Exhibit 10.1

ASSET PURCHASE AGREEMENT

By and Among

MOOG INC.

and

SUREFLY, INC.

and

WORKHORSE GROUP INC.

Date as of October 1, 2019

TABLE OF CONTENTS

pg. i

pg. ii

SCHEDULES

| Schedule | Description | |

| Schedule 1.1(a) | Accounts Payable | |

| Schedule 1.1(b) | Accounts Receivable | |

| Schedule 1.1(c) | Accrued Liabilities | |

| Schedule 1.1(f) | Assumed Contracts | |

| Schedule 1.1(g) | Business Employees | |

| Schedule 1.1(h) | Inventory | |

| Schedule 3.3 | Consents and Approvals; No Violations | |

| Schedule 3.5 | Financial Statements | |

| Schedule 3.6 | Owned Tangible Personal Property | |

| Schedule 3.9 | Breaches, Loss Contracts, and Performance Guaranty Contracts | |

| Schedule 3.13 | Data Set, IP Infringement, Issued Patents and Patent Applications, IP Licenses | |

| Schedule 3.15 | RESERVED | |

| Schedule 3.16 | Inventory | |

| Schedule 3.17 | Personnel | |

| Schedule 3.18 | Employee Plans | |

| Schedule 3.20 | Permits | |

| Schedule 3.21 | Absence of Changes | |

| Schedule 3.22 | Suppliers and Customers | |

| Schedule 3.23 | Affiliate Transactions | |

| Schedule 3.25(a) | Product and Service Deliveries | |

| Schedule 3.26(a) | Import and Export Licenses | |

| Schedule 3.26(b) | Voluntary Governmental Disclosures | |

| Schedule 5.8 | Non-Competition | |

| Schedule 5.9 | Use of Name for Transition Period |

pg. 1

THIS ASSET PURCHASE AGREEMENT (this “Agreement”) made and entered as of October 1, 2019, by and among MOOG INC., a New York corporation (“Purchaser”), SUREFLY, INC., a Delaware corporation (“Surefly”) and WORKHORSE GROUP INC., a Nevada corporation (“Seller Parent”; together with Surefly, collectively “Seller”).

WITNESSETH:

WHEREAS, Seller has since 2016, been involved in the design, development, testing and manufacture of a hybrid electrically powered vertical takeoff and landing aircraft (the “Business” and the “Surefly Aircraft”, respectively); and

WHEREAS, Seller Parent both directly and through subsidiaries, manufactures and sells trucks to customers in the United States which operations are not included in the Business (the “Seller Parent Business”);

WHEREAS, as part of the Seller Parent Business, Seller Parent has been involved in the design, development, testing and manufacture of an electrically powered unmanned aerial system (the “Horsefly System”) which is intended to operate from trucks.

WHEREAS, (a) the Seller desires to sell, transfer and assign the Purchased Assets (as hereinafter defined) to the Purchaser, and the Purchaser desires to purchase the Purchased Assets from the Seller, and (b) the Seller Parent and the Purchaser desire to enter into a contractual arrangement regarding intellectual property licensing and future cooperation with respect to the Horsefly System, all upon the terms and subject to the conditions set forth in this Agreement;

WHEREAS, the Seller is a wholly-owned direct subsidiary of the Seller Parent.

pg. 2

NOW, THEREFORE, in consideration of the foregoing premises and the mutual covenants and agreements herein contained, and intending to be legally bound hereby, the parties hereby agree as follows:

When used in this Agreement, the following terms shall have the respective meanings specified below.

| (a) | “Accounts Payable” means all bona fide accounts payable of the Business (exclusive of any accounts payable to Affiliates of the Seller) as of the Closing Date. Schedule 1.1(a) sets forth the Accounts Payable as of June 30, 2019. |

| (b) | “Accounts Receivable” means all bona fide accounts receivable of the Business (exclusive of any accounts receivable to Affiliates of the Seller) as of the Closing Date. Schedule 1.1(b) sets forth the Accounts Receivable as of June 30, 2019. |

| (c) | “Accrued Liabilities” means all accrued expenses of the Business (other than (i) Accounts Payable, (ii) Retained Liabilities and (ii) Taxes based on income) of a type shown on the Financial Statements (as defined in Section 3.5 below). Schedule 1.1(c) sets forth the Accrued Liabilities as of the close of business on June 30, 2019. |

| (d) | “Active Business Employee” means each Business Employee who is not inactive as of the Closing Date by reason of sickness, disability or medical leave, military leave or other permitted leave of absence. |

| (e) | “Affiliate” means, with respect to any Person, any other Person directly or indirectly controlling, controlled by, or under common control with, such Person; provided that, for the purposes of this definition, “control” (including, with correlative meanings, the terms “controlled by” and “under common control with”), as used with respect to any Person, means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, whether through the ownership of voting securities, by contract or otherwise. |

| (f) | “Assumed Contracts” means the contracts, agreements, purchase orders, leases, subleases, license agreements and commitments or proposals whether written or oral, which are currently in effect, to which the Seller is a party, and which relate exclusively to the Business. Schedule 1.1(f) sets forth the Assumed Contracts as of June 30, 2019. |

| (g) | “Assumed Liabilities” means (i) the Accounts Payable and the Accrued Liabilities as of the Closing Date and (ii) liabilities and obligations under the Assumed Contracts as of the Closing Date arising or to be paid or performed after the Closing Date (other than any liability or obligation to the extent it results from, arises out of or relates to any breach of contract, tort, infringement or violation of law by the Seller occurring prior to the Closing Date). |

| (h) | “Books and Records” means originals or true copies of the following operating data and records relating exclusively to the Business: financial, accounting and bookkeeping books and records, purchase and sale orders and invoices, sales and sales promotional data, advertising materials, marketing analyses, past and present price lists, past and present customer service files, credit files, warranty files, batch and product serial number records and files, written operating methods and procedures, specifications, operating records and other information related to the Purchased Assets, reference catalogues, insurance files relating to any product liability or other liability claims against the Business or casualty claims affecting assets of the Business, personnel records, records relating to the Active Business Employees (but only to the extent that the individual employee has provided a written consent to the transfer of such files) and other records, on whatever media, pertaining to the Business or the Surefly Aircraft, or relating to customers or suppliers of, or any other parties having contracts or other relationships with the Business. Notwithstanding the foregoing, the term ““Books and Records” shall include all quality records maintained by or for the Business related to the fabrication, servicing, repair, inspection, test, certification and sale of the Inventory. |

pg. 3

| (i) | “Business Day” means any day, other than a Saturday, Sunday or a day on which banks are permitted or required by law to be closed in the State of New York. |

| (j) | “Business Employee” means any employee or officer of the Seller or any Affiliate of the Seller whose employment relates solely to the Business, including, without limitation, those employees who are on vacation, sickness, disability or medical leave or other permitted leave of absence, all of whom are listed on Schedule 1.1(j) hereto. The term “Business Employee” shall not include any employee who is inactive on the Closing Date by reason of such employee’s retirement, layoff or furlough. |

| (k) | “Closing Date” means the thirtieth calendar day following the date of execution of this Agreement or on such other date and at such place as the parties hereto shall mutually agree, but in no event later than October 4, 2019; if the purchase contemplated by this Agreement has not closed by that date, this Agreement shall be terminated and the Parties shall bear no further legal responsibility to each other. |

| (l) | “COBRA” means the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended, and the rules and regulations promulgated thereunder, all as the same shall be in effect from time to time. |

| (m) | “Code” means the Internal Revenue Code of 1986, as amended from time to time, and the rules and regulations promulgated thereunder. Section references to the Code are to the Code as in effect at the date of this Agreement. |

| (n) | “Confidential Information” means any information (other than information which is generally available to the public, other than as a result of a breach by any Person with any confidentiality obligation to the Seller) solely concerning the Business or of any third party which the Seller is currently under an obligation to keep confidential or that is currently maintained by the Seller as confidential, including, without limitation, confidential or secret processes, products, technology, know-how, merchandising and advertising programs and plans, suppliers, services, techniques, customers and plans with respect to the Business. |

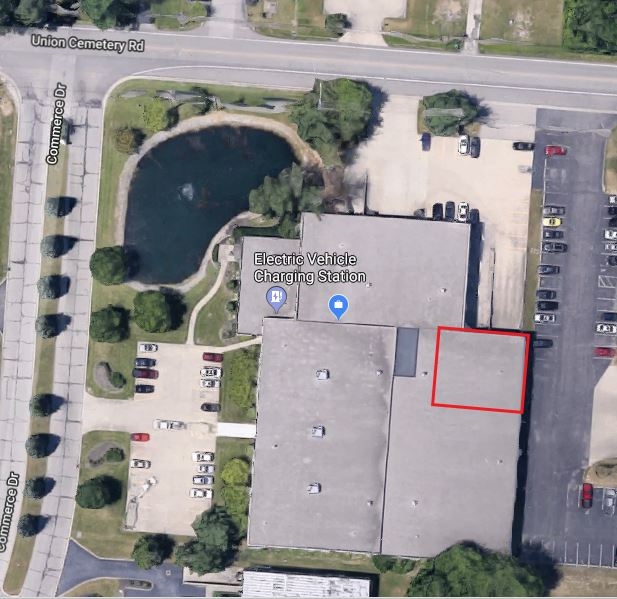

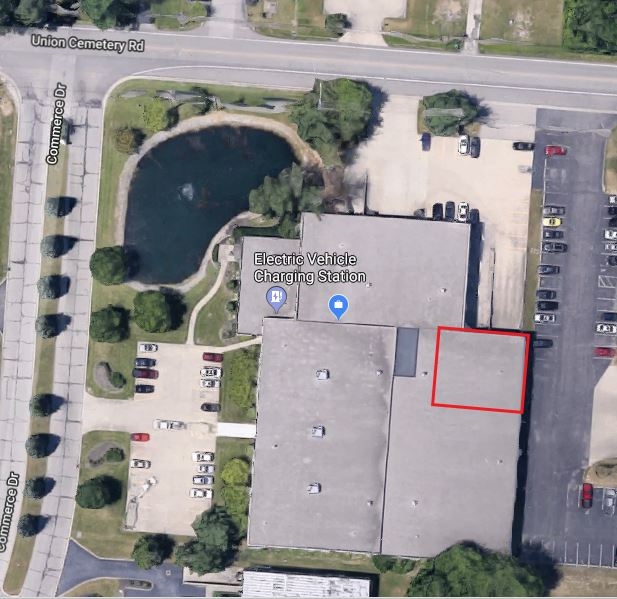

| (o) | “Current Real Property” means the real property and improvements thereon utilized by Surefly within a facility owned by Seller Parent commonly known located in Loveland Ohio and the hangar space leased from Signature Engines, located at 4760 Airport Road, Cincinnati, OH, 45226, |

pg. 4

| (p) | “Environmental Law” means any Law, Order or other requirement of law, relating to the protection of human health or the environment, or to the manufacture, use, transport, treatment, storage, disposal, release or threatened release of petroleum products, asbestos, urea formaldehyde insulation, polychlorinated biphenyls or any substance listed, classified or regulated as hazardous or toxic, or any similar term, under such Environmental Law. |

| (q) | “ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and the rules and regulations promulgated thereunder. Section references to ERISA are to ERISA as in effect at the date of this Agreement. |

| (r) | “Excluded Assets” means any and all assets of the Seller other than the specifically identified Purchased Assets. Without limiting the foregoing, “Excluded Assets” includes (i) cash and cash equivalents, (ii) all assets and intellectual property related to the Horsefly System (subject to any separate license or other agreements among the parties), (iii) insurance policies, (iv) claims and rights of action against any third party that arise out of the Seller’s ownership, use or possession of any of the Purchased Assets on or before the Closing Date or relating to any of the Excluded Assets or Retained Liabilities, and (v) claims for and rights to receive refunds, rebates or similar payments of Taxes and other charges of Governmental or Regulatory Authorities to the extent relating to periods prior to Closing. |

| (s) | “GAAP” means United States generally accepted accounting principles. |

| (t) | “Goodwill” means the goodwill of the Business. |

| (u) | “Governmental or Regulatory Authority” means any instrumentality, subdivision, court, administrative agency, commission, official or other authority of the United States or any other country or any state, province, prefect, municipality, locality or other government or political subdivision thereof, or any quasi-governmental or private body exercising any regulatory, taxing, importing or other governmental or quasi-governmental authority. |

| (v) | “Intellectual Property” shall mean all intellectual property and proprietary rights of the Seller relating exclusively to the Business including, but not limited to, (i) all inventions (whether patentable or unpatentable and whether or not reduced to practice), all improvements thereto, and all patents, patent applications and patent disclosures, together with all reissuances, continuations, continuations-in-part, revisions, extensions and re-examinations thereof, (ii) all trademarks, service marks, trade dress, logos, trade names and corporate names together with all translations, adaptations, derivations, and combinations thereof and including all goodwill associated therewith, and all applications, registrations, and renewals in connection therewith, (iii) all copyrightable works, all copyrights, and all applications, registrations and renewals in connection therewith, (iv) all mask works and all applications, registrations, and renewals in connection therewith, (v) all trade secrets and confidential business information (including ideas, research and development, know-how, formulas, compositions, manufacturing and production processes and techniques, technical data, designs, drawings, specifications, customer and supplier lists, pricing and cost information, and business and marketing plans and proposals), (vi) all computer software (including data and related documentation and including software installed on hard disk drives) other than off-the-shelf computer software subject to shrinkwrap or clickwrap licenses and (vii) all copies and tangible embodiments of any of the foregoing (in whatever form or medium). |

pg. 5

| (w) | “Inventory” means all raw material, work-in-process and finished goods inventory of the Business. Schedule 1.1(w) sets forth the Inventory as of June 30, 2019. |

| (x) | “Law” means any statute, law, ordinance, rule or regulation of any Governmental or Regulatory Authority. |

| (y) | “Leases” means that certain Sublease Agreement between Signature Engines, Inc. and Workhorse Technologies Inc. dated February 20, 2018.;. |

| (z) | “Liens” means liens, security interests, options, rights of first refusal, claims, easements, mortgages, charges, indentures, deeds of trust, rights of way, restrictions on the use of real property, encroachments, licenses to third parties, leases to third parties, security agreements, or any other encumbrances and other restrictions or limitations on use of real or personal property or irregularities in title thereto. |

| (aa) | “Material Adverse Change” or “Material Adverse Effect” means, when used with respect to the Business, any change or effect that individually or in the aggregate is or would reasonably be expected to be material and adverse to the condition (financial or otherwise), assets or operations of Business. |

| (bb) | “Order” means any judgment, order, injunction, decree or decision of any Governmental or Regulatory Authority or any arbitrator. |

| (cc) | “Owned Tangible Personal Property” shall mean all Tangible Personal Property of the Business owned by the Seller set forth in Schedule 3.6. |

| (dd) | “Permits” shall mean all permits, licenses, consents, franchises, approvals and other authorizations required from any Governmental or Regulatory Authority or other Person in connection with the operation of the Business and necessary to conduct the Business as presently conducted. |

| (ee) | “Permitted Liens” means (i) Liens consisting of zoning or planning restrictions or regulations, easements, Permits, restrictive covenants, encroachments and other restrictions or limitations on the use of real property or irregularities in, or exceptions to, title thereto which, individually or in the aggregate, do not materially detract from the value of, or impair the use of, such property by the Seller and (ii) Liens for current Taxes not yet due and payable, and (iii) mechanic’s, materialman’s, carrier’s, repairer’s and other similar Liens arising or incurred in the ordinary course of business consistent with past practice and not yet due and payable or, if due and payable, are being contested in good faith. |

| (ff) | “Person” means an individual, a partnership, a limited partnership, a joint venture, a corporation, an association, a limited liability company, a limited liability partnership, a trust, an incorporated organization, and a Governmental or Regulatory Authority. |

| (gg) | “Proceeding” means any action, suit, litigation, audit, inquiry, order, writ, injunction, judgment, assessment, decree, grievance, arbitral action, investigation or other proceeding by or before any Governmental or Regulatory Authority, arbitrator or mediator. |

pg. 6

| (hh) | “Purchased Assets” means all right, title and interest of the Seller in and to those assets of the Business listed below as they exist on the Closing Date, and no other assets of Seller or the Business: |

(i) the Assumed Contracts;

(ii) the Books and Records;

(iii) the Goodwill;

(iv) the Inventory;

(v) the Accounts Receivable, and prepaids, if any;

(vi) the Owned Tangible Personal Property;

(vii) the Permits (to the extent transferrable); and

(ix) all Intellectual Property.

| (ii) | “Representative” means any officer, director, manager, principal, attorney, accountant, agent, employee or other representative of any Person. |

| (jj) | “Retained Liabilities” means any liability or obligation of every nature of the Seller other than the Assumed Liabilities, including, but not limited to, any liabilities and obligations of the Seller (i) for personal injury or property damage arising or incurred with respect to products sold or services provided by the Seller prior to the Closing Date, (ii) arising under or pursuant to Seller’s 401(k) Plan and (iii) accounts payable of the Seller to Affiliates of the Seller with respect to the Business, or (iii) expenses relating to any financial advisor or similar party as described in Schedule 3.24. |

| (kk) | “Tangible Personal Property” means all tangible personal property classified as fixed assets in the Financial Statements and owned or leased by the Seller and used in the Business, including, without limitation, warehouse equipment, computer hardware, furniture and fixtures, transportation equipment, and leasehold improvements, together with any transferable manufacturer or vendor warranties related thereto. Schedule 3.6 sets forth a list of the Tangible Personal Property as of June 30, 2019. |

| (ll) | “Taxes” means all taxes, assessments, charges, duties, fees, levies or other governmental charges, including, but not limited to, all U.S. and non-U.S. federal, state, local and other income, franchise, profits, capital gains, capital stock, transfer, sales, use, occupation, property, excise, severance, windfall profits, stamp, license, payroll, withholding and other taxes, assessments, charges, duties, fees, levies or other governmental charges of any kind whatsoever (whether payable directly or by withholding and whether or not requiring the filing of a tax return), all estimated taxes, deficiency assessments, additions to tax, penalties and interest and shall include any liability for such amounts as a result either of being a member of a combined, consolidated, unitary or affiliated group or of a contractual obligation to indemnify any Person. |

pg. 7

| (mm) | “Transaction Documents” means: |

| a. | This Agreement |

| b. | A bill of sale in the form attached hereto as Exhibit 1.1.mm.1 |

| c. | A lease (the “Loveland Lease”) between Seller Parent and Purchase in the form attached hereto as Exhibit 1.1.mm.2 |

| d. | An amendment, assignment and assumption with respect to the Lease in the form attached hereto as Exhibit 1.1.mm.3 |

| e. | An assignment of patent applications in the form attached hereto as Exhibit 1.1.mm.4 |

| (nn) | “Transaction Ancillary Documents means: |

| a. | A joint venture organizational document and operating agreement (collectively the “JV Documents”) between Purchaser and Seller Parent substantially in conformance with the joint venture memorandum attached hereto as Exhibit 1.1.nn.1 |

| b. | Employment-related agreements between the Purchaser and each of the Active Business Employees in a form to be agreed upon by those Parties. |

In addition to the terms defined in Section 1.1, the following terms shall have the respective meanings assigned thereto in the sections indicated below.

| DEFINED TERMS | SECTION |

| “Agreement” | Preamble |

| “Business” | Recitals |

| “Cap” | 8.4(a) |

| “Claim Notice” | 8.6(a) |

| “Closing” | 2.5 |

| “Closing Date” | 2.5 |

| “Closing Payment” | 2.3 |

| “Damages” | 8.2 |

| “Employee Plans” | 3.18(a) |

| “Final Net Operating Assets Value Statement” | 2.4(b) |

| “Financial Statements” | 3.5 |

| “Indemnifying Party” | 8.4(c) |

| “Independent Accountants” | 2.4(c) |

| “Net Operating Assets Adjustment” | 2.4(a) |

| “Non-Transferable Assets” | 5.17(a) |

| “Performance Guaranty Contracts” | 3.9(b) |

| “Purchase Price” | 2.3 |

| “Purchaser” | Preamble |

| “Purchaser Benefit Plan” | 5.8(b) |

| “Purchaser Indemnifiable Claim” | 8.3 |

| “Purchaser Indemnified Party” | 8.2 |

| “Seller” | Preamble |

| “Seller Indemnifiable Claim” | 8.2 |

| “Seller Indemnified Party” | 8.3 |

| “Seller Parent” | Preamble |

| “Seller Warranty Obligations” | 5.11 |

| “Transferred Employee” | 5.8 |

pg. 8

In this Agreement, unless the context otherwise requires:

| (a) | any reference in this Agreement to “writing” or comparable expressions includes a reference to facsimile transmission or comparable means of communication; |

| (b) | words expressed in the singular number shall include the plural and vice versa, words expressed in the masculine shall include the feminine and neuter gender and vice versa; |

| (c) | references to Articles, Sections, Schedules and Recitals are references to articles, sections, exhibits, schedules and recitals of this Agreement; |

| (d) | references to “day” or “days” are to calendar days; and |

| (e) | “include,” “includes,” and “including” are deemed to be followed by “without limitation” whether or not they are in fact followed by such words or words of similar import. |

The Schedules to this Agreement are incorporated into and form an integral part of this Agreement.

pg. 9

ARTICLE 2 – SALE OF PURCHASED ASSETS

2.1 Transfer of Purchased Assets

On the terms, and subject to the conditions, set forth in this Agreement, the Seller shall sell, assign, transfer and deliver to Purchaser on the Closing Date, and the Purchaser shall purchase and acquire from the Seller, all of the Purchased Assets as they exist on and as of the Closing Date, subject to Seller’s right (i) to reserve to itself the non-exclusive right to seek indemnification, contribution or damages from any customer of or supplier to the Business with regard to any Retained Liability and (ii) to retain copies of all of the Books and Records relating to the import and export licenses of the Business issued by any United States Governmental or Regulatory Authority as required by applicable Law. The Seller shall retain the Excluded Assets and Purchaser shall have no rights whatsoever therein.

2.2 Assumption of Assumed Liabilities; Retained Liabilities.

On the Closing Date, the Purchaser shall assume and pay or perform the Assumed Liabilities in accordance with their terms. Notwithstanding anything to the contrary in this Agreement or any of the Transaction Documents, and regardless of whether such liability is disclosed in this Agreement, in any of the Transaction Documents or on any Schedule hereto or thereto, the Purchaser shall not assume, agree to pay, perform or discharge, bear the economic burden of or in any way be responsible for any of the Retained Liabilities. The Seller shall retain and pay or perform, in accordance with their terms all of the Retained Liabilities.

2.3 Payment of Purchase Price.

The aggregate consideration for the sale of the Purchased Assets by the Seller to the Purchaser shall be an amount equal to $4,000,000 (the “Purchase Price”), which shall be paid in full at Closing

All payments to be made by wire transfer of immediately available funds to an account, identified by the Seller to Purchaser at least two (2) Business Days prior to the payment date.

The closing of the sale referred to in Section 2.1 (the “Closing”) shall take place at the offices of the Seller Parent on the Closing Date. The Closing and the other transactions contemplated hereby shall be deemed to have become effective at 12:01 a.m. on the Closing Date.

| (a) | Instruments and Possession. Upon the terms and conditions contained in this Agreement, on the Closing Date, the Seller shall deliver to the Purchaser (i) one or more bills of sale conveying in the aggregate all of the Owned Tangible Personal Property and the Inventory, (ii) one or more assignments conveying in the aggregate all of the Assumed Contracts, (iii) an assignment and assumption agreement assigning all of the Intellectual Property used in the Business to the Purchaser, in recordable form, in substantially the form attached hereto as Exhibit 1.1.mm(4) (the “IP Assignment and Assumption Agreement”), (iv) such other instruments as are reasonably requested by the Purchaser to vest in the Purchaser title in and to the Purchased Assets in accordance with the provisions of this Agreement and (iv) such other documents and agreements as are contemplated by this Agreement. All such instruments will be in form and substance, and will be executed and delivered in a manner, reasonably satisfactory to the Purchaser and the Seller, but will not diminish the status of title to the Purchased Assets required to be delivered by the Seller pursuant to this Agreement. |

pg. 10

| (b) | Assumptions at Closing. Upon the terms and conditions contained in this Agreement, on the Closing Date, the Purchaser will deliver to the Seller (i) an assumption of the Assumed Liabilities and (ii) such other documents and agreements as are contemplated by this Agreement. All such instruments will be in form and substance, and will be executed and delivered in a manner, reasonably satisfactory to the Seller and the Purchaser, but will not increase or decrease the Assumed Liabilities required to be assumed by the Purchaser pursuant to this Agreement. |

| (c) | Certificates and Other Documents. Each of the Purchaser and the Seller shall deliver or cause to be delivered the certificates and other documents and items described in Articles 6 and 7. |

The Seller shall be responsible for the payment of any sales, use, transfer, excise, stamp or other similar Taxes imposed by reason of the transfer of the Purchased Assets pursuant to this Agreement and any deficiency, interest or penalty with respect to such Taxes. The Purchaser shall pay all sales and use tax imposed by reason of the use of the Purchased Assets subsequent to Closing and any deficiency, interest or penalty with respect to such sales and use taxes.

2.7 Allocation of Purchase Price.

The Parties will each allocate the Purchase Price for their internal use (including without limitation for financial reporting and tax purposes) as they each see fit and neither Party shall bear any responsibility to the other with respect to such allocation.

| (a) | Purchase Conditions: Purchaser’s obligations with respect to the Closing are conditioned on satisfaction or waiver by the Purchaser, at or prior to the Closing, of the following conditions: |

| 1) | Representations and Warranties. Each of the representations and warranties of the Seller contained in this Agreement shall be true and correct on and as of the Closing Date as though made on and as of the Closing Date (except for representations and warranties that are made as of a specific date, which shall be true and correct as of that date, and except for changes in the ordinary course of business after the date hereof or changes beyond the Seller’s reasonable control, which changes would not have a material and negative impact on the Business or its financial condition), and the Seller shall have delivered to the Purchaser a certificate, dated the Closing Date, to such effect. |

pg. 11

| 2) | Agreements and Covenants. In all material respects, the Seller shall have performed or complied with all agreements and covenants required by this Agreement to be performed or complied with by it on or prior to the Closing Date, and the Seller shall have delivered to the Purchaser a certificate, dated the Closing Date, to such effect. |

| 3) | No Litigation. No Proceedings shall have been instituted or threatened before a court or other Governmental or Regulatory Authority to restrain or prohibit or materially delay any of the transactions contemplated hereby. |

| 4) | Consents and Approvals. All governmental and third-party consents, waivers and approvals, if any, disclosed in Schedule 3.3 or otherwise necessary to permit the consummation of the transactions contemplated by this Agreement shall have been received. |

| 5) | Proceedings. All proceedings to be taken in connection with the transactions contemplated by this Agreement and all documents incident thereto (including without limitation the Transaction Documents and the Transaction Ancillary Documents) shall be reasonably satisfactory in form and substance to the Purchaser and its counsel, and Purchaser shall have received executed copies of all such documents and other evidences as it or its counsel may reasonably request in order to establish the consummation of such transactions and the taking of all proceedings in connection therewith. |

| 6) | Release of Liens. The Seller shall have delivered to the Purchaser releases, discharges or other documents releasing any liens on the Purchased Assets, each in form and substance reasonably satisfactory to Purchaser. |

| (b) | Seller Conditions: The sale of the Purchased Assets by the Seller on the Closing Date is conditioned upon satisfaction or waiver by the Seller, at or prior to the Closing, of the following conditions: |

| 1) | Representations and Warranties. Each of the representations and warranties of the Purchaser contained in this Agreement shall have been true and correct, in all material respects, on and as of the Closing Date as though made on and as of the Closing Date (except for representations and warranties that are made as of a specific date, which shall be true and correct as of that date), and the Purchaser shall have delivered to the Seller a certificate of the Purchaser, dated the Closing Date, to such effect. |

| 2) | Agreements and Covenants. In all material respects, the Purchaser shall have performed or complied with all agreements and covenants required by this Agreement to be performed or complied with by it on or prior to the Closing Date, and the Purchaser shall have delivered to the Seller a certificate of the Purchaser, dated the Closing Date, to such effect. |

pg. 12

| 3) | No Litigation. No Proceedings shall have been instituted or threatened against the Purchaser, the Seller or the Seller Parent before a court or other Governmental or Regulatory Authority to restrain or prohibit or materially delay any of the transactions contemplated hereby. |

| 4) | Proceedings. All proceedings to be taken in connection with the transactions contemplated by this Agreement and all documents incident thereto (including without limitation the Transaction Documents and the JVA) shall be reasonably satisfactory in form and substance to the Seller and its counsel, and the Seller shall have received executed copies of all such documents and other evidences as it or its counsel may reasonably request in order to establish the consummation of such transactions and the taking of all proceedings in connection therewith. |

2.9 Operations Pending Closing

From the date of this Agreement to the Closing Date, and except as otherwise specifically provided in this Agreement or consented to or approved by the Purchaser in advance in writing, such consent or approval not to be unreasonably withheld or delayed:

| (i) | the Seller shall carry on the Business substantially in the same manner as heretofore conducted and shall not engage in any transaction or activity, enter into or amend any agreement or make any commitment except in the ordinary course of business; |

| (ii) | the Seller shall use reasonable commercial efforts to preserve the Seller’s existence and to preserve the properties, assets and relationships of the Business with its personnel, suppliers, customers and others with whom it has business relations; |

| (iii) | the Seller shall not hire any employees or enter into or establish any Employee Plan for the Business; |

| (iv) | the Seller shall not (A) grant any special conditions with respect to any Accounts Receivable other than in the ordinary course of business, (B) fail to pay any Account Payable on a timely basis in the ordinary course of business consistent with past practice, or (C) except as disclosed in this Agreement, make or commit to make any capital expenditures in excess of $5,000 in the aggregate for the Business; |

| (v) | the Seller shall not enter into any settlement with respect to any Proceeding against or relating to the Business which will restrict or have a material effect on how the Purchaser will be permitted to operate the Business after Closing; |

| (vi) | the Seller shall not voluntarily take any action which would cause, or voluntarily fail to take any action the failure of which would cause, any representation or warranty of the Seller set forth in this Agreement to be breached or untrue in any material respect. |

pg. 13

ARTICLE 3 – REPRESENTATIONS AND WARRANTIES OF THE SELLER

The Seller represents and warrants to the Purchaser as follows:

3.1 Existence and Good Standing.

Each of the Seller and Seller Parent (i) is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware and Nevada, respectively, (ii) has all requisite corporate power and authority to own its property and to carry on its business as now conducted and (iii) is duly qualified to do business and is in good standing in each jurisdiction in which the character or location of the properties owned, leased or operated by it or the nature of the business conducted by it makes such qualification necessary.

3.2 Authority and Enforceability.

The Seller has all necessary corporate power and authority and has taken all action necessary to authorize, execute and deliver this Agreement and the Transaction Documents, to consummate the transactions contemplated hereby and thereby, and to perform its obligations under this Agreement and the Transaction Documents. No other action on the part of the Seller is required to authorize the execution and delivery of this Agreement and the Transaction Documents and to consummate the transactions contemplated hereby and thereby. This Agreement and the Transaction Documents, when delivered in accordance with the terms hereof, assuming the due execution and delivery of this Agreement and each such other document by the other parties hereto and thereto, shall have been duly executed and delivered by the Seller and Seller Parent, and shall be valid and binding obligations of the Seller and Seller Parent, enforceable against each in accordance with their respective terms, except to the extent that their enforceability may be subject to applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the enforcement of creditors’ rights generally and to general equitable principles.

3.3 Consents and Approvals; No Violations.

| (a) | The execution and delivery by the Seller of this Agreement and the Transaction Documents will not, and the consummation by it of the transactions contemplated hereby and thereby will not, result in a violation or breach of, conflict with, constitute (with or without due notice or lapse of time or both) a default (or give rise to any right of termination, cancellation, payment or acceleration) under, or result in the creation of any Lien on any of the properties or assets of the Business under: (i) any provision of the organizational documents of the Seller; (ii) subject to obtaining and making any of the approvals, consents, notices and filings referred to in paragraph (b) below, any Law or Order applicable to the Seller or by which the Seller or its properties or assets may be bound; or (iii) except as set forth in Schedule 3.3, any of the terms, conditions or provisions of any Assumed Contract. |

| (b) | Except as set forth in Schedule 3.3, no consent, approval or action of, filing with or notice to any Governmental or Regulatory Authority or other Person is necessary or required (i) under any of the terms, conditions or provisions of any Law or Order applicable to the Business or by which the Business or any of its assets or properties may be bound, (ii) under any of the terms, conditions or provisions of any Assumed Contract or (iii) for the execution and delivery of this Agreement and the Transaction Documents by the Seller or the performance by the Seller of its obligations hereunder or thereunder or the consummation of the transactions contemplated hereby or thereby. |

pg. 14

The Seller has good and marketable title to all the Purchased Assets and all the Purchased Assets are free and clear of any Liens, other than Permitted Liens.

The Seller has furnished the Purchaser with cost center activity of the Business for 17-month period from January 1, 2018 through May 31, 2019 (collectively, the “Financial Statements”), copies of which are attached hereto as Schedule 3.5. The Financial Statements are unaudited and have been prepared internally by the Seller. The cost center activity statement for the period ended May 31, 2019 accurately reflects associated overhead and direct costs of the Business for the period from January 1, 2018 through May 31, 2019. For these purposes (i) “direct costs” means those costs that can be directly traced to developing the goods intended to be sold by the Business, and does not include any insurance costs, bank charges, letter of credit fees or any allocation of overhead or expenses of the purchasing, payables, receivables or accounting departments, and (ii) “associated overhead” means the expenses directly traced to the costs incurred to support the Business at the Current Real Property, including, but not limited to rent, utilities, and compensation of the Business Employees.

Schedule 3.6 sets forth (i) a copy of the depreciation schedule listing the Owned Tangible Personal Property and the accumulated depreciation of each such item, and (ii) a list of each item of Tangible Personal Property leased by the Seller having an annual rental in excess of $5,000. Except as set forth in Schedule 3.6, all of the Tangible Personal Property is located at the Current Real Property and there is no tangible personal property used exclusively in the operation of the Business located at the Current Real Property or at the Seller Parent’s facilities located at 100 Commerce Drive, Loveland, Ohio 45140. As described in Schedule 3.6, The Tangible Personal Property has been utilized for research purposes, and, as result, certain of the Tangible Personal Property has been damaged and may continue to be damaged going forward.

All of the Books and Records, recorded, stored, maintained or held by any means (including all means of access hereto and therefrom) are under the exclusive ownership and direct control of the Seller or Seller Parent.

The Lease(s) are/is the only leases, sublease or other agreements relating to the use or occupancy of real property to which the Seller is a party or bound and which relates to the Business. The Seller has a valid leasehold interest in the real property described in the Lease, free and clear of any and all Liens (other than Permitted Liens and the rights of the lessor under the terms of the Lease and applicable Law). The Lease is in full force and effect; all rents and additional rents due to date on the Lease have been paid; the Seller has been in peaceable possession since the commencement of the original term of the Lease and is not in default thereunder; no waiver, indulgence or postponement of the Seller’s obligations thereunder has been granted by the lessor; and there exists no default by Seller or, to the Seller’s knowledge event, occurrence, condition or act (excluding the assignment of the Lease to Purchaser in connection with the transfer of the Purchased Assets) which, with the giving of notice, the lapse of time or the happening of any further event or condition, would reasonably be expected to become a default under such Lease. The Seller has not violated and is not currently in violation of any of the terms or conditions under the Lease in any material respect, and, to the knowledge of the Seller, all of the covenants to be performed by the lessor under the Lease have been fully performed.

pg. 15

| (a) | Each Assumed Contract is in full force and effect and there exists (i) no default or event of default by the Seller or Seller Parent or, to the knowledge of the Seller, any other party to any such Assumed Contract with respect to any material term or provision of any such Assumed Contract and/or (ii) except as set forth in Schedule 3.9, no event, occurrence, condition or act (including the consummation of the transactions contemplated hereby) which, with the giving of notice, the lapse of time or the happening of any other event or condition, would become a default or event of default by the Seller or, to the knowledge of the Seller, any other party thereto, with respect to any material term or provision of any such Assumed Contract. Except as set forth in Schedule 3.9, with respect to each Assumed Contract, the cost of completion thereof would not reasonably be expected to exceed the balance of monies to be invoiced to a customer or other Person to the Seller thereunder. |

| (b) | Schedule 3.9 sets forth each Assumed Contract which includes a guaranty of performance (the “Performance Guaranty Contracts”). |

There is no Proceeding pending or, to the knowledge of the Seller, threatened, (a) against the Seller or Seller Parent that affects any of the Purchased Assets or the Current Real Property, or (b) relating to the Business. Neither the Seller nor the Seller Parent is subject to any Order relating to the Business.

| (a) | Tax Liens. There are no Liens on any of the Purchased Assets that arose in connection with any failure (or alleged failure) to pay any Tax. |

| (b) | Payment of Taxes. There is no dispute or claim concerning any Tax liability of the Seller or any shareholder of the Seller, in connection with the Business, either (i) claimed or raised by any Governmental or Regulatory Authority in writing or (ii) as to which the Seller has knowledge. |

pg. 16

Seller has provided to Purchaser a copy of Seller Parent’s insurance manual which contains descriptions of the blanket insurance policies portfolio information. There are no pending claims, and there have been no claims since the inception of the Business in 2016, under Seller’s insurance policies (excluding health insurance policies) relating exclusively to the Business.

| (a) | The Seller owns, or has the right to use, all Intellectual Property necessary for the conduct of the Business as currently conducted. No claim has been asserted in writing or is pending by any Person challenging or questioning the use of any such Intellectual Property or the validity or effectiveness of any such Intellectual Property, nor, to the knowledge of the Seller, does any valid basis for any such claim exist. To the Seller’s knowledge, the Seller’s operations and business do not infringe or misappropriate the Intellectual Property rights of any Person. The Seller has taken reasonable steps to maintain and protect as confidential and proprietary all of its trade secrets and other non-public proprietary information. The Data Package described in Schedule 3.13(a) contains the necessary information required to continue operating the Business. |

| (b) | Except as set forth on Schedule 3.13(b), (i) to the Seller’s knowledge, the Seller has not interfered with, infringed upon, misappropriated or otherwise come into conflict with any Intellectual Property rights of third parties, and in the last five (5) years, the Seller has not received any charge, complaint, claim, demand or notice in writing alleging any such interference, infringement, misappropriation or violation (including any claim that the Seller must license or refrain from using any intangible property rights of any third party) which has not been resolved, and (ii) to the Seller’s knowledge, no third party has interfered with, infringed upon, misappropriated or otherwise come into conflict with any of the Intellectual Property. |

| (c) | Schedule 3.13(c) identifies (i) each patent or registration which has been issued to the Seller with respect to any of the Intellectual Property, (ii) each pending patent application or application for registration which the Seller has made with respect to any of the Intellectual Property, and (iii) each license, sublicense or other agreement which the Seller has granted to any third party with respect to any of the Intellectual Property. Schedule 3.13(c) also identifies each copyright, trademark, trade name or unregistered mark used by the Seller in connection with the Business. |

| (d) | Except as set forth on Schedule 3.13(d), with respect to each item of Intellectual Property required to be identified in Schedule 3.13(c): (i) the Seller possesses all right, title, and interest in and to the item, free and clear of any Liens or licenses, (ii) the item is not subject to any outstanding Order, (iii) no Proceeding is pending or, to the knowledge of the Seller, threatened which challenges the legality, validity, enforceability, use of ownership of the item, and (iv) other than routine indemnities given to distributors, sales representatives, dealers and customers, the Seller does not have any current obligations to indemnify any Person for or against any interference, infringement, misappropriation, or other conflict with respect to the item. |

pg. 17

| (e) | Schedule 3.13(e) identifies each item of Intellectual Property that any third party owns and that the Seller uses pursuant to a license, sublicense or agreement (other than off-the-shelf, “shrink-wrap” or “clickwrap” licenses). The Seller has delivered to the Purchaser correct and complete copies of all such licenses, sublicenses and other agreements (as amended to date). Except as set forth on Schedule 3.13(e), with respect to each item of Intellectual Property required to be identified in Schedule 3.13(e): (i) each license, sublicense or other agreement covering the item is enforceable, (ii) neither the Seller nor, to the knowledge of the Seller, any other party to a license, sublicense or other agreement is in material breach or default, and no event has occurred which, with notice or lapse of time, would constitute a breach or default or permit early termination, modification or acceleration thereunder, (iii) neither the Seller nor, to the knowledge of the Seller, any other party to a license, sublicense or other agreement has repudiated any provision thereof, (iv) to the Seller’s knowledge, the underlying item of Intellectual Property is not subject to any outstanding Order, (v) no Proceeding is pending or, to the knowledge of the Seller, threatened which challenges the legality, validity, enforceability or use of the underlying item of Intellectual Property, and (iv) the Seller has not granted any sublicense or similar right with respect to any license, sublicense or other agreement. Notwithstanding the foregoing, Purchaser acknowledges that the licenses, sublicenses, and other agreements set forth on Schedule 3.13(e) are personal to Seller and may not be assigned to Purchaser and enforceable by Purchaser without the prior written consent of the other parties thereto |

With respect to the Business, the Seller has complied with, and the Seller and the Purchased Assets are in compliance in all material respects with, all applicable Laws, Orders and Permits, including Federal Aviation Administration, European Aviation Safety Agency and similar Governmental or Regulatory Authority Laws, Orders and Permits with respect to the identification, labeling and tracking of aircraft parts. The Seller has not received any written notice to the effect that, or otherwise been advised that, the Business or any of the Purchased Assets are not in compliance with any applicable Law, Order or Permit and, to the knowledge of the Seller, there are no presently existing facts, circumstances or events relating to the Business which, with notice or lapse of time, would result in violations of any applicable Law or Permit.

3.15 Accounts Receivable; Accounts Payable; Accrued Liabilities.

The Accounts Payable and Accrued Liabilities have arisen in bona fide arm’s length transactions in the ordinary course of business. None of the Accounts Payable or Accrued Liabilities represents amounts alleged to be owed by the Seller, or other alleged obligations of the Seller, which the Seller has disputed or determined to dispute or refuse to pay.

pg. 18

| (a) | Except as set forth in Schedule 1.1 (w) the Inventory is in the physical possession of the Seller and (ii) none of the Inventory has been pledged as collateral or otherwise is subject to any Lien (other than any Lien imposed as a matter of Law) or is held on consignment from others. The Inventory was acquired or produced by the Seller in the ordinary course of business. |

| (b) | Between the date hereof and the Closing Date, the Seller shall maintain the Inventory at levels necessary to conduct the Business in the ordinary course consistent with past practice. |

| (c) | THE IMPLIED WARRANTY OF FITNESS FOR A PARTICULAR PURPOSE SHALL NOT APPLY AND NO CUSTOM OR USAGE OF TRADE SHALL EXPAND ANY OF THE WARRANTIES GIVEN HEREUNDER. |

| (a) | Schedule 3.17 identifies for each Business Employee, his or her name, position or job title, and employment commencement date Each Business Employee is an employee “at will.” Seller has previously provided to Purchase accurate and complete information regarding each Business Employee’s base compensation and bonus compensation earned in the year ended December 31, 2018, and his or her current base compensation. |

| (b) | Insofar as it relates only to Business Employees, (i) the Seller does not have any obligations under any written or oral labor agreement, collective bargaining agreement or other agreement with any labor organization or employee group, (ii) the Seller is not currently engaged in any unfair labor practice and there is no unfair labor practice charge or other employee-related or employment-related complaint against the Seller pending or, to the knowledge of the Seller, threatened before any Governmental or Regulatory Authority, (iii) there is currently no labor strike, labor disturbance, slowdown, work stoppage or other material labor dispute or arbitration pending or, to the knowledge of the Seller, threatened against the Seller with respect to the Business and no material grievance currently being asserted, (iv) the Seller, with respect to the Business, has not experienced a labor strike, labor disturbance, slowdown, work stoppage or other material labor dispute at any time during the three (3) years immediately preceding the date of this Agreement, (v) there is no organizational campaign being conducted or, to the knowledge of the Seller, contemplated and there is no pending or, to the knowledge of Seller, threatened petition before any Governmental or Regulatory Authority or other dispute as to the representation of any employees of the Business and (vi) to the knowledge of the Seller, there are no known claims against the Seller by employees or former employees of the Business for unpaid wages, wrongful termination, accidental injury or death, sexual harassment or discrimination or violation of any Law. |

| (c) | The Seller has classified each individual who currently performs services for or on behalf of the Business as a contractor or employee in accordance with all applicable Laws. |

pg. 19

| (d) | The Seller has on file a valid Form I-9 for each current employee of the Business. All such employees are (i) United States citizens or lawful permanent residents of the United States, (ii) aliens whose right to work in the United States is unrestricted, (iii) aliens who have valid, unexpired work authorization issued by the Attorney General of the United States (Immigration and Naturalization Service) or (iv) aliens who have been continually employed by the Business since November 6, 1986. With respect to the Business Employees, the Seller has not been the subject of an immigration compliance or employment visit from, nor has the Business been assessed any fine or penalty by or been the subject of any order or directive of, the United States Department of Labor or the Attorney General of the United States (Immigration and Naturalization Service). |

| (a) | Schedule 3.18 sets forth a list of all “employee benefit plans” (as defined in Section 3(3) of ERISA), whether or not subject to ERISA and all other employment, compensation, consulting, bonus, stock option, restricted stock grant, stock purchase, other cash or stock-based incentive, profit sharing, savings, retirement, disability, insurance, severance, retention, change in control, deferred compensation and other compensatory plans, policies, programs, agreements or arrangements sponsored, maintained, contributed to or required to be contributed to, or entered into or made by the Seller with or for the benefit of, or relating to, any Business Employee and with respect to which the Seller has or may have any direct or indirect liability (together, the “Employee Plans”). |

| (b) | The Seller has provided the Purchaser true and complete copies of all Employee Plans, together with all amendments thereto, (or complete and accurate summaries of the material terms thereof) applicable to the Active Business Employees. |

| (c) | There are no pending or, to the knowledge of the Seller, threatened claims, arbitrations, regulatory or other proceedings (other than routine claims for benefits) by or on behalf of any Business Employee relating to any of the Employee Plans, or the assets of any trust for any Employee Plan. |

With respect to the conduct of the Business, the Seller is now, and at all times prior to the Closing Date has been in material compliance with all applicable Environmental Laws and has obtained, and is in material compliance with, all Permits required of it under applicable Environmental Laws. To the knowledge of Seller, there are no facts, circumstances or conditions relating to the past or present business or operations of the Business (including the disposal of any wastes, hazardous substances or other materials), or to any past or present real property and/or improvements now or formerly owned (directly, indirectly, or beneficially), leased, used, operated or occupied by the Business, that could reasonably be expected to give rise to any claim, proceeding or action, or to any liability, under any Environmental Law.

pg. 20

Schedule 3.20 contains a complete and accurate list of all Permits obtained or possessed by the Seller exclusively for the operation of the Business, the date each Permit was last granted to the Seller and the current term of each Permit. To the knowledge of the Seller, the Seller has obtained and possesses all Permits and has made all registrations or filings with or notices to any Governmental or Regulatory Authority necessary for the lawful conduct of the Business as presently conducted, or necessary for the lawful ownership of the Purchased Assets. All such Permits are in full force and effect. The Seller is in compliance with all such Permits except for such non-compliances that would not, individually or in the aggregate, have a Material Adverse Effect. No proceeding to modify, suspend, revoke, withdraw, terminate or otherwise limit any such Permit is pending or, to the knowledge of the Seller, threatened, and the Seller does not know of any valid basis for such proceeding.

Except as set forth in Schedule 3.21, since June 30, 2019, there has not been a Material Adverse Change with respect to the Business, no fact, circumstance or event exists or has occurred which would, individually or in the aggregate, result in a Material Adverse Change with respect to the Business and, the Seller has not:

| (a) | increased the compensation payable (including, but not limited to, wages, salaries, bonuses or any other remuneration) or to become payable to any officer, employee or agent of the Business, except for increases consistent with past practice as to amount and timing; |

| (b) | made any bonus, profit sharing, pension, retirement or insurance payment, distribution or arrangement to or with any employee, officer, personnel, consultant or agent of the Business, except for payments that were already accrued at June 30, 2019 or otherwise due in the ordinary course; |

| (c) | with respect to the Business, entered into, materially amended or become subject to any contract or agreement outside the ordinary course of business; |

| (d) | permitted any of the Purchased Assets to be subject to any Lien (other than Permitted Liens); |

| (e) | with respect to the Business, sold, transferred, leased, licensed or otherwise disposed of any assets or properties except for (i) sales of Inventory in the ordinary course of business consistent with past practice and (ii) leases or licenses entered into in the ordinary course of business consistent with past practice; |

| (f) | with respect to the Business, made any capital expenditure or commitment therefor in excess of $5,000 individually or $20,000 in the aggregate or otherwise acquired any assets or properties (other than Inventory in the ordinary course of business consistent with past practice) or entered into any contract, agreement, letter of intent or similar arrangement (whether or not enforceable) with respect to the foregoing; |

| (g) | with respect to the Business, entered into, materially amended or become subject to any joint venture, partnership, strategic alliance, members’ agreement, co-marketing, co-promotion, co-packaging, joint development or similar arrangement; |

pg. 21

| (h) | with respect to the Business, written-off as uncollectible any notes or Accounts Receivable, except write-offs in the ordinary course of business consistent with past practice charged to applicable reserves; |

| (i) | with respect to the Business, canceled or waived any claims or rights of substantial value; |

| (j) | with respect to the Business, made any change in any method of accounting or auditing practice; |

| (k) | with respect to the Business, paid, discharged, settled or satisfied any claims, liabilities or obligations (absolute, accrued, asserted or unasserted, contingent or otherwise), other than payments, discharges or satisfactions in the ordinary course of business and consistent with past practice of liabilities reflected or reserved against in the Financial Statements; |

| (1) | with respect to the Business, conducted its cash management customs and practices (including the collection of receivables and payment of payables) other than in the ordinary course of business consistent with past practice; or |

| (m) | with respect to the Business, entered into any contract or letter of intent with respect to (whether or not binding), or otherwise committed or agreed, whether or not in writing, to do any of the foregoing. |

Schedule 3.22 sets forth the suppliers and customers of the Business for the period beginning on December 31, 2018 and ending on June 30, 2019]. Except as set forth in Schedule 3.22, to the knowledge of the Seller, no such supplier or customer has canceled or otherwise terminated, or threatened to cancel or otherwise terminate, its relationship with the Business. The Seller has not received any written notice, and has no reason to believe, that any such supplier or customer will cancel or otherwise materially and adversely modify its relationship with the Business either as a result of the transactions contemplated hereby or otherwise.

Other than payables for goods and services provided as listed on Schedule 3.23, as of June 30, 2019, there are no liabilities or obligations between the Business, on the one hand, and the Seller or any Affiliate of the Seller on the other hand.

3.24 Broker’s or Finder’s Fees.

Except as set forth on Schedule 3.24, no agent, broker, Person or firm acting on behalf of the Seller or any of its Affiliates is, or will be, entitled to any commission or brokers’ or finders’ fees from the Seller, the Purchaser or from any of their Affiliates, in connection with any of the transactions contemplated by this Agreement. Seller shall be solely responsible for the payment of any compensation that may be due to any party listed on Schedule 3.24, and shall indemnify, defend and hold harmless Purchaser from any claims from any such party with respect to the transactions contemplated by this Agreement.

pg. 22

3.25 Product and Service Deliveries.

Except as described in Schedule 3.25, the Business does not and has not, since Seller’s commencement of the Business, designed or manufactured any products sold to third parties, nor provided any services to third parties.

3.26 Export Control Regulations

| (a) | Schedule 3.26(a) contains a true and complete list of (i) all current and active import and export licenses issued by the United States government for the products imported or exported by the Business; (ii) a complete and current summary of licensing exemptions used by the Business for products being imported or exported; and (iii) all export related agreements, including, but not limited to, technical assistance agreements, manufacturing license agreements, distribution and warehousing agreements with any non-U.S. entity for the manufacture of export controlled designs or for the transfer of technical information between the Business and a non-U.S. Person. |

| (b) | Schedule 3.26(b) contains a true and complete list of all voluntary disclosure made, currently in process or proposed for submission to the U.S. Government by the Business with respect to import and export matters within the last four (4) years. |

| (c) | To the knowledge of the Seller, no current or past violation of the regulations of the United States or of any foreign government as related to the import or export of the products of the Business has occurred during the last four (4) years. |

3.27 Disclaimer. The representations and warranties made by the Seller in this Article 3 are the sole and exclusive representations and warranties made by the Seller or any of its Affiliates in connection with the transactions contemplated by this Agreement. The Seller hereby disclaims any other express or implied representations or warranties with respect to the Business, the Surefly Aircraft, or the Purchased Assets. Except for the representations and warranties made by the Seller in this Article 3, the Purchased Assets are sold on an “as is, where is” and “with all faults” basis.

pg. 23

ARTICLE 4 – REPRESENTATIONS AND WARRANTIES OF THE PURCHASER

The Purchaser represents and warrants to the Seller and Seller Parent as follows:

4.1 Existence and Good Standing.

The Purchaser (i) is a corporation duly organized, validly existing and in good standing under the laws of the State of New York, (ii) has all requisite corporate power and authority to own its property and to carry on its business as now conducted and (iii) is duly qualified to do business and is in good standing in each jurisdiction in which the character or location of the properties owned, leased or operated by it or the nature of the business conducted by it makes such qualification necessary.

4.2 Authority and Enforceability.

The Purchaser has all necessary corporate power and authority and has taken all action necessary to authorize, execute and deliver this Agreement and the Transaction Documents, to consummate the transactions contemplated hereby and thereby, and to perform its obligations under this Agreement and the Transaction Documents. No other action on the part of the Purchaser is required to authorize the execution and delivery of this Agreement and the Transaction Documents and to consummate the transactions contemplated hereby and thereby. This Agreement and the Transaction Documents, when delivered in accordance with the terms hereof, assuming the due execution and delivery of this Agreement and each such other document by the other parties hereto and thereto, shall have been duly executed and delivered by the Purchaser and shall be valid and binding obligations of the Purchaser, enforceable against it in accordance with their respective terms, except to the extent that their enforceability may be subject to applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the enforcement of creditors’ rights generally and to general equitable principles.

4.3 Consents and Approvals; No Violations.

| (a) | The execution and delivery of this Agreement by the Purchaser do not, the execution and delivery by the Purchaser of the other instruments and agreements to be executed and delivered by the Purchaser as contemplated hereby will not, and the consummation by the Purchaser of the transactions contemplated hereby and thereby will not, result in a violation or breach of, conflict with, constitute, (with or without due notice or lapse of time or both) a default (or give rise to any right of termination, cancellation, payment or acceleration) under, or result in the creation of any Lien upon any of the properties or assets of the Purchaser under: (i) any provision of the organizational documents of the Purchaser; (ii) subject to obtaining and making any of the approvals, consents, notices and filings referred to in paragraph (b) below, any Law or Order applicable to the Purchaser or by which any of its properties or assets may be bound (iii) any contract to which the Purchaser is a party, or by which any of its properties or assets is bound. |

| (b) | No consent, approval or action of, filing with or notice to any Governmental or Regulatory Authority or other Person is necessary or required under any of the terms, conditions or provisions of any Law or Order, any contract to which the Purchaser is a party or by which any of its properties or assets is bound, for the execution and delivery of this Agreement and the Transaction Documents by the Purchaser, the performance by the Purchaser of its obligations hereunder or thereunder or the consummation of the transactions contemplated hereby and thereby. |

4.4 Brokers’ or Finders’ Fees.

Except as set forth on Schedule 3.24, no agent, broker, Person or firm acting on behalf of the Purchaser or any of its Affiliates is, or will be, entitled to any commission or brokers’ or finders’ fees from the Seller, the Purchaser or from any of their Affiliates, in connection with any of the transactions contemplated by this Agreement.

There is no Proceeding pending or, to the knowledge of Purchaser, threatened, against the Purchaser or any of its Affiliates challenging the legality, validity or propriety of this Agreement or the transactions contemplated hereby. Purchaser is not subject to any Order which may restrict its ability or right to operate the Business.

pg. 24

Except for the filing of a Form 8-K Current Report with the Securities and Exchange Commission and the issuance of a mutually agreed-upon press release disclosing this Agreement and the Closing, neither the Seller and the Seller Parent, on the one hand, nor the Purchaser, on the other hand, shall, nor shall any of their respective Affiliates, without the approval of the other party, issue any press release or otherwise make any public statements with respect to the transactions contemplated by this Agreement, except as may be required by applicable law or regulation or by obligations pursuant to any listing agreement with any national securities exchange.

5.2 Notification of Certain Matters.

| (a) | The Seller shall give prompt written notice to the Purchaser of (i) any fact or circumstance, or any occurrence or failure to occur of any event of which the Seller has knowledge, which fact, circumstance, occurrence or failure causes or, with notice or the lapse of time, would cause any representation or warranty of the Seller contained in this Agreement to be breached or untrue or inaccurate in any respect at any time from the date of this Agreement to the Closing Date and (ii) any failure of the Seller to comply with or satisfy any covenant, condition or agreement to be complied with or satisfied by the Seller under this Agreement. |

| (b) | The Purchaser shall give prompt written notice to the Seller of (i) any fact or circumstance, or any occurrence or failure to occur of any event of which the Purchaser has knowledge, which fact, circumstance, occurrence or failure causes or, with notice or the lapse of time, would cause any representation or warranty of the Purchaser contained in this Agreement to be breached or untrue or inaccurate in any respect any time from the date of this Agreement to the Closing Date and (ii) any failure of the Purchaser to comply with or satisfy any covenant, condition or agreement to be complied with or satisfied by the Purchaser under this Agreement. |

5.3 Access to Records and Personnel.

| (a) | For a period of six (6) years after the Closing Date, the Seller and its Representatives will have reasonable access to (including the right to make copies of) all Books and Records transferred to the Purchaser hereunder, and to all former personnel of the Business having knowledge with respect thereto, to the extent that such access may reasonably be required in connection with matters relating to (i) liabilities of the Seller not assumed by the Purchaser hereunder, (ii) all matters as to which the Seller is required to provide indemnification under this Agreement or (iii) the preparation of any Tax returns required to be filed by the Seller with respect to any periods prior to the Closing. Such access will be afforded by the Purchaser upon receipt of reasonable advance notice and during normal business hours, provided such access does not unduly disrupt the Purchaser’s normal business operations. The Seller will be solely responsible for any costs or expenses incurred by it pursuant to this Section 5.3(a). If the Purchaser wishes to dispose of any of such books and records prior to the expiration of the six-year period, the Purchaser shall, prior to such disposition, give the Seller a reasonable opportunity, at the Seller’s expense, to segregate and remove such books and records as the Seller may select. |

pg. 25

For a period of six (6) years after the Closing Date, the Purchaser and its Representatives will have reasonable access to (including the right to make copies of) all of the books and records relating solely to the Business which the Seller or Seller Parent may retain after the Closing Date, excluding however, personnel records with respect to Business Employees which will be made available only upon receipt of a written consent from the applicable employee in a form acceptable to Seller. Such access will be afforded by the Seller and its Representatives upon receipt of reasonable advance notice and during normal business hours, provided such access does not unduly disrupt Seller’s normal business operations. The Purchaser will be solely responsible for any costs and expenses incurred by it pursuant to this Section 5.7(b). If the Seller wishes to dispose of any of such books and records prior to the expiration of such six-year period, the Seller shall, prior to such disposition, give the Purchaser a reasonable opportunity, at the Purchaser’s expense, to segregate and remove such books and records (other than personnel records) as the Purchaser may select.

Purchaser, Seller Parent and Seller agree to work together to accomplish direct rollovers of the Transferred Employees’ account balances, including outstanding loans by Seller’s 401(k) Plan to the Transferred Employees, under Seller’s 401(k) Plan to Purchaser’s 401(k) Plan if such direct rollovers are permissible under both Seller’s and Purchaser’s respective 401(k) Plans.

Purchaser is not assuming, under this Agreement or otherwise, and Seller is and will remain fully responsible for any obligation, responsibility or liability, whether contractual or statutory, including but not limited to compliance (if required) with COBRA, arising out of the termination of employees not hired by Purchaser. In the case of Transferred Employees, Purchaser is not assuming, under this Agreement or otherwise, and Seller is and will remain fully responsible for any obligations, responsibilities or liabilities that relate to their employment with Seller for the period of time up until the Closing, including but not limited to any vacation hours accrued under Seller’s vacation policies prior to the Closing Date except to the extent the liability for such vacation hours is included in the Accrued Expenses as of the Closing Date. Seller will be responsible and liable for all workers’ compensation claims made by Transferred Employees based on occurrences prior to the employees’ respective dates of hire by Purchaser.

At any time and from time to time at or after the Closing, the Seller shall, at the reasonable request of the Purchaser and at the Purchaser’s expense but without further consideration, execute and deliver any further deeds, bills of sale, endorsements, assignments, and other instruments of conveyance and transfer, and take such other actions as the Purchaser may reasonably request in order (i) to more effectively transfer, convey, assign and deliver to the Purchaser, and to place the Purchaser in actual possession and operating control of, and to vest, perfect or confirm, of record or otherwise, in the Purchaser all right, title and interest in, to and under the Purchased Assets, (ii) to assist in the collection or reduction to possession of any and all of the Purchased Assets or to enable the Purchaser to exercise and enjoy all rights and benefits with respect thereto or (iii) to otherwise carry out the intents and purposes of this Agreement.

pg. 26

| (a) | Commencing on the date hereof and continuing for a period of three (3) years thereafter, (i) the Seller will not, and will cause its Affiliates not to, divulge, transmit or otherwise disclose (except as legally compelled by court order, and then only to the extent required, after prompt notice to the Purchaser of any such order), directly or indirectly, any Confidential Information with respect to the Business and (ii) the Seller will not, and will cause its Affiliates not to, use, directly or indirectly, any Confidential Information for the benefit of anyone other than the Purchaser or the Business. |

| (b) | It is the desire and intent of the parties to this Agreement that the provisions of this Section 5.7 shall be enforced to the fullest extent permissible under the laws and public policies applied in each jurisdiction in which enforcement is sought. If any particular provisions or portion of this Section 5.7 shall be adjudicated to be invalid or unenforceable, this Section 5.7 shall be deemed amended to delete therefrom such provision or portion adjudicated to be invalid or unenforceable, such amendment to apply only with respect to the operation of such Section in the particular jurisdiction in which such adjudication is made. |

| (c) | The parties recognize that the performance of the obligations under this Section 5.7 by each of the parties is special, unique and extraordinary in character, and that in the event of the break by the other party of the terms and conditions of this Section 5.7, the non-breaching party shall be entitled, if it so elects, to obtain damages for any breach of this Section 5.7 or to enforce the specific performance thereof by the breaching party and/or its Affiliates or to seek an injunction or other equitable relief in any court of competent jurisdiction enjoining any such breach. The parties agree that the party seeking relief under this Section 5.7 shall not be required to post a bond or other security in connection with the issuance of any such injunction. |

5.8 Non-Competition and Non-Solicitation.

| (a) | In consideration of the purchase of the Purchased Assets by the Purchaser, the Seller and the Seller Parent agree that from the date of this Agreement until the second anniversary of the Closing Date, they will not, and shall cause their Affiliates that they control to not, solicit orders for, offer to sell or sell, directly or indirectly, the products listed on Schedule 5.8 hereto to the customers listed on such Schedule 5.8. |

| (b) | It is the desire and intent of the parties to this Agreement that the provisions of Section 5.8(a) shall be construed narrowly and enforced to the fullest extent permissible under the laws and public policies applied in each jurisdiction in which enforcement is sought. If any particular provisions or portion of this Section 5.8(a) shall be adjudicated to be invalid or unenforceable, this Section shall be deemed amended to delete therefrom such provision or portion adjudicated to be invalid or unenforceable, such amendment to apply only with respect to the operation of such Section in the particular jurisdiction in which such adjudication is made. The parties also recognize that Seller Parent and its Affiliates design, build and/or operate high performance battery-electric vehicles and delivery drones for its customers and the Purchaser acknowledges that the continuation of such businesses (including with respect to the Horsefly System) in no way shall be limited by this Agreement except as expressly provided in Section 5.8(a) above. |

pg. 27