial discipline,” said Workhorse CFO Bob Ginnan. “We expect to ramp up production and delivery throughout the rest of the year, which will generate significant revenue growth in 2023. At the same time, we are managing our cash burn well and enhancing our systems internally to make us an even more efficient organization.” Conference Call Workhorse management will hold a conference call today (May 15, 2023) at 10:00 a.m. Eastern time (7:00 a.m. Pacific time) to discuss these results and answer related questions. U.S. dial-in: 877-407-8289 International dial-in: 201-689-8341 Please call the conference telephone number 10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860. The conference call will be broadcast live and available for replay here and via the Investor Relations section of Workhorse's website. A telephonic replay of the conference call will be available after 1:00 p.m. Eastern time on the same day through May 22, 2023. Toll-free replay number: 877-660-6853 International replay number: 201-612-7415 Replay ID: 13738511 About Workhorse Group Inc. Workhorse is a technology company focused on providing ground and air based electric vehicles to the last-mile delivery sector. As an American original equipment manufacturer, we design and build high performance, battery-electric trucks and drones. Workhorse also develops cloud-based, real-time telematics performance monitoring systems that are fully integrated with our vehicles and enable fleet operators to optimize energy and route efficiency. All Workhorse vehicles are designed to make the movement of people and goods more efficient and less harmful to the environment. For additional information visit workhorse.com. Forward-Looking Statements The discussions in this press release contain forward-looking statements reflecting our current expectations that involve risks and uncertainties. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. When used in this press release, the words “anticipate,” “expect,” “plan,” “believe,” “seek,” “estimate” and similar expressions are intended to identify forward-looking statements. These are statements that relate to future periods and include, but are not limited to, statements about the features, benefits

and performance of our products, our ability to introduce new product offerings and increase revenue from existing products, expected expenses including those related to selling and marketing, product development and general and administrative, our beliefs regarding the health and growth of the market for our products, anticipated increase in our customer base, expansion of our products functionalities, expected revenue levels and sources of revenue, expected impact, if any, of legal proceedings, the adequacy of liquidity and capital resources, and expected growth in business. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from the forward-looking statements contained in this press release. Factors that could cause actual results to differ materially include, but are not limited to: our ability to develop and manufacture our new product portfolio, including the W4 CC, W750, W56 and WNext platforms; our ability to attract and retain customers for our existing and new products; risks associated with obtaining orders and executing upon such orders; supply chain disruptions, including constraints on steel, semiconductors and other material inputs and resulting cost increases impacting our company, our customers, our suppliers or the industry; our ability to capitalize on opportunities to deliver products to meet customer requirements; our limited operations and need to expand and enhance elements of our production process to fulfill product orders; our inability to raise additional capital to fund our operations and business plan; our inability to maintain our listing of our securities on the Nasdaq Capital Market; the ability to protect our intellectual property; market acceptance for our products; our ability to control our expenses; potential competition, including without limitation shifts in technology; volatility in and deterioration of national and international capital markets and economic conditions; global and local business conditions; acts of war (including without limitation the conflict in Ukraine) and/or terrorism; the prices being charged by our competitors; our inability to retain key members of our management team; our inability to satisfy our customer warranty claims; the outcome of any regulatory or legal proceedings; and other risks and uncertainties and other factors discussed from time to time in our filings with the Securities and Exchange Commission ("SEC"), including under the “Risk Factors” section of our filings with the SEC. Forward-looking statements speak only as of the date hereof. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based, except as required by law. Media Contact: Aaron Palash / Greg Klassen Joele Frank, Wilkinson Brimmer Katcher 212-355-4449 Investor Relations Contact: Matt Glover and Tom Colton Gateway Investor Relations 949-574-3860 [email protected] FINANCIAL TABLES TO FOLLOW

Workhorse Group Inc. Condensed Consolidated Statements of Operations (Unaudited) Three Months Ended March 31, 2023 2022 Sales, net of returns and allowances $ 1,693,415 $ 14,299 Cost of sales 5,328,119 3,923,351 Gross loss (3,634,704) (3,909,052) Operating expenses Selling, general and administrative 14,689,843 11,910,259 Research and development 7,224,849 4,011,934 Total operating expenses 21,914,692 15,922,193 Loss from operations (25,549,396) (19,831,245) Interest income (expense), net 550,359 (2,223,290) Loss before benefit for income taxes (24,999,037) (22,054,535) Benefit for income taxes — — Net loss $ (24,999,037) $ (22,054,535) Net loss per share of common stock Basic and Diluted $ (0.15) $ (0.15) Weighted average shares used in computing net loss per share of common stock Basic and Diluted 167,144,351 151,939,491

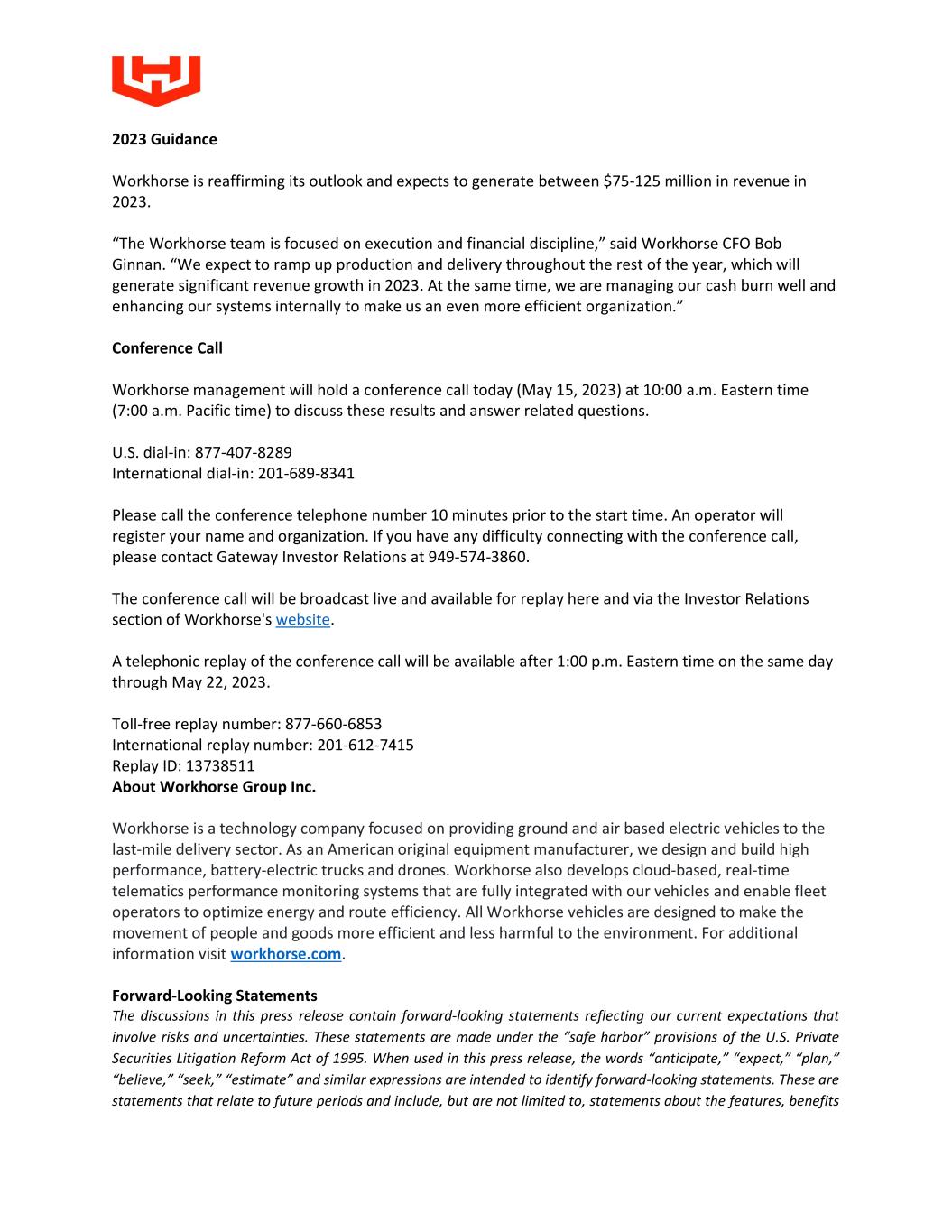

Workhorse Group Inc. Condensed Consolidated Balance Sheets (Unaudited) March 31, 2023 December 31, 2022 Assets Current assets: Cash and cash equivalents $ 79,110,576 $ 99,276,301 Accounts receivable, less allowance for credit losses of $46,259 and zero as of March 31, 2023 and December 31, 2022, respectively 1,815,320 2,079,343 Other receivable 15,000,000 15,000,000 Inventory, net 21,937,725 8,850,142 Prepaid expenses and other current assets 14,984,887 14,152,481 Total current assets 132,848,508 139,358,267 Property, plant and equipment, net 26,924,853 21,501,095 Investment in Tropos 10,000,000 10,000,000 Lease right-of-use assets 11,434,325 11,706,803 Other assets 176,310 176,310 Total Assets $ 181,383,996 $ 182,742,475 Liabilities Current liabilities: Accounts payable $ 14,458,894 $ 10,235,345 Accrued and other current liabilities 45,035,950 46,207,431 Deferred revenue, current 2,207,250 3,375,000 Warranty liability 2,066,588 2,207,674 Current portion of lease liabilities 1,390,135 1,285,032 Total current liabilities 65,158,817 63,310,482 Deferred revenue, long-term 2,940,749 2,005,000 Lease liabilities, long-term 8,463,882 8,840,062 Total Liabilities 76,563,448 74,155,544 Commitments and contingencies Stockholders’ Equity: Series A preferred stock, par value $0.001 per share, 75,000,000 shares authorized, zero shares issued and outstanding as of March 31, 2023 and December 31, 2022 — — Common stock, par value $0.001 per share, 250,000,000 shares authorized, 180,580,804 shares issued and outstanding as of March 31, 2023 and 165,605,355 shares issued and outstanding as of December 31, 2022 180,580 165,605 Additional paid-in capital 757,288,067 736,070,388 Accumulated deficit (652,648,099) (627,649,062) Total stockholders’ equity 104,820,548 108,586,931 Total Liabilities and Stockholders’ Equity $ 181,383,996 $ 182,742,475