Workhorse Group Reports Fourth Quarter and Full Year 2021 Results

CINCINNATI, Mar. 01, 2022 (GLOBE NEWSWIRE) – Workhorse Group Inc. (Nasdaq: WKHS) (“Workhorse” or “the Company”), an American technology company focused on providing sustainable and cost-effective electric vehicles to the last-mile delivery sector, today reported financial results for the fourth quarter and full year ended December 31, 2021.

Management Commentary

“We have taken significant action across the business to strengthen the foundation of the Company,” said Workhorse CEO Rick Dauch. “We moved quickly to build an experienced, capable leadership team, significantly enhance our engineering and technical expertise, open a new design facility and strengthen our financial position. Most importantly, we have developed a revised and executable strategic product roadmap for our electric vehicle delivery offerings, which includes developing two new truck chassis platforms and multipurpose drones. We also entered a supplier agreement with GreenPower Motor Company, which demonstrates the value we provide as a strategic partner. While we have significant work ahead, we are confident we have the right team and structure in place to execute on our plans, deliver new vehicles to meet significant customer demand and deliver long-term value to our shareholders.”

Fourth Quarter 2021 and Recent Operational Highlights

Workhorse delivered on its stated priorities from the fourth quarter by bolstering its talent and operational capabilities:

•Continued to build out an experienced executive team through the appointments of:

◦Robert Ginnan as Chief Financial Officer. Mr. Ginnan brings more than 25 years of senior finance and leadership experience, having most recently served as the CEO & CFO for privately held Family RV Group, the fifth largest RV dealership network in the country.

◦Kerry Roraff as Chief Human Resources Officer. Ms. Roraff brings with her more than 15 years of progressive global HR leadership experience within the automotive and telecommunications industries.

◦Brad Hartzell as Vice President, Manufacturing Services. Mr. Hartzell has over 25 years of tier one automotive experience in manufacturing engineering, maintenance, and operations. For the past decade, Brad has supported global operations in China, Thailand, India, Turkey, and Germany.

◦Ben Drake as Vice President, Government Affairs. Mr. Drake was formerly the DOD leader for energy resiliency policy and, prior to that, was a professional Senate energy policy staff member.

•Opened a technical design and testing center in Wixom, Michigan to expand engineering talent and capabilities. As part of opening the new tech center, Workhorse hired experienced automotive design engineers with more than 270 years of cumulative design experience and expertise in chassis, suspension, drivetrain, energy storage and supply chain management. In addition, Workhorse plans to consolidate and relocate its headquarters together with its advanced technology team in Sharonville, Ohio in April 2022.

•Completed the FMVSS compliance and full-vehicle structural, E-powertrain testing, defined necessary corrective actions and developed production plans for the C-1000. Existing vehicles will be repaired, and a limited number of additional vehicles manufactured in 2022.

Revised Strategic Product Roadmap

Workhorse has developed a clear, revised strategic product roadmap to expand its electric vehicle delivery offering through a multi-faceted approach across four electric vehicle platforms:

•C-1000: With FMVSS testing completed, the Company will repair all currently manufactured vehicles produced to date. Workhorse will also manufacture 50-75 additional vehicles from inventory on hand during 2022. The Company will then retire the model, ending production of new vehicles while continuing to provide service and parts to customers with vehicles that are on the road.

•W750: As announced in a separate press release issued today, to bridge the gap between the C-1000 manufacturing and launch of the W56 and W34 platforms, Workhorse has signed a strategic supplier agreement with GreenPower to produce the W750. The W750 is a class 4 delivery step van that is FMVSS / CMVSS certified and features a payload of more than 5,000 lbs. Production is planned for Q3 2022.

•W56: The W56 will be the first new Workhorse vehicle to the market and will serve the Class 5 and 6 delivery van and truck market segments, building on Workhorse’s significant experience with these classes of vehicles, with production targeted for Q3 2023. The W56 will have a target payload range of greater than 7,000 lbs. across multiple wheelbase options and will leverage existing Workhorse designs, extensive real world operating history and a common parts bin.

•W34: The W34 platform will build upon the technology and field experiences from the E-Gen and C-1000 trucks to create a new Class 3-4 vehicle featuring the Accessible Low Floor Platform with improved ride handling and lightweight systems. Production is expected to start in 2024.

Progress in Aerospace Technology

Workhorse continues to invest in its drone operations and achieved several important milestones during the fourth quarter:

•Received Federal government approval to pursue commercial FAA Type Certification (Part 21.17) in 2022-2023.

•Entered the final development and testing phase for market segment leading payload and range capabilities.

•Awarded multiple grants and contracts with the U.S. Department of Agriculture to provide sensor monitoring, data procurement and analytics as part of demonstration projects.

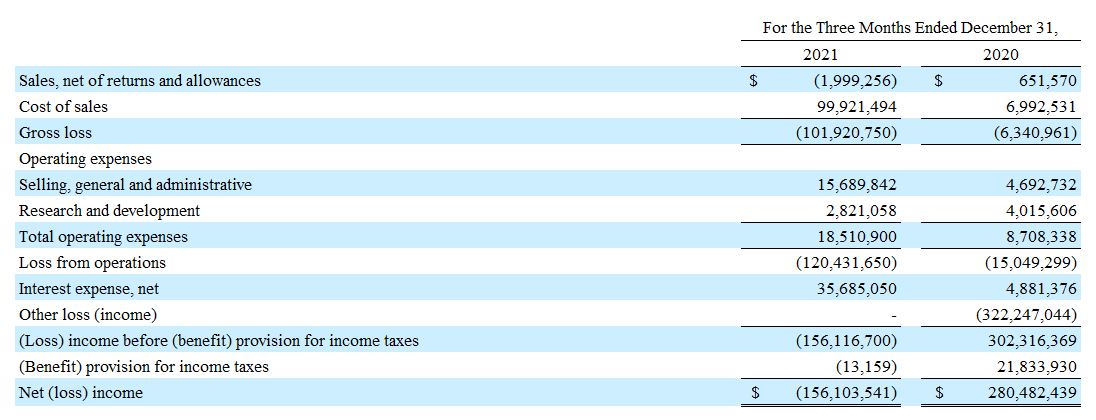

Fourth Quarter 2021 Financial Results

Sales, net of returns and allowances, for the fourth quarter of 2021 were recorded at $(2.0) million compared to $0.7 million in the fourth quarter of 2020. The decrease in sales was primarily due to a decrease in volume and an increase in vehicle returns and allowances in connection with the recall of C-1000 vehicles.

Cost of sales increased to $99.9 million from $7.0 million in the same period last year as the Company took several non-cash charges including a $63.6 million increase in inventory reserves, a $23.9 million increase in the prepaid purchases reserve, and a $6.8 million impairment to adjust the carrying amount of tooling and other assets related to the C-Series electric delivery truck.

Selling, general and administrative (“SG&A”) expenses increased to $15.7 million from $4.7 million in the same period last year. The increase in SG&A expenses was primarily driven by a $4.1 million increase in selling costs, a $3.2 million increase in legal and professional fees and a $2.7 million increase in employee and labor related expenses from increased headcount and the appointments of the Company’s new executive leadership team.

Research and development (“R&D”) expenses decreased to $2.8 million compared to $4.0 million in the same period last year. The decrease in R&D expenses was primarily related to reductions in consulting

fees, slightly offset by an increase in employee and labor related expenses due to an increase in headcount. The decrease is also attributable to lower prototype component costs related to the C-1000.

Net interest expense was $35.7 million compared to $4.9 million in the same period last year. The increase in interest expense was primarily driven by losses on exchange of the Company’s convertible notes to common stock.

Other loss was nil compared to $322.2 million of other income in the same period last year. The other income in the prior period was primarily attributable to favorable changes in fair value of the Company’s investment in Lordstown Motor Corporation (“LMC”), which was sold entirely in Q3 2021.

Net loss was $156.1 million, compared to net income of $280.5 million in the same period last year. Loss from operations for the fourth quarter was $120.4 million compared to $15.0 million in the same period last year.

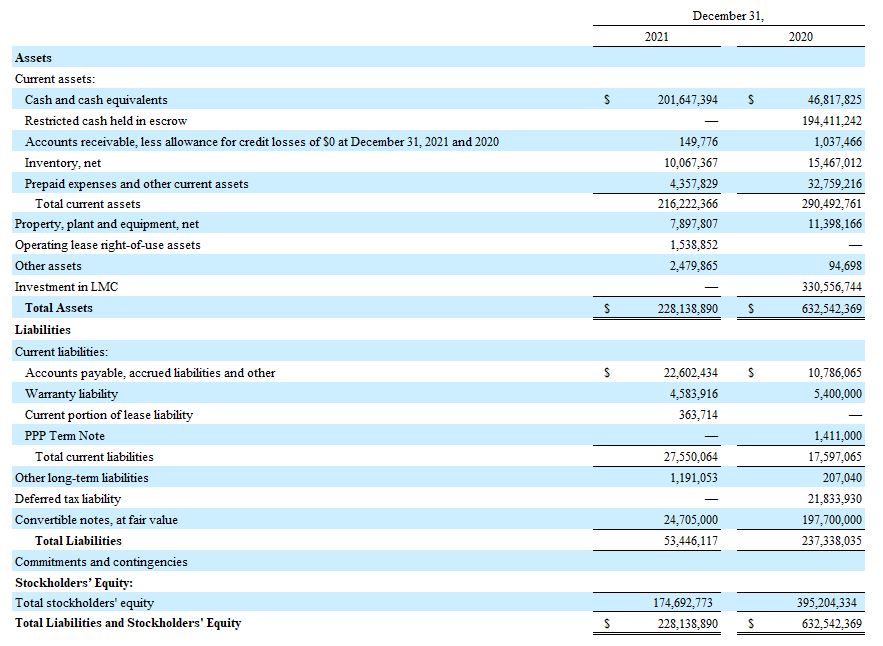

As of December 31, 2021, the Company had approximately $201.6 million in cash and cash equivalents.

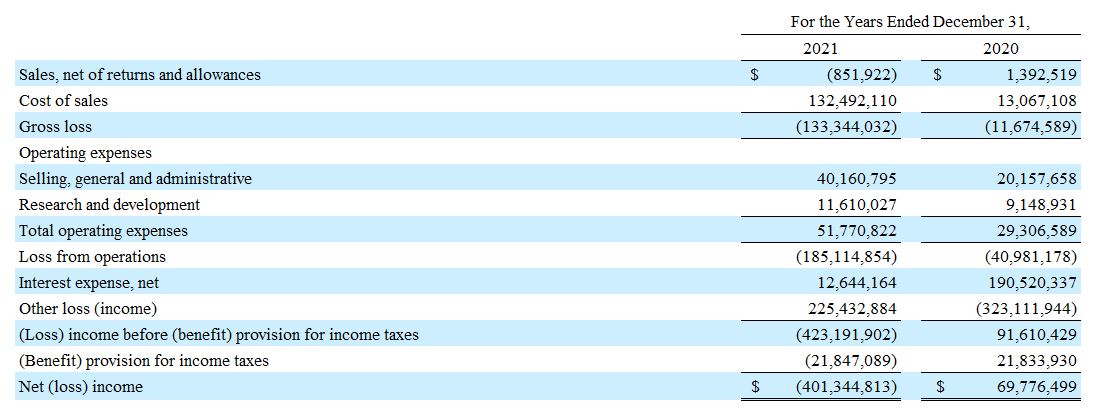

Full Year 2021 Financial Results

Sales, net of returns and allowances, for the full year 2021 were recorded at $(0.9) million compared to $1.4 million in 2020. The decrease in sales was primarily due to an increase in sales returns and allowances in connection with the recall of C-1000 vehicles announced in the third quarter of 2021.

Cost of sales for the full year 2021 increased $119.4 million to $132.5 million from $13.1 million in 2020. The increase was primarily due to several non-cash charges including a $75.0 million increase in the inventory reserve, a $23.9 million increase in the prepaid purchases reserve, and a $6.8 million impairment charge to adjust the carrying amount of tooling and other assets related to the C-Series electric delivery truck. The year over year increases described above were primarily driven by the Company’s decision to produce the C-1000 platform at low-volume and transition to a new all-electric delivery truck platform in the near future. This decision was based on results of extensive testing performed on the C-1000 vehicles, which concluded in early 2022.

SG&A expenses for the full year 2021 increased to $40.2 million from $20.2 million in 2020. The increase was primarily due to an increase of $7.9 million in employee and labor related expenses from increased headcount and the appointments of the Company’s new executive leadership team during the year. Additionally, there was an increase of $7.0 million in professional services related to litigation and settlements, marketing programs, investor relations services and general consulting fees, and a $3.1 million increase in selling related fees.

R&D expenses for the full year 2021 increased to $11.6 million from $9.1 million in 2020. The increase was primarily due to an increase in employee and labor related expenses due to an increase in headcount to support the current and expanding product roadmap and continuing development of the HorseFlyTM UAV.

Other loss changed unfavorably during 2021 as the Company recognized a loss of $225.4 million, primarily attributable to unfavorable changes in fair value and sale of the investment in LMC. During the year ended December 31, 2020, the Company recognized income of $323.1 million, primarily attributable to favorable changes in fair value of the investment in LMC.

Net interest expense for the full year 2021 decreased to $12.6 million compared to $190.5 million in 2020. The decrease was primarily due to a reduction of $153.4 million related to fair value adjustments and losses on conversion of the Company’s convertible notes. Additionally, there was a decrease of $12.2 million related to mark-to-market adjustments and losses on exercises of warrants issued to lenders, a $7.7 million decrease in costs related to the issuance of convertible notes, and a $4.7 million decrease in losses recognized on the redemption of Series B Preferred Stock.

For the years ended December 31, 2021 and 2020, the Company has no federal tax expense primarily due to loss on operations.

Net loss was $401.3 million, or a loss of $3.12 per fully diluted share, compared to net income of $69.8 million, or income of $0.70 per fully diluted share, last year.

2022 Guidance

“Our outlook for 2022 reflects our planned progressive ramp in manufacturing, which is backloaded, as we are not expecting to produce any vehicles in the first half of the year,” said Workhorse CFO Bob Ginnan.

Under the newly developed business plans, Workhorse expects to manufacture and sell at least 250 vehicles in 2022, assuming current supply chain visibility remains unchanged, and generate at least $25 million in revenue.

Conference Call

Workhorse management will hold a conference call today (March 1, 2022) at 10:00 a.m. Eastern time (7:00 a.m. Pacific time) to discuss these results and answer related questions.

U.S. dial-in: 877-407-8289

International dial-in: 201-689-8341

The conference call will be broadcast live and available for replay here and via the Investor Relations section of Workhorse's website: https://ir.workhorse.com/.

A telephonic replay of the conference call will be available after 1:00 p.m. Eastern time on the same day through March 8, 2022.

Toll-free replay number: 877-660-6853

International replay number: 201-612-7415

Replay ID: 13727292

About Workhorse Group Inc.

Workhorse is a technology company focused on providing drone-integrated electric vehicles to the last-mile delivery sector. As an American original equipment manufacturer, we design and build high performance, battery-electric vehicles including trucks and aircraft. Workhorse also develops cloud-based, real-time telematics performance monitoring systems that are fully integrated with our vehicles and enable fleet operators to optimize energy and route efficiency. All Workhorse vehicles are designed to make the movement of people and goods more efficient and less harmful to the environment. For additional information visit workhorse.com.

Annual Meeting of Stockholders

The Company also announced that its Annual Meeting of Stockholders would take place on May 3, 2022, with a record date of March 7, 2022.

Forward-Looking Statements

This press release includes forward-looking statements. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as "believes," "expects," "anticipates," "estimates," "projects," "intends," "should," "seeks," "future," "continue," or the negative of such terms, or other comparable terminology. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from the forward-looking statements contained herein. Factors that could cause actual results to differ materially include, but are not limited to: our ability to successfully develop and manufacture our new product portfolio, including the recently announced W750, W56 and W34 platforms; our ability to attract and retain customers for our existing and new products; risks associated with obtaining orders and executing upon such orders; supply chain disruptions, including constraints on steel and semiconductors and resulting increases in costs impacting our company, our customers, our suppliers or the industry; our

ability to implement modifications to vehicles to achieve compliance with FMVSS and to meet customer demands with respect to the C-1000s; the results of our ongoing review of the Company’s business and go-forward operating and commercial plans; our ability to capitalize on opportunities to deliver products to meet customer requirements; our limited operations and need to expand to fulfill product orders; the ability to protect our intellectual property; negative impacts stemming from the continuing COVID-19 pandemic; market acceptance of our products; our ability to control our expenses; potential competition, including shifts in technology; global and local business conditions; our inability to retain key members of our management team; our inability to raise additional capital to fund our operations and business plan; our inability to satisfy covenants in our financing agreements; our inability to maintain our listing of our securities on the Nasdaq Capital Market; our inability to satisfy our customer warranty claims; the outcome of any regulatory proceedings; our liquidity and other risks and uncertainties and other factors discussed from time to time in our filings with the Securities and Exchange Commission ("SEC"), including our annual report on Form 10-K filed with the SEC. Workhorse expressly disclaims any obligation to publicly update any forward-looking statements contained herein, whether as a result of new information, future events or otherwise, except as required by law.

Media Contact:

Aaron Palash / Tim Lynch

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

Investor Relations Contact:

Matt Glover and Tom Colton

Gateway Investor Relations

949-574-3860

WKHS@gatewayir.com

Workhorse Group Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

Workhorse Group Inc.

Condensed Consolidated Statements of Operations

Workhorse Group Inc.

Condensed Consolidated Balance Sheets