UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

SCHEDULE 14A

(Rule 14a-101)

Information Required in Proxy Statement

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

___________________________

|

Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ |

|

Check the appropriate box: |

||

|

☒ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☐ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

|

WORKHORSE GROUP INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

|

Payment of Filing Fee (Check the appropriate box): |

||

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

|

Workhorse Group Inc. 3600 Park 42 Drive, Suite 160E, Sharonville, Ohio 45241 (888) 646-5205 |

|

Notice of Annual Meeting of

Stockholders to be held

on May 14, 2024

|

MEETING DETAILS |

||||||||

|

|

Time and Date May 14, 2024, |

|

Location The Annual Meeting will be held in a virtual meeting format at www.virtualshare- holdermeeting.com/WKHS2024. |

|

Record Date Stockholders of record at the close of business on March 15, 2024 will be entitled to receive notice of, attend and vote at the Annual Meeting. |

|||

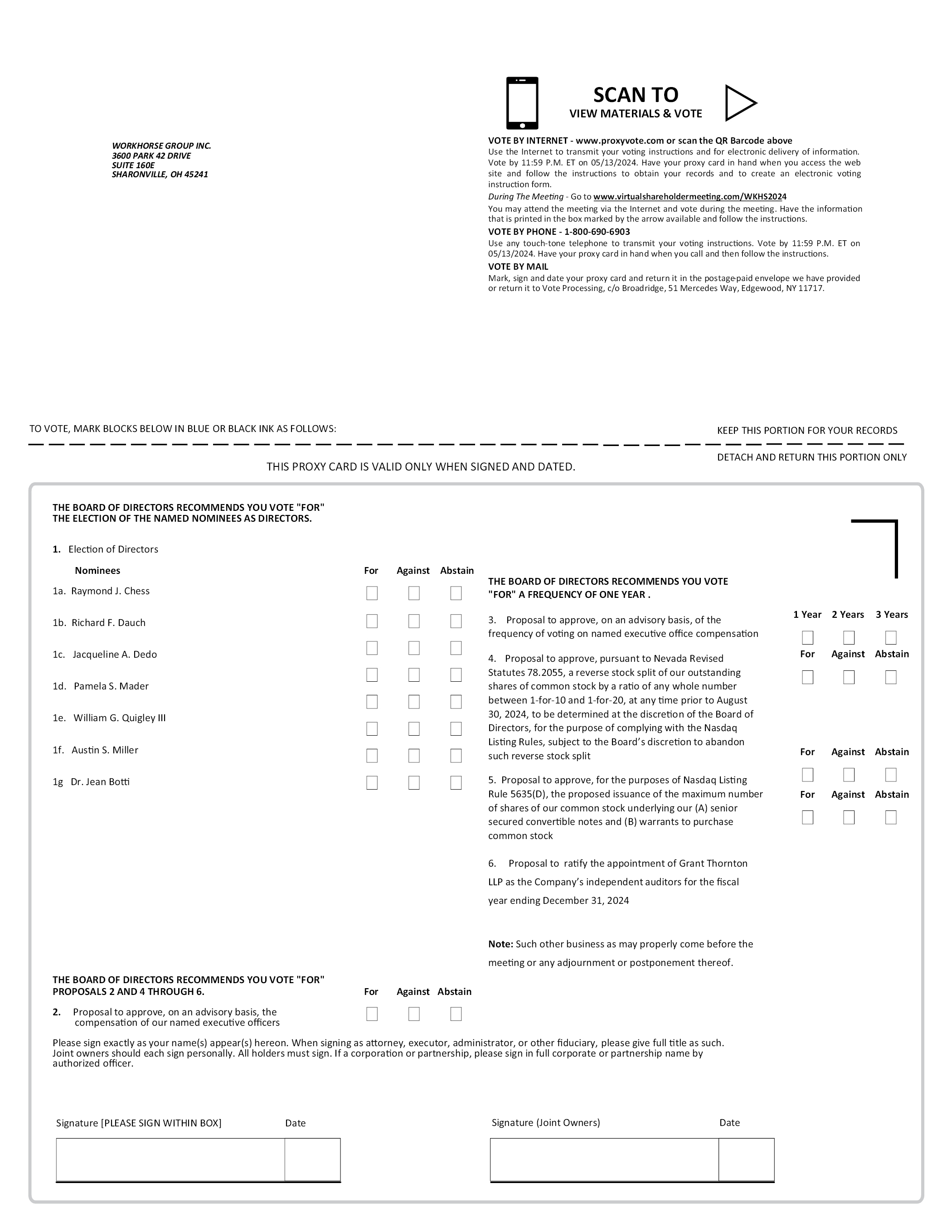

The 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Workhorse Group Inc. (“Workhorse,” the “Company” or “we”) will be held on May 14, 2024, at 9:00 a.m. Eastern Time. The Annual Meeting will be held in a virtual meeting format at www.virtualshareholdermeeting.com/WKHS2024.

AT THE ANNUAL MEETING, YOU WILL BE ASKED:

|

1 |

To elect the seven director nominees named in the Proxy Statement to hold office until the next annual meeting of stockholders or until their successors are duly elected and qualified; |

|

|

2 |

To approve, on an advisory basis, the compensation of the Company’s named executive officers; |

|

|

3 |

To approve, on an advisory basis, the frequency of voting on named executive officer compensation; |

|

|

4 |

To approve, pursuant to Nevada Revised Statutes 78.2055, a reverse stock split of our outstanding shares of common stock by a ratio of any whole number between 1-for-10 and 1-for-20, at any time prior to August 30, 2024, to be determined at the discretion of the Board of Directors, for the purpose of complying with the Nasdaq Listing Rules, subject to the Board’s discretion to abandon such reverse stock split; |

|

|

5 |

To approve, for the purposes of Nasdaq Listing Rule 5635(D), the proposed issuance of the maximum number of shares of our common stock underlying our (A) senior secured convertible notes and (B) warrants to purchase common stock; |

|

|

6 |

To ratify the appointment of Grant Thornton LLP as the Company’s independent auditors for the fiscal year ending December 31, 2024; and |

|

|

7 |

To act on such other matters as may properly come before the meeting or any adjournment thereof. |

Because of the significance of these proposals to the Company and its stockholders, it is vital that every stockholder vote at the Annual Meeting.

These proposals are fully set forth in the accompanying Proxy Statement which you are urged to read thoroughly. For the reasons set forth in the Proxy Statement, your Board of Directors recommends a vote “FOR” each of the director nominees under Proposal 1, “FOR” Proposals 2, 4, 5, 6 and 7; and FOR annual frequency on Proposal 3. After reading the enclosed Proxy Statement, please sign, date, and return promptly the enclosed Proxy in the

accompanying postpaid envelope we have provided for your convenience or vote via the Internet as instructed herein to ensure that your shares will be represented. You may wish to provide your response electronically through the Internet by following the instructions set out on the enclosed proxy card.

To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/WKHS2024, you must have your control number available and follow the instructions found on your proxy card or voting instruction form. You may vote during the Annual Meeting, but we suggest you vote beforehand by following the instructions available on the meeting website during the meeting. Please allow sufficient time before the Annual Meeting to complete the online check-in process. Your vote is very important.

Proxy materials or a Notice of Internet Availability of Proxy Materials (the “Notice”) are being first released or mailed on or about April , 2024 to all stockholders entitled to vote at the Annual Meeting. In accordance with rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of our proxy materials to each record stockholder, we may furnish proxy materials by providing internet access to those documents. The Notice contains instructions on how to access our proxy materials and vote online, or in the alternative, request a paper copy of the proxy materials and a proxy card.

By Order of the Board of Directors

Raymond J. Chess

Chairman of the Board of Directors

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held May 14, 2024. In addition to the copies you have received, the Proxy Statement and our 2023 Annual Report on Form 10-K are available to stockholders at: https://www.proxyvote.com. Whether or not you plan on attending the virtual meeting, please vote as promptly as possible to ensure that your vote is counted. |

|

Workhorse Group Inc. 3600 Park 42 Drive, Suite 160E, Sharonville, Ohio 45241 (888) 646-5205 |

|

April , 2024

Dear Fellow Workhorse Stockholders,

Over the last year, the Workhorse team made significant progress electrifying last mile delivery by bringing our commercial EV trucks to customers.

Executing on a Clear Strategy

We ended 2023 with important momentum advancing our commercial EV product roadmap, including:

• Rolling out our first W56 step van, securing our first W56 fleet customers and receiving HVIP certification approval for these vehicles

• Increasing our production capabilities for our W4 CC and W750 vehicles.

• Expanding our commercial network, adding key dealers and partners in multiple states with 11 dealers nationwide.

• Completing the revamp of our manufacturing complex in Union City, Indiana

Our Stables by Workhorse continued electrifying the fleet of delivery vehicles it uses on a series of FedEx Ground delivery routes in the greater Cincinnati, Ohio area. We expect this entire fleet to be electrified by the end of 2024. We put our first W56 step van into service during Q1 2024.

For our Aero business, we made the strategic decision to move away from design and manufacturing and exclusively focus on a less capital-intensive ‘Drones as a Service’ (“Daas”) model. This model gives the Company the chance to build on its strong relationships with government agencies and generate revenues providing DaaS services. We are continuing a strategic review to determine the best path forward for our Aero business.

Strengthening our Financial Position

While we advance our roadmap, we have taken critical steps to help secure the runway to achieve our goals. We recently closed a financing transaction that is intended to provide short- and long-term liquidity. We have also taken aggressive cost reduction actions across the organization. Together, these actions can provide the resources to execute our plans for 2024.

I’m incredibly proud of the Workhorse team and grateful for the contributions of all our employees, including those whose jobs were impacted by the difficult but necessary actions we took recently.

Building on a Foundation Based on Sustainability

Sustainability is inherent in everything we are doing, from our zero emissions vehicles to our investments in our employees and communities. We are designing and manufacturing commercial vehicles that can play a key role in the low-carbon revolution now underway. Our products enable more efficient, safer and healthier transportation for our customers and communities.

Our Board of Directors has extensive experience in the automotive industry, as well as aviation and drones, which provides the insight and guidance to help Workhorse achieve its ambitious growth goals.

Looking Ahead

I remain optimistic about the future of Workhorse. The transition to commercial EV powered vehicles is not going to happen overnight, and this year we navigated challenges that slowed, but never stopped, our progress.

We are committed to our mission and will continue taking decisive steps to succeed in the market and drive value for our stockholders. We believe our products and technologies can be an important part of this once-in-a-generation powertrain technology transition, and we are committed to meeting the needs of our customers. We are prepared for the transition — we have the people, products, processes, and business partners to meet the needs of the market when this EV transition hits full stride. We need our customers to start and ramp up their own transition to EV powered vehicles and believe that 2 or 3 of the largest fleets in North America will be ready to do so soon.

Thank you for your investment in Workhorse.

Best Regards.

Sincerely,

Richard F. Dauch

Chief Executive Officer

|

|

|

1 |

||

|

1 |

||

|

1 |

||

|

2 |

||

|

2 |

||

|

2 |

||

|

2 |

||

|

2 |

||

|

3 |

||

|

3 |

||

|

4 |

||

|

4 |

||

|

5 |

||

|

5 |

||

|

5 |

||

|

6 |

||

|

Interest of Officers and Directors in matters to be acted upon |

6 |

|

|

7 |

||

|

7 |

||

|

8 |

||

|

Security Ownership of Certain Beneficial Holders and Management |

10 |

|

|

12 |

||

|

12 |

||

|

12 |

||

|

12 |

||

|

13 |

||

|

14 |

||

|

15 |

||

|

15 |

||

|

16 |

||

|

17 |

||

|

17 |

||

|

18 |

||

|

19 |

||

|

19 |

||

|

20 |

||

|

Member of the Current Board of Directors not Standing for Re-election |

24 |

|

|

24 |

||

|

24 |

||

|

25 |

||

|

29 |

||

|

Approve, on an Advisory Basis, the Compensation of Our Named Executive Officers |

30 |

|

Workhorse Group |

i |

2024 Proxy Statement |

|

30 |

||

|

30 |

||

|

31 |

||

|

31 |

||

|

31 |

||

|

32 |

||

|

33 |

||

|

33 |

||

|

34 |

||

|

34 |

||

|

35 |

||

|

35 |

||

|

35 |

||

|

35 |

||

|

37 |

||

|

37 |

||

|

38 |

||

|

38 |

||

|

39 |

||

|

39 |

||

|

40 |

||

|

40 |

||

|

41 |

||

|

41 |

||

|

Consideration of Most Recent Stockholder Advisory Vote on Executive Compensation |

41 |

|

|

42 |

||

|

42 |

||

|

43 |

||

|

44 |

||

|

Employment Agreements and Potential Payments on Change of Control and Termination |

45 |

|

|

46 |

||

|

46 |

||

|

47 |

||

|

47 |

||

|

48 |

||

|

Securities Authorized for Issuance under Equity Compensation Plans |

49 |

|

|

Approve, on an Advisory Basis, the Frequency of Voting on Named Executive Officer Compensation |

51 |

|

|

51 |

||

|

51 |

||

|

52 |

||

|

52 |

||

|

52 |

||

|

54 |

||

|

55 |

||

|

55 |

|

Workhorse Group |

ii |

2024 Proxy Statement |

|

56 |

||

|

56 |

||

|

56 |

||

|

56 |

||

|

57 |

||

|

57 |

||

|

57 |

||

|

57 |

||

|

Certain Material U.s. Federal Income Tax Consequences of a Reverse Stock Split |

58 |

|

|

59 |

||

|

59 |

||

|

59 |

||

|

60 |

||

|

60 |

||

|

62 |

||

|

63 |

||

|

63 |

||

|

64 |

||

|

64 |

||

|

64 |

||

|

65 |

||

|

65 |

||

|

66 |

||

|

66 |

||

|

66 |

||

|

67 |

||

|

67 |

||

|

68 |

||

|

68 |

||

|

68 |

||

|

68 |

||

|

68 |

||

|

68 |

||

|

68 |

||

|

69 |

||

|

69 |

||

|

A-1 |

||

|

B-1 |

||

|

C-1 |

|

Workhorse Group |

iii |

2024 Proxy Statement |

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Workhorse Group Inc. (“Workhorse” or the “Company”) to be voted at the Annual Meeting of Stockholders (the “Annual Meeting”), which will be held on May 14, 2024, at 9:00 a.m. Eastern Time and at any postponements or adjournments thereof. The proxy materials will be furnished to stockholders on or about April , 2024. The Annual Meeting will be held as a virtual meeting. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend and participate in the Annual Meeting online via a live webcast by visiting www.virtualshareholdermeeting.com/WKHS2024. In addition to voting by submitting your proxy prior to the Annual Meeting, you also will be able to vote your shares electronically during the Annual Meeting.

Any stockholder executing a proxy that is solicited hereby has the power to revoke it prior to the voting of the proxy. Revocation may be made by attending the Annual Meeting and voting the shares of stock in person, or by delivering to the General Counsel of the Company at the principal office of the Company prior to the Annual Meeting a written notice of revocation or a later-dated, properly executed proxy. Solicitation of proxies may be made by directors, officers and other employees of the Company by personal interview, telephone, facsimile transmittal or electronic communications. No additional compensation will be paid for any such services. This solicitation of proxies is being made by the Company, which will bear all costs associated with the mailing of this Proxy Statement and the solicitation of proxies.

Stockholders of record at the close of business on March 15, 2024, will be entitled to receive notice of, attend and vote at the Annual Meeting.

|

Workhorse Group |

1 |

2024 Proxy Statement |

why am i receiving these materials?

The Company has furnished these materials to you, in connection with the Company’s solicitation of proxies for use at the Annual Meeting of Stockholders to be held on May 14, 2024, at 9:00 a.m. Eastern Time. The Annual Meeting will be held as a virtual meeting. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend and participate in the Annual Meeting online via a live webcast by visiting www.virtualshareholdermeeting.com/WKHS2024. These materials have also been made available to you on the Internet. These materials describe the proposals on which the Company would like you to vote and also give you information on these proposals so that you can make an informed decision. We are furnishing our proxy materials on or about April , 2024 to all stockholders of record entitled to vote at the Annual Meeting.

Notice of Internet Availability (Notice and Access)

Instead of mailing a printed copy of our proxy materials to each stockholder, we are furnishing proxy materials via the Internet. This reduces both the costs and the environmental impact of sending our proxy materials to our stockholders. If you received a “Notice of Internet Availability,” you will not receive a printed copy of the proxy materials unless you specifically request a printed copy. The Notice of Internet Availability will instruct you how to access and review the important information contained in the proxy materials. The Notice of Internet Availability also instructs you how to submit your proxy on the Internet and how to vote by telephone.

If you would like to receive a printed or emailed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability. In addition, if you received paper copies of our proxy materials and wish to receive all future proxy materials, proxy cards and annual reports electronically, please follow the electronic delivery instructions on www.proxyvote.com. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the cost and environmental impact of our annual stockholder meetings.

The Notice of Internet Availability is first being sent to stockholders on or about April , 2024. Also on or about April , 2024, we will first make available to our stockholders this Proxy Statement and the form of proxy relating to the 2024 Annual Meeting filed with the SEC on April , 2024.

What is included in these materials?

These materials include:

• this Proxy Statement for the Annual Meeting; and

• the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

The proxy card enables you to appoint Richard F. Dauch, our Chief Executive Officer, and James D. Harrington, our General Counsel, Chief Compliance Officer, and Secretary, as your representatives at the Annual Meeting. By completing and returning a proxy card, you are authorizing these individuals to vote your shares at the Annual Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or not you attend the Annual Meeting.

|

Workhorse Group |

2 |

2024 Proxy Statement |

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will act upon the matters outlined in the Notice of Annual Meeting on the cover page of this Proxy Statement, including the following:

(i) the election of the seven persons named herein as nominees for directors of the Company, to hold office subject to the provisions of the bylaws of the Company, until the next annual meeting of stockholders or until their successors are duly elected and qualified;

(ii) the approval, on an advisory basis, of the compensation of the Company’s named executive officers;

(iii) the approval, on an advisory basis, of the frequency of voting on named executive officer compensation;

(iv) the approval of, pursuant to Nevada Revised Statutes 78.2055, a reverse stock split of our outstanding shares of common stock by a ratio of any whole number between 1-for-10 and 1-for-20, at any time prior to August 30, 2024, to be determined at the discretion of the Board of Directors, for the purpose of complying with the Nasdaq Listing Rules, subject to the Board’s discretion to abandon such reverse stock split;

(v) the approval of, for the purposes of Nasdaq Listing Rule 5635(D), the proposed issuance of the maximum number of shares of our common stock underlying our (A) senior secured convertible notes and (B) warrants to purchase common stock; and

(vi) the ratification of the appointment of Grant Thornton LLP as the Company’s independent auditors for the fiscal year ending December 31, 2024.

In addition, management will report on the performance of the Company during fiscal year 2023 and respond to questions from stockholders.

VOTE REQUIRED; QUORUM; BROKER NON-VOTES

The presence at the meeting, in person or by proxy, of the holders of a majority of the number of shares of common stock issued and outstanding on the record date will constitute a quorum permitting the meeting to conduct its business. As of the record date, there were 314,606,266 shares of Workhorse common stock issued and outstanding. Thus, the presence of the holders of common stock representing at least 157,303,134 votes will be required to establish a quorum. Stockholders are entitled to one vote for each share of common stock held by them.

For purposes of the quorum and the discussion below regarding the vote necessary to take stockholder action, stockholders of record who are present at the virtual Annual Meeting or by proxy and who abstain, including brokers holding customers’ shares of record who cause abstentions to be recorded at the meeting, are considered stockholders who are present and entitled to vote and are counted towards the quorum.

Brokers holding shares of record for customers generally are not entitled to vote on “non-routine” matters, unless they receive voting instructions from their customers. As used herein, “uninstructed shares” means shares held by a broker who has not received such instructions from its customers on a proposal. A “broker non-vote” occurs when a nominee holding uninstructed shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that non-routine matter. It is important that you provide voting instructions to your bank, broker or other nominee, if you wish to determine the voting of your shares.

We anticipate that only Proposal No. 4, the proposal to authorize the Board to effect a reverse stock split, and Proposal No. 6, the proposal to ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm, are routine matters that brokers are entitled to vote shares on without receiving instructions.

For the election of directors, the nominees receiving the most “For” votes at the Annual Meeting or by proxy will be elected. For the Say-on-Frequency proposal, the frequency that receives the highest number of votes will be deemed to be the frequency selected by our stockholders. Approval of all other matters requires the affirmative vote

|

Workhorse Group |

3 |

2024 Proxy Statement |

of a majority of the votes cast on the applicable matter via attendance at the virtual Annual Meeting or by proxy. Abstentions, broker non-votes and directions to withhold authority will not be counted as votes cast and accordingly will have no effect on the outcome of any proposal.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Most of our stockholders hold their shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially in street name.

Stockholder of Record

If, on March 15, 2024, your shares were registered directly in your name with our transfer agent, Empire Stock Transfer, Inc., you are considered a stockholder of record with respect to those shares, and the Notice of Annual Meeting and Proxy Statement was sent directly to you by the Company. As the stockholder of record, you have the right to direct the voting of your shares by returning the proxy card to us. Whether or not you plan to attend the Annual Meeting, if you do not vote over the Internet, please complete, date, sign and return a proxy card to ensure that your vote is counted.

Beneficial Owner of Shares Held in Street Name

If, on March 15, 2024, your shares were held in an account at a brokerage firm, bank, broker-dealer, or other nominee holder, then you are considered the beneficial owner of shares held in “street name,” and the Notice of Annual Meeting & Proxy statement was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you receive a valid proxy from the organization.

Stockholders of Record. If you are a stockholder of record, you may vote by any of the following methods:

|

|

Via the Internet. You may vote by proxy via the Internet by following the instructions provided on the enclosed proxy card. |

|

By Mail. You may vote by completing, signing, dating and returning your proxy card in the pre-addressed, postage-paid envelope provided. |

|

Online at the Meeting. You can vote at the meeting at www.virtualshareholdermeeting.com/WKHS2024. |

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name, you may vote by any of the following methods:

|

|

Via the Internet. You may vote by proxy via the Internet by following the instructions provided on the enclosed proxy card. |

|

By Mail. You may vote by proxy by filling out the vote instruction form and returning it in the pre-addressed, postage-paid envelope provided. |

|

Online at the Meeting. You can vote at the meeting at www.virtualshareholdermeeting.com/ WKHS2024. |

|

Workhorse Group |

4 |

2024 Proxy Statement |

How can I get electronic access to the proxy materials?

The Notice provides you with instructions regarding how to:

• view the Company’s proxy materials for the Annual Meeting on the Internet;

• request hard copies of the materials; and

• instruct the Company to send future proxy materials to you electronically by email.

Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to you and will reduce the impact of the Company’s annual stockholder meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

What happens if I do not give specific voting instructions?

Stockholders of Record. If you are a stockholder of record and you:

• indicate when voting on the Internet that you wish to vote as recommended by the Board, or

• sign and return a proxy card without giving specific voting instructions,

then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters, but not on non-routine matters. Under New York Stock Exchange (“NYSE”) rules, if your shares are held by a member organization, as that term is defined under NYSE rules, responsibility for making a final determination as to whether a specific proposal constitutes a routine or non-routine matter rests with that organization or third parties acting on its behalf.

What are the Board’s recommendations?

The Board’s recommendation is set forth together with the description of each item in this Proxy Statement. In summary, the Board recommends a vote:

• for election of the seven director nominees named in the Proxy Statement to hold office until the next annual meeting of stockholders or until their successors are duly elected and qualified;

• for the approval, on an advisory basis, of the compensation of the Company’s named executive officers;

• for a one year frequency, on an advisory basis, of the frequency of voting on named executive officer compensation;

• for the approval of, pursuant to Nevada Revised Statutes 78.2055, a reverse stock split of our outstanding shares of common stock by a ratio of any whole number between 1-for-10 and 1-for-20, at any time prior to August 30, 2024, to be determined at the discretion of the Board of Directors, for the purpose of complying with the Nasdaq Listing Rules, subject to the Board’s discretion to abandon such reverse stock split;

• for the approval of, for the purposes of Nasdaq Listing Rule 5635(D), the proposed issuance of the maximum number of shares of our common stock underlying our (A) senior secured convertible notes and (B) warrants to purchase common stock;

• for ratification of the appointment of Grant Thornton LLP as the Company’s independent auditors for the fiscal year ending December 31, 2024;

With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

|

Workhorse Group |

5 |

2024 Proxy Statement |

How are proxy materials delivered to households?

Only one copy of the Company’s Notice of Internet Availability, Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and this Proxy Statement will be delivered to an address where two or more stockholders reside with the same last name or who otherwise reasonably appear to be members of the same family based on the stockholders’ prior express or implied consent.

We will deliver promptly, upon written or oral request, a separate copy of the Company’s Notice of Internet Availability, Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and this Proxy Statement. If you share an address with at least one other stockholder, currently receive one copy of our Annual Report on Form 10-K and Proxy Statement at your residence, and would like to receive a separate copy of our Annual Report on Form 10-K and Proxy Statement for future stockholder meetings of the Company, please specify such request in writing and send such written request to Workhorse Group Inc., 3600 Park 42 Drive, Suite 160E, Sharonville, Ohio 45241; Attention: General Counsel.

Interest of Officers and Directors in matters to be acted upon

Except for the election to our Board of the nominees, none of our officers or directors has any interest in any of the matters to be acted upon at the Annual Meeting.

|

Workhorse Group |

6 |

2024 Proxy Statement |

Our mission is based on the foundation of the commercial vehicle transition to zero emissions. To do this, we embrace a world with reduced carbon emissions in both energy generation and consumption. We are designing and manufacturing a key ingredient of the transportation ecosystem evolution to achieve this goal — last mile electric delivery vehicles. We design and manufacture all-electric delivery trucks, including the technology that optimizes the way these vehicles operate. We are focused on our core competency of bringing our electric delivery vehicle platforms to serve the last mile delivery market.

We are investing to make our facilities more efficient and sustainably designed and are also driving a continuous safety mindset by focusing on worker engagement. In addition, we are focused on reducing the carbon footprint throughout our supply chain. We are committed to developing sourcing of responsibly produced materials from suppliers who have social, environmental and sustainability best practices in their own operations.

Finally, we believe that sound corporate governance is essential to helping us achieve our goal, including with respect to Environmental, Social, and Governance matters (“ESG”). We continue to evolve a governance framework that exercises appropriate oversight of responsibilities at all levels throughout the company. During 2023, the ESG Committee, made up of leaders from across our company, oversaw workforce training to advance the Company’s ESG priorities. The Committee provides regular presentations on ESG related initiatives to our Board, which guides our ESG impacts, initiatives and priorities.

We have established a comprehensive corporate governance plan for the purpose of defining responsibilities, setting high standards of professional and personal conduct and assuring compliance with these responsibilities and standards. As part of its annual review process, our Board of Directors monitors developments in corporate governance. Summarized below are some of the key elements of our corporate governance plan. Many of these matters are described in more detail elsewhere in this Proxy Statement.

Director Independence and Diversity. Seven of our eight current directors are, and, if all nominees are elected, six of our seven directors will be, independent under the independence standards of the Nasdaq Stock Market. Under our Corporate Governance Guidelines, at least three-quarters (75%) of our directors shall meet such independence standards as well as the SEC’s enhanced independence standards for audit committee members. In addition, the diversity of our Board members satisfies Nasdaq’s board diversity objective. Non-employee directors are scheduled to meet separately in executive session after every regularly scheduled Board meeting.

Audit Committee. All members meet the independence standards for audit committee membership under the rules of the Nasdaq Stock Market and applicable SEC rules. Mr. Quigley has been designated as an “audit committee financial expert” as defined in the SEC rules. All members of the Audit Committee satisfy Nasdaq’s financial literacy requirements. The Audit Committee operates under a written charter that governs its duties and responsibilities. These responsibilities include the sole authority to appoint, review, evaluate and replace our independent auditors; overseeing our internal control over financial reporting, our internal audit function, our enterprise risk management program and our compliance programs generally; and reviewing proposed related party transactions.

Human Resource Management and Compensation Committee. All members meet the independence standards for compensation committee membership under the rules of the Nasdaq Stock Market and applicable SEC rules. The Human Resource Management and Compensation Committee operates under a written charter that governs its duties and responsibilities. These responsibilities include overseeing our policies, processes and controls relating to human resources, including related to our culture, diversity and inclusion, and talent development programs; reviewing our overall compensation philosophy and programs to ensure they appropriately link management’s interests with those of stockholders, reward executive officers for their contributions, and provide appropriate retention incentives; and overseeing our executive succession planning for all executive officers other than our CEO.

|

Workhorse Group |

7 |

2024 Proxy Statement |

Nominating and Corporate Governance Committee. All members are independent under the rules of the Nasdaq Stock Market. The Nominating and Corporate Governance Committee operates under a written charter that governs its duties and responsibilities. These responsibilities include recommending to the Board the nominees for election as directors at any meeting of stockholders and the persons to be elected by the Board to fill any vacancies on the Board; overseeing our CEO and independent director succession planning; and overseeing our ESG program, except relating to human resources policies and procedures.

Corporate Governance Guidelines. We have adopted Corporate Governance Guidelines, including qualification and independence standards for directors, director responsibilities, and board structure and process.

Stock Ownership Guidelines. We have adopted Stock Ownership Guidelines to align the interests of our executives and directors with the interests of our stockholders and promote our commitment to sound corporate governance. The Stock Ownership Guidelines apply to the non-employee directors (3x annual cash retainer), the Chief Executive Officer (6x salary) and all other executive officers (3x salary).

Anti-Hedging Policy and Trading Restrictions. We have an insider trading policy which, among other things, prohibits our directors, officers and other employees from engaging in “insider trading,” trading in our securities on a short-term basis, purchasing our securities on margin, short-selling our securities or entering into transactions designed to hedge the risks and benefits of ownership of our securities.

Anti-Pledging Policy. Under our insider trading policy, our directors and executive officers are prohibited from pledging our securities as collateral.

Code of Ethics. We have adopted a Code of Ethics that applies to all directors, officers and employees, including our principal executive officer, principal financial officer, and principal accounting officer, and covers a broad range of topics, including data security, compliance with laws, restrictions on gifts, and conflicts of interest. All salaried employees are required to affirm from time to time in writing their acceptance of, and compliance with, the Code of Ethics. The Code of Ethics is posted on our website at http://www.ir.workhorse.com.

Clawback Policy. We have adopted a clawback policy in compliance with Section 10D of the Securities Exchange Act of 1934 and the listing standards of The Nasdaq Stock Market.

Double-Trigger Required on Change in Control. The employment agreements with our executive officers, including our Named Executive Officers, provide for severance payments and accelerated vesting of equity grants upon a change in control only if a qualifying termination occurs within 18 months of the change in control.

We understand that our innovation leadership is ultimately rooted in people. Competition for qualified personnel in our space is intense, and our success depends in large part on our ability to recruit, develop and retain a productive and engaged workforce. Accordingly, investing in our employees and their well-being, offering competitive compensation and benefits, promoting diversity and inclusion, adopting progressive human capital management practices and community outreach constitute core elements of our corporate strategy.

Governance. Our Board and its committees provide important oversight on certain human capital matters. The Human Resource Management and Compensation Committee maintains responsibility to review, discuss and set strategic direction for various people-related business strategies, including compensation and benefit programs. Our collective recommendations to our Board and its committees are how we proactively manage our human capital and care for our employees in a manner that aligns with our core values. Our management team administers all employment matters, including recruiting and hiring, onboarding and training, compensation and rewards, performance management, and professional development. We continuously evaluate and enhance our internal policies, process and practices to increase employee engagement and productivity.

Employee Hotline. We have an employee hotline that provides our employees an opportunity to report matters such as safety concerns, fraud or other misconduct. All reported matters are reviewed in accordance with established protocols by our Legal, Human Resources and Internal Audit departments, who monitor the remediation and disposition of any reported matters.

Support Employee Well-being and Engagement. We support the overall well-being of our employees from a physical, emotional, financial, and social perspective. Our well-being program includes a long-standing practice of flexible paid time off, life planning benefits, wellness platforms and employee assistance programs.

|

Workhorse Group |

8 |

2024 Proxy Statement |

Offer Competitive Compensation and Benefits. We strive to ensure our employees receive competitive and fair compensation and innovative benefits offerings, tying incentive compensation to both business and individual performance, offering competitive maternal/paternal leave policies, and providing meaningful retirement and health benefits.

Promote Sense of Belonging through Diversity and Inclusion Initiatives. We promote an inclusive and diverse workplace, where all individuals are respected and feel they belong regardless of their age, race, national origin, gender, religion, disability, sexual orientation, or gender identity.

Provide Programs for Employee Recognition. We also offer rewards and recognition programs to our employees, including awards to recognize employees who best exemplify our values and spot awards to recognize employee contributions. We believe that these recognition programs help drive strong employee performance and retention. We conduct annual employee performance reviews, where each employee is evaluated by his or her manager and also completes a self-assessment, a process which empowers our employees. Employee performance is assessed based on a variety of key performance metrics, including the achievement of objectives specific to the employee’s department or role.

Create Opportunities for Growth and Development. We focus on creating opportunities for employee growth, development, training, and education, including opportunities to cultivate talent and identify candidates for new roles from within the Company and management and leadership development programs.

|

Workhorse Group |

9 |

2024 Proxy Statement |

|

Security Ownership of Certain |

The following table shows the number of shares of common stock beneficially owned as of the Record Date by (i) each director and nominee for director, by each current executive officer, and by all current directors and executive officers as a group and (ii) all the persons who were known to be beneficial owners of five percent or more of our common stock, our only voting securities, on March 15, 2024. Applicable percentage ownership is based on 314,606,266 shares of common stock outstanding as of March 15, 2024.

|

NAME OF BENEFICIAL OWNER(1) |

COMMON STOCK |

PERCENTAGE OF |

||

|

DIRECTORS |

|

|

||

|

Raymond J. Chess |

248,163(3) |

* |

||

|

Richard F. Dauch |

3,155,898(4) |

1.00% |

||

|

Jacqueline A. Dedo |

150,428(5) |

* |

||

|

Pamela S. Mader |

103,013(5) |

* |

||

|

William G. Quigley III |

82,508(5) |

* |

||

|

Austin Scott Miller |

73,315(5) |

* |

||

|

Brandon Torres Declet† |

111,982(5) |

* |

||

|

Dr. Jean Botti† |

111,982(5) |

* |

||

|

EXECUTIVE OFFICERS |

|

|

||

|

Joshua J. Anderson |

236,831(6) |

* |

||

|

Ryan W. Gaul |

251,312(7) |

* |

||

|

Robert M. Ginnan |

342,930(8) |

* |

||

|

John W. Graber |

224,800(9) |

* |

||

|

James D. Harrington |

350,911(10) |

* |

||

|

Stanley R. March |

259,105(11) |

* |

||

|

James C. Peters |

129,089(12) |

* |

||

|

Kerry K. Roraff |

167,891(13) |

* |

||

|

All officers and directors as a group (16 people) |

6,000,158 |

1.91% |

* Less than one percent.

1. Except as otherwise indicated, the address of each beneficial owner is c/o Workhorse Group Inc., 3600 Park 42 Drive, Suite 160E, Sharonville, Ohio 45241.

2. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Stock options to purchase shares of common stock that are currently exercisable or exercisable within 60 days of March 15, 2024 are deemed to be beneficially owned by the person holding such securities for the purpose of computing the percentage of ownership of such person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

3. Excludes 394,322 Restricted Stock Units that vest August 21, 2024.

4. Includes (i) 1,541,812 shares of restricted stock that vest as follows: 41,666 vest on each of April 30, 2024 and October 31, 2024; 83,334 vest on September 1, 2024; 385,039 vest on February 23, 2025; and 495,053 vest on each of February 22, 2025 and February 22, 2026; and (ii) options to purchase 247,024 shares of common stock at an exercise price of $10.27, all of which options are currently exercisable. Excludes (i) 745,050 Performance Units for the performance period of January 1, 2022 to December 31, 2024; 990,100 Performance Units for the performance period of January 1, 2023 to December 31, 2025; and 5,725,552 Performance Units for the performance period of January 1, 2024 to December 31, 2026; (ii) 5,725,552 Restricted Stock Units that vest ratably on February 21, 2025, February 21, 2026 and February 21, 2027; and (iii) 49,405 options that vest on September 1, 2024.

5. Excludes 315,457 Restricted Stock Units that vest on August 21, 2024.

|

Workhorse Group |

10 |

2024 Proxy Statement |

6. Includes 118,220 shares of restricted stock held by Mr. Anderson that vest as follows: 16,666 vest on each of April 20, 2024 and October 20, 2024; 23,104 vest on February 23, 2025; and 30,892 vest on each of February 22, 2025 and February 22, 2026, Excludes (i) 29,703 Performance Units for the performance period of January 1, 2022 to December 31, 2024; 61,784 Performance Units for the performance period of January 1, 2023 to December 31, 2025; and 492,114 Performance Units for the performance period of January 1, 2024 to December 31, 2026; and (ii) 492,114 Restricted Stock Units that vest ratably on February 21, 2025, February 21, 2026 and February 21, 2027.

7. Includes 145,514 shares of restricted stock held by Mr. Gaul that vest as follows: 6,020 vest on April 22, 2024; 38,504 vest on February 23, 2025; and 50,495 vest on each of February 22, 2025 and February 22, 2026. Excludes (i) 49,505 Performance Units for the performance period of January 1, 2022 to December 31, 2024; 100,992 Performance Units for the performance period of January 1, 2023 to December 31, 2025; and 804,416 Performance Units for the performance period of January 1, 2024 to December 31, 2026; and (ii) 804,416 Restricted Stock Units that vest ratably on February 21, 2025, February 21, 2026 and February 21, 2027.

8. Includes 198,351 shares of restricted stock held by Mr. Ginnan that vest as follows: 16,667 vest on each of July 4, 2024 and January 4, 2025; 46,205 vest on February 23, 2025; and 59,406 vest on each of February 22, 2025 and February 22, 2026. Excludes (i) 59,406 Performance Units for the performance period of January 1, 2022 to December 31, 2024; 118,812 Performance Units for the performance period of January 1, 2023 to December 31, 2025; and 946,372 Performance Units for the performance period of January 1, 2024 to December 31, 2026; and (ii) 946,372 Restricted Stock Units that vest ratably on February 21, 2025, February 21, 2026 and February 21, 2027.

9. Includes 135,221 shares of restricted stock held by Mr. Graber that vest as follows: 6,111 vest on April 20, 2024; 34,654 vest on February 23, 2025; and 47,228 vest on each of February 22, 2025 and February 22, 2026. Excludes (i) 44,555 Performance Units for the performance period of January 1, 2022 to December 31, 2024; 94,456 Performance Units for the performance period of January 1, 2023 to December 31, 2025; and 473,186 Performance Units for the performance period of January 1, 2024 to December 31, 2026; and (ii) 473,186 Restricted Stock Units that vest ratably on February 21, 2025, February 21, 2026 and February 21, 2027.

10. Includes 183,436 shares of restricted stock held by Mr. Harrington that vest as follows: 16,666 vest on September 15, 2024; 6,033 vest on each of June 27, 2024 and December 27, 2024; 43,318 vest on February 23, 2025; and 55,693 vest on each of February 22, 2025 and February 22, 2026. Excludes (i) 44,555 Performance Units for the performance period of January 1, 2022 to December 31, 2024; 94,456 Performance Units for the performance period of January 1, 2023 to December 31, 2025; and 887,224 Performance Units for the performance period of January 1, 2024 to December 31, 2026; and (ii) 887,224 Restricted Stock Units that vest ratably on February 21, 2025, February 21, 2026 and February 21, 2027.

11. Includes 96,095 shares of restricted stock held by Mr. March that vest as follows: 8,333 vest on each of May 15, 2024 and November 15, 2024; 20,023 vest on February 23, 2025; and 29,703 vest on each of February 22, 2025 and February 22, 2026. Excludes (i) 45,743 Performance Units for the performance period of January 1, 2022 to December 31, 2024; 59,406 Performance Units for the performance period of January 1, 2023 to December 31, 2025; and 473,186 Performance Units for the performance period of January 1, 2024 to December 31, 2026; and (ii) 473,186 Restricted Stock Units that vest ratably on February 21, 2025, February 21, 2026 and February 21, 2027.

12. Includes 79,072 shares of restricted stock held by Mr. Peters that vest as follows: 4,167 vest on each of April 1, 2024 and October 1, 2024; 19,252 vest on February 23, 2025; and 25,743 vest on each of February 22, 2025 and February 22, 2026. Excludes (i) 24,752 Performance Units for the performance period of January 1, 2022 to December 31, 2024; 51,486 Performance Units for the performance period of January 1, 2023 to December 31, 2025; and 410,095 Performance Units for the performance period of January 1, 2024 to December 31, 2026; and (ii) 410,095 Restricted Stock Units that vest ratably on February 21, 2025, February 21, 2026 and February 21, 2027.

13. Includes 96,427 shares of restricted stock held by Ms. Roraff that vest as follows: 8,334 vest on each of August 21, 2024 and February 21, 2024; 22,333 vest on February 23, 2025; and 28,713 vest on each of February 22, 2025 and February 22, 2026. Excludes (i) 28,713 Performance Units for the performance period of January 1, 2022 to December 31, 2024; 57,426 Performance Units for the performance period of January 1, 2023 to December 31, 2025; and 474,763 Performance Units for the performance period of January 1, 2024 to December 31, 2026; and (ii) 474,763 Restricted Stock Units that vest ratably on February 21, 2025, February 21, 2026 and February 21, 2027.

|

Workhorse Group |

11 |

2024 Proxy Statement |

The Board oversees our business and affairs and monitors the performance of management. Currently, seven of our eight directors are independent. Biographical information about our directors is provided in “Proposal No. 1 — Proposal for the Election of Seven Directors” on page 19. Except as set forth in this Proxy Statement, none of our directors held directorships in other reporting companies or registered investment companies at any time during the past five years. Our Board currently consists of the following eight persons, seven of whom have been nominated by the Company to stand for re-election. Immediately following this year’s Annual Meeting, our Board will be reduced to seven directors.

|

NAME |

AGE |

Position |

Director Since |

|

Raymond J. Chess(2)(3) |

66 |

Director, Chairman |

2014 |

|

Richard F. Dauch |

63 |

Director and Chief Executive Officer |

2021 |

|

Jacqueline A. Dedo(1)(2*) |

62 |

Director |

2020 |

|

Pamela S. Mader(2)(3*) |

60 |

Director |

2020 |

|

William G. Quigley III(1*)(2) |

62 |

Director |

2022 |

|

Austin Scott Miller(3) |

62 |

Director |

2022 |

|

Brandon Torres Declet(3) |

48 |

Director |

2023 |

|

Dr. Jean Botti(1) |

67 |

Director |

2023 |

1. Audit Committee

2. Nominating and Corporate Governance Committee

3. Human Resource Management and Compensation Committee

* Committee Chair

Board meetings during the 2023 fiscal year

During 2023, the Board held 15 meetings. Each director attended at least 75% of the meetings of the Board and committees on which such director served in 2023. The Board also approved certain actions by unanimous written consent. Directors are not required to attend the Annual Meeting, but all directors attended the 2023 Annual Meeting.

Committees established by the Board

The Board has standing Audit, Human Resource Management and Compensation, and Nominating and Corporate Governance Committees. Information concerning the function of each Board committee follows.

The Board has established an Audit Committee in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), consisting of William G. Quigley III (Chair), Jacqueline A. Dedo and Dr. Jean Botti. Our Board has determined that the members are all “independent directors” as defined by the rules of the Nasdaq Capital Market (“Nasdaq”) applicable to members of an audit committee and Rule 10A-3(b)(i) under the Exchange Act. In addition, Mr. Quigley is an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K and demonstrates “financial sophistication” as defined by the rules of Nasdaq. The Audit Committee assists the Board in monitoring (1) the integrity of our financial statements, (2) our compliance with legal and regulatory requirements, and (3) the independence and performance of our internal and external auditors. The Audit Committee’s principal functions include:

• reviewing our annual audited consolidated financial statements with management and our independent auditors, including major issues regarding accounting and auditing principles and practices and financial reporting that could significantly affect our consolidated financial statements;

|

Workhorse Group |

12 |

2024 Proxy Statement |

• reviewing our quarterly consolidated financial statements with management and our independent auditors prior to the filing of our Quarterly Reports on Form 10-Q, including the results of the independent auditors’ reviews of the quarterly consolidated financial statements;

• recommending to the Board the appointment of, and continued evaluation of the performance of, our independent auditors;

• approving the fees to be paid to our independent auditors for audit services and approving the retention of our independent auditors for non-audit services and all fees for such services;

• reviewing periodic reports from our independent auditors regarding our independent auditors’ independence, including discussion of such reports with the independent auditors;

• reviewing the adequacy of our overall control environment, including internal financial controls and disclosure controls and procedures;

• reviewing with our management and legal counsel legal matters that may have a material impact on our consolidated financial statements or our compliance policies and any material reports or inquiries received from regulators or governmental agencies;

• reviewing proposed related party transactions;

• overseeing our internal audit function;

• overseeing our risk management policies and risk management framework, including our enterprise risk management program;

• overseeing our cybersecurity, data and privacy risks and the Company’s cybersecurity risk management program; and

• reviewing the overall adequacy and effectiveness our regulatory and ethics and compliance programs.

During 2023, the Audit Committee met seven times. A copy of the Audit Committee’s charter is posted on the Company’s website at www.workhorse.com in the “Investors” section of the website.

human resource MANAGEMENT AND COMPENSATION COMMITTEE

Our Human Resource Management and Compensation Committee consists of Pamela S. Mader (Chair), Raymond Chess, Brandon Torres Declet and Austin Scott Miller. Our Board has determined that each of the members is an “independent director” as defined by the Nasdaq rules applicable to members of a compensation committee. The Human Resource Management and Compensation Committee is responsible for establishing the compensation of our senior management, including salaries, bonuses, termination arrangements, and other executive officer benefits as well as director compensation. The Human Resource Management and Compensation Committee also administers our equity incentive plans. The Human Resource Management and Compensation Committee works with our Chairman and Chief Executive Officer and reviews and recommends to the Board compensation decisions regarding senior management including compensation levels and equity incentive awards. The Human Resource Management and Compensation Committee also approves employment and compensation agreements with our key personnel and directors. The Human Resource Management and Compensation Committee has the power and authority to conduct or authorize studies, retain independent consultants, accountants or others, and obtain unrestricted access to management, our internal auditors, human resources and accounting employees and all information relevant to its responsibilities. The Human Resource Management and Compensation Committee is responsible for developing our executive compensation philosophy and reviewing and recommending to the Board for approval all compensation policies and compensation programs for the executive team.

The responsibilities of the Human Resource Management and Compensation Committee, as stated in its charter, include the following:

• assisting the Board in its oversight of our policies and strategies relating to culture, diversity and inclusion, and talent development programs;

• overseeing our ESG program relating to human resources matters;

|

Workhorse Group |

13 |

2024 Proxy Statement |

• reviewing and approving the Company’s compensation guidelines and structure;

• reviewing and recommending to the Board on an annual basis the corporate goals and objectives with respect to compensation for the Chief Executive Officer;

• overseeing an annual review by the Board on succession planning for our executive officers other than our CEO;

• reviewing on an annual basis the potential risk to us from our compensation programs and policies, including any incentive plans, and whether such programs and policies incentivize unnecessary and excessive risk taking; and

• periodically reviewing and making recommendations to the Board regarding the compensation of non-employee directors.

During 2023, the Human Resource Management and Compensation Committee met four times. The Human Resource Management and Compensation Committee is governed by a written charter approved by the Board. A copy of the charter is posted on the Company’s website at www.workhorse.com in the “Investors” section of the website.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Jacqueline A. Dedo (Chair), Raymond J. Chess, Pamela S. Mader and William G. Quigley III. Our Board has determined that each of the members of the Nominating and Corporate Governance Committee is an “independent director” as defined by the rules of Nasdaq. The Nominating and Corporate Governance Committee is generally responsible for recommending to the Board policies, procedures, and practices designed to help ensure that our corporate governance policies, procedures, and practices continue to assist the Board and our management in effectively and efficiently promoting the best interests of our stockholders. The Nominating and Corporate Governance Committee is also responsible for selecting and recommending for approval by our Board a slate of director nominees for election at each of our annual meetings of stockholders; recommending to the Board the composition and chairs of our Board committees; and recommending to the Board director nominees to fill vacancies or new positions on the Board or its committees that may occur or be created from time to time, all in accordance with our bylaws and applicable law. The Nominating and Corporate Governance Committee’s principal functions include:

• developing and maintaining our Corporate Governance Guidelines;

• evaluating the performance of the Board and its committees;

• overseeing an annual review by the Board on succession planning for our CEO and members of the Board;

• overseeing our ESG program, except relating to human resources policies and procedures;

• periodically reviewing and evaluating our policies on insider trading and internal controls related thereto; and

• selecting and recommending a slate of director nominees for election at each of our annual meetings of the stockholders and recommending to the Board director nominees to fill vacancies or new positions on the Board or its committees that may occur from time to time.

During 2023, the Nominating and Corporate Governance Committee met four times. The Nominating and Corporate Governance Committee is governed by a written charter approved by our Board. A copy of the Nominating and Corporate Governance Committee’s charter is posted on the Company’s website at www.workhorse.com in the “Investors” section of the website.

In identifying potential independent candidates for the Board with significant senior-level professional experience, the Nominating and Corporate Governance Committee solicits candidates from the Board, senior management and others and may engage a search firm in the process. The Nominating and Corporate Governance Committee reviews and narrows the list of candidates and interviews potential nominees. The final candidate is also introduced and interviewed by the Board and the Chairman. In general, in considering whether to recommend a particular candidate for inclusion in our Board slate of recommended director nominees, the Nominating and Corporate Governance

|

Workhorse Group |

14 |

2024 Proxy Statement |

Committee will apply the criteria set forth in our Corporate Governance Guidelines. Further, specific consideration is given to, among other things, diversity of background and experience that a candidate would bring to our Board. The Nominating and Corporate Governance Committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. We believe that the backgrounds and qualifications of our directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow our Board to fulfill its responsibilities. Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials to our Nominating and Corporate Governance Committee. Assuming that appropriate biographical and background material has been provided on a timely basis, the Nominating and Corporate Governance Committee will evaluate stockholder recommended candidates by following substantially the same process and applying substantially the same criteria, as it follows for candidates submitted by others.

As provided in its charter and as described above, the Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become directors. In evaluating potential candidates for director, the Nominating and Corporate Governance Committee considers the entirety of each candidate’s credentials.

Qualifications for consideration as a director nominee may vary according to the particular areas of expertise being sought as a complement to the existing composition of the Board. However, at a minimum, candidates for director must possess:

• high personal and professional ethics and integrity;

• the ability to exercise sound judgment;

• the ability to make independent analytical inquiries;

• a willingness and ability to devote adequate time and resources to diligently perform Board and committee duties; and

• the appropriate and relevant business experience and acumen.

The Nominating and Corporate Governance Committee will consider nominees recommended by stockholders if such recommendations are made in writing to the committee. The Nominating and Corporate Governance Committee does not plan to change the manner in which the committee evaluates nominees for election as a director based on whether the nominee has been recommended by a stockholder or otherwise.

The Nominating and Corporate Governance Committee does not have a formal policy relating to diversity among directors. In considering new nominees and whether to re-nominate existing members of the Board, the committee seeks to achieve a Board with strengths in its collective knowledge and a broad diversity of perspectives, skills and business and professional experience. Among other items, the committee looks for a range of experience in strategic planning, sales, operations, finance, executive leadership, industry and similar attributes. The diversity of our Board members satisfies Nasdaq’s board diversity objective.

At least a majority of the directors on the Board must be “independent directors” as defined by Nasdaq rules. Under our Corporate Governance Guidelines, at least three-quarters (75%) of our directors must meet Nasdaq’s independence standards as well as the SEC’s enhanced independence standards for audit committee members.

Board Leadership Structure and Role in Risk Oversight

The Company has separated the positions of Chairman and Chief Executive Officer. Given the demanding nature of these positions, the Board believes it is appropriate to separate the positions of Chairman and Chief Executive Officer. Our Chairman presides over all meetings of the Board, including executive sessions when held. He briefs the Chief Executive Officer on issues arising in executive sessions and communicates frequently with him on matters of importance. He has responsibility for shaping the Board’s agenda and consults with all directors to ensure the Board agendas and Board materials provide the Board with the information needed to fulfill its responsibilities. From time to time, he may also represent the Company in interactions with external stakeholders at the discretion of the Board.

|

Workhorse Group |

15 |

2024 Proxy Statement |

The Board has determined that each of our current directors, except for Mr. Dauch, is an “independent director” as that term is defined in the Nasdaq listing standards. The Board has also determined that each member of the Audit Committee, Human Resource Management and Compensation Committee and Nominating and Corporate Governance Committee meets the independence standards applicable to those committees prescribed by Nasdaq and the SEC. In making these determinations, the Board considered all relationships between the Company and the directors. The Board determined each such relationship, and the aggregate of such relationships, to be immaterial to the applicable director’s ability to exercise independent judgment.

Our Board has overall responsibility for risk oversight, including cybersecurity risks. The oversight is conducted primarily through committees of the Board, as disclosed in each of the descriptions of each of the committees above and in the charters of each of the committees, but the full Board has retained responsibility for general oversight of risks as well as the Company’s overall strategy.

Board Oversight of Cybersecurity

Cybersecurity risk management is a critical component of our overall enterprise risk management program. We utilize an internal cross-departmental approach to addressing cybersecurity risk, including input from employees, Senior Management, and our Board. A cross functional Senior Management Cybersecurity Steering Committee devotes resources to cybersecurity and risk management to adapt to the changing cybersecurity landscape and respond to emerging threats in a timely and effective manner. Our Board delegates to the Audit Committee the responsibility to review with management our cybersecurity, data and privacy related risks, and the steps management has taken to mitigate such exposures, including the structure, design, adoption and implementation of risk management policies and internal control systems. The Audit Committee also reviews with management other information technology risks and management’s operation of our cybersecurity risk management program.

The Audit Committee and the Board actively participate in discussions with management and among themselves regarding cybersecurity risks. The Audit Committee’s semi-annual cybersecurity review also includes review of recent enhancements to the Company’s defenses and management’s progress on its cybersecurity strategic roadmap. In addition, the Cybersecurity Steering Committee receives quarterly cybersecurity reports, which include a review of key performance indicators, test results and related remediation, and may discuss recent threats and how the Company is managing those threats.

Our information technology team reviews enterprise risk management-level cybersecurity risks annually, and risks are incorporated into the Enterprise Risk Management Committee framework. Our Director of Cybersecurity in cooperation with the Chief Information Officer is responsible for developing and implementing our information security program and reporting on cybersecurity matters to the Company’s internal Cybersecurity Steering Committee.

Stockholders requesting communication with directors can do so by writing to Workhorse Group Inc., c/o General Counsel, 3600 Park 42 Drive, Suite 160E, Sharonville, Ohio 45241 or by emailing [email protected]. At this time we do not screen communications received and would forward any requests directly to the named director. If no director was named in a general inquiry, the General Counsel would contact either the Chairman or the chairperson of a particular committee, as appropriate. We do not provide the physical address, email address, or phone numbers of directors to outside parties without a director’s permission.

|

Workhorse Group |

16 |

2024 Proxy Statement |

Our non-employee directors are generally eligible to receive compensation for services they provide to us consisting of retainers and equity compensation as described below. During 2023, each non-employee director was eligible to receive an annual Board retainer of $75,000. The Chairman received an additional retainer of $25,000.

In addition to cash compensation, our non-employee directors are eligible to receive annual equity-based compensation consisting of restricted stock awards with an aggregate grant date value equal to $100,000 or, in the case of the Chairman, $125,000. Generally, the forfeiture restrictions applicable to the restricted stock awards lapse on the six-month anniversary of the date of grant of such awards. The restricted stock awards granted to our non-employee directors are subject to the terms and conditions of our equity plans and the award agreements pursuant to which such awards are granted. Each non-employee director is also reimbursed for travel and miscellaneous expenses to attend meetings and activities of the Board or its committees. In the second quarter of 2024, all non-employee directors have elected to defer their monthly retainers for 3 months as part of the company’s overall cost-savings initiatives.

|

Name |

FEES EARNED OR |

STOCK AWARDS |

TOTAL |

|

Raymond J. Chess |

100,000 |

125,000 |

225,000 |

|

Pamela S. Mader |

75,000 |

100,000 |

175,000 |

|

Jacqueline A. Dedo |

75,000 |

100,000 |

175,000 |

|

William G. Quigley III |

75,000 |

100,000 |

175,000 |

|

Austin Scott Miller |

75,000 |

100,000 |

175,000 |

|

Brandon Torres Declet |

50,000 |

100,000 |

150,000 |

|

Dr. Jean Botti |

50,000 |

100,000 |

150,000 |

1. The amounts reflected in the “Stock Awards” column represent the grant date fair value of restricted stock awards granted to our non-employee directors, as computed in accordance with FASB ASC Topic 718.

Directors’ and Officers’ Insurance

The Company has purchased directors’ and officers’ liability insurance (“D&O Insurance”) for the benefit of its directors and officers, and the directors and officers of its subsidiaries, against liability incurred by them in the performance of their duties as directors and officers of the Company, or its subsidiaries, as the case may be. The primary policy also provides coverage to the corporate entity for securities claims.

|

Workhorse Group |

17 |

2024 Proxy Statement |

The Audit Committee, on behalf of the Board, serves as an independent and objective party to monitor and provide general oversight of the integrity of our consolidated financial statements, our independent registered public accounting firm’s qualifications and independence, the performance of our independent registered public accounting firm and our standards of business conduct. The Audit Committee performs these oversight responsibilities in accordance with its Audit Committee Charter.

Our management is responsible for preparing our consolidated financial statements and managing our financial reporting process. Our independent registered public accounting firm is responsible for expressing an opinion on the conformity of our audited consolidated financial statements to generally accepted accounting principles in the United States of America. The Audit Committee met with our independent registered public accounting firm, with and without management present, to discuss the results of their examinations and the overall quality of our financial reporting.

In this context, the Audit Committee reviewed and discussed our audited consolidated financial statements for the year ended December 31, 2023 with management and with our independent registered public accounting firm. The Audit Committee has discussed with our independent registered public accounting firm the matters required to be discussed by applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. In addition, the Audit Committee provided guidance and oversight to the internal audit function, including the audit plan, and results of internal audit activity. The Company’s Director of Internal Audit has direct access to the Audit Committee to discuss any matters desired, and she presented an update of internal audit activity at each regularly scheduled Audit Committee meeting.

The Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding such independent registered public accounting firm’s communications with the Audit Committee concerning independence and has discussed with the independent registered public accounting firm its independence from us and our management.

Based on its review of the audited consolidated financial statements and the various discussions noted above, the Audit Committee recommended to the Board that our audited consolidated financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2023.

Respectfully submitted by the Audit Committee,

William G. Quigley III (Chair)

Jacqueline A. Dedo

Dr. Jean Botti

The foregoing Audit Committee Report does not constitute soliciting material and shall not be deemed filed or incorporated by reference into any other filing of our Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent we specifically incorporate this Audit Committee Report by reference therein.

|

Workhorse Group |

18 |

2024 Proxy Statement |

|