WORKHORSE GROUP INC.,

THE GUARANTORS LISTED ON THE SIGNATURE PAGES HEREOF

and

U.S. Bank National Association

as Trustee and Collateral Agent

___________________________

INDENTURE

Dated as of October 14, 2020

___________________________

Senior Secured Convertible Notes due 2024

TABLE OF CONTENTS

| | | | | | | | | | | | | | |

| | | | Page |

| Article 1. Definitions; Rules of Construction | | | | 1 |

| | | | |

| Section 1.01 | Definitions | | 1 |

| Section 1.02 | Rules of Construction | | 21 |

| | | | |

| Article 2. The Notes | | | | 22 |

| | | | |

| Section 2.01 | Designation and Amount | | 22 |

| Section 2.02 | Form of Notes | | 22 |

| Section 2.03 | Date and Denomination of Notes; Payments of Interest and Defaulted Amounts | | 23 |

| Section 2.04 | Execution, Authentication and Delivery of Notes | | 25 |

| Section 2.05 | Exchange and Registration of Transfer of Notes; Restrictions on Transfer Depositary | | 26 |

| Section 2.06 | Mutilated, Destroyed, Lost or Stolen Notes | | 33 |

| Section 2.07 | Temporary Notes | | 34 |

| Section 2.08 | Cancellation of Notes Paid, Converted, Etc. | | 34 |

| Section 2.09 | CUSIP Numbers | | 34 |

| Section 2.10 | Repurchases | | 35 |

| Section 2.11 | Notes Held by the Company or its Affiliates | | 35 |

| | | | |

| Article 3. Covenants | | | | 35 |

| | | | |

| Section 3.01. | Stay, Extension and Usury Laws. | | 35 |

| Section 3.02. | Corporate Existence | | 35 |

| Section 3.03. | Ranking | | 36 |

| Section 3.04. | Indebtedness; Amendments to Indebtedness | | 36 |

| Section 3.05. | Liens. | | 36 |

| Section 3.06. | Investments | | 36 |

| Section 3.07. | Dividends and Other Payment Restrictions Affecting Affiliates | | 37 |

| Section 3.08. | Transfers | | 37 |

| Section 3.09. | Taxes. | | 37 |

| Section 3.10. | Minimum Backlog Sales. | | 37 |

| Section 3.11. | [Reserved]. | | 37 |

| Section 3.12. | Change in Nature of Business | | 37 |

| Section 3.13. | Maintenance of Properties. Etc. | | 38 |

| Section 3.14. | Maintenance of Intellectual Property | | 38 |

| Section 3.15. | Maintenance of Insurance | | 38 |

| | | | | | | | | | | | | | |

| Section 3.16. | Transactions with Affiliates | | 38 |

| Section 3.17. | Restricted Issuances | | 38 |

| Section 3.18. | [Reserved]. | | 39 |

| Section 3.19. | Rule 144A Information and Annual Reports | | 39 |

| Section 3.20. | Maintenance of Office or Agency | | 41 |

| Section 3.21. | Impairment of Security Interest. | | 41 |

| | | | |

| Article 4. Repurchase and Redemption | | | | 42 |

| | | | |

| Section 4.01. | No Mandatory Redemption or Sinking Fund | | 42 |

| Section 4.02. | Right of Holders to Require the Company to Repurchase Notes Upon a Fundamental Change | | 42 |

| Section 4.03. | [Reserved]. | | 45 |

| Section 4.04. | Right of the Company to Redeem the Notes | | 45 |

| | | | |

| Article 5. Conversion | | | | 42 |

| | | | |

| Section 5.01. | Right to Convert. | | 48 |

| Section 5.02. | When Notes May Be Converted. | | 48 |

| Section 5.03. | Conversion Procedures | | 48 |

| Section 5.04. | Settlement Upon Conversion | | 49 |

| Section 5.05. | Reserve and Status of Common Stock Issued upon Conversion. | | 51 |

| Section 5.06. | [Reserved]. | | 51 |

| Section 5.07. | Adjustments to the Conversion Rate. | | 51 |

| Section 5.08. | Voluntary Adjustments | | 60 |

| Section 5.09. | [Reserved]. | | 60 |

| Section 5.10. | Effect of Certain Recapitalizations, Reclassifications, Consolidations, Mergers and Sales | | 60 |

| Section 5.11. | Limitations on Conversions | | 62 |

| Section 5.12. | [Reserved]. | | 63 |

| Section 5.13. | Responsibility of Trustee and Conversion Agent | | 63 |

| | | | |

| Article 6. Successors | | | | 64 |

| | | | |

| Section 6.01. | When the Company May Merge, Etc. | | 64 |

| Section 6.02. | Successor Corporation Substituted | | 65 |

| | | | |

| Article 7. Defaults and Remedies | | | | 65 |

| | | | |

| Section 7.01. | Events of Default | | 65 |

| Section 7.02. | Acceleration | | 68 |

| | | | | | | | | | | | | | |

| Section 7.03. | Notice of Events of Default. | | 68 |

| Section 7.04. | Additional Interest | | 69 |

| Section 7.05. | Other Remedies | | 70 |

| Section 7.06. | Waiver of Past Defaults | | 70 |

| Section 7.07. | Control by Majority | | 70 |

| Section 7.08. | Limitation on Suits | | 70 |

| Section 7.09. | Absolute Right of Holders to Institute Suit for the Enforcement of the Right to Receive Payment and Conversion Consideration | | 71 |

| Section 7.10. | Collection Suit by Trustee and Collateral Agent | | 71 |

| Section 7.11. | Trustee and Collateral Agent May File Proofs of Claim | | 72 |

| Section 7.12. | Priorities | | 72 |

| Section 7.13. | Undertaking for Costs | | 73 |

| | | | |

| Article 8. Amendments, Supplements and Waivers | | | | 73 |

| | | | |

| Section 8.01. | Without the Consent of Holders | | 73 |

| Section 8.02. | With the Consent of Holders | | 74 |

| Section 8.03. | Notice of Amendments, Supplements and Waivers | | 75 |

| Section 8.04. | Revocation, Effect and Solicitation of Consents; Special Record Dates; Etc. | | 75 |

| Section 8.05. | Notations and Exchanges | | 76 |

| Section 8.06. | Trustee and Collateral Agent to Execute Supplemental Indentures | | 76 |

| | | | |

| Article 9. Guarantees | | | | 77 |

| | | | |

| Section 9.01. | Guarantees. | | 77 |

| Section 9.02. | Limitation on Guarantor Liability. | | 78 |

| Section 9.03. | Execution and Delivery of Guarantee. | | 78 |

| Section 9.04. | When the Guarantors May Merge, Etc. | | 79 |

| Section 9.05. | Future Guarantors. | | 79 |

| Section 9.06. | Application of Certain Provisions to the Guarantors. | | 80 |

| Section 9.07. | Release of Guarantees. | | 80 |

| | | | |

| Article 10. Collateral | | | | 80 |

| | | | |

| Section 10.01. | Grant of Security Interest | | 80 |

| Section 10.02. | Recording. | | 81 |

| Section 10.03. | Liens on Additional Property. | | 81 |

| Section 10.04. | Release of Collateral. | | 82 |

| Section 10.05. | Form and Sufficiency or Release | | 83 |

| | | | | | | | | | | | | | |

| Section 10.06. | Purchase Protected | | 83 |

| Section 10.07. | Actions to Be Taken by the Collateral Agent | | 84 |

| Section 10.08. | Receipt of Funds by the Collateral Agent | | 84 |

| Section 10.09. | Collateral Agent Rights, Protections and Duties and Related Provisions | | 85 |

| | | | |

| Article 11. Satisfaction and Discharge; Defeasance of Restrictive Covenants | | | | 88 |

| | | | |

| Section 11.01. | Termination of Company’s Obligations | | 88 |

| Section 11.02. | Repayment to Company | | 89 |

| Section 11.03. | Reinstatement | | 89 |

| Section 11.04. | Defeasance of Restrictive Covenants | | 90 |

| | | | |

| Article 12. Trustee | | | | 91 |

| | | | |

| Section 12.01. | Duties of the Trustee | | 91 |

| Section 12.02. | Rights of the Trustee | | 92 |

| Section 12.03. | Individual Rights of the Trustee | | 94 |

| Section 12.04. | Trustee’s Disclaimer | | 94 |

| Section 12.05. | Notice of Defaults | | 94 |

| Section 12.06. | Compensation and Indemnity | | 94 |

| Section 12.07. | Replacement of the Trustee | | 96 |

| Section 12.08. | Successor Trustee by Merger, Etc. | | 97 |

| Section 12.09. | Eligibility; Disqualification | | 97 |

| | | | |

| Article 13. Miscellaneous | | | | 97 |

| | | | |

| Section 13.01. | Notices | | 97 |

| Section 13.02. | Delivery of Officer’s Certificate and Opinion of Counsel as to Conditions Precedent | | 98 |

| Section 13.03. | Statements Required in Officer’s Certificate and Opinion of Counsel | | 99 |

| Section 13.04. | Rules by the Trustee, the Note Registrar and the Paying Agent. | | 99 |

| Section 13.05. | No Personal Liability of Directors, Officers, Employees and Stockholders | | 99 |

| Section 13.06. | Governing Law; Waiver of Jury Trial | | 99 |

| Section 13.07. | Submission to Jurisdiction | | 100 |

| Section 13.08. | No Adverse Interpretation of Other Agreements | | 100 |

| Section 13.09. | Successors | | 100 |

| Section 13.10. | Force Majeure | | 100 |

| Section 13.11. | U.S.A. Patriot Act | | 100 |

| | | | | | | | | | | | | | |

| Section 13.12. | Calculations | | 101 |

| Section 13.13. | Severability | | 101 |

| Section 13.14. | Counterparts | | 101 |

| Section 13.15. | Table of Contents, Headings, Etc. | | 101 |

| Section 13.16. | Withholding Taxes | | 101 |

| Section 13.17. | Authenticating Agent | | 102 |

| Section 13.18. | Evidence of Compliance with Conditions Precedent; Certificates and Opinions of Counsel to Trustee | | 103 |

| | | | |

| | | | |

| | | | |

| Exhibits | | | | |

| Exhibit A: Form of Note | | | | A-1 |

| | | | |

| Exhibit B: Form of Supplemental Indenture | | | | B-1 |

INDENTURE, dated as of October 14, 2020, among Workhorse Group Inc., a Nevada corporation, as issuer (the “Company”), the Guarantors (as defined herein) listed on the signature pages hereof and U.S. Bank National Association, as trustee (in such capacity, the “Trustee”) and as collateral agent (in such capacity, the “Collateral Agent”).

Each party to this Indenture (as defined below) agrees as follows for the benefit of the other parties and for the equal and ratable benefit of the Holders (as defined below) of the Company’s Senior Secured Convertible Notes due 2024 (the “Notes”).

Article 1.DEFINITIONS; RULES OF CONSTRUCTION

Section 1.01.DEFINITIONS.

“Acceptable Security Interest” means, with respect to any Property, a Lien that (A) exists in favor of the Collateral Agent for the benefit of the Holders, the Trustee and the Collateral Agent; (B) is superior to all Liens or rights of any other Person in the Property encumbered thereby (other than Permitted Prior Liens); (C) secures the Notes and other Obligations under the Notes and this Indenture; and (D) is perfected and enforceable.

“Additional Interest” means all amounts, if any, payable pursuant to Section 3.19(D), Section 3.19(E) and Section 7.04, as applicable.

“Affiliate” has the meaning set forth in Rule 144 as in effect on the Issue Date.

“Attribution Parties” means, collectively, the following Persons and entities as it relates to any Holder: (i) any investment vehicle, including, any funds, feeder funds or managed accounts, currently, or from time to time after the Issue Date, directly or indirectly managed or advised by any Holder’s investment manager or any of its Affiliates or principals, (ii) any direct or indirect Affiliates of such Holder or any of the foregoing, (iii) any Person acting or who could be deemed to be acting as a “group” (within the meaning of Section 13(d)(3) of the Exchange Act) together with such Holder or any of the foregoing and (iv) any other Persons whose beneficial ownership of the Common Stock would or could be aggregated with such Holder’s and the other Attribution Parties for purposes of Section 13(d) of the Exchange Act. For clarity, the purpose of the foregoing is to subject collectively any Holder and all other of such Holder’s Attribution Parties to the Maximum Percentage.

“Authorized Denominations” has the meaning set forth in Section 2.03(A).

“Backlog Conversions” means, as of any date, the total net sales made by the Company and its Subsidiaries pursuant to Firm Orders for the four most recently completed fiscal quarters of the Company, calculated on a basis consistent with GAAP and the Company’s historical reporting practices (as reflected in the Company’s most recent Forms 10-Q and 10-K); provided that, to the extent any business, division or assets are divested or disposed of, or acquired, merged, consolidated or amalgamated, in each case, as permitted hereunder, such calculation shall be made after giving pro forma effect to such divestiture, disposition, acquisition, merger, consolidated or amalgamation.

“Backlog Orders” means, as of any date, an amount equal to the product of (a) the total number of units for which the Company and its Subsidiaries have Firm Orders as of the last day of the Company’s most recently ended fiscal quarter, multiplied by (b) the net purchase price applicable to such units, in each case, calculated on a basis consistent with GAAP and the Company’s historical reporting practices (as reflected in the Company’s most recent Forms 10-Q and 10-K); provided that, to the extent any business, division or assets are divested or disposed of, or acquired, merged, consolidated or amalgamated, in each case, as permitted hereunder, such calculation shall be made after giving pro forma effect to such divestiture, disposition, acquisition, merger, consolidated or amalgamation.

“Backlog Sales” means, as of any date, the sum of Backlog Conversions and Backlog Orders for such date.

“Bankruptcy Law” means Title 11, United States Code, or any similar U.S. federal or state or non-U.S. law for the relief of debtors.

“Board of Directors” means the board of directors of the Company or a committee of such board duly authorized to act on behalf of such board.

“Business Combination Event” has the meaning set forth in Section 6.01(A).

“Business Day” means any day other than a Saturday, a Sunday or any day on which commercial banks in the City of New York are authorized or required by law or executive order to close or be closed; provided, however, for clarification, commercial banks in the City of New York shall not be deemed to be authorized or required by law or executive order to close or be closed due to “stay at home,” “shelter-in-place,” “non-essential employee” or any other similar orders or restrictions or the closure of any physical branch locations at the direction of any governmental authority so long as the electronic funds transfer systems (including for wire transfers) of commercial banks in the City of New York are open for use by customers on such day.

“Capital Expenditures” means (A) all expenditures (whether paid in cash or accrued as liabilities) by the Company and its Subsidiaries during such period that, in conformity with GAAP, are or are required to be included as additions during such period to property, plant or equipment reflected in the consolidated balance sheet of the Company and its Subsidiaries, (B) all capitalized research and development costs during such period and (C) all fixed asset additions financed through Financing Lease Obligations incurred by the Company and its Subsidiaries and recorded on the balance sheet in accordance with GAAP during such period.

“Capital Lease” means, with respect to any Person, any leasing or similar arrangement conveying the right to use any Property, whether real or personal Property, or a combination thereof, by that Person as lessee that, in conformity with GAAP, is required to be accounted for as a capital lease on the balance sheet of such Person.

“Capital Lease Obligation” means, at the time any determination is to be made, the amount of the liability in respect of a Capital Lease that would at that time be required to be

capitalized on a balance sheet prepared in accordance with GAAP, and the stated maturity thereof shall be the date of the last payment of rent or any other amount due under such lease prior to the first date upon which such lease may be prepaid by the lessee without payment of a penalty.

“Capital Stock” of any Person means any and all shares of, interests in, rights to purchase, warrants or options for, participations in, or other equivalents of, in each case however designated, the equity of such Person (but excluding any debt security that is convertible into for such equity).

“Cash” means all cash and liquid funds.

“Cash Equivalents” means, as of any date of determination, any of the following:

(A)marketable securities (i) issued or directly and unconditionally guaranteed as to interest and principal by the United States Government, or (ii) issued by any agency of the United States the obligations of which are backed by the full faith and credit of the United States, in each case maturing within one (1) year after such date;

(B)marketable direct obligations issued by any state of the United States or any political subdivision of any such state or any public instrumentality thereof, in each case maturing within one (1) year after such date and having, at the time of the acquisition thereof, a rating of at least A-1 from Standard & Poor’s Corporation or at least P-1 from Moody’s Investors Service;

(C)commercial paper maturing no more than one (1) year from the date of creation thereof and having, at the time of the acquisition thereof, a rating of at least A-1 from Standard & Poor’s Corporation or at least P-1 from Moody’s Investors Service;

(D)certificates of deposit or bankers’ acceptances maturing within one (1) year after such date and issued or accepted by any commercial bank organized under the laws of the United States of America or any State thereof or the District of Columbia that (i) is at least “adequately capitalized” (as defined in the regulations of its primary federal banking regulator), and (ii) has Tier 1 capital (as defined in such regulations) of not less than $100,000,000; and

(E)shares of any money market mutual fund that (i) has substantially all of its assets invested continuously in the types of investments referred to in clauses (A) and (B) above, (ii) has net assets of not less than $500,000,000, and (iii) has the highest rating obtainable from either Standard & Poor’s Corporation or Moody’s Investors Service.

“Certus” means Certus Unmanned Aerial Systems LLC, a Delaware limited liability company.

“Close of Business” means 5:00 p.m., New York City time.

“Collateral” means all Property mortgaged under the Mortgages and any other Property, whether now owned or hereafter acquired, upon which a Lien securing the Obligations under this Indenture, the Notes and the Guarantees is granted or purported to be granted under any Collateral Agreement; provided, however, that “Collateral” does not include any Excluded Collateral.

“Collateral Agent” means the Person named as the “Collateral Agent” in the first paragraph of this Indenture until a successor collateral agent shall have become such pursuant to the applicable provisions of this Indenture, and thereafter “Collateral Agent” shall mean or include each Person who is then a Collateral Agent hereunder.

“Collateral Agreements” means, collectively, each Mortgage, the Security Agreement, and each other agreement or instrument creating Liens in favor of the Trustee or the Collateral Agent as required by this Indenture, in each case, as the same may be in force from time to time.

“Commission” means the U.S. Securities and Exchange Commission.

“Common Stock” means the common stock, $0.001 par value per share, of the Company, subject to Section 5.10(A).

“Common Stock Change Event” has the meaning set forth in Section 5.10(A).

“Company” means the Person named as such in the first paragraph of this Indenture and, subject to Article 6, its successors and assigns.

“Company Order” means a written request or order signed on behalf of the Company by one (1) of its Officers and delivered to the Trustee.

“Contingent Obligation” means, as applied to any Person, any direct or indirect liability, contingent or otherwise, of that Person with respect to (A) any Indebtedness or other obligations of another Person, including any such obligation directly or indirectly guaranteed, endorsed, co-made or discounted or sold with recourse by that Person, or in respect of which that Person is otherwise directly or indirectly liable; (B) any obligations with respect to undrawn letters of credit, corporate credit cards or merchant services issued for the account of that Person; and (C) all obligations arising under any interest rate, currency or commodity swap agreement, interest rate cap agreement, interest rate collar agreement, or other agreement or arrangement designated to protect a Person against fluctuation in interest rates, currency exchange rates or commodity prices; provided, however, that the term “Contingent Obligation” shall not include endorsements for collection or deposit in the ordinary course of business. The amount of any Contingent Obligation shall be deemed to be an amount equal to the stated or determined amount of the primary obligation in respect of which such Contingent Obligation is made or, if not stated or determinable, the maximum reasonably anticipated liability in respect thereof as determined by such Person in good faith; provided, however, that such amount shall not in any event exceed the maximum amount of the obligations under the guarantee or other support arrangement.

“Conversion Agent” has the meaning set forth in Section 3.20.

“Conversion Consideration” has the meaning set forth in Section 5.04(A).

“Conversion Consideration Interest Shares” has the meaning set forth in Section 5.04(A)(ii).

“Conversion Consideration Interest Shares Notice” has the meaning set forth in Section 5.04(B).

“Conversion Date” means, with respect to a Note, the first Business Day on which the requirements set forth in Section 5.02(A) to convert such Note are satisfied.

“Conversion Price” means, as of any time, an amount equal to (A) one thousand dollars ($1,000) divided by (B) the Conversion Rate in effect at such time.

“Conversion Rate” initially means 28.3354 shares of Common Stock per $1,000 principal amount of Notes, which amount is subject to adjustment pursuant to Article 5. Whenever this Indenture refers to the Conversion Rate as of a particular date without setting forth a particular time on such date, such reference will be deemed to be to the Conversion Rate as of the Close of Business on such date.

“Conversion Settlement Date” has the meaning set forth in Section 5.04(D).

“Conversion Share” means any share of Common Stock issued or issuable upon conversion of any Note.

“Copyright License” means any written agreement granting any right to use any Copyright or Copyright registration, now owned or hereafter acquired by the Company or in which the Company now holds or hereafter acquires any interest.

“Copyrights” means all copyrights, whether registered or unregistered, held pursuant to the laws of the United States, any State thereof, or of any other country.

“Corporate Trust Office” means the office of the Trustee or the Collateral Agent, as applicable, at which at any particular time its corporate trust business shall be administered, which office on the date hereof is located at U.S. Bank Global Corporate Trust, 425 Walnut Street, CN-OH-W6CT, Cincinnati, OH 45202, or such other address as the Trustee or the Collateral Agent, as applicable, may designate from time to time by notice to the Holders and the Company, or the designated corporate trust office of any successor Trustee or Collateral Agent (or such other address as such successor Trustee or Collateral Agent, as applicable, may designate from time to time by notice to the Holders and the Company).

“Covenant Defeasance” means any defeasance pursuant to, and subject to the terms of, Section 11.04.

“Covering Price” has the meaning set forth in Section 5.04(F)(i).

“Custodian” means the Trustee, as custodian for the Depositary, with respect to the Global Notes, or any successor entity thereto.

“Daily VWAP” means, for any VWAP Trading Day, the per share volume-weighted average price of the Common Stock as displayed under the heading “Bloomberg VWAP” on Bloomberg page “WKHS <EQUITY> VAP” (or, if such page is not available, its equivalent successor page) in respect of the period from the scheduled open of trading until the scheduled close of trading of the primary trading session on such VWAP Trading Day (or, if such volume-weighted average price is unavailable, the market value of one share of Common Stock on such VWAP Trading Day, determined, using a volume-weighted average price method, by a nationally recognized independent investment banking firm selected by the Company). The Daily VWAP will be determined without regard to after-hours trading or any other trading outside of the regular trading session.

“Default” means any event that is (or, after notice, passage of time or both, would be) an Event of Default.

“Default Interest” means has the meaning set forth in Section 2.03(C).

“Defaulted Shares” has the meaning set forth in Section 5.04(F).

“Depositary” means The Depository Trust Company or its successor.

“Depositary Procedures” means, with respect to any conversion, transfer, exchange or transaction involving a Global Note or any beneficial interest therein, the rules and procedures of the Depositary applicable to such conversion, transfer, exchange or transaction.

“Disqualified Stock” means, with respect to any Person, any Capital Stock that by its terms (or by the terms of any security into which it is convertible or for which it is exchangeable at the option of the holder) or upon the happening of any event:

(A)matures or is mandatorily redeemable pursuant to a sinking fund obligation or otherwise;

(B)is convertible or exchangeable for Indebtedness or Disqualified Stock (excluding Capital Stock convertible or exchangeable solely at the option of the issuer or a Subsidiary; provided that any such conversion or exchange will be deemed an incurrence of Indebtedness or Disqualified Stock, as applicable); or

(C)is redeemable at the option of the holder thereof, in whole or in part,

in the case of each of clauses (A), (B) and (C), at any point prior to the one hundred eighty-first (181st) day after the Maturity Date.

“Eligible Exchange” means any of The New York Stock Exchange, The Nasdaq Capital Market, The Nasdaq Global Market or The Nasdaq Global Select Market (or any of their respective successors).

“Equipment” means all “equipment” as defined in the UCC with such additions to such term as may hereafter be made, and includes without limitation all machinery, fixtures, goods, vehicles (including motor vehicles and trailers), and any interest in any of the foregoing.

“Equity Conditions” will be deemed to be satisfied as of any date if all of the following conditions are satisfied as of such date and on each of the twenty (20) previous Trading Days: (A) the shares issuable upon conversion of the Notes are Freely Tradable; (B) the Holders are not in possession of any material non-public information provided by or on behalf of the Company; (C) the issuance of such shares will not be limited by Section 5.11; (D) the Company is in compliance with Section 5.05(A) and such shares will satisfy Section 5.05(B); (E) no public announcement of a pending, proposed or intended Fundamental Change has occurred that has not been abandoned, terminated or consummated; (F) the Daily VWAP per share of Common Stock is not less than $5.00 (subject to proportionate adjustments for events of the type set forth in Section 5.07(A)(i)); (G) the daily dollar trading volume (as reported on Bloomberg) of the Common Stock on the applicable Eligible Exchange is not less than five million dollars ($5,000,000); and (H) no Default or Event of Default will have occurred or be continuing.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and the regulations promulgated thereunder.

“Event of Default” has the meaning set forth in Section 7.01(A).

“Event of Default Notice” has the meaning set forth in Section 7.03.

“Ex-Dividend Date” means, with respect to an issuance, dividend or distribution on the Common Stock, the first date on which shares of Common Stock trade on the applicable exchange or in the applicable market, regular way, without the right to receive such issuance, dividend or distribution (including pursuant to due bills or similar arrangements required by the relevant stock exchange). For the avoidance of doubt, any alternative trading convention on the applicable exchange or market in respect of the Common Stock under a separate ticker symbol or CUSIP number will not be considered “regular way” for this purpose.

“Excess Shares” has the meaning set forth in Section 5.11.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“Expiration Date” has the meaning set forth in Section 5.07(A)(d).

“Expiration Time” has the meaning set forth in Section 5.07(A)(d).

“Financing Lease Obligations” means an obligation that is required to be accounted for as a financing or capital lease (and, for the avoidance of doubt, not a straight-line or operating lease) on both the balance sheet and income statement for financial reporting purposes in accordance with GAAP as in effect on the Issue Date. At the time any determination thereof is to be made, the amount of the liability in respect of a financing or capital lease would be the

amount required to be reflected as a liability on such balance sheet (excluding the footnotes thereto) in accordance with GAAP as in effect on the Issue Date.

“Firm Orders” means orders that have been made by customers pursuant to a binding contract or purchase order.

“Freely Tradable” means, with respect to any shares of Common Stock issued or issuable upon conversion of the Notes, that (A) such shares would be eligible to be offered, sold or otherwise transferred by a Holder pursuant to Rule 144, without any requirements as to volume, manner of sale, availability of current public information (whether or not then satisfied) or notice under the Securities Act and without any requirement for registration under any state securities or “blue sky” laws; or (B) such shares are (or, when issued, will be) (i) represented by book-entries at the Depositary and identified therein by an “unrestricted” CUSIP number; (ii) not represented by any certificate that bears a legend referring to transfer restrictions under the Securities Act or other securities laws; and (iii) listed and admitted for trading, without suspension or material limitation on trading, on an Eligible Exchange; and (C) no delisting or suspension by such Eligible Exchange has been threatened (with a reasonable prospect of delisting occurring after giving effect to all applicable notice, appeal, compliance and hearing periods) or reasonably likely to occur or pending as evidenced by (x) a writing by such Eligible Exchange or (y) the Company falling below the minimum listing maintenance requirements of such Eligible Exchange.

“Fundamental Change” means any of the following events:

(A)a “person” or “group” (within the meaning of Section 13(d)(3) of the Exchange Act), other than the Company or its Wholly Owned Subsidiaries, or the employee benefit plans of the Company or its Wholly Owned Subsidiaries, files any report with the Commission indicating that such person or group has become the direct or indirect “beneficial owner” (as defined below) of shares of the Company’s common equity representing more than fifty percent (50%) of the voting power of all of the Company’s then-outstanding common equity;

(B)the consummation of (i) any sale, lease or other transfer, in one transaction or a series of transactions, of all or substantially all of the assets of the Company and its Subsidiaries, taken as a whole, to any Person (other than solely to one or more of the Company’s Wholly Owned Subsidiaries); or (ii) any transaction or series of related transactions in connection with which (whether by means of merger, consolidation, share exchange, combination, reclassification, recapitalization, acquisition, liquidation or otherwise) all of the Common Stock is exchanged for, converted into, acquired for, or constitutes solely the right to receive, other securities, cash or other Property (other than a subdivision or combination, or solely a change in par value, of the Common Stock); provided, however, that any merger, consolidation, share exchange or combination of the Company pursuant to which the Persons that directly or indirectly “beneficially owned” (as defined below) all classes of the Company’s common equity immediately before such transaction directly or indirectly “beneficially own,” immediately after such transaction, more than fifty percent (50%) of all classes of common equity of the

surviving, continuing or acquiring company or other transferee, as applicable, or the parent thereof, in substantially the same proportions vis-à-vis each other as immediately before such transaction will be deemed not to be a Fundamental Change pursuant to this clause (B);

(C)the Company’s stockholders approve any plan or proposal for the liquidation or dissolution of the Company; or

(D)the Common Stock ceases to be listed on any Eligible Exchange,

For the purposes of this definition, (x) any transaction or event described in both clause (A) and in clause (B)(i) or (ii) above (without regard to the proviso in clause (B)) will be deemed to occur solely pursuant to clause (B) above (subject to such proviso); and (y) whether a Person is a “beneficial owner” and whether shares are “beneficially owned” will be determined in accordance with Rule 13d-3 under the Exchange Act.

“Fundamental Change Repurchase Date” means the date as of which the Notes must be repurchased for cash in connection with a Fundamental Change, as provided in Section 4.02(B).

“Fundamental Change Repurchase Notice” has the meaning set forth in Section 4.02(C).

“Fundamental Change Repurchase Price” has the meaning set forth in Section 4.02(D).

“Fundamental Change Repurchase Right” has the meaning set forth in Section 4.01(A).

“GAAP” means generally accepted accounting principles in the United States of America, as in effect from time to time; provided the definitions set forth in the Notes and any financial calculations required thereby shall be computed to exclude any change to lease accounting rules from those in effect pursuant to Financial Accounting Standards Board Accounting Standards Codification 840 (Leases) and other related lease accounting guidance as in effect on the date hereof.

“Global Note” shall have the meaning specified in Section 2.05(B).

“Guarantee” means the guarantee by each Guarantor of the Company’s obligations under this Indenture and the Notes pursuant to Article 9.

“Guaranteed Obligations” has the meaning set forth in Section 9.01(A).

“Guarantor” means (A) each Subsidiary of the Company executing this Indenture as an initial Guarantor and (B) any Subsidiary of the Company that becomes a Guarantor in accordance with this Indenture, and its successors and assigns.

“Guarantor Business Combination Event” has the meaning set forth in Section 9.04(A).

“Holder” as applied to any Note, or other similar terms (but excluding the term “beneficial holder”), means any Person in whose name at the time a particular Note is registered on the Note Register.

The term “including” means “including without limitation,” unless the context provides otherwise.

Section 2.01.“Indebtedness” means, indebtedness of any kind, including, without duplication (A) all indebtedness for borrowed money or the deferred purchase price of Property or services (excluding trade credit entered into in the ordinary course of business due within ninety (90) days), including reimbursement and other obligations with respect to surety bonds and letters of credit, (B) all obligations evidenced by notes, bonds, debentures or similar instruments, (C) all Capital Lease Obligations, (D) all Contingent Obligations, and (E) Disqualified Stock.

“Indenture” has the meaning set forth in the preamble.

“Initial Holders” means Antara Capital LP and HT Investments MA LLC and their respective Affiliates.

“Intellectual Property” means all of the Company’s Copyrights; Trademarks; Patents; Licenses; trade secrets and inventions; mask works; the Company’s applications therefor and reissues, extensions, or renewals thereof; and the Company’s goodwill associated with any of the foregoing, together with the Company’s rights to sue for past, present and future infringement of Intellectual Property and the goodwill associated therewith.

“Intellectual Property Rights” means the rights or Licenses to use all Trademarks, trade names, service marks, service mark registrations, service names, original works of authorship, Patents, Patent rights, Copyrights, inventions, licenses, approvals, governmental authorizations, trade secrets and other intellectual property rights and all applications and registrations therefor.

“Interest Payment Date” means, with respect to a Note, (A) each January 15, April 15, July 15 and October 15 of each calendar year, beginning on January 15, 2021; and (B) if not otherwise included in clause (A), the Maturity Date.

“Investment” means any beneficial ownership (including stock, partnership or limited liability company interests) of or in any Person, or any loan, advance or capital contribution to any Person or the acquisition of all, or substantially all, of the assets of another Person or the purchase of any assets of another Person for greater than the fair market value of such assets to solely the extent of the amount in excess of the fair market value.

“Issue Date” means October 14, 2020.

“Last Reported Sale Price” of the Common Stock for any Trading Day means the closing sale price per share (or, if no closing sale price is reported, the average of the last bid price and the last ask price per share or, if more than one in either case, the average of the average last bid prices and the average last ask prices per share) of Common Stock on such Trading Day as reported in composite transactions for the principal U.S. national or regional securities exchange on which the Common Stock is then listed. If the Common Stock is not listed on a U.S. national or regional securities exchange on such Trading Day, then the Last Reported Sale Price will be the last quoted bid price per share of Common Stock on such Trading Day in the over-the-counter market as reported by OTC Markets Group Inc. or a similar organization. If the Common Stock is not so quoted on such Trading Day, then the Last Reported Sale Price will be the average of the mid-point of the last bid price and the last ask price per share of Common Stock on such Trading Day from a nationally recognized independent investment banking firm selected by the Company.

“License” means any Copyright License, Patent License, Trademark License or other written license of rights or interests.

“Lien” means any mortgage, deed of trust, pledge, hypothecation, assignment for security, security interest, encumbrance, levy, lien or charge of any kind, whether voluntarily incurred or arising by operation of law or otherwise, against any Property, any conditional sale or other title retention agreement, and any lease in the nature of a security interest; provided that for the avoidance of doubt, licenses, strain escrows and similar provisions in collaboration agreements, research and development agreements that do not create or purport to create a security interest, encumbrance, levy, lien or charge of any kind shall not be deemed to be Liens for purposes of the Notes.

“Market Disruption Event” means, with respect to any date, the occurrence or existence, during the one-half hour period ending at the scheduled close of trading on such date on the principal U.S. national or regional securities exchange or other market on which the Common Stock is listed for trading or trades, of any material suspension or limitation imposed on trading (by reason of movements in price exceeding limits permitted by the relevant exchange or otherwise) in the Common Stock or in any options contracts or futures contracts relating to the Common Stock.

“Market Stock Interest Payment Price” means, with respect to any Interest Payment Date, an amount equal to the average of the five (5) Daily VWAPs during the five (5) VWAP Trading Day period ending on the VWAP Trading Day immediately prior to such Interest Payment Date; provided that the Market Stock Interest Payment Price shall in no case be less than $1.50.

“Material Adverse Effect” means any material adverse effect on (i) the business, Properties, assets, liabilities, operations (including results thereof), or condition (financial or otherwise) of the Company or a Guarantor, or any of their respective Subsidiaries, taken as a whole, (ii) the transactions contemplated hereby or in any of the other Transaction Documents or any other agreements or instruments to be entered into in connection herewith or therewith or (iii) the authority or ability of the Company or a Guarantor, or any of their respective

Subsidiaries, to perform any of their respective obligations under any of the Transaction Documents.

“Maturity Date” means October 15, 2024.

“Maximum Percentage” has the meaning set forth in Section 5.11(A).

“Minimum Backlog Sales” has the meaning set forth in Section 3.10.

“Mortgages” means the mortgages, deeds of trust, deeds to secure Indebtedness, assignments of as-extracted collateral, fixture filings or other similar documents granting Liens on the Company’s and the Subsidiaries’ Properties and interests to secure the Notes.

“Net Sales” means with respect to any Person for any period, the total amount of net sales of such Person for such period on a consolidated basis and as determined in accordance with GAAP.

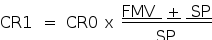

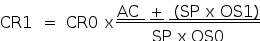

“Net Sales Coverage Ratio” means, as of any date of determination, the ratio of (A) Net Sales of the Company and its Subsidiaries for the most recently completed four consecutive fiscal quarters of the Company ending on or immediately preceding the date of determination for which internal financial statements are available, to (B) the total aggregate amount of the Traditional Working Capital Facilities then outstanding, determined on a pro forma basis (including a pro forma application of the net proceeds therefrom), as if the additional Traditional Working Capital Facility had been incurred, and the application of proceeds therefrom had occurred at the beginning of such period.

“Note Purchase Agreement” means that certain Note Purchase Agreement, dated as of October 12, 2020, among the Company, Antara Capital LP and HT Investments MA LLC, providing for the purchase of the Notes.

“Note Register” shall have the meaning specified in Section 2.05(A).

“Note Registrar” has the meaning set forth in Section 2.05(A).

“Notes” has the meaning set forth in the recitals.

“Notice of Redemption” has the meaning set forth in Section 4.04(B)(i).

“Obligations” means any principal, premium, if any, interest (including interest accruing on or after the filing of any petition in bankruptcy or for reorganization, whether or not a claim for post-filing interest is allowed in such proceeding), penalties, fees, charges, expenses, indemnifications, reimbursement obligations, damages, guarantees, and other liabilities or amounts payable under the documentation governing any Indebtedness or in respect thereto.

“Officer” means, with respect to the Company, the Chief Executive Officer, the President, the Chief Financial Officer, the Chief Operating Officer, the Chief Legal Officer, the Treasurer, the Secretary, any Executive or Senior Vice President or any Vice President (whether

or not designated by a number or numbers or word or words added before or after the title “Vice President”).

“Officer’s Certificate,” when used with respect to the Company, means a certificate that is delivered to the Trustee and that is signed by any Officer of the Company. Each such certificate shall include the statements provided for in Section 13.18 if and to the extent required by the provisions of such Section 13.18.

“Open of Business” means 9:00 a.m., New York City time.

“Opinion of Counsel” means an opinion in writing signed by legal counsel, who may be an employee of or counsel to the Company, or other counsel who is reasonably acceptable to the Trustee, which opinion may contain customary exceptions and qualifications as to the matters set forth therein, that is delivered to the Trustee. Each such opinion shall include the statements provided for in Section 13.18 if and to the extent required by the provisions of such Section 13.18.

“Optional Redemption” has the meaning set forth in Section 4.04(A).

The term “or” is not exclusive, unless the context expressly provides otherwise.

“Patents” means all letters patent of, or rights corresponding thereto, in the United States or in any other country, all registrations and recordings thereof, and all applications for letters patent of, or rights corresponding thereto, in the United States or any other country.

“Patent License” means any written agreement granting any right with respect to any invention covered by a Patent that is in existence or a Patent application that is pending, in which agreement the Company now holds or hereafter acquires any interest.

“Paying Agent” has the meaning set forth in Section 3.20.

“Permitted Indebtedness” means:

(A)Indebtedness evidenced by the Notes;

(B)Indebtedness in existence as of the Issue Date (including all other Indebtedness accrued in the balance sheet included in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2020), other than Indebtedness incurred pursuant to clauses (A) and (I) of this definition;

(C)Indebtedness of up to five million dollars ($5,000,000) outstanding at any time secured by a Lien described in clause (G) of the defined term “Permitted Liens,” provided such Indebtedness does not exceed the cost of the Equipment and related expenses financed with such Indebtedness;

(D)Indebtedness to trade creditors incurred in the ordinary course of business, including Indebtedness incurred in the ordinary course of business with corporate credit cards;

(E)Indebtedness that also constitutes a Permitted Investment;

(F)Subordinated Indebtedness of the Company or any Guarantor;

(G)reimbursement obligations in connection with letters of credit or similar instruments that are secured by Cash or Cash Equivalents and issued on behalf of the Company or a Subsidiary thereof in an aggregate amount not to exceed $1,000,000 at any time outstanding;

(H)other unsecured Indebtedness of the Company, so long as such Indebtedness does not have (i) a final maturity date, amortization payment, sinking fund, mandatory redemption or other repurchase obligation or put right at the option of the lender or holder of such Indebtedness earlier than one hundred eighty-one (181) days following the Maturity Date, or (ii) any other material terms more favorable to the holder of such Indebtedness than this Indenture, including applicable interest rates;

(I) Indebtedness in respect of Traditional Working Capital Facilities; provided that the Company may not incur any Indebtedness under a Traditional Working Capital Facility unless, after giving effect to such incurrence, the Net Sales Coverage Ratio for the Company would have been greater than or equal to 4.00 to 1.00;

(J) Contingent Obligations that are guarantees of Indebtedness described in clauses (A) through (E) and (G) through (I); and

(K)extensions, refinancings and renewals of any items of Permitted Indebtedness (other than any Indebtedness repaid with the proceeds of the Notes), provided that the principal amount is not increased or the terms modified to impose materially more burdensome terms upon the Company or its Subsidiaries, as the case may be, and provided further, that if the lender of any such proposed extension, refinancing or renewal of Permitted Indebtedness incurred hereunder is different from the lender of the Permitted Indebtedness to be so extended, refinanced or renewed then, in addition to the foregoing proviso, such Permitted Indebtedness shall also not have a final maturity date, amortization payment, sinking fund, mandatory redemption or other repurchase obligation earlier than one hundred eighty-one (181) days following the Maturity Date.

“Permitted Intellectual Property Licenses” means Intellectual Property (A) licenses in existence at the Issue Date, including those listed on the Schedules to the Security Agreement, and (B) non-perpetual licenses granted in the ordinary course of business on arm’s length terms consisting of the licensing of technology, the development of technology or the providing of technical support which may include licenses with unlimited renewal options solely to the extent such options require mutual consent for renewal or are subject to financial or other conditions as

to the ability of licensee to perform under the license; provided such license was not entered into during continuance of a Default or an Event of Default.

“Permitted Investment” means:

(A)Investments existing on the Issue Date;

(B)(i) marketable direct obligations issued or unconditionally guaranteed by the United States of America or any agency or any State thereof maturing within one year from the date of acquisition thereof, (ii) commercial paper maturing no more than one year from the date of creation thereof and currently having a rating of at least A-2 or P-2 from either Standard & Poor’s Corporation or Moody’s Investors Service, (iii) certificates of deposit issued by any bank headquartered in the United States with assets of at least $500,000,000 maturing no more than one year from the date of investment therein, and (iv) money market accounts;

(C)Investments accepted in connection with Permitted Transfers;

(D)Investments (including debt obligations) received in connection with the bankruptcy or reorganization of customers or suppliers and in settlement of delinquent obligations of, and other disputes with, customers or suppliers arising in the ordinary course of the Company’s business;

(E)Investments consisting of notes receivable of, or prepaid royalties and other credit extensions, to customers and suppliers in the ordinary course of business and consistent with past practice, provided that this subparagraph (E) shall not apply to Investments of the Company in any Subsidiary;

(F)Investments consisting of loans not involving the net transfer on a substantially contemporaneous basis of cash proceeds to employees, officers or directors relating to the purchase of capital stock of the Company pursuant to employee stock purchase plans or other similar agreements approved by the Company’s Board of Directors;

(G)Investments consisting of travel advances in the ordinary course of business;

(H)(i) Investments in wholly-owned Subsidiaries, (ii) non-cash Investments in joint ventures in businesses related or complementary to the business of the Company and its Subsidiaries (but excluding the use of Capital Stock or other equity interest of the Company or any of its Subsidiaries); provided that such Investments shall not include the transfer of ownership or title of any assets that are, individually or in the aggregate, material to the Company’s medium-duty truck business, and (iii) net cash Investments in joint ventures in businesses related or complementary to the business of the Company and its Subsidiaries in an amount not to exceed twenty five million dollars ($25,000,000) at any time outstanding; provided that for any Investments pursuant to clauses (ii) and (iii),

the Capital Stock of any such joint venture owned by the Company or any of its Subsidiaries shall be concurrently added to the Collateral securing the Notes and the Guarantees in the manner and to the extent required under this Indenture or any of the Collateral Agreements; and

(I)Permitted Intellectual Property Licenses.

“Permitted Liens” means any and all of the following:

(A)Liens in favor of the Collateral Agent;

(B)Liens existing on the Issue Date, other than Liens securing the Notes and any Traditional Working Capital Facility;

(C)Liens for taxes, fees, assessments or other governmental charges or levies, either not delinquent or being contested in good faith by appropriate proceedings; provided that the Company maintains adequate reserves therefor in accordance with GAAP;

(D)Liens securing claims or demands of materialmen, artisans, mechanics, carriers, warehousemen, landlords and other like Persons arising in the ordinary course of business; provided that the payment thereof is not yet required;

(E)Liens arising from judgments, decrees or attachments in circumstances which do not constitute a Default or an Event of Default hereunder;

(F)the following deposits, to the extent made in the ordinary course of business: deposits under workers’ compensation, unemployment insurance, social security and other similar laws, or to secure the performance of bids, tenders or contracts (other than for the repayment of borrowed money) or to secure indemnity, performance or other similar bonds for the performance of bids, tenders or contracts (other than for the repayment of borrowed money) or to secure statutory obligations (other than Liens arising under ERISA or environmental Liens) or surety or appeal bonds, or to secure indemnity, performance or other similar bonds;

(G)Liens on Equipment constituting purchase money Liens and Liens in connection with Capital Leases securing Indebtedness permitted in clause (C) of “Permitted Indebtedness”;

(H)leasehold interests in leases or subleases and licenses granted in the ordinary course of the Company’s business and not interfering in any material respect with the business of the licensor;

(I)Liens in favor of customs and revenue authorities arising as a matter of law to secure payment of custom duties that are promptly paid on or before the date they become due;

(J)Liens on insurance proceeds securing the payment of financed insurance premiums that are promptly paid on or before the date they become due (provided that such Liens extend only to such insurance proceeds and not to any other Property or assets);

(K)statutory and common law rights of set-off and other similar rights as to deposits of cash and securities in favor of banks, other depository institutions and brokerage firms;

(L)easements, zoning restrictions, rights-of-way and similar encumbrances on real Property imposed by law or arising in the ordinary course of business so long as they do not materially impair the value or marketability of the related Property;

(M)Liens on Cash or Cash Equivalents securing obligations permitted under clause (D) and (G) of the definition of Permitted Indebtedness;

(N)Liens securing obligations related to Indebtedness in respect of a Traditional Working Capital Facility permitted under clause (I) of the definition of Permitted Indebtedness; provided such Liens are on a pari passu or junior lien basis to the Notes; and

(O)Liens incurred in connection with the extension, renewal or refinancing of the Indebtedness secured by Liens of the type described in clauses (A) through (N) above (other than any Indebtedness repaid with the proceeds of the Notes); provided that any extension, renewal or replacement Lien shall be limited to the Property encumbered by the existing Lien and the principal amount of the Indebtedness being extended, renewed or refinanced (as may have been reduced by any payment thereon) does not increase.

“Permitted Prior Liens” means Liens described in the definition of Permitted Liens that, by operation of law, have priority over the Liens securing the Notes.

“Permitted Transfers” means:

(A)dispositions of inventory sold, and Permitted Intellectual Property Licenses entered into, in each case, in the ordinary course of business;

(B)dispositions of worn-out, obsolete or surplus Property at fair market value in the ordinary course of business;

(C)dispositions of accounts or payment intangibles (each as defined in the UCC) resulting from the compromise or settlement thereof in the ordinary course of business for less than the full amount thereof;

(D)transfers consisting of Permitted Investments in wholly-owned Subsidiaries under clause (H) of Permitted Investments; and

(E) dispositions of the Company’s Investment in Lordstown Motor Corp.; provided that (x) 100% of the consideration from such disposition is in the form of Cash or Cash Equivalents, (y) such consideration is at least equal to the fair market value of the shares or assets of such disposition and (z) such consideration shall be deposited directly into a collateral account pursuant to a Security Document; provided further that the proceeds of such disposition are used or useful in a Similar Business and used to make (i) an Investment in any one or more businesses, including any joint venture, as long as such Investment in any business is in the form of the acquisition of Capital Stock, (ii) Capital Expenditures, (iii) acquisitions of other assets or (iv) other capital, operating or research and development expenditures; provided further that any Investments, Property, Capital Stock or other assets purchased with the proceeds of such disposition shall be concurrently added to the Collateral securing the Notes and the Guarantees in the manner and to the extent required under this Indenture or any of the Collateral Agreements.

“Person” or “person” means any individual, sole proprietorship, partnership, limited liability company, joint venture, company, trust, unincorporated organization, association, corporation, institution, public benefit corporation, firm, joint stock company, estate, entity or government agency.

“Physical Notes” means permanent certificated Notes in registered form issued in minimum denominations of $1,000 principal amount and integral multiple of $1,000 in excess thereof.

“Predecessor Note” of any particular Note means every previous Note evidencing all or a portion of the same debt as that evidenced by such particular Note; and, for the purposes of this definition, any Note authenticated and delivered under Section 2.06 in lieu of or in exchange for a mutilated, lost, destroyed or stolen Note shall be deemed to evidence the same debt as the mutilated, lost, destroyed or stolen Note that it replaces.

“Property” means any right or interest in or to property of any kind whatsoever, whether real, personal or mixed and whether tangible or intangible.

“Redemption Date” has the meaning set forth in Section 4.04(B)(i).

“Redemption Price” means for any Notes to be redeemed pursuant to Section 4.04(A), 100% of the principal amount of such Notes, plus accrued and unpaid interest, if any, to, but excluding, the Redemption Date (unless the Redemption Date falls after a Regular Record Date but on or prior to the immediately succeeding Interest Payment Date, in which case the Company will pay, on or, at the Company’s election, before such Interest Payment Date, the full amount of accrued and unpaid interest to the Holders of record of such Notes as of the close of business on such Regular Record Date, and the Redemption Price will be equal to 100% of the principal amount of such Notes to be redeemed).

“Reference Property” has the meaning set forth in Section 5.10(A).

“Reference Property Unit” has the meaning set forth in Section 5.10(A).

“Regular Record Date,” with respect to any Interest Payment Date, means the January 1, April 1, July 1 or October 1 (whether or not such day is a Business Day), as the case may be, immediately preceding the applicable January 15, April 15, July 15 and October 15 Interest Payment Date, respectively.

“Reported Outstanding Share Number” has the meaning set forth in Section 5.11(A).

“Repurchase Upon Fundamental Change” means the repurchase of any Note by the Company pursuant to Article 4.

“Resale Restriction Termination Date” shall have the meaning specified in Section 2.05(C).

“Responsible Officer” means, when used with respect to the Trustee, any officer within the Corporate Trust Office of the Trustee, including any senior vice president, vice president, assistant vice president, any trust officer or assistant trust officer, or any other officer of the Trustee who customarily performs functions similar to those performed by the persons who at the time shall be such officers, respectively, or to whom any corporate trust matter relating to this Indenture is referred because of such person’s knowledge of and familiarity with the particular subject and who, in each case, shall have direct responsibility for the administration of this Indenture.

“Restricted Securities” shall have the meaning specified in Section 2.05(C).

“Restrictive Notes Legend” shall have the meaning specified in Section 2.05(C).

“Rule 144” means Rule 144 as promulgated under the Securities Act.

“Rule 144A” means Rule 144A as promulgated under the Securities Act.

“Scheduled Trading Day” means any day that is scheduled to be a Trading Day on the principal U.S. national or regional securities exchange on which the Common Stock is then listed or, if the Common Stock is not then listed on a U.S. national or regional securities exchange, on the principal other market on which the Common Stock is then traded. If the Common Stock is not so listed or traded, then “Scheduled Trading Day” means a Business Day.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Security Agreement” means that certain Security Agreement, dated as of October 14, 2020, among the Company, the Guarantors party thereto and the Collateral Agent.

“Security Document” has the meaning set forth in the Security Agreement.

“Similar Business” means any business conducted or proposed to be conducted by the Company and its Subsidiaries on the Issue Date or any business that is similar, complimentary, reasonably related, incidental or ancillary thereto or is a reasonable extension, development or expansion thereof.

“Specified Courts” has the meaning set forth in Section 13.07.

“Spin-Off” has the meaning set forth in Section 5.07(A)(iii)(b).

“Spin-Off Valuation Period” has the meaning set forth in Section 5.07(A)(iii)(b).

“Stated Interest” means, as of any date, a rate per annum equal to 4.00%; provided that in the event that the Company receives a USPS Minimum Firm Order, the Stated Interest shall be 2.75% beginning on the Interest Payment Date following receipt of such USPS Minimum Firm Order, certified to the Trustee in an Officer’s Certificate, until the Maturity Date.

“Subordinated Indebtedness” means with respect to the Notes and the Guarantees,

(A)any Indebtedness of the Company which is by its terms subordinated in right of payment to the Notes; and

(B) any Indebtedness of any Guarantor which is by its terms subordinated in right of payment to the Guarantee of such entity of the Notes;

provided, that, in each case, such Subordinated Indebtedness shall not have a final maturity date, amortization payment, sinking fund, mandatory redemption or other repurchase obligation or put right at the option of the lender or holder of such Subordinated Indebtedness earlier than one hundred eighty-one (181) days following the Maturity Date.

“Subsidiary” means, with respect to any Person, (A) any corporation, association or other business entity (other than a partnership or limited liability company) of which more than fifty percent (50%) of the total voting power of the Capital Stock entitled (without regard to the occurrence of any contingency, but after giving effect to any voting agreement or stockholders’ agreement that effectively transfers voting power) to vote in the election of directors, managers or trustees, as applicable, of such corporation, association or other business entity is owned or controlled, directly or indirectly, by such Person or one or more of the other Subsidiaries of such Person; and (B) any partnership or limited liability company where (i) more than fifty percent (50%) of the capital accounts, distribution rights, equity and voting interests, or of the general and limited partnership interests, as applicable, of such partnership or limited liability company are owned or controlled, directly or indirectly, by such Person or one or more of the other Subsidiaries of such Person, whether in the form of membership, general, special or limited partnership or limited liability company interests or otherwise; and (ii) such Person or any one or more of the other Subsidiaries of such Person is a controlling general partner of, or otherwise controls, such partnership or limited liability company.

“Successor Corporation” has the meaning set forth in Section 6.01(A)(i).

“Successor Guarantor Corporation” has the meaning set forth in Section 9.04(A)(i).

“Successor Person” has the meaning set forth in Section 5.10(A).

“Tender/Exchange Offer Valuation Period” has the meaning set forth in Section 5.07(A)(d).

“Total Indebtedness” means, as at any date of determination, an amount equal to the aggregate principal amount of all outstanding Indebtedness of the Company and its Subsidiaries on a consolidated basis consisting of (x) all Indebtedness for borrowed money or the deferred purchase price of Property or services (excluding trade credit entered into in the ordinary course of business due within ninety (90) days), including reimbursement and other obligations with respect to surety bonds and letters of credit, all obligations evidenced by notes, bonds, debentures or similar instruments, all Capital Lease Obligations, all Contingent Obligations, and Disqualified Stock and (y) guarantees of Indebtedness of any Person (other than the Company or any Subsidiary) of the type described in clause (x).

“Trademark License” means any written agreement granting any right to use any Trademark or Trademark registration, now owned or hereafter acquired by the Company or in which the Company now holds or hereafter acquires any interest.

“Trademarks” means all trademarks (registered, common law or otherwise) and any applications in connection therewith, including registrations, recordings and applications in the United States Patent and Trademark Office or in any similar office or agency of the United States, any State thereof or any other country or any political subdivision thereof.

“Trading Day” means any day on which (A) trading in the Common Stock generally occurs on the principal U.S. national or regional securities exchange on which the Common Stock is then listed or, if the Common Stock is not then listed on a U.S. national or regional securities exchange, on the principal other market on which the Common Stock is then traded; and (B) there is no Market Disruption Event. If the Common Stock is not so listed or traded, then “Trading Day” means a Business Day.

“Traditional Working Capital Facility” means non-convertible debt (or similar instruments) resulting in net proceeds to the Company of no less than twenty million dollars ($20,000,000) with (A) annual interest of no greater than LIBOR plus 8.00%, (B) no redemption provisions prior to the Maturity Date, (C) no original issue discount, (D) no make-whole interest or payments and (E) the purpose of which is to fund working capital for truck production.

“Transaction Documents” means, collectively, the Note Purchase Agreement, the Notes, the Security Agreement, the instructions to the transfer agent pursuant to the Note Purchase Agreement and each of the other agreements and instruments entered into or delivered by the Company in connection with the transactions contemplated by thereby, as may be amended from time to time.

“Trustee” means the Person named as the “Trustee” in the first paragraph of this Indenture until a successor trustee shall have become such pursuant to the applicable provisions of this Indenture, and thereafter “Trustee” shall mean or include each Person who is then a Trustee hereunder.

“UCC” means the Uniform Commercial Code as the same is, from time to time, in effect in the State of New York.

“USPS” means the United States Postal Service.

“USPS Award” means any award by the USPS pursuant to Contract No. 3D-20-A-0031 - Next Generation Delivery Vehicle (NGDV) Production Phase 3 Request for Proposal (RFP).

“USPS Minimum Firm Order” means a Firm Order of at least forty thousand (40,000) Next Generation Delivery Vehicles.

“VWAP Market Disruption Event” means, with respect to any date, (A) the failure by the principal U.S. national or regional securities exchange on which the Common Stock is then listed, or, if the Common Stock is not then listed on a U.S. national or regional securities exchange, the principal other market on which the Common Stock is then traded, to open for trading during its regular trading session on such date; or (B) the occurrence or existence, for more than one half hour period in the aggregate, of any suspension or limitation imposed on trading (by reason of movements in price exceeding limits permitted by the relevant exchange or otherwise) in the Common Stock or in any options contracts or futures contracts relating to the Common Stock, and such suspension or limitation occurs or exists at any time before 1:00 p.m., New York City time, on such date.

“VWAP Trading Day” means a day on which (A) there is no VWAP Market Disruption Event; provided that that Holders of a majority in the aggregate principal amount of the Notes then outstanding, by written notice to the Company, may waive any such VWAP Market Disruption Event; and (B) trading in the Common Stock generally occurs on the principal U.S. national or regional securities exchange on which the Common Stock is then listed or, if the Common Stock is not then listed on a U.S. national or regional securities exchange, on the principal other market on which the Common Stock is then traded. If the Common Stock is not so listed or traded, then “VWAP Trading Day” means a Business Day.

Section 1.02.RULES OF CONSTRUCTION.

For purposes of this Indenture:

(A)“or” is not exclusive;

(B)“including” means “including without limitation”;

(C)“will” expresses a command;

(D)words in the singular include the plural and in the plural include the singular, unless the context requires otherwise;

(E)“herein,” “hereof” and other words of similar import refer to this Indenture as a whole and not to any particular Article, Section or other subdivision of this Indenture, unless the context requires otherwise;

(F)references to currency mean the lawful currency of the United States of America, unless the context requires otherwise;

(G)the exhibits, schedules and other attachments to this Indenture are deemed to form part of this Indenture; and

(H)the term “interest,” when used with respect to a Note, includes any Additional Interest, in each case to the extent then due, unless the context requires otherwise.

Article 2.THE NOTES

Section 2.01.DESIGNATION AND AMOUNT.

The Notes shall be designated as the “4.00% Convertible Senior Secured Notes due 2024.” The aggregate principal amount of Notes that may be authenticated and delivered under this Indenture is initially limited to $200,000,000, subject to Section 2.10 and except for Notes authenticated and delivered upon registration or transfer of, or in exchange for, or in lieu of other Notes to the extent expressly permitted hereunder.

Section 2.02.FORM OF NOTES.

The Notes and the Trustee’s certificate of authentication shall be substantially in the form set forth in Exhibit A, the terms and provisions of which shall constitute, and are incorporated in and made a part hereof. To the extent applicable, the Company and the Trustee, by their execution and delivery of this Indenture, expressly agree to such terms and provisions and to be bound thereby. In the case of any conflict between this Indenture and a Note, the provisions of this Indenture shall control and govern to the extent of such conflict.

Any Global Note may be endorsed with or have incorporated in the text thereof such legends or recitals or changes not inconsistent with the provisions of this Indenture as may be required by the Custodian or the Depositary, or as may be required to comply with any applicable law or any regulation thereunder or with the rules and regulations of any securities exchange or automated quotation system upon which the Notes may be listed or traded or designated for issuance or to conform with any usage with respect thereto, or to indicate any special limitations or restrictions to which any particular Notes are subject.

Any of the Notes may have such letters, numbers or other marks of identification and such notations, legends or endorsements as the Officer executing the same may approve (execution thereof to be conclusive evidence of such approval) and as are not inconsistent with the provisions of this Indenture, or as may be required to comply with any law or with any rule

or regulation made pursuant thereto or with any rule or regulation of any securities exchange or automated quotation system on which the Notes may be listed or designated for issuance, or to conform to usage or to indicate any special limitations or restrictions to which any particular Notes are subject.

Each Global Note shall represent such principal amount of the outstanding Notes as shall be specified therein and shall provide that it shall represent the aggregate principal amount of outstanding Notes from time to time endorsed thereon and that the aggregate principal amount of outstanding Notes represented thereby may from time to time be increased or reduced to reflect redemptions, repurchases, cancellations, conversions, transfers or exchanges permitted hereby. Any endorsement of a Global Note to reflect the amount of any increase or decrease in the amount of outstanding Notes represented thereby shall be made by the Trustee or the Custodian, at the direction of the Trustee, in such manner and upon instructions given by the Holder of such Notes in accordance with this Indenture. Payment of principal (including the Redemption Price and the Fundamental Change Repurchase Price, if applicable) of, and accrued and unpaid interest on, a Global Note shall be made to the Holder of such Note on the date of payment, unless a record date or other means of determining Holders eligible to receive payment is provided for herein.

Section 2.03.DATE AND DENOMINATION OF NOTES; PAYMENTS OF INTEREST AND DEFAULTED AMOUNTS.

(A)Date and Denominations. The Notes shall be issuable in registered form without coupons in minimum denominations of $1,000 principal amount and integral multiples of $1,000 in excess thereof (“Authorized Denominations”). Each Note shall be dated the date of its authentication and shall bear cash interest from the date specified on the face of such Note. Accrued interest on the Notes shall be computed on the basis of a 360-day year composed of twelve 30-day months and, for partial months, on the basis of the number of days actually elapsed in a 30-day month.

(B)Payments. The Person in whose name any Note (or its Predecessor Note) is registered on the Note Register at the close of business on any Regular Record Date with respect to any Interest Payment Date shall be entitled to receive the interest payable on such Interest Payment Date. The principal amount of any Note (x) in the case of any Physical Note, shall be payable at the office or agency of the Company maintained by the Company for such purposes in the United States of America, which shall initially be the Corporate Trust Office and (y) in the case of any Global Note, shall be payable by wire transfer of immediately available funds to the account of the Depositary or its nominee. The Company shall pay, or cause the Paying Agent to pay, interest (i) on any Physical Notes (A) to Holders holding Physical Notes having an aggregate principal amount of $5,000,000 or less, by check mailed to the Holders of these Notes at their address as it appears in the Note Register and (B) to Holders holding Physical Notes having an aggregate principal amount of more than $5,000,000, either by check mailed to each such Holder or, upon written application by such a Holder to the Note Registrar in a form reasonably satisfactory to the Note Registrar not later than the relevant Regular Record Date, by wire transfer in immediately available funds to that Holder’s account within the United States if

such Holder has provided the Trustee or the Paying Agent (if other than the Trustee) with the requisite information necessary to make such wire transfer, which written application shall remain in effect until the Holder notifies, in writing, the Note Registrar to the contrary or (ii) on any Global Note by wire transfer of immediately available funds to the account of the Depositary or its nominee.

(C)Defaulted Amounts. If (i) the Company fails to pay any amount payable on the Notes (including, without limitation, the Redemption Price, the Fundamental Change Repurchase Price, principal amount and interest) on or before the due date therefor as provided in this Indenture and the Notes, then, regardless of whether such failure constitutes an Event of Default, or (ii) a Default or Event of Default occurs (such amount payable or the principal amount outstanding as of such failure to pay, or Default or Event of Default (as applicable, a “Defaulted Amount”)) then in each case, to the extent lawful, interest (“Default Interest”) will accrue on such Defaulted Amount at a rate per annum equal to eight percent (8.0%) in excess of the Stated Interest on the Notes, from, and including, such due date or the date of such Default or Event of Default, as applicable, to, but excluding, the date such failure to pay or Default or Event of Default is cured and all outstanding Default Interest under this Indenture has been paid, as applicable. Such Defaulted Amounts together with such Default Interest thereon shall be paid by the Company, at its election in each case, as provided in clause (i) or (ii) below: