SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for the use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

WORKHORSE GROUP INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-1l (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION

Workhorse Group Inc.

2020

NOTICE OF ANNUAL MEETING

AND

PROXY STATEMENT

[*], 2020

at 10:00 a.m. Eastern Time

100 Commerce Drive

Loveland, Ohio 45140

Workhorse Group Inc.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON [*], 2020

The 2020 Annual Meeting of Stockholders (the “Annual Meeting”) of Workhorse Group Inc. (“Workhorse” or the “Company”) will be held on [*], 2020, at 10:00 a.m. Eastern Time, to consider the below proposals. Due to the public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our employees and stockholders, the Annual Meeting will be held in a virtual meeting format at [*].

| (1) | To elect the eight director nominees named in the Proxy Statement to hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified; |

| (2) |

To approve, for purposes of NASDAQ Listing Rule 5635(d), the issuance of the maximum number of shares of our common stock issuable in connection with the potential future (A) conversion of the Note issued pursuant to the Securities Purchase Agreement, dated June 30, 2020, by and between the Company and HT Investments MA LLC, and (B) delivery of shares of common stock in lieu of cash payments of interest and principal on the Note;

| |

| (3) | To ratify the appointment of Grant Thornton LLP as the Company’s independent auditors for the fiscal year ending December 31, 2020; and | |

| (4) | To act on such other matters as may properly come before the meeting or any adjournment thereof. |

BECAUSE OF THE SIGNIFICANCE OF THESE PROPOSALS TO THE COMPANY AND ITS STOCKHOLDERS, IT IS VITAL THAT EVERY STOCKHOLDER VOTE AT THE ANNUAL MEETING IN PERSON OR BY PROXY.

These proposals are fully set forth in the accompanying Proxy Statement which you are urged to read thoroughly. For the reasons set forth in the Proxy Statement, your Board of Directors recommends a vote “FOR” each of the director nominees under Proposal 1 and “FOR” Proposals 2 and 3. A list of all stockholders entitled to vote at the Annual Meeting will be available at the principal office of the Company during usual business hours for examination by any stockholder for any purpose germane to the Annual Meeting for 10 days prior to the date thereof. After reading the enclosed Proxy Statement, please sign, date, and return promptly the enclosed Proxy in the accompanying postpaid envelope we have provided for your convenience or vote via the Internet as instructed herein to ensure that your shares will be represented. You may wish to provide your response electronically through the Internet by following the instructions set out on the enclosed Proxy Card. If you do attend the meeting and wish to vote your shares personally, you may revoke your Proxy.

To be admitted to the Annual Meeting at https: www.[*] you must have your control number available and follow the instructions found on your proxy card or voting instruction form. You may vote during the Annual Meeting but suggest you vote beforehand by following the instructions available on the meeting website during the meeting. Please allow sufficient time before the Annual Meeting to complete the online check-in process. Your vote is very important.

Proxy materials or a Notice of Internet Availability of Proxy Materials (the “Notice”) are being first released or mailed on or about [*], 2020, to all shareholders entitled to vote at the Annual Meeting. In accordance with rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of our proxy materials to each record shareholder, we may furnish proxy materials by providing internet access to those documents. The Notice contains instructions on how to access our proxy materials and vote online, or in the alternative, request a paper copy of the proxy materials and a proxy card.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held [*], 2020. In addition to the copies you have received, the Proxy Statement and our 2019 Annual Report on Form 10-K to Stockholders are available at: https://www.proxyvote.com.

| By Order of the Board of Directors | |

| /s/ Raymond Chess | |

| Raymond Chess | |

| Chairman of the Board of Directors |

WHETHER OR NOT YOU PLAN ON ATTENDING THE MEETING IN PERSON, PLEASE VOTE AS PROMPTLY AS POSSIBLE TO ENSURE THAT YOUR VOTE IS COUNTED.

Workhorse Group Inc.

100 Commerce Drive

Loveland, Ohio 45140

(513) 297-3640

PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Workhorse Group Inc. (“Workhorse” or the “Company”) to be voted at the Annual Meeting of Stockholders (the “Annual Meeting”) which will be held on [*], 2020, at 10:00 a.m. Eastern Time, and at any postponements or adjournments thereof. The proxy materials will be furnished to stockholders on or about [*], 2020. This year’s annual meeting of shareholders will be held as a virtual meeting. Shareholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend and participate in the annual meeting online via a live webcast by visiting www.[*]. In addition to voting by submitting your proxy prior to the annual meeting, you also will be able to vote your shares electronically during the annual meeting.

REVOCABILITY OF PROXY AND SOLICITATION

Any stockholder executing a proxy that is solicited hereby has the power to revoke it prior to the voting of the proxy. Revocation may be made by attending the Annual Meeting and voting the shares of stock in person, or by delivering to the Chief Financial Officer of the Company at the principal office of the Company prior to the Annual Meeting a written notice of revocation or a later-dated, properly executed proxy. Solicitation of proxies may be made by directors, officers and other employees of the Company by personal interview, telephone, facsimile transmittal or electronic communications. No additional compensation will be paid for any such services. This solicitation of proxies is being made by the Company, which will bear all costs associated with the mailing of this Proxy Statement and the solicitation of proxies.

RECORD DATE

Stockholders of record at the close of business on [*], 2020, will be entitled to receive notice of, attend and vote at the Annual Meeting.

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving these materials?

The Company has furnished these materials to you by mail, in connection with the Company’s solicitation of proxies for use at the Annual Meeting of Stockholders to be held on [*], 2020, at 10:00 a.m. local time. This year’s annual meeting of shareholders will be held as a virtual meeting. Shareholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend and participate in the annual meeting online via a live webcast by visiting www.[*]. These materials have also been made available to you on the Internet. These materials describe the proposals on which the Company would like you to vote and also give you information on these proposals so that you can make an informed decision. We are furnishing our proxy materials on or about [*], 2020 to all stockholders of record entitled to vote at the Annual Meeting.

Notice of Internet Availability (Notice and Access)

Instead of mailing a printed copy of our proxy materials to each shareholder, we are furnishing proxy materials via the Internet. This reduces both the costs and the environmental impact of sending our proxy materials to our shareholders. If you received a “Notice of Internet Availability,” you will not receive a printed copy of the proxy materials unless you specifically request a printed copy. The Notice of Internet Availability will instruct you how to access and review all of the important information contained in the proxy materials. The Notice of Internet Availability also instructs you how to submit your proxy on the Internet and how to vote by telephone.

If you would like to receive a printed or emailed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability. In addition, if you received paper copies of our proxy materials and wish to receive all future proxy materials, proxy cards and annual reports electronically, please follow the electronic delivery instructions on www.proxyvote.com. We encourage shareholders to take advantage of the availability of the proxy materials on the Internet to help reduce the cost and environmental impact of our annual shareholder meetings.

The Notice of Internet Availability is first being sent to shareholders on or about [*], 2020. Also on or about [*], 2020, we will first make available to our shareholders this Proxy Statement and the form of proxy relating to the 2020 Annual Meeting filed with the SEC on [*], 2020.

What is included in these materials?

These materials include:

| ● | this Proxy Statement for the Annual Meeting; and |

| ● | the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019. |

1

What is the proxy card?

The proxy card enables you to appoint Duane Hughes, our Chief Executive Officer, and Steve Schrader, our Chief Financial Officer, as your representatives at the Annual Meeting. By completing and returning a proxy card, you are authorizing these individuals to vote your shares at the Annual Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or not you attend the Annual Meeting.

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will act upon the matters outlined in the Notice of Annual Meeting on the cover page of this Proxy Statement, including (i) the election of eight persons named herein as nominees for directors of the Company, to hold office subject to the provisions of the bylaws of the Company, until the next annual meeting of stockholders and until their successors are duly elected and qualified; (ii) issuance of additional shares of common stock in respect of the Notes pursuant to the Purchase Agreement, and (iii) ratification of the appointment of Grant Thornton LLP as the Company’s independent auditors for the fiscal year ending December 31, 2020. In addition, management will report on the performance of the Company during fiscal year 2019 and respond to questions from stockholders.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the number of shares of common stock issued and outstanding on the record date will constitute a quorum permitting the meeting to conduct its business. As of the record date, there were [*] shares of Workhorse common stock issued and outstanding. Thus, the presence of the holders of common stock representing at least [*] votes will be required to establish a quorum.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Most of our stockholders hold their shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially in street name.

How can I get electronic access to the proxy materials?

The Notice provides you with instructions regarding how to:

| ● | view the Company’s proxy materials for the Annual Meeting on the Internet; |

| ● | request hard copies of the materials; and |

| ● | instruct the Company to send future proxy materials to you electronically by email. |

Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to you and will reduce the impact of the Company’s annual meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

Stockholder of Record

If on [*], 2020, your shares were registered directly in your name with our transfer agent, Empire Stock Transfer, Inc., you are considered a stockholder of record with respect to those shares, and the Notice of Annual Meeting and Proxy Statement was sent directly to you by the Company. As the stockholder of record, you have the right to direct the voting of your shares by returning the proxy card to us. Whether or not you plan to attend the Annual Meeting, if you do not vote over the Internet, please complete, date, sign and return a proxy card to ensure that your vote is counted.

Beneficial Owner of Shares Held in Street Name

If on [*], 2020, your shares were held in an account at a brokerage firm, bank, broker-dealer, or other nominee holder, then you are considered the beneficial owner of shares held in “street name,” and the Notice of Annual Meeting & Proxy statement was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you receive a valid proxy from the organization.

2

How do I vote?

Stockholders of Record. If you are a stockholder of record, you may vote by any of the following methods:

| ● | Via the Internet. You may vote by proxy via the Internet by following the instructions provided on the enclosed Proxy Card. |

| ● | By Mail. You may vote by completing, signing, dating and returning your proxy card in the pre-addressed, postage-paid envelope provided. |

| ● | Online at the Meeting. You can vote at the meeting at www.[*]. |

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name, you may vote by any of the following methods:

| ● | Via the Internet. You may vote by proxy via the Internet by following the instructions provided on the enclosed Proxy Card. |

| ● | By Mail. You may vote by proxy by filling out the vote instruction form and returning it in the pre-addressed, postage-paid envelope provided. |

| ● | Online at the Meeting. You can vote at the meeting at www.[*].. |

What are abstentions and broker non-votes?

While the inspector of elections will treat shares represented by proxies that reflect abstentions or include “broker non-votes” as shares that are present and entitled to vote for purposes of determining the presence of a quorum, abstentions or “broker non-votes” do not constitute a vote “for” or “against” any matter and thus will be disregarded in any calculation of “votes cast.” However, abstentions and “broker non-votes” will have the effect of a negative vote if an item requires the approval of a majority of a quorum or of a specified proportion of all issued and outstanding shares.

Brokers holding shares of record for customers generally are not entitled to vote on “non-routine” matters, unless they receive voting instructions from their customers (see What happens if I do not give specific voting instructions). As used herein, “uninstructed shares” means shares held by a broker who has not received voting instructions from its customers on a proposal. A “broker non-vote” occurs when a nominee holding uninstructed shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that non-routine matter.

What happens if I do not give specific voting instructions?

Stockholders of Record. If you are a stockholder of record and you:

| ● | indicate when voting on the Internet that you wish to vote as recommended by the Board of Directors, or |

| ● | sign and return a proxy card without giving specific voting instructions, |

then the proxy holders will vote your shares in the manner recommended by the Board of Directors on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters, but not on non-routine matters. Under New York Stock Exchange (“NYSE”) rules, if your shares are held by a member organization, as that term is defined under NYSE rules, responsibility for making a final determination as to whether a specific proposal constitutes a routine or non-routine matter rests with that organization, or third parties acting on its behalf.

What are the Board’s recommendations?

The Board’s recommendation is set forth together with the description of each item in this Proxy Statement. In summary, the Board recommends a vote:

| ● | for election of the eight director nominees named in the Proxy Statement to hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified; |

| ● |

for approval, for the purposes of NASDAQ Listing Rule 5635(D), of the issuance of the maximum number of shares of our Common Stock in connection with the Purchase Agreement (as defined herein) between the Company and HT Investment MA LLC, dated June 30, 2020; and

| |

| ● | for ratification of the appointment of Grant Thornton LLP as the Company’s independent auditors for the fiscal year ending December 31, 2020. |

3

With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

How are proxy materials delivered to households?

Only one copy of the Company’s Notice of Internet Availability, Annual Report on Form 10-K for the fiscal year ending December 31, 2019 and this Proxy Statement will be delivered to an address where two or more stockholders reside with the same last name or who otherwise reasonably appear to be members of the same family based on the stockholders’ prior express or implied consent.

We will deliver promptly upon written or oral request a separate copy of the Company’s Notice of Internet Availability, Annual Report on Form 10-K for the fiscal year ending December 31, 2019 and this Proxy Statement. If you share an address with at least one other stockholder, currently receive one copy of our Annual Report on Form 10-K and Proxy Statement at your residence, and would like to receive a separate copy of our Annual Report on Form 10-K and Proxy Statement for future stockholder meetings of the Company, please specify such request in writing and send such written request to Workhorse Group Inc., 100 Commerce Drive, Loveland, Ohio 45140; Attention: Chief Financial Officer.

Interest of Officers and Directors in matters to be acted upon

Except for the election to our Board of the eight nominees, none of our officers or directors has any interest in any of the matters to be acted upon at the Annual Meeting.

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

| Name of Beneficial Owner (1) | Common Stock Beneficially Owned | Percentage of Common stock (2) | ||||||||

| Joseph T. Lukens | (3) | 6,123,851 | 5.8 | % | ||||||

| Arosa Opportunistic Fund, L.P. | (4) | 5,968,706 | 5.5 | % | ||||||

| Seaport Global Capital L.P. | (5) | 5,280,690 | 4.8 | % | ||||||

| Benjamin Samuels † | (6) | 2,160,083 | 2.1 | % | ||||||

| Duane Hughes † | (7) | 1,741,589 | 1.6 | % | ||||||

| Stephen Fleming † | (8) | 655,171 | * | |||||||

| Anthony Furey † | (9) | 386,523 | * | |||||||

| Robert Willison † | (10) | 309,508 | * | |||||||

| Gerald Budde † | (11) | 274,047 | * | |||||||

| Steve Schrader † | (12) | 179,950 | * | |||||||

| Raymond Chess † | (13) | 177,243 | * | |||||||

| Harry DeMott † | (14) | 136,355 | * | |||||||

| Michael Clark † | (15) | 116,355 | * | |||||||

| Pamela Mader † | (16) | 11,939 | * | |||||||

| Jacqueline Dedo † | (17) | 11,939 | * | |||||||

| All officers and directors as a group (13 people) | 6,290,608 | 5.9 | % | |||||||

| * | Less than one percent. |

| † | Executive officer and/or director. |

| (1) | Except as otherwise indicated, the address of each beneficial owner is c/o Workhorse Group Inc., 100 Commerce Drive, Loveland, Ohio 45140. |

| (2) | Applicable percentage ownership is based on 104,595,365 shares of common stock outstanding as of July 20, 2020. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock that are currently exercisable or exercisable within 60 days of July 20, 2020 are deemed to be beneficially owned by the person holding such securities for the purpose of computing the percentage of ownership of such person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. |

4

| (3) | Represents (i) 4,002,422 shares of common stock held by Mr. Lukens fund, the New Era Capital Fund; (ii) 1,500,000 shares of common stock held by Mr. Lukens; (iii) 25,000 shares of common stock held by the Joseph T Lukens, Jr. and Gerald Budde, Co-Trustee of the Joseph T. Lukens, Jr. Irrevocable Trust for Nathan J. Lukens U/T/A Dated 2/23/2016; (iv) 25,000 shares of common stock held by the Joseph T Lukens, Jr. and Gerald Budde, Co-Trustee of the Joseph T. Lukens, Jr. Irrevocable Trust for Roman E. Lukens U/T/A Dated 2/23/2016; and (vi) a common stock purchase warrant to acquire 571,429 shares of common stock at $5.28 per share. |

| (4) | Represents (i) a common stock warrant to purchase 2,260,050 shares of common stock at $1.62 per share; (ii) a common stock warrant to purchase 894,821 shares of common stock at $1.25 per share; and (iii) 2,813,835 shares of common stock. Pursuant to the warrants, Arosa may not exercise such warrant if such exercise would result in Arosa beneficially owning in excess of 9.99% of our then issued and outstanding common stock. The shares, including the shares of common stock issuable upon exercise of the Warrants, are held by Arosa Opportunistic Fund LP, a Cayman Islands exempted limited partnership (“Arosa Opportunistic Fund”). Arosa Capital Management LP, a Delaware limited partnership (“Arosa Capital”), serves as the registered investment adviser of Arosa Opportunistic Fund, and Till Bechtolsheimer (“Mr. Bechtolsheimer”), the managing member of the general partner of Arosa Opportunistic Fund and Chief Executive Officer of Arosa Capital, may be deemed to beneficially own the shares reported herein. The business address of Arosa is 55 Hudson Yards, Suite 2800, NY, NY 10036. |

| (5) | Represents (i) 723,180 shares of common stock held by Seaport Global Asset Management, LLC; (ii) a common stock warrant to purchase 2,391,910 shares of common stock at $1.62 per share held by Seaport Global Asset Management EV LLC; (iii) a common stock warrant to purchase 1,200,000 shares of common stock at $1.62 per share held by the Armory Fund, LLP: and (iv) a common stock warrant to purchase 965,600 shares of common stock at $1.62 per share held by AMFCO-4, LLC. Pursuant to the warrants, Seaport may not exercise such warrant if such exercise would result in Seaport beneficially owning in excess of 9.99% of our then issued and outstanding common stock. Seaport Global Asset Management, LLC (“SGAM”) is the manager of Seaport Global Asset Management EV LLC, Armory Fund, LP and AMFCO-4, LLC. Stephen C. Smith is the Chief Executive Officer of SGAM. The business address of the foregoing person is 319 Clematis Street, Suite 1000, West Palm Beach, FL 33401 and the business address of SGAM is 360 Madison Avenue, 20th Floor, New York, New York 10017. |

| (6) | Represents (i) 765,094 shares of common stock held by Samuel 2012 Children’s Trust UAD 10/28/12 (the “Trust”), (ii) a common stock purchase warrant to acquire 285,071 shares of common stock at an exercise price of $5.28 per share held by the Trust, (iii) a common stock purchase warrant to acquire 95,253 shares of common stock at an exercise price of $5.28 per share held by the Trust, and (iv) a stock option to acquire 50,000 shares of common stock at $7.01 per share; (v) a stock option to acquire 10,000 shares of common stock at $7.21 per share; (vi) 533,701 shares of common stock held directly by Mr. Samuels; and (vii) 420,964 shares of common stock held by the Marci Rosenberg 2012 Family Trust, a trust managed by Mr. Samuels’ wife. Mr. Samuels is a trustee of the Children’s Trust. |

| (7) | Represents (i) a stock option to acquire 25,000 shares of common stock at $4.99 per share; (ii) a stock option to acquire 22,000 shares of common stock at $7.21 per share; (iii) a common stock option to acquire 400,000 shares of common stock at $5.28 per share; (iv) a stock option to acquire 50,000 shares of common stock at $0.97 per share; (v) a common stock option to acquire 1,000,000 shares of common stock at $0.97 per share; and (vi) 347,589 shares of common stock held by Mr. Hughes. |

| (8) | Represents (i) a stock option to acquire 150,000 shares of common stock at $1.19 per share; and (ii) 580,171 shares of common stock held by Mr. Fleming. |

| (9) | Represents (i) 348,324 shares of common stock owned by Mr. Furey; and (ii) 38,199 shares of common stock owned by Fastnet Advisors, LLC. Mr. Furey is the owner and manager of Fastnet Advisors, LLC. |

| (10) | Represents (i) a stock option to acquire 400,000 shares of common stock at $0.932 per share; and (ii) 184,508 shares of common stock owned by Mr. Willison. |

| (11) | Represents (i) a stock option to acquire 50,000 shares of common stock at $7.01 per share; (ii) a stock option to acquire 10,000 shares of common stock at $7.21 per share; and (iii) 214,047 shares of common stock owned by Mr. Budde. |

| (12) | Represents 179,950 shares of common stock owned by Mr. Schrader. |

| (13) | Represents (i) a stock option to acquire 10,000 shares of common stock at $4.99 per share; (ii) a stock option to acquire 10,000 shares of common stock at $7.21 per share; and (iii) 157,243 shares of common stock owned by Mr. Chess. |

| (14) | Represents (i) a stock option to acquire 50,000 shares of common stock at $8.20 per share; and (ii) 94,355 shares of common stock owned by Mr. DeMott. |

| (15) | Represents (i) a stock option to acquire 50,000 shares of common stock at $1.10 per share; and (ii) 94,355 shares of common stock owned by Mr. Clark. |

| (16) | Represents 11,939 shares of common stock owned by Ms. Mader. |

| (17) | Represents 11,939 shares of common stock owned by Ms. Dedo. |

5

INFORMATION ABOUT THE BOARD OF DIRECTORS1

The Board of Directors oversees our business and affairs and monitors the performance of management. In accordance with corporate governance principles, the Board does not involve itself in day-to-day operations. The directors keep themselves informed through discussions with the Chief Executive Officer and other key executives, visits to the Company’s facilities, by reading the reports and other materials that we send them and by participating in Board and committee meetings. Each director’s term will continue until the election and qualification of his or her successor, or his or her earlier death, resignation or removal. Biographical information about our directors is provided in “Proposal No. 1 — Proposal for the Election of Eight Directors” on page 24. Except as set forth in this Proxy Statement, none of our directors held directorships in other reporting companies or registered investment companies at any time during the past five years. Our Board currently consists of eight persons, all of whom have been nominated by the Company to stand for re-election.

| Name | Age | Position | Director Since | ||

| Raymond J. Chess (1)(2*) | 63 | Director, Chairman | 2013 | ||

| Harry DeMott (2)(3) | 54 | Director | 2016 | ||

| H. Benjamin Samuels (1)(3) | 53 | Director | 2015 | ||

| Gerald B. Budde (1*)(2)(3) | 59 | Director | 2015 | ||

| Duane Hughes | 57 | Director, Chief Executive Officer, and Treasurer | 2019 | ||

| Michael L. Clark (1)(3*) | 49 | Director | 2018 | ||

| Jacqueline A. Dedo (1)(2) | 59 | Director | 2020 | ||

| Pamela S. Mader (3) | 57 | Director | 2020 |

| (1) | Audit Committee |

| (2) | Nominating and Corporate Governance Committee |

| (3) | Compensation Committee |

| * | Committee Chair |

Involvement in Certain Legal Proceedings

There are currently no legal proceedings, and during the past 10 years there have been no legal proceedings, that are material to the evaluation of the ability or integrity of any of our directors or director nominees.

Board meetings during fiscal 2019

During 2019, the Board of Directors held 11 meetings. Each director attended all of the meetings of the Board and all of the meetings held by all committees on which such director served. The Board also approved certain actions by unanimous written consent.

Committees established by the Board

The Board of Directors has standing Audit, Compensation, and Nominating and Corporate Governance Committees. Information concerning the function of each Board committee follows.

Audit Committee

We have a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), consisting of Gerald Budde, Raymond Chess, Benjamin Samuels, Michael Clark and Jacqueline A. Dedo. Our board of directors has determined that the members are all “independent directors” as defined by the rules of The NASDAQ Stock Market, Inc. applicable to members of an audit committee and Rule 10A-3(b)(i) under the Exchange Act. In addition, Mr. Budde is an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K and demonstrates “financial sophistication” as defined by the rules of The NASDAQ Stock Market, Inc. The Audit Committee is appointed by our board of directors to assist our board of directors in monitoring (1) the integrity of our financial statements, (2) our compliance with legal and regulatory requirements, and (3) the independence and performance of our internal and external auditors. The Audit Committee’s principal functions include:

| ● | reviewing our annual audited consolidated financial statements with management and our independent auditors, including major issues regarding accounting and auditing principles and practices and financial reporting that could significantly affect our financial statements; |

| 1 | NTD: Need to include the periods of service for each director per Reg. S-K, Item 401. |

6

| ● | reviewing our quarterly consolidated financial statements with management and our independent auditor prior to the filing of our Quarterly Reports on Form 10-Q, including the results of the independent auditors’ reviews of the quarterly financial statements; | |

| ● | recommending to the board of directors the appointment of, and continued evaluation of the performance of, our independent auditor; | |

| ● | approving the fees to be paid to our independent auditor for audit services and approving the retention of our independent auditor for non-audit services and all fees for such services; | |

| ● | reviewing periodic reports from our independent auditor regarding our auditor’s independence, including discussion of such reports with the auditor; | |

| ● | reviewing the adequacy of our overall control environment, including internal financial controls and disclosure controls and procedures; and | |

| ● | reviewing with our management and legal counsel legal matters that may have a material impact on our financial statements or our compliance policies and any material reports or inquiries received from regulators or governmental agencies. |

During 2019, the audit committee met four times. A copy of the Audit Committee’s charter is posted on the Company’s website at www.workhorse.com in the “Investors” section of the website.

Meetings may be held from time to time to consider matters for which approval of our Board of Directors is desirable or is required by law.

Compensation Committee

Our compensation committee consists of Harry DeMott, Gerald Budde, Michael Clark, Benjamin Samuels and Pamela S. Mader. Our board of directors has determined that each of the members are an “independent director” as defined by the rules of The NASDAQ Stock Market, Inc. applicable to members of a compensation committee. The Compensation Committee is responsible for establishing the compensation of our senior management, including salaries, bonuses, termination arrangements, and other executive officer benefits as well as director compensation. The Compensation Committee also administers our equity incentive plans. During 2019, the Compensation Committee met six times. The Compensation Committee is governed by a written charter approved by the board of directors. A copy of the Compensation Committee’s charter is posted on the Company’s website at www.workhorse.com in the “Investors” section of the website. The Compensation Committee works with the Chairman of the Board and Chief Executive Officer and reviews and approves compensation decisions regarding senior management including compensation levels and equity incentive awards. The Compensation Committee also approves employment and compensation agreements with our key personnel and directors. The Compensation Committee has the power and authority to conduct or authorize studies, retain independent consultants, accountants or others, and obtain unrestricted access to management, our internal auditors, human resources and accounting employees and all information relevant to its responsibilities.

The responsibilities of the Compensation Committee, as stated in its charter, include the following:

| ● | review and approve the Company’s compensation guidelines and structure; | |

| ● | review and approve on an annual basis the corporate goals and objectives with respect to compensation for the Chief Executive Officer; |

| ● | review and approve on an annual basis the evaluation process and compensation structure for the Company’s other officers, including salary, bonus, incentive and equity compensation; and | |

| ● | periodically review and make recommendations to the Board of Directors regarding the compensation of non-management directors. |

The Compensation Committee is responsible for developing the executive compensation philosophy and reviewing and recommending to the Board of Directors for approval all compensation policies and compensation programs for the executive team.

Nominating and Corporate Governance Committee

Our board of directors has determined that each of the members of the Governance Committee is an “independent director” as defined by the rules of The NASDAQ Stock Market, Inc. The Governance Committee is generally responsible for recommending to our full board of directors’ policies, procedures, and practices designed to help ensure that our corporate governance policies, procedures, and practices continue to assist the board of directors and our management in effectively and efficiently promoting the best interests of our stockholders. The Governance Committee is also responsible for selecting and recommending for approval by our board of directors and our stockholders a slate of director nominees for election at each of our annual meetings of stockholders, and otherwise for determining the board committee members and chairmen, subject to board of directors ratification, as well as recommending to the board director nominees to fill vacancies or new positions on the board of directors or its committees that may occur or be created from time to time, all in accordance with our bylaws and applicable law. The Governance Committee’s principal functions include:

| ● | developing and maintaining our corporate governance policy guidelines; |

7

| ● | developing and maintaining our codes of conduct and ethics; |

| ● | overseeing the interpretation and enforcement of our Code of Conduct and our Code of Ethics for Chief Executive Officer and Senior Financial and Accounting Officers; |

| ● | evaluating the performance of our board of directors, its committees, and committee chairmen and our directors; and |

| ● | selecting and recommending a slate of director nominees for election at each of our annual meetings of the stockholders and recommending to the board director nominees to fill vacancies or new positions on the board of directors or its committees that may occur from time to time. |

During 2019, the Governance Committee met one time. The Governance Committee is governed by a written charter approved by our board of directors. A copy of the Governance Committee’s charter is posted on the Company’s website at www.workhorse.com in the “Investors” section of the website. In identifying potential independent board of directors’ candidates with significant senior-level professional experience, the Governance Committee solicits candidates from the board of directors, senior management and others and may engage a search firm in the process. The Governance Committee reviews and narrows the list of candidates and interviews potential nominees. The final candidate is also introduced and interviewed by the board of directors and the lead director if one has been appointed. In general, in considering whether to recommend a particular candidate for inclusion in our board of directors’ slate of recommended director nominees, the Governance Committee will apply the criteria set forth in our corporate governance guidelines. These criteria include the candidate’s integrity, business acumen, commitment to understanding our business and industry, experience, conflicts of interest and the ability to act in the interests of our stockholders. Further, specific consideration is given to, among other things, diversity of background and experience that a candidate would bring to our board of directors. The Governance Committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. We believe that the backgrounds and qualifications of our directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow our board of directors to fulfill its responsibilities. Stockholders may recommend individuals to the Governance Committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials to our Governance Committee. Assuming that appropriate biographical and background material has been provided on a timely basis, the Governance Committee will evaluate stockholder recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

Nomination of Directors

As provided in its charter, the Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become directors. The Nominating and Corporate Governance Committee seeks to identify director candidates based on input provided by a number of sources including (1) the Nominating and Corporate Governance Committee members, (2) our other directors, (3) our stockholders, (4) our Chief Executive Officer or Chair of the Board, and (5) third parties such as service providers. In evaluating potential candidates for director, the Nominating and Corporate Governance Committee considers the entirety of each candidate’s credentials.

Qualifications for consideration as a director nominee may vary according to the particular areas of expertise being sought as a complement to the existing composition of the Board of Directors. However, at a minimum, candidates for director must possess:

| ● | high personal and professional ethics and integrity; |

| ● | the ability to exercise sound judgment; |

| ● | the ability to make independent analytical inquiries; |

| ● | a willingness and ability to devote adequate time and resources to diligently perform Board and committee duties; and |

| ● | the appropriate and relevant business experience and acumen. |

The Nominating and Corporate Governance Committee will consider nominees recommended by stockholders if such recommendations are made in writing to the committee. The Nominating and Corporate Governance Committee does not plan to change the manner in which the committee evaluates nominees for election as a director based on whether the nominee has been recommended by a stockholder or otherwise.

The Nominating and Corporate Governance Committee does not have a formal policy relating to diversity among directors. In considering new nominees and whether to re-nominate existing members of the Board, the committee seeks to achieve a Board with strengths in its collective knowledge and a broad diversity of perspectives, skills and business and professional experience. Among other items, the committee looks for a range of experience in strategic planning, sales, finance, executive leadership, industry and similar attributes.

At least a majority of the directors on the Board must be Independent Directors as this term is defined in the rules of THE NASDAQ STOCK MARKET, INC.

8

Board Leadership Structure and Role in Risk Oversight

The Company has separated the positions of Chair of the Board of Directors and Chief Executive Officer. Given the demanding nature of these positions, the Board believes it is appropriate to separate the positions of Chair and Chief Executive Officer. Our Chair presides over all meetings of the Board of Directors, including executive sessions when held. He briefs the Chief Executive Officer on issues arising in executive sessions and communicates frequently with him on matters of importance. He has responsibility for shaping the Board’s agenda and consults with all directors to ensure that the board agendas and board materials provide the Board with the information needed to fulfill its responsibilities. From time to time he may also represent the Company in interactions with external stakeholders at the discretion of the Board.

The Board of Directors has determined that each of our current directors, except for Mr. Hughes, is an “independent director” as that term is defined in the listing standards of THE NASDAQ STOCK MARKET, INC. The Board of Directors has also determined that each member of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee meets the independence standards applicable to those committees prescribed by THE NASDAQ STOCK MARKET, INC. and the SEC. In making this decision, the Board considered all relationships between the Company and the directors. The Board determined each such relationship, and the aggregate of such relationships, to be immaterial to the applicable director’s ability to exercise independent judgment.

Our Board has overall responsibility for risk oversight. The oversight is conducted primarily through committees of the Board of Directors, as disclosed in each of the descriptions of each of the committees above and in the charters of each of the committees, but the full Board of Directors has retained responsibility for general oversight of risks.

Stockholder Communications

Stockholders requesting communication with directors can do so by writing to Workhorse Group Inc., c/o Chief Financial Officer, 100 Commerce Drive, Loveland, Ohio 45140 or emailing to [email protected]. At this time we do not screen communications received and would forward any requests directly to the named director. If no director was named in a general inquiry, the Chief Financial Officer would contact either the Chair of the Board of Directors or the chairperson of a particular committee, as appropriate. We do not provide the physical address, email address, or phone numbers of directors to outside parties without a Director’s permission.

Code of Ethics and Business Conduct

We have adopted a Code of Ethics and Business Conduct that applies to all of our directors, officers and employees including our Chief Executive Officer and Chief Financial Officer and principal accounting officer. The Code of Ethics and Business Conduct is posted on our website at http://www.workhorse.com.

COMPENSATION OF DIRECTORS

The following table sets forth compensation information for our non-employee directors for the year ended December 31, 2019.

| Name | Fees Earned or Paid in Cash $ | Stock Awards $ | Non-equity Incentive Plan Compensation $ | Change in Pension Value and Non- Qualified Deferred Compensation Earnings $ | All Other Compensation $ | Total $ | ||||||||||||||||||

| Raymond Chess | 40,000 | - | - | - | - | 40,000 | ||||||||||||||||||

| Benjamin Samuels | 40,000 | - | - | - | - | 40,000 | ||||||||||||||||||

| Gerald Budde | 40,000 | - | - | - | - | 40,000 | ||||||||||||||||||

| Harry DeMott | 40,000 | - | - | - | - | 40,000 | ||||||||||||||||||

| Michael L. Clark | 6,667 | 24,500 | - | - | - | 31,167 | ||||||||||||||||||

On October 24, 2013, Raymond J. Chess was appointed as a director of the Company. Prior to joining the Board of Directors, Mr. Chess served on our advisory board pursuant to which he received a stock option to acquire 10,000 shares of common stock at an exercise price of $2.50 per share. On October 24, 2013, Mr. Chess entered into a letter agreement with the Company pursuant to which he was appointed as a director of the Company in consideration of an annual fee of $40,000. Additionally, the Company granted Mr. Chess options to purchase 50,000 shares of the Company’s common stock at $2.60 per share. The options will expire five years from the vesting period with 10,000 options vesting upon the signing of the agreement and 4,000 every six months thereafter for a total of 50,000 shares.

On December 17, 2015, Messrs. Budde and Samuels entered into letter agreements with the Company pursuant to which they were each appointed as directors of the Company in consideration of an annual fee of $40,000. Additionally, the Company granted Messrs. Budde and Samuels options to purchase 50,000 shares of the Company’s common stock at $7.01 per share. The options will expire five years from the vesting period with 10,000 options vesting upon the signing of the agreement and 4,000 every June 30 and December 31 thereafter for a total of 50,000 shares.

9

On September 14, 2016, Mr. DeMott entered into a letter agreement with the Company pursuant to which he was appointed as a director of the Company in consideration of an annual fee of $40,000. Additionally, the Company granted Mr. DeMott an option to purchase 50,000 shares of the Company’s common stock at $8.20 per share. The option will expire five (5) years from the vesting period with 10,000 options vesting upon the signing of the agreement and 4,000 every June 30 and December 31 thereafter for a total of 50,000 shares.

On July 6, 2018, the Company, as borrower, entered into a Loan Agreement with a fund managed by Arosa Capital Management LP (“Arosa”), as lender, providing for a term loan in the principal amount of $6,100,000 (the “Loan Agreement”). Pursuant to the Loan Agreement, the Company is required to appoint to the Board of Directors a person designated in writing by Arosa for a period of no less than 12 months. Mr. Clark was designated by Arosa. Except as set forth herein, there is no understanding or arrangement between Mr. Clark and any other person pursuant to which Mr. Clark was selected as a director of the Company. Mr. Clark does not have any family relationship with any director, executive officer or person nominated or chosen by us to become a director or an executive officer. Since January 1, 2016, Mr. Clark has not had a direct or indirect material interest in any transaction or proposed transaction, in which the Company was or is a proposed participant exceeding $120,000. On September 28, 2018, Mr. Clark entered into letter agreements with the Company pursuant to which he was appointed as director of the Company in consideration of an annual fee of $40,000. Additionally, the Company granted Mr. Clark options to purchase 50,000 shares of the Company’s common stock at $1.10 per share. The options will expire five years from the vesting period with 10,000 options vesting upon the signing of the agreement and 4,000 every June 30 and December 31 thereafter for a total of 50,000 shares.

The Company’s compensation policy for the above directors was based on comparisons of other companies’ remunerations made to their Chairman and other directors and the value of their expertise to the Company.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee, on behalf of our Board of Directors, serves as an independent and objective party to monitor and provide general oversight of the integrity of our consolidated financial statements, our independent registered public accounting firm’s qualifications and independence, the performance of our independent registered public accounting firm and our standards of business conduct. The Audit Committee performs these oversight responsibilities in accordance with its Audit Committee Charter.

Our management is responsible for preparing our consolidated financial statements and managing our financial reporting process. Our independent registered public accounting firm is responsible for expressing an opinion on the conformity of our audited consolidated financial statements to generally accepted accounting principles in the United States of America. The Audit Committee met with our independent registered public accounting firm, with and without management present, to discuss the results of their examinations and the overall quality of our financial reporting.

In this context, the Audit Committee reviewed and discussed our audited consolidated financial statements for the year ended December 31, 2019 with management and with our independent registered public accounting firm. The Audit Committee has discussed with our independent registered public accounting firm the matters required to be discussed by the statement on PCAOB AS 16 (Communications with Audit Committees), as adopted by the Public Company Accounting Oversight Board in Rule 3200T, which includes, among other items, matters related to the conduct of the audit of our annual consolidated financial statements.

The Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding such independent registered public accounting firm’s communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm its independence from us and our management.

Based on its review of the audited financial statements and the various discussions noted above, the Audit Committee recommended to our Board of Directors that our audited consolidated financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2019.

Respectfully submitted by the Audit Committee,

Gerald Budde, Chair

Raymond Chess

Benjamin Samuels

Michael Clark

The foregoing Audit Committee Report does not constitute soliciting material and shall not be deemed filed or incorporated by reference into any other filing of our Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except to the extent we specifically incorporate this Audit Committee Report by reference therein.

10

INFORMATION ABOUT THE EXECUTIVE OFFICERS

The executive officers are appointed annually by our Board of Directors and hold office until their successors are elected and duly qualified unless otherwise specified in an individual’s employment agreement. There are no family relationships between any of our directors or executive officers. The current executive officers of the Company, and their ages as of July 20, 2020 are as follows:

| Name | Age | Position | Officer Since | |||

| Duane Hughes | 57 | Chief Executive Officer and President | CEO since 2019, engaged as COO from 2015 to 2019 | |||

| Robert Willison | 59 | Chief Operating Officer | COO since 2019 | |||

| Steve Schrader | 57 | Chief Financial Officer | CFO since 2019 | |||

| Stephen Fleming | 47 | General Counsel and VP | General Counsel and VP since 2019 | |||

| Anthony Furey | 47 | Vice President of Finance | Vice President of Finance since 2019 | |||

| Gregory Ackerson | 43 | Controller | Controller since 2019 |

Biographical information regarding our executive officers as of July 20, 2020 is set forth below:

Duane Hughes, Chief Operating Officer and President

Mr. Hughes is a senior-level executive with more than 20 years experience including direct business relationships in the automotive, advertising, and technology segments. Prior to joining Workhorse/AMP Electric Vehicles, Mr. Hughes served as Chief Operating Officer for Cumulus Interactive Technologies Group. As COO, Mr. Hughes was responsible for managing the company’s day-to-day sales and operations. He was responsible for all operations of the business unit. Prior to Cumulus ITG, Mr. Hughes spent nearly fifteen years in senior management positions with Gannett Co., Inc., including his duties as Vice President of Sales and Operations for Gannett Media Technologies International.

Robert Willison, Chief Operating Officer

On February 19, 2019, the Company announced the appointment of Robert Willison as Chief Operating Officer effective February 18, 2019. Mr. Willison previously served as Director of Fleet Technology for Sysco Corporation. Prior to joining Sysco, Mr. Willison served as the Company’s Director of Research and Development from 2016 until 2018. Prior to joining the Company, Mr. Willison served as a Partner and Chief Technology Officer for Räv Technology LLC from 2014 until 2016. Prior to joining Räv Technology, Mr. Willison served as Director of International Operations and New Business Development for PDi Communication Systems.

Steve Schrader, Chief Financial Officer

Mr. Schrader has over sixteen years of experience in public and private companies in industries such as manufacturing, health care and utilities and is currently serving as our Chief Financial Officer. Prior to his appointment by the Company, from December 2015 to December 2019, Mr. Schrader was Chief Financial Officer of Fuyao Glass America Inc., a subsidiary of a Chinese-owned public company specializing in the manufacture of automobile glass. From October 2006 to May 2015, Mr. Schrader served as the Chief Financial Officer of Oncology Hematology Care (OHC), the largest oncology practice in the Cincinnati metro area. Mr. Schrader started his career working for utilities that are now part of Duke Energy. His last position there was Vice President and Chief Financial Officer of Cinergy’s Regulated Business prior to Duke’s acquisition in 2006. Mr. Schrader holds a B.S. in Finance and Accounting from Ball State and an MBA from Butler University. He also received an Advanced Management Program Certificate from Harvard Business School.

Stephen Fleming, General Counsel and Vice President

Mr. Fleming serves has our corporate general counsel. Prior to joining Workhorse in November 2019, Mr. Fleming served as outside corporate/securities counsel to Workhorse since 2010. Mr. Fleming has served as the Managing Member of Fleming PLLC, a boutique law firm specializing in corporate/securities law, since 2008. Mr. Fleming graduated from Catholic University of America in 1995 with a Bachelor of Arts in Political Science. In 1999, Mr. Fleming received his Juris Doctorate and Master of Science in Finance from the University of Denver.

Anthony Furey, Vice President of Finance

Mr. Furey is a senior-level finance executive with more than 25 years of experience in corporate finance and capital markets and is currently serving as our Vice President of Finance. Prior to that, Mr. Furey was the Director of Business Development for Workhorse and Director of Finance for SureFly a former subsidiary of Workhorse Group. Prior to joining Workhorse, Anthony owned and was president of Fastnet Advisors, LLC, an mergers and acquisition and corporate advisory practice. As President, Anthony led over $300 million in financing and uplisting transactions and was responsible for managing the company’s day-to-day growth and operations. Prior to Fastnet Advisors, LLC, Anthony spent fifteen years on both the buy and sell side in institutional sales and trading, holding Series 7,65 & 63 licenses.

11

Gregory Ackerson, Controller

Mr. Ackerson has been with the Company since April 2018. Prior to joining the Company, Mr. Ackerson was an Assurance Senior Manager with BDO USA LLP from December 2015 through March 2018, Assistant Vice President Accounting Risk and Policy at Fifth Third Corporation from June 2015 to December 2015 and Senior Manager Technical Accounting for NewPage Corporation from April 2011 through March 2015. Mr. Ackerson has also served as an Inspection Specialist for PCAOB and various progressive audit roles with PwC. Mr. Ackerson received his Master of Science in Accounting and Bachelor of Business Administration and Finance both in 2000.

COMPENSATION DISCUSSION AND ANALYSIS (“CD&A”)

This CD&A is designed to provide our shareholders with an understanding of our compensation philosophy and objectives, as well as the analysis that we performed in setting executive compensation for 2019. It discusses the Compensation Committee’s (referred to as the Committee in this CD&A) determination of how and why, in addition to what, compensation actions were taken during 2019 for our Chief Executive Officer and our two next highest paid executive officers (the “Named Executive Officers” or “NEOs”). As a Smaller Reporting Company much of this disclosure is voluntary but allows us to showcase our adoption of many widely accepted compensation and governance “best practices.”

Overview

Many of our compensation decisions for the last year reflect our continued transition of our executive compensation program. Workhorse’s historical compensation philosophy was to provide base salaries with equity based incentives, primarily in the form of stock options. However, in order to continue to attract high quality executives and employees, we recognized that we needed to be more competitive on cash compensation going forward by offering a more structured annual bonus program, and we also shifted to granting restricted stock awards mixed with options as part of our equity incentives to better align with market practices.

Highlights of key changes made as part of our transition include:

Salary increase for our CEO – our CEO received an increase in base salary in recognition of his transition from COO to President & CEO bringing it more in line with competitive pay levels and to more accurately reflect his duties and responsibilities.

Established annual incentive target opportunities – each NEO now has a target bonus opportunity expressed as a percentage of base salary. We see this as a step toward better alignment with peers and market best practices.

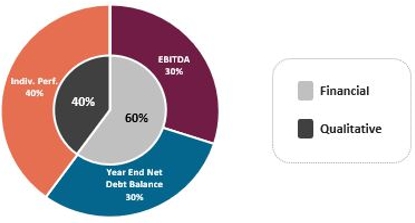

A formalized approach to funding annual incentives – the bonus funding for 2019 was formulaically determined based on a mix of financial and individual performance targets. Although we made substantial progress on our operating model in Fiscal 2019, both adjusted EBITDA and year end net debt balance were below threshold for 2019. Individual performance was assessed by the Compensation Committee to be at maximum performance levels resulting in overall annual incentive funding below target opportunity level.

Shifted to include restricted stock awards with time-based vesting – given our historical reliance on stock options, our executives had relatively little in-the-money unvested equity. As a result, the Compensation Committee determined that it was appropriate to use restricted stock awards as a primary vehicle for equity awards for 2019 in order to provide greater retention incentives, create more direct alignment with stockholders, and be more consistent with peers.

12

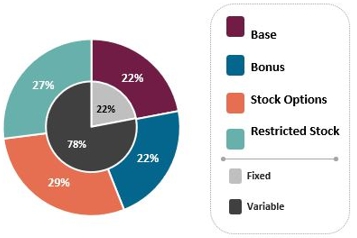

Increased allocation of CEO’s at-risk and variable compensation - 78% of our CEO’s compensation is at-risk or variable in nature. The graph below illustrates the allocation of our CEO’s pay under our latest programs and awards.

Our Named Executive Officers

Our Named Executive Officers, along with other select members of the senior management team participate in the compensation plans and programs described in this CD&A. While different in some aspects of their operation, the compensation programs for the broader employee population at Workhorse are driven by consistent principles which seek to compete effectively in our industry with the ability to reward for strong corporate and individual performance.

The list below reflects our Principal Executive Officer and our two other highest paid executive officers in 2019:

| Name | Age | Position | ||

| Duane A. Hughes | 56 | President and Chief Executive Officer | ||

| Robert Willison | 58 | Chief Operating Officer | ||

| Stephen Fleming | 47 | General Counsel and Vice President |

Workhorse’s Executive Compensation Objections & Practices

In order to accomplish our goals and to ensure that the Company’s executive compensation program is consistent with its direction and business strategy, the compensation program for our senior executive officers is based on the following objectives:

| ● | to attract, motivate, retain and reward a knowledgeable and driven management team and to encourage them to attain and exceed performance expectations within a calculated risk framework; and |

| ● | to reward each executive based on individual and corporate performance and to incentivize such executives to drive the organization’s current growth and sustainability objectives. |

These objectives serve to assure our long-term success and are built on the following compensation principles:

| ● | compensation is designed to align executives to the critical business issues facing the Company; |

| ● | compensation should be fair and reasonable to shareholders and be set with reference to the local market and similar positions in comparable companies; |

| ● | an appropriate portion of total compensation should be equity-based, aligning the interest of executives with shareholders; and |

| ● | compensation should be transparent to the Board of Directors, executives, and our shareholders. |

All elements of compensation are compared to the total compensation packages of a peer group of companies, which includes both competitors and companies representing our industry broadly to reflect the markets in which we compete for business and people.

13

Compensation Best Practices

We have made significant effort to align our executive compensation programs and practices with stockholder interests, and to incorporate strong governance standards within our compensation program, such as:

| † | Annual Incentives Based on Performance - in 2019 we designed and implemented an annual incentive award program that is based on Company financial and operational performance and also includes an assessment of individual performance as determined by the Committee. |

| † | Cap on Incentive Award Payouts - incentive award payouts are capped in our new program |

| † | Balanced Mix of Variable & Performance Based Compensation - we provide our executives with a balanced mix of variable and performance based compensation designed to motivate our executives to improve both our financial performance and stock price over the short and long-term. |

| † | Actively Engage with our Shareholders - throughout the year we actively engage with our largest shareholders and consider feedback and input on our programs and practices |

| † | Anti-Hedging & Anti-Pledging Policies - we prohibit our executives and directors from hedging and pledging Company securities. |

| † | Double Trigger” Change of Control Payments - our change of control program provides for cash payments that are triggered only in a qualifying termination of employment occurs in connection with the change in control. |

| † | Clawback Policy - our annual incentive awards and any future performance based awards are subject to a clawback policy which applies to all of our executive officers and provides for the forfeiture of these awards or the return of any related gain in the event of a restatement of our financial statements. |

| † | No Excise Tax Gross-Ups - we do not provide gross-ups in any executive employment agreement or severance program. |

| † | Engagement of Independent Compensation Consultant - our Committee retains an independent compensation consultant who reports directly to the Committee and does not provide any other services to management or the Company. |

What We Don’t Do

| ☒ | No Guaranteed Annual Salary Increases or Bonuses. |

| ☒ | No Special Tax Gross Ups. |

| ☒ | No Repricing or Exchange of Underwater Stock Options. |

| ☒ | No Plans that Encourage Excessive Risk-Taking. |

| ☒ | No Hedging or Pledging of Workhorse Securities. |

| ☒ | No Excessive Perks. |

Executive Compensation Recoupment Policy

The Board can recoup all or part of any compensation paid to an executive officer in the event of a material restatement of the company’s financial results. The Board will consider:

| ● | whether any executive officer received compensation based on the original consolidated financial statements because it appeared he or she achieved financial performance targets that in fact were not achieved based on the restatement; and |

| ● | the accountability of any executive officer whose acts or omissions were responsible, in whole or in part, for the events that led to the restatement and whether such actions or omissions constituted misconduct. |

Role of the Compensation Committee in Setting Compensation & Overall Oversight of Our Programs

Our compensation committee consists of Harry DeMott, Gerald Budde, Michael Clark, Benjamin Samuels and Pamela Mader. Our board of directors has determined that each of the members are an “independent director” as defined by the rules of The NASDAQ Stock Market, Inc. applicable to members of a compensation committee. The Compensation Committee is responsible for establishing the compensation of our senior management, including salaries, bonuses, termination arrangements, and other executive officer benefits as well as director compensation. The Compensation Committee also administers our equity incentive plans. During 2019, the Compensation Committee met six times. The Compensation Committee is governed by a written charter approved by the board of directors. A copy of the Compensation Committee’s charter is posted on the Company’s website at www.workhorse.com in the “Investors” section of the website. The Compensation Committee works with the Chairman of the Board and Chief Executive Officer and reviews and approves compensation decisions regarding senior management including compensation levels and equity incentive awards. The Compensation Committee also approves employment and compensation agreements with our key personnel and directors. The Compensation Committee has the power and authority to conduct or authorize studies, retain independent consultants, accountants or others, and obtain unrestricted access to management, our internal auditors, human resources and accounting employees and all information relevant to its responsibilities.

14

The responsibilities of the Compensation Committee, as stated in its charter, include the following:

| ● | review and approve the Company’s compensation guidelines and structure; |

| ● | review and approve on an annual basis the corporate goals and objectives with respect to compensation for the Chief Executive Officer; |

| ● | review and approve on an annual basis the evaluation process and compensation structure for the Company’s other officers, including salary, bonus, incentive and equity compensation; and |

| ● | periodically review and make recommendations to the Board of Directors regarding the compensation of non-management directors. |

The Compensation Committee is responsible for developing the executive compensation philosophy and reviewing and recommending to the Board of Directors for approval all compensation policies and compensation programs for the executive team.

Role of Management in Setting Compensation

Our CEO is consulted in the Committee’s determination of compensation matters related to the executive officers reporting directly to the CEO. Each year, the CEO makes recommendations to the Committee regarding such components as salary adjustments, target annual incentive opportunities and the value of long-term incentive awards. In making his recommendations, the CEO considers such components as experience level, individual performance, overall contribution to Company performance and market data for similar positions. The Committee takes the CEO’s recommendations under advisement, but the Committee makes all final decisions regarding such individual compensation.

Our CEO’s compensation is reviewed and discussed by the Committee, which then makes recommendations regarding his compensation to the independent members of our board of directors. Our board of directors ultimately makes decisions regarding the CEO’s compensation.

Our CEO attends Committee meetings as necessary. He is excused from any meeting when the Committee deems it advisable to meet in executive session or when the Committee meets to discuss items that would impact the CEO’s compensation. The Committee may also consult other employees, including the remaining Named Executive Officers, when making compensation decisions, but the Committee is under No obligation to involve the Named Executive Officers in its decision-making process.

Role of the Compensation

Consultant in Setting Compensation

The Compensation Committee has engaged the services of Compensation Advisory Partners, LLC (“CAP”) as its independent executive compensation consultant. Certain of our Board members have worked with CAP in the past and value the firm’s collective knowledge and capabilities, and its ability to help us develop compensation programs that incentivize our executives and align performance with company strategies and stockholders’ interests.

CAP’s current role is to advise the Committee on matters relating to executive compensation to help guide, develop, and implement our executive compensation programs. CAP reports directly to the Compensation Committee. The Committee regularly reviews the services provided by CAP and believe the firm to be independent in providing executive compensation consulting services to us. A review of CAP’s relationship did not raise any conflicts of interest, consistent with the guidelines provided under the Dodd-Frank Act and by the SEC and the NYSE. In making this determination, the Committee notes that during 2019:

| ● | CAP did not provide any services to the Company or management other than services requested by or with the approval of the Committee, and its services were limited to executive and director compensation consulting; |

| ● | The Committee or members of the Committee meet regularly in executive session with CAP outside the presence of management; |

| ● | CAP maintains a conflicts policy, which was provided to the Committee with specific policies and procedures designed to ensure independence; |

| ● | Fees paid to CAP by Workhorse during 2019 were less than 1% of CAP’s total revenue; |

| ● | None of the CAP consultants working on matters with us had any business or personal relationship with Committee members (other than in connection with working on matters with us); |

| ● | None of the CAP consultants working on matters with us (or any consultants at CAP) had any business or personal relationship with any of our executive officers; and |

| ● | None of the CAP consultants working on matters with us owns shares of our common stock. |

The Committee continues to monitor the independence of its compensation consultant on a periodic basis.

15

Compensation Peer Group

We have developed a compensation peer group, which is composed of specific peer companies within our industry. Our peer group was developed with the assistance of CAP and is used to analyze our executive and director compensation levels and overall program design. This compensation peer group is used to determine market levels of the main elements of executive compensation (base salary, annual incentives/bonus, long-term incentives, as well as total direct compensation).

The peer group is also used to gauge industry practices regarding the structure and mechanics of annual and long-term incentive plans, employment agreements, severance and change in control policies and employee benefits. The composition of the peer group is reviewed by the Committee on an annual basis to ensure that we have and maintain an appropriate group of comparator companies.

In May 2019, with the assistance of CAP, the Committee developed and approved the peer group for use as a source of executive compensation and practices data. Criteria for selecting peer companies for compensation benchmarking is based on a number of factors. The peer companies selected should reflect an optimum mix of the criteria listed below in their relative order of importance:

Competitive market:

| † | Competing Talent—companies with executive talent similar to that valued by us; |

| † | Competitors—companies in the same or similar industry sector; and |

| † | Competing Industry—companies in the same general industry sector having similar talent pools. |

Size and demographics:

| † | Companies that are generally similar in revenue and/or market cap size and whose median revenue for the group approximates our revenue; |

| † | Firms with a competitive posture and comparable area of operations; and |

| † | Companies within our corporate headquarters region. |

16

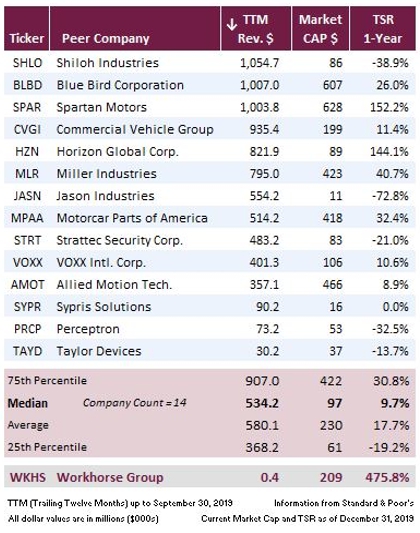

The Committee, based on CAP’s analysis and our internal analysis, determined to use the following peer group of 14 companies to evaluate and compare our compensation practices in 2019:

Overview of Executive Compensation

The Company recognizes that people are our primary asset and our principal source of competitive advantage. In order to recruit, motivate and retain the most qualified individuals as senior executive officers, the Company strives to maintain an executive compensation program that is competitive in the commercial transportation industry, which is a competitive, global labor market.