UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

WORKHORSE GROUP INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11 |

PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION

WORKHORSE GROUP INC.

3600 Park 42 Drive, Suite 160E

Sharonville, OH 45241

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To be Held August 28, 2023

A Special Meeting of Stockholders (the “Special Meeting”) of Workhorse Group Inc. (“Workhorse” or the “Company”) will be held virtually on August 28, 2023, at 10:30 a.m. Eastern Time, to consider the following proposals:

| 1. | To approve an amendment to our Articles of Incorporation to increase the number of authorized shares of common stock; and |

| 2. | To act on such other matters as may properly come before the meeting or any adjournment thereof. |

Before you vote, we encourage you to read the full text of the enclosed Proxy Statement for an explanation of the proposal. You may wish to provide your response electronically through the internet by following the instructions set out on the enclosed Proxy Card. If you do attend the meeting and wish to vote your shares personally, you may revoke your proxy.

Your vote is important. To ensure that your shares are voted at the meeting, we encourage you to act promptly. The Proxy Statement for the Special Meeting of Shareholders is also available on the internet at the website address identified on the enclosed Proxy Card.

| By Order of the Board of Directors | |

| /s/ Raymond Chess | |

| Raymond Chess | |

| Chair of the Board of Directors |

-1-

WORKHORSE GROUP INC.

Special Meeting of Stockholders

August 28, 2023

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Workhorse Group Inc. (“Workhorse” or the "Company") to be voted at the Special Meeting of Stockholders (the “Special Meeting”), which will be held on August 28, 2023, at 10:30 a.m. Eastern Time and at any postponements or adjournments thereof. We are furnishing our proxy materials to stockholders on or about July 24, 2023. The Special Meeting will be held as a virtual meeting. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend and participate in the Special Meeting online via a live webcast by visiting www.virtualshareholdermeeting.com/WKHS2023SM. In addition to voting by submitting your proxy prior to the Special Meeting, you also will be able to vote your shares electronically during the Special Meeting.

REVOCABILITY OF PROXY AND SOLICITATION

Any stockholder executing a proxy that is solicited hereby has the power to revoke it prior to the voting of the proxy. Revocation may be made by attending the Special Meeting and voting the shares of stock in person, or by delivering to the General Counsel of the Company at the principal office of the Company prior to the Special Meeting a written notice of revocation or a later-dated, properly executed proxy. Solicitation of proxies may be made by directors, officers and other employees of the Company by personal interview, telephone, facsimile transmittal or electronic communications. No additional compensation will be paid for any such services. This solicitation of proxies is being made by the Company, which will bear all costs associated with the mailing of this Proxy Statement and the solicitation of proxies.

RECORD DATE

Stockholders of record at the close of business on July 10, 2023 (the “Record Date”), will be entitled to receive notice of, attend and vote at the Special Meeting. Each share of common stock that you owned as of the Record Date entitles you to one vote on each matter to be voted at the Special Meeting.

INFORMATION ABOUT THE SPECIAL MEETING AND VOTING

Why am I receiving these materials?

Workhorse has furnished these materials to you in connection with the Company’s solicitation of proxies for use at the Special Meeting of Stockholders to be held on August 28, 2023, at 10:30 a.m. Eastern Time. The Special Meeting will be held as a virtual meeting. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend and participate in the Special Meeting online via a live webcast by visiting www.virtualshareholdermeeting.com/WKHS2023SM. These materials have also been made available to you on the internet. These materials describe the proposal on which the Company would like you to vote and also give you information on this proposal so that you can make an informed decision. We are furnishing our proxy materials on or about July 24, 2023 to all stockholders of record entitled to vote at the Special Meeting.

-2-

What is included in these materials?

These materials include the proxy statement for this Special Meeting. The Proxy Statement for the Special Meeting of Shareholders is also available on the internet at the website address identified on the enclosed Proxy Card.

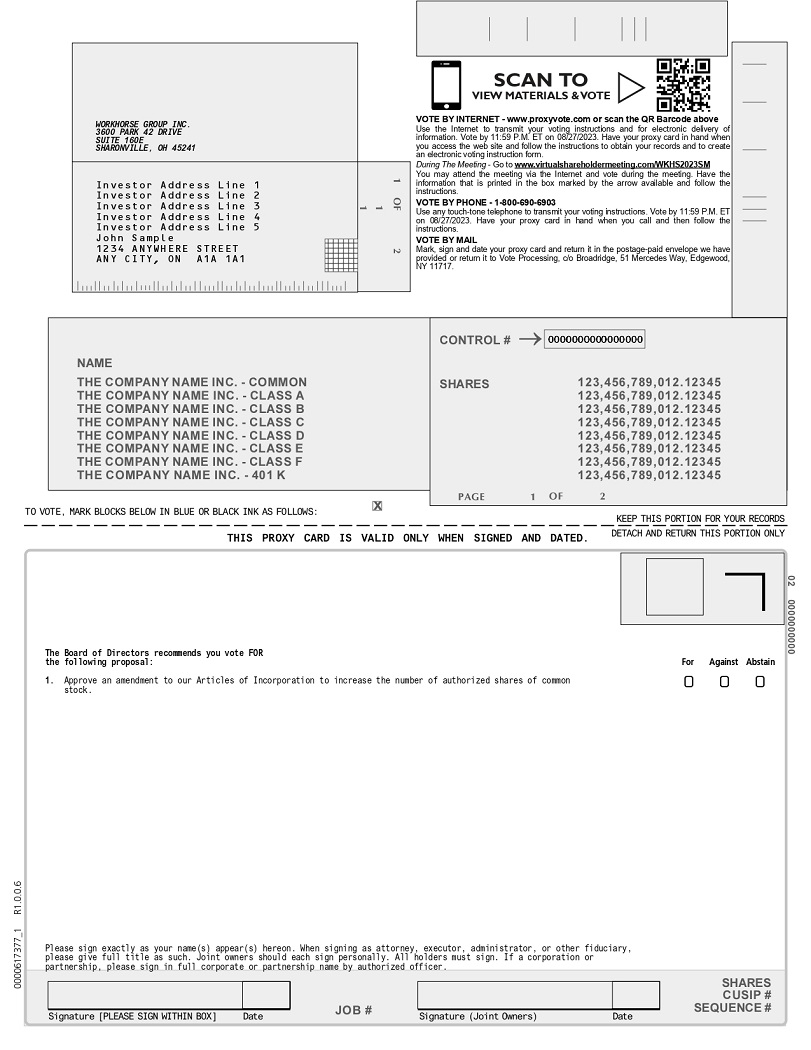

What is the proxy card?

The proxy card enables you to appoint Richard Dauch, our Chief Executive Officer, and James D. Harrington, our General Counsel, Chief Compliance Officer and Secretary, as your representatives at the Special Meeting. By completing and returning a proxy card, you are authorizing these individuals to vote your shares at the Special Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or not you attend the Special Meeting.

What is the purpose of the Special Meeting?

At the Special Meeting, stockholders will act upon the matters outlined in the Notice of Special Meeting on the cover page of this Proxy Statement, including amending the Articles of Incorporation to increase the number of authorized shares of common stock and acting on such other matters as may properly come before the meeting.

Vote Required; Quorum; Broker Non-Votes

The presence at the meeting, in person or by proxy, of the holders of a majority of the number of shares of common stock issued and outstanding on the record date will constitute a quorum permitting the meeting to conduct its business. As of the record date, there were 210,793,111 shares of Workhorse common stock issued and outstanding. Thus, the presence of the holders of common stock representing at least 105,396,556 votes will be required to establish a quorum.

For purposes of the quorum and the discussion below regarding the vote necessary to take stockholder action, stockholders of record who are present at the Special Meeting virtually or by proxy and who abstain, including brokers holding customers’ shares of record who cause abstentions to be recorded at the meeting, are considered stockholders who are present and entitled to vote and are counted towards the quorum.

Under the rules of the New York Stock Exchange (“NYSE”) applicable to voting by brokers, brokers who hold shares on behalf of beneficial owners have discretion to vote such shares with respect to matters deemed to be “routine” by the NYSE without receiving voting instructions from the beneficial owners of the shares. Brokers holding shares of record for customers generally are not entitled to vote on “non-routine” matters, unless they receive voting instructions from their customers. As used herein, “uninstructed shares” means shares held by a broker who has not received such instructions from its customers on a proposal. A “broker non-vote” occurs when a nominee holding uninstructed shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that non-routine matter. It is important that you provide voting instructions to your bank, broker or other nominee, if you wish to determine the voting of your shares.

Stockholders of Record

If on July 10, 2023, your shares were registered directly in your name with our transfer agent, Empire Stock Transfer, Inc., you are considered a stockholder of record with respect to those shares, and the Notice of Special Meeting and Proxy Statement was sent directly to you by the Company. As the stockholder of record, you have the right to direct the voting of your shares by returning the proxy card to us. Whether or not you plan to attend the Special Meeting, if you do not vote over the internet, please complete, date, sign and return a proxy card to ensure that your vote is counted.

-3-

Beneficial Owner of Shares Held in Street Name

If on July 10, 2023, your shares were held in an account at a brokerage firm, bank, broker-dealer, or other nominee holder, then you are considered the beneficial owner of shares held in “street name,” and the Notice of Special Meeting & Proxy Statement was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Special Meeting. As the beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. However, since you are not the stockholder of record, you may not vote these shares in person at the Special Meeting unless you receive a valid proxy from the organization.

How do I vote?

Stockholders of Record.

If you are a stockholder of record, you may vote by any of the following methods:

| ● | Via the Internet. You may vote by proxy via the internet by following the instructions provided on the enclosed Proxy Card. |

| ● | By Mail. You may vote by completing, signing, dating and returning your proxy card in the pre-addressed, postage-paid envelope provided. |

| ● | In Person. You can vote at the meeting at www.virtualshareholdermeeting.com/WKHS2023SM. |

Beneficial Owners of Shares Held in Street Name.

If you are a beneficial owner of shares held in street name, you may vote by any of the following methods:

| ● | Via the Internet. You may vote by proxy via the internet by following the instructions provided on the enclosed Proxy Card. |

| ● | By Mail. You may vote by proxy by filling out the vote instruction form and returning it in the pre-addressed, postage-paid envelope provided. |

| ● | In Person. You can vote at the meeting at www.virtualshareholdermeeting.com/WKHS2023SM. |

What happens if I do not give specific voting instructions?

Stockholders of Record.

If you are a stockholder of record and you:

| ● | indicate when voting on the internet that you wish to vote as recommended by the Board of Directors, or |

| ● | sign and return a proxy card without giving specific voting instructions |

then the proxy holders will vote your shares in the manner recommended by the Board of Directors on the matter presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Special Meeting.

Beneficial Owners of Shares Held in Street Name.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters, but not on non-routine matters. Under NYSE rules, if your shares are held by a member organization, as that term is defined under NYSE rules, responsibility for making a final determination as to whether a specific proposal constitutes a routine or non-routine matter rests with that organization or third parties acting on its behalf.

-4-

What is the Board’s recommendation?

The Board’s recommendation and its reasons for so recommending are set forth more fully under “Discussion of Proposal to Be Voted On”, below. In summary, the Board recommends a vote:

| ● | for approval of the amendment to our Articles of Incorporation to increase the number of authorized shares of our common stock. |

With respect to any other matter that properly comes before the Special Meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

How are proxy materials delivered to households?

Only one copy of this Proxy Statement will be delivered to an address where two or more stockholders reside with the same last name or who otherwise reasonably appear to be members of the same family based on the stockholders’ prior express or implied consent.

We will deliver promptly upon written or oral request a separate copy of this Proxy Statement. If you share an address with at least one other stockholder, currently receive one copy of our Proxy Statement at your residence, and would like to receive a separate copy of our Proxy Statement for future stockholder meetings of the Company, or if you currently receive multiple copies of this document and would prefer to receive only one copy, please specify such request and send such request to Workhorse Group Inc., 3600 Park 42 Drive, Suite 160E, Sharonville, OH 45241; Attention: General Counsel.

Interest of Officers and Directors in matters to be acted upon

None of our officers or directors has an interest in the matter to be acted upon at the Special Meeting, except to the extent they are stockholders or holders of options issued by the Company and the amendment to our Articles of Incorporation to increase the number of authorized shares of our common stock may result in increased liquidity of our common stock and the exercisability of such options.

How much stock is owned by 5% stockholders, directors, and executive officers?

The following table sets forth certain information as of July 10, 2023 with respect to the beneficial ownership of the outstanding common stock by (i) any holder of more than five (5%) percent; (ii) each of the Company’s executive officers and directors; and (iii) the Company’s directors and executive officers as a group. Except as otherwise indicated, each of the stockholders listed below has sole voting and investment power over the shares beneficially owned.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following tables set forth certain information known to us with respect to the beneficial ownership of our common stock as of July 10, 2023 by (i) each of our named executive officers, (ii) each of our directors, (iii) all directors and executive officers as a group, and (iv) all persons known to us to beneficially own five percent (5%) or more of our common stock or preferred stock.

-5-

There were 210,793,111 shares of our common stock outstanding as of July 10, 2023.

| Name Of Beneficial Owner(1) | Common Stock Beneficially Owned | Percentage of Common Stock(2) | ||||||

| Directors | ||||||||

| Raymond J. Chess | 248,164 | (3) | * | |||||

| Richard F. Dauch | 3,322,479 | (4) | 1.57 | % | ||||

| Jacqueline A. Dedo | 150,428 | (5) | * | |||||

| Pamela S. Mader | 103,013 | (5) | * | |||||

| William G. Quigley III | 82,508 | (5) | * | |||||

| Austin Scott Miller | 73,315 | (5) | * | |||||

| Brandon Torres Declet | 111,982 | (6) | * | |||||

| Dr. Jean Botti | 111,982 | (6) | * | |||||

| Executive Officers | ||||||||

| Gregory T. Ackerson | 240,985 | (7) | * | |||||

| Joshua J. Anderson | 256,753 | (8) | * | |||||

| Ryan W. Gaul | 283,203 | (9) | * | |||||

| Robert M. Ginnan | 385,298 | (10) | * | |||||

| John W. Graber | 263,016 | (11) | * | |||||

| James D. Harrington | 398,469 | (12) | * | |||||

| Stanley R. March | 274,375 | (13) | * | |||||

| James C. Peters | 149,663 | (14) | * | |||||

| Kerry K. Roraff | 190,402 | (15) | * | |||||

| All officers and directors as a group (17 people) | 6,646,035 | 3.15 | % | |||||

| Certain Other Beneficial Holders | ||||||||

| BlackRock, Inc. | 11,538,946 | (16) | 5.47 | % | ||||

| The Vanguard Group | 8,857,480 | (17) | 4.20 | % | ||||

| * | Less than one percent. |

-6-

| 1. | Except as otherwise indicated, the address of each beneficial owner is c/o Workhorse Group Inc., 3600 Park 42 Drive, Suite 160E, Sharonville, Ohio 45241. |

| 2. | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Stock options to purchase shares of common stock that are currently exercisable or exercisable within 60 days of July 10, 2023 are deemed to be beneficially owned by the person holding such securities for the purpose of computing the percentage of ownership of such person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. |

| 3. | Includes 61,882 shares of restricted stock which vest in August 2023. |

| 4. | Includes 2,630,226 shares of restricted stock, all of which vest no later than February 22, 2026; and (ii) options to purchase 197,618 shares of common stock at an exercise price of $10.27, all of which options are currently exercisable. |

| 5. | Includes 49,505 shares of restricted stock which vest in August 2023. |

| 6. | Includes 111,982 shares of restricted stock which vest in November 2023. |

| 7. | Includes (i) 119,847 shares of restricted stock held by Mr. Ackerson, all of which vest no later than February 22, 2026; and (ii) options to purchase 10,000 shares of common stock at an exercise price of $1.19 held by Mr. Ackerson, all of which options are currently exercisable. |

| 8. | Includes 188,879 shares of restricted stock held by Mr. Anderson, all of which vest no later than February 22, 2026. |

| 9. | Includes 240,532 shares of restricted stock held by Mr. Gaul, all of which vest no later than February 22, 2026. |

| 10. | Includes 320,628 shares of restricted stock held by Mr. Ginnan, all of which vest no later than February 22, 2026. |

| 11. | Includes 223,215 shares of restricted stock held by Mr. Graber, all of which vest no later than February 22, 2026. |

| 12. | Includes 321,813 shares of restricted stock held by Mr. Harrington, all of which vest no later than February 22, 2026. |

| 13. | Includes 154,153 shares of restricted stock held by Mr. March, all of which vest no later than February 22, 2026. |

| 14. | Includes 128,232 shares of restricted stock held by Mr. Peters, all of which vest no later than February 22, 2026. |

| 15. | Includes 164,138 shares of restricted stock held by Ms. Roraff, all of which vest no later than February 22, 2026. |

| 16. | This information was derived solely from the Schedule 13G/A filed by BlackRock, Inc. on January 31, 2023. The address of BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055. BlackRock, Inc. reported sole voting power over 11,305,125 shares and sole dispositive power over 11,538,946 shares. |

| 17. | This information was derived solely from the Schedule 13G filed by The Vanguard Group on February 9, 2023. The address of The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355. The Vanguard Group reported shared voting power over 248,039 shares, sole dispositive power over 8,473,868 shares and shared dispositive power over 383,612 shares. |

-7-

DISCUSSION OF PROPOSAL TO BE VOTED ON

PROPOSAL NO. 1: AMENDMENT TO OUR ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

Purposes of the Proposed Increase in Authorized Stock

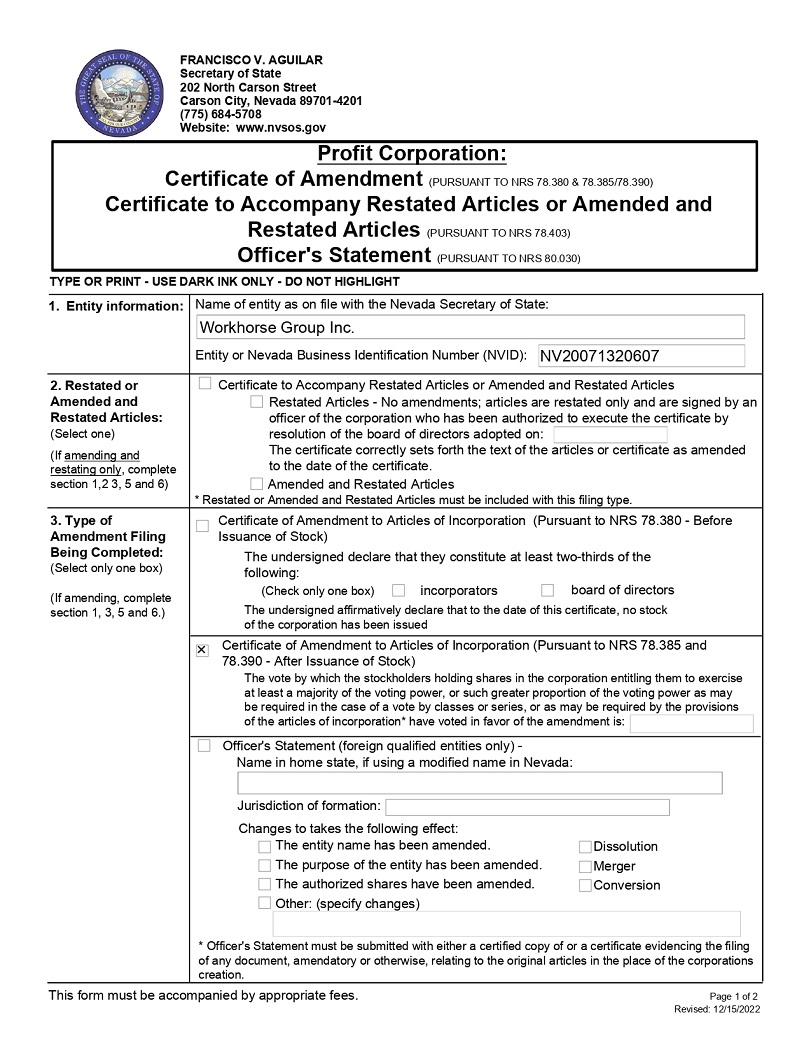

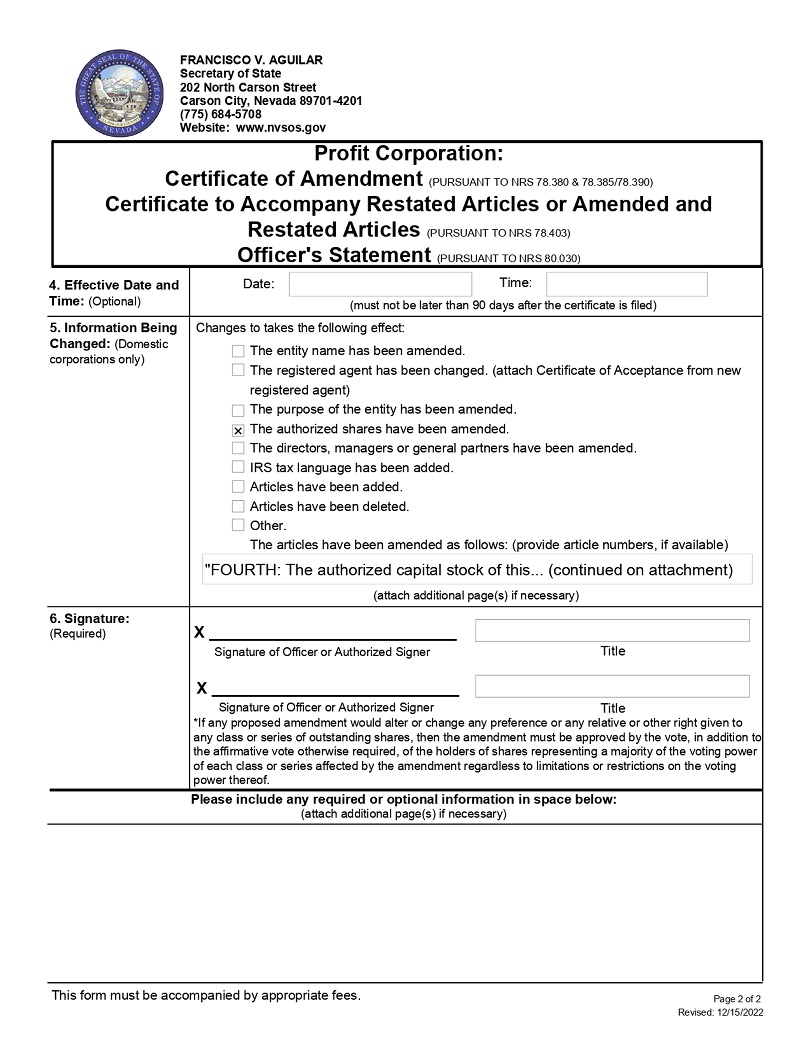

On July 7, 2023, our Board of Directors (the “Board”) approved an amendment to our Articles of Incorporation to increase the number of authorized shares of common stock to 450 million shares (the “Amendment”). Under the terms of our Certificate of Amendment to Articles of Incorporation and Nevada law, the Amendment must be approved by the holders of a majority of the outstanding shares of common stock. A copy of the Amendment, which is in the form of a Certificate of Amendment to Articles of Incorporation, is attached to this Proxy Statement as Appendix A. The Amendment makes no other changes to our Articles of Incorporation.

The Amendment is intended to give the Company flexibility to issue common stock or securities convertible into common stock for general corporate purposes if an attractive opportunity to do so arises. The Company plans to continue issuing and selling shares of common stock under its existing at-the-market offering program, if the Company determines such sales to be at desirable prices, and it will be required to issue and deliver $20 million of common stock to satisfy its obligations under its previously disclosed class action settlement, the issuance of which is expected to be made on August 29, 2023. The Company is also currently exploring the possibility of entering into one or more convertible note or other equity-linked transactions to provide liquidity to allow it to continue to pursue its current business plan. Without an increase in the number of authorized shares of common stock, the Company may be constrained in its ability to raise capital in order to support its business objectives, and may lose important business opportunities, including to competitors, which could adversely affect the Company’s financial performance and growth.

If the Company issues additional shares, the ownership interests of holders of our common stock will be diluted. Also, if the Company issues shares of preferred stock, the shares may have rights, preferences and privileges senior to those of its common stock.

Description of the Amendment

As of July 10, 2023, our current authorized capital stock of 325,000,000 consisted of 250,000,000 shares of common stock, of which 210,793,111 shares were outstanding and 75,000,000 shares of preferred stock, no shares of which were outstanding. Approximately 352,429 shares may be issued upon the exercise of options under our employee incentive arrangements. We have also issued 3,099,303 unvested performance units, which upon vesting are typically settled in cash, but may be settled in shares of common stock at the Company’s option.

Under the terms of the Amendment, the total number of authorized shares of capital stock will be increased to 525,000,000. The number of shares of common stock authorized will be increased to 450,000,000. The number of shares of preferred stock will remain unchanged at 75,000,000. The newly authorized shares of common stock will be identical to previously authorized shares of common stock, and will entitle the holders thereto to the same rights and privileges as holders of the previously authorized shares.

Terms of the common stock

The terms of the common stock are as follows:

Dividends. The holders of our common stock will be entitled to dividends as may be declared from time to time by the board of directors from funds available therefor.

-8-

Voting Rights. Each share of common stock entitles its holder to one vote on all matters to be voted on by the stockholders. Our Articles of Incorporation do not provide for cumulative voting.

Preemptive Rights. Holders of common stock do not have preemptive rights with respect to the issuance and sale by the Company of additional shares of common stock or other equity securities of the Company.

Liquidation Rights. Upon dissolution, liquidation or winding-up, the holders of shares of common stock will be entitled to receive our assets available for distribution proportionate to their pro rata ownership of the outstanding shares of common stock.

Anti-takeover effects of the Increase in Authorized Shares

An increase in the number of authorized shares of common stock may also, under certain circumstances, be construed as having an anti-takeover effect. Although not designed or intended for such purposes, the effect of the proposed increase might be to render more difficult or to discourage a merger, tender offer, proxy contest or change in control of us and the removal of management, which stockholders might otherwise deem favorable. For example, the authority of our Board to issue common stock might be used to create voting impediments or to frustrate an attempt by another person or entity to effect a takeover or otherwise gain control of us because the issuance of additional shares of common stock would dilute the voting power of the common stock then outstanding. Our common stock could also be issued to purchasers who would support our Board in opposing a takeover bid which our Board determines not to be in our best interests and those of our stockholders.

The Board is not presently aware of any attempt, or contemplated attempt, to acquire control of the Company and the proposed Certificate of Amendment to increase the number of authorized shares of common stock is not part of any plan by our Board to recommend or implement a series of anti-takeover measures.

Interest of Certain Persons in Matters to Be Acted Upon

None of the Company’s officers or directors has an interest in the Amendment, except to the extent they are stockholders or holders of options issued by the Company and the Amendment may result in increased liquidity of our common stock and the exercisability of such options.

Dissenter’s Rights of Appraisal

The stockholders who dissent from the Amendment have no right to appraisal under the Nevada Revised Statutes, our Articles of Incorporation, or our bylaws.

Procedure for Implementing the Increase in Authorized Shares

The Amendment will become effective upon the filing of a certificate of amendment to our Articles of Incorporation with the Secretary of State of the State of Nevada.

Vote Required to Approve the Increase in Authorized Shares of Common Stock

Under the terms of our Certificate of Amendment to Articles of Incorporation and Nevada law, the Amendment must be approved by the holders of a majority of the outstanding shares of common stock. Abstentions will have the same effect as votes against the Amendment. Because the Amendment is expected to be considered a “routine” matter, we do not expect to receive any “broker-non-votes”; however, if any “broker non-votes” are received they would have the same effect as votes against the Amendment.

Board Recommendation

The Board recommends that stockholders vote FOR the Amendment.

-9-

OTHER MATTERS

The Board of Directors knows of no other business which will be presented at the Special Meeting. If any other matters properly come before the meeting, the persons named in the enclosed Proxy, or their substitutes, will vote the shares represented thereby in accordance with their judgment on such matters.

ADDITIONAL INFORMATION

Householding

Under SEC rules, only one proxy statement need be sent to any household at which two or more of our stockholders reside if they appear to be members of the same family and contrary instructions have not been received from an affected stockholder. This procedure, referred to as householding, reduces the volume of duplicate information stockholders receive and reduces mailing and printing expenses for us. Brokers with account holders who are our stockholders may be householding these materials. Once you have received notice from your broker that it will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, now or at any time in the future, you no longer wish to participate in householding and would like to receive a separate proxy statement, or if you currently receive multiple copies of these documents at your address and would prefer that the communications be householded, you should contact us at [email protected] or James D. Harrington, General Counsel, Chief Compliance Officer and Secretary, Workhorse Group Inc., 3600 Park 42 Drive, Suite 160E, Sharonville, Ohio 45241.

Proxy Solicitation Costs

The proxies being solicited hereby are being solicited by the Company. The Company will bear the entire cost of solicitation of proxies including preparation, assembly, printing and mailing of the Proxy Statement, the Proxy card and establishment of the internet site hosting the proxy material. We have engaged Morrow Sodali to assist us in the solicitation of votes described above. We will bear the costs of the fees for the solicitation agent, which includes a fee of $12,500 and a fee of $6.50 per proxy solicitation call with our shareholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of common stock beneficially owned by others to forward to such beneficial owners. Officers and regular employees of the Company may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal conversations, or by telephone, telex, facsimile or electronic means. We will, upon request, reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of stock.

| By Order of the Board of Directors | |

| /s/ Raymond Chess | |

| Raymond Chess | |

| Chair of the Board of Directors |

-10-

APPENDIX A

A-1

A-2

Workhorse Group, Inc

Amended Articles Continued

Corporation is 525,000,000 shares of capital stock, consisting of 450,000,000 shares of common stock with full voting rights and with a par value of $0.001 per share, and 75,000,000 shares of preferred stock, with a par value of $0.001 per share (the “Preferred Stock”). The Preferred Stock may be issued from time to time in one or more series with such designations, preferences and relative participating, optional or other special rights and qualifications, limitations or restrictions thereof, as shall be stated in the resolutions adopted by the Corporation’s Board of Directors (the “Board”) providing for the issuance of such Preferred Stock or series thereof; and the Board is hereby vested with authority to fix such designations, preferences and relative participating, optional or other special rights or qualifications, limitations, or restrictions for each series, including, but not by way of limitation, the power to fix the redemption and liquidation preferences, the rate of dividends payable and the time for the priority of payment thereof and to determine whether such dividends shall be cumulative or not and to provide for and fix the terms of conversion of such Preferred Stock or any series thereof into Common Stock of the Corporation and fix the voting Power, if any, of shares of Preferred Stock or any series thereof.

Pursuant to NRS 78.385 and NRS 78.390, and any successor statutory provisions, the Board of Directors is authorized to adopt a resolution to increase decrease, add, or remove or otherwise alter any current or additional classes or series of this Corporations’ capital stock by a board resolution amending these Articles, in the Board or Directors’ sole discretion for increases or decreased of any class or series of authorized stock where applicable pursuant to NRS 78.207 and any successor statutory provision, or otherwise subject to the approval of the holders of at least a majority or shares having voting rights, either in a special meeting or the next annual meeting of shareholders. Notwithstanding the foregoing, where any shares of any class or series would be materially and adversely affected by such change, shareholder approval by the holders of at least a majority of such adversely affected shares must also be obtained before filing an amendment with the Office of the Secretary of State of Nevada. The capital stock of this Corporation shall be non-accessible and shall not be subject to assessment to pay the debts of the Corporation.”

A-3