UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT

Commission file number: 000-53704

WORKHORSE GROUP INC.

(Name of registrant as specified in its charter)

| Nevada | 26-1394771 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

| 100 Commerce Drive | ||

| Loveland, Ohio 45140 | 513-360-4704 | |

| (Address of principal executive offices) | (Registrant’s telephone number) |

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE EXCHANGE ACT:

| Title of each Class: | Name of Each Exchange | |

| Common Stock, $0.001 par value per share | The NASDAQ Stock Market LLC |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE EXCHANGE ACT:

None.

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company Emerging growth company |

☐ ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2017, the last business day of the Registrant’s most recently completed second fiscal quarter, the market value of our common stock held by non-affiliates was $134,353,896.

The number of shares of the Registrant’s common stock, $0.001 par value per share, outstanding as of March 8, 2018, was 41,828,474.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Amendment”) amends the Annual Report on Form 10-K of Workhorse Group, Inc. (the “Company”) for the fiscal year ended December 31, 2017 (the “Form 10-K”), as filed with the Securities and Exchange Commission (the “SEC”) on March 14, 2018 (the “Original Filing Date”).

This Amendment is being filed to correct the balance of the Company’s accrued liabilities account and an error relating to the improper exclusion of inventory in transit as of December 31, 2017. Accordingly, we are restating: (i) our Consolidated Balance Sheet and our Consolidated Statement of Stockholders’ Equity (Deficit), consolidated as of December 31, 2017 and our Consolidated Statements of Operations and Consolidated Statements of Cash Flows cash flows for the years then ended. The applicable notes to the consolidated financial statements as well as the relevant portions of Items 5, 6 and 7 have also been updated for consistency with the restated consolidated financial statements.

No other changes have been made to the Form 10-K. This Amendment speaks as of the Original Filing Date and does not reflect events that may have occurred subsequent to the Original Filing Date, and, except as expressly set forth herein, does not modify or update in any way the disclosures made in the Form 10-K.

TABLE OF CONTENTS

i

Forward-Looking Statements

The discussions in this Annual Report contain forward-looking statements reflecting our current expectations that involve risks and uncertainties. When used in this Report, the words “anticipate”, expect”, “plan”, “believe”, “seek”, “estimate” and similar expressions are intended to identify forward-looking statements. These are statements that relate to future periods and include, but are not limited to, statements about the features, benefits and performance of our products, our ability to introduce new product offerings and increase revenue from existing products, expected expenses including those related to selling and marketing, product development and general and administrative, our beliefs regarding the health and growth of the market for our products, anticipated increase in our customer base, expansion of our products functionalities, expected revenue levels and sources of revenue, expected impact, if any, of legal proceedings, the adequacy of liquidity and capital resource, and expected growth in business. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, but are not limited to, market acceptance for our products, our ability to attract and retain customers for existing and new products, our ability to control our expenses, our ability to recruit and retain employees, legislation and government regulation, shifts in technology, global and local business conditions, our ability to effectively maintain and update our product and service portfolio, the strength of competitive offerings, the prices being charged by those competitors and the risks discussed elsewhere herein and our ability to raise capital under acceptable terms. These forward-looking statements speak only as of the date hereof. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

All references in this Form 10-K that refer to the “Company”, “WORKHORSE GROUP”, “Workhorse”, “we,” “us” or “our” are to WORKHORSE GROUP INC. and unless otherwise differentiated, its wholly-owned subsidiaries, Workhorse Technologies Inc., Workhorse Motor Works Inc and Workhorse Properties Inc.

ii

Overview

We are a technology company focused on providing sustainable

and cost-effective solutions to the commercial transportation sector. As an American manufacturer we design and build high performance

battery-electric vehicles and aircraft that make movement of people and goods more efficient and less harmful to the environment.

As part of our solution, we also develop cloud-based, real-time telematics performance monitoring systems that enable fleet operators

to optimize energy and route efficiency. Although we operate as a single unit through our subsidiaries, we approach our development

through two divisions, Automotive and Aviation.

Automotive

In March of 2013, we purchased the former Workhorse Custom Chassis assembly plant in Union City, Indiana from Navistar International (NAV: NYSE). With this acquisition, we acquired the capability to be an Original Equipment Manufacturer (OEM) of Class 3-6 commercial-grade, medium-duty truck chassis, to be marketed under the Workhorse® brand. All Workhorse last mile delivery vans are assembled in the Union City assembly facility. We believe that we are the only medium-duty battery-electric OEM in the U.S. and we will be expanding our product portfolio through introduction of the N-GEN electric cargo van, as well as the W-15 range-extended electric pickup truck in late 2018 and 2019.

We believe our battery-electric and range-extended battery electric commercial vehicles offer fleet operators significant benefits, which include:

| ● | Low Total Cost-of-Ownership vs. conventional gas/diesel vehicles |

| ● | Competitive advantage to increase brand loyalty and last mile delivery market share |

| ● | Improved profitability through: |

| o | Lower maintenance costs |

| o | Reduced fuel expenses |

| ● | Increased package deliveries per day through use of more efficient delivery methods |

| ● | Decreased vehicle emissions and reduction in carbon footprint |

| ● | Improved vehicle safety and driver experience |

The Company currently sells and leases its vehicles to fleet customers directly and through its primary distributor Ryder System, Inc. Ryder also is the exclusive maintenance provider for Workhorse, which provides fleet operators with access to Ryder’s network of 800 maintenance facilities and nearly 6,000 trained service technicians across North America.

Cargo Vans for Last Mile Delivery and Commercial Work Use

Workhorse E-100 battery-electric and E-GEN range-extended delivery vans are currently in production at our Union City, Indiana plant and are in use by our customers on daily routes across the United States. To date, we have built and delivered over 360 electric and range extended medium-duty delivery trucks to our customers. To our knowledge, we are the only American commercial electric vehicle OEM to achieve such a milestone. Our delivery customers include companies such as UPS, FedEx Express, Alpha Baking and Ryder System.

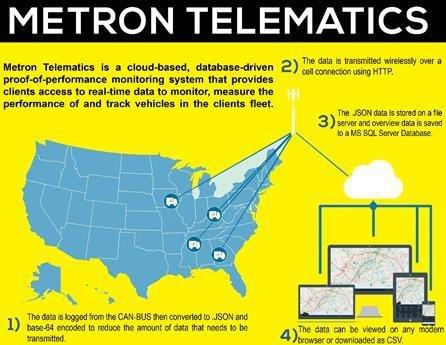

Data from our in-house developed Metron telematics system demonstrates our vehicles have logged more than 2,000,000 customer miles on the road and are averaging a 500% increase in fuel economy as compared to conventional gasoline-based trucks of the same size and duty cycle. In addition to improved fuel economy, we anticipate that the performance of our vehicles on-route will reduce long-term vehicle maintenance expense by approximately 50% as compared to fossil-fueled trucks. Over a 20-year vehicle life, we estimate that our E-GEN Range-Extended Electric delivery vans will save over $150,000 in fuel and maintenance savings. Due to this positive return-on-investment, we charge a premium price for our vehicles when selling to major fleet operators. We expect that fleet operators will be able to achieve a four-year or better total cost of ownership breakeven (without government incentives), which we believe justifies the higher acquisition cost of our vehicles.

Our goal is to continue to increase sales and production of our existing vehicle portfolio, while executing on a cost-down strategy in order to achieve sustained gross margin profitability of the last mile-delivery van platform. It is our intention that this strategy in combination with the development and launch of the N-GEN cargo van and W-15 pickup truck platforms, which target high-volume market segments, will drive further cost-down volume synergies across our supply chain.

U.S. Post Office Replenishment Program / Next Generation Delivery Vehicle Project

Workhorse, with our partner VT Hackney, is one of five awardees that the United States Postal Service selected to build prototype vehicles for the USPS Next Generation Delivery Vehicle (NGDV) project. The Post Office has stated that the number of vehicles to be replaced in the project is approximately 180,000. In September 2017, Workhorse delivered six vehicles for prototype testing under the NGDV Acquisition Program in compliance with the terms set forth in their USPS prototype contract. These vehicles continue to undergo testing in the field and at testing facilities. The Post Office has stated that they intend to test the prototypes and select a winning bid(s) following the testing process.

1

N-GEN Electric Cargo Van

In 2017, Workhorse announced the development of its N-GEN electric cargo van, which leverages the existing ultra-low floor, long-life commercial delivery vehicle platform that was developed for the USPS, as well as our extensive customer experience gained from working with our E-GEN and E-100 customers. The N-GEN incorporates lightweight materials, all-wheel drive, best in class turning radius, 360o cameras, collision avoidance systems and an optional roof mounted HorseFly delivery drone.

The Workhorse N-Gen electric cargo van platform will be available in 450, 700 and 1,000 cubic feet configurations. We intend to initially launch the 450 cubic foot and 1,000 cubic foot configurations with the goal of competing with conventional market leaders, including the Mercedes Sprinter, Ford Transit and Dodge Promaster gasoline/diesel vans for both last-mile delivery and other service-oriented applications such as telecommunications. We expect these vehicles to achieve a fuel economy of approximately 60 miles per gallon equivalent (MPGe), and offer fleet operators the most favorable total cost-of-ownership of any comparable conventional van utilizing an internal combustion engine that is available today.

W-15 Range-Extended Electric Pickup Truck

In May 2017, we unveiled a working prototype of our W-15 range-extended electric pickup truck to address the specific needs of commercial fleet work truck operators, including utilities, municipalities, construction, airports and service businesses. We believe that the W-15 has the potential to transform the pickup truck market for fleet operators in the United States, estimated at 250,000 new vehicle purchases per year. The performance specifications of the Workhorse W-15 pickup include a true all-wheel drivetrain and two electric engines that generate up to 460 horsepower and provide a top acceleration time from 0 to 60 MPH of 5.6 seconds. The W-15 also has a fuel-economy rating of 75 MPGe and a range of 80 miles in all-electric operation. A gasoline-powered range extender also comes standard on the truck to extend the driving range to 300 miles on a single tank of gas by continuously charging the batteries during operation.

We have secured letters-of-intent for more than 5,500 trucks, amounting to nearly $300 million from corporate fleets representing the utility, municipality and automotive logistics sectors. We have established a Leadership Council comprised of seasoned fleet experts from our LOI partners, who will be piloting our production intent vehicles prior to launch in late 2018.

We intend to produce the W-15 at our existing 250,000 square foot facility in Union City, Indiana. This plant has the capability to produce more than 60,000 vehicles per year. The battery packs for all Workhorse vehicles will be built in our Loveland, Ohio battery pack plant using Panasonic cells produced in Japan.

Delivery As A Service (DAAS) and Future Platform Development

Last mile delivery is considered the most expensive, inefficient, and pollution generating segment of transport, in addition to being the largest growing segment of the trucking market, according to Datex Corp. and NTEA (2018). Driven by the growth in e-commerce, this is expected to double to 26 billion parcels over the next 10 years. McKinsey & Company estimates that 80% of all home deliveries will transition to driver assisted and autonomous models, driven by driver labor shortages, urban congestion, and consumer demand.

As part of continued efforts to advance our last mile delivery platform technologies, in the fourth quarter of 2017, Workhorse initiated a pilot of its Delivery As A Service offering, which provides turn-key electric last mile delivery for conventional brick and mortar and e-commerce businesses. Through our DAAS program, Workhorse electric vehicles, drivers and dispatchers as well as potentially drones provide an asset-light opportunity for businesses to offer zero-emission last mile delivery services to their customers. Workhorse’s DAAS is currently operating in one major metropolitan market, with plans to expand to additional cities in conjunction with our pilot customers, in 2018.

Aviation

Delivery Drones

Our HorseFly™ Delivery Drone is a custom-designed, purpose-built drone that is fully integrated with our electric trucks. We have a patent pending on this architecture and we believe we are the only company in the world with a working drone/truck system. The HorseFly delivery drone and truck system is designed to work within the FAA Rule 107 that permits the use of commercial drones in U.S. airspace under certain conditions.

To date, we have conducted two demonstration deliveries with large multi-national corporations, including UPS. UPS conducted a successful real-world test with us in February 2017 and it received worldwide news coverage. The knowledge we have gained in building electric delivery trucks for last-mile delivery has led us to believe that a drone/truck delivery system can have significant cost savings in the growing last mile delivery market.

UPS has estimated in a press release dated February 21, 2017 that a reduction of just one mile per driver per day over one year can save UPS up to $50 million. Rural delivery routes are the most expensive to serve due to the time and vehicle expenses required to complete each delivery. In this test, the drone made one delivery while the driver continued down the road to make another. We believe that this truck/drone architecture represents significant cost savings for delivery fleets and that we are first to market with such a system. We continue to work closely with the FAA as we strive to bring the system to the point of daily drone deliveries across rural America.

2

SureFly™ Multicopter

SureFly is our entry into the emerging vertical take-off and landing (VTOL) market. It is designed to be a two-person, 400-pound payload aircraft with on a hybrid internal combustion/electric power generation system. Our approach in the design is to build the safest and simplest to fly rotary wing aircraft in the world. We believe it is a practical answer to personal flight, and has additional applications in the commercial transportation segments, including air taxi services, agriculture and others.

The FAA to date has granted three separate Experimental Airworthiness Certifications, registered as N834LW, for the aircraft. These certifications come after an extensive design review and inspection of the aircraft with each renewed certificate.

Our SureFly Aerospace team continues to further develop the SureFly platform and routinely performs test cards, including testing the aircraft’s power systems, executing tethered high-power ground tests and manned flights.

In December 2017, we initiated the process of spinning off our SureFly operations into a separate publicly traded company, Surefly, Inc.

Surefly, Inc. will encompass all of SureFly’s aerial technology and expertise, including property related to the personal helicopter, but it will not own the assets related to the package express-related HorseFly drone, which will be retained by Workhorse. Workhorse granted SureFly a royalty-free, perpetual license to utilize the HorseFly drone except with respect to deliveries implemented from a ground-based vehicle focused on package express.

The initial steps of the spin-off, which we took in December 2017, provided for a capital infusion of $5 million into Workhorse in the form of a Senior Secured Note which is expected, although not guaranteed, to be exchanged into equity of SureFly concurrent with the spin-off.

At the spin-off date, Workhorse expects to retain a portion of SureFly’s common stock and distribute a portion as a dividend to existing Workhorse shareholders. After the spin-off, expected during 2018, we intend to evaluate all of our options relating to the SureFly equity we have retained.

To facilitate the spin-off, Workhorse expects to enter into, among other things, a transition services agreement with SureFly to provide certain services not anticipated to be provided immediately by employees of SureFly.

The completion of the spin-off will enable us to focus all of our resources on our core automotive business. We believe the decision to spin-off SureFly into a separate entity will better position both companies for sustained long-term growth. The spin-off will improve the operational focus and financial outlook for Workhorse's core business while creating new opportunities for SureFly.

The spin-off transaction will be subject to the receipt of regulatory approvals, the execution of inter-company agreements, arrangement of adequate debt and/or equity financing, the effectiveness of a registration statement, final approval by Workhorse's board of directors, and certain other customary conditions. The spin-off will not require a shareholder vote and is expected to be completed by the end of 2018, but there can be no assurance regarding the ultimate timing of the spin-off or that the spin-off will ultimately occur.

Technology

Batteries Are Key

The battery pack is key to the design, development, and manufacture of advanced electric-vehicle powertrains. Where some other electric vehicle (EV) manufacturers purchase their batteries in a plug-and-play pack, we build our own battery packs. This keeps the intellectual property related to the design and production of the pack in-house and avoids the issues that occur when a battery supplier fails. It also enables us to pay less for our battery packs than our competitors, thus our all-electric truck is less expensive than competitive vehicles. We use the Panasonic 18650 cells and design the pack around these commodity cells.

In-House Software Development is Essential

Our powertrains encompass the complete motor assemblies, computers, and software required for vehicle electrification. We use off-the-shelf proven components and combine them with our proprietary software.

Innovation is the Future

Additionally, we have developed a cloud-based, remote management system to manage and track the performance of all of the vehicles that we deploy in order to provide a 21st Century solution for fleet managers.

3

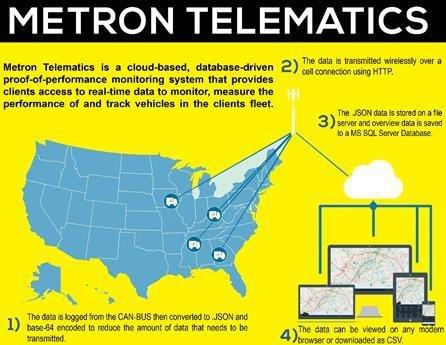

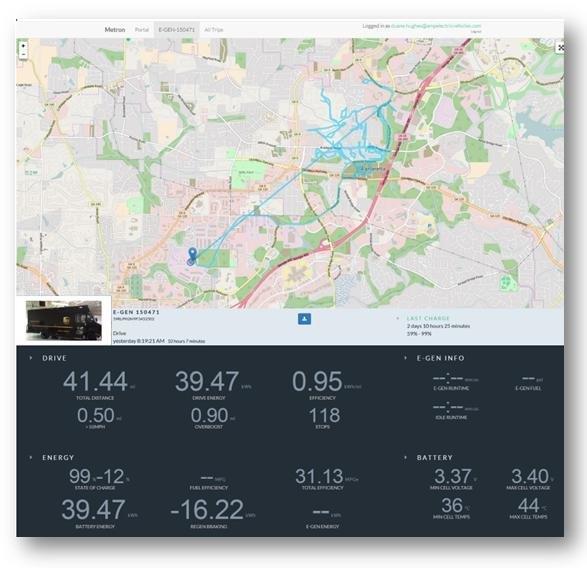

The telematics system and associated hardware installed in the Workhorse vehicles is designed to monitor the controller area network (CAN) traffic for specific signals. These signals are uploaded along with GPS data to a Workhorse server facility where the data signals are tracked at ten second intervals while driving and during the electricity generating process and at sixty seconds during a plug-in charge. The real-time data is stored in a database as it arrives and delivers updates to clients connected through the web interface.

4

Clients are given login credentials (username and password) to the telematics website where they can monitor the performance and location of the vehicles. Group privileges can be configured to limit access to client-specific vehicles securing the vehicle data so clients can only view their vehicle data. Administrator privileges allow all data for all clients to be monitored and viewed.

As a parameter-based system, we can set route-specific parameters to better manage the battery-provided power with the additional power generated through the E-GEN process (not applicable to E-100). In an upcoming release, we will add the ability to integrate Metron Telematics with the client’s internal telematics system and automatically update the parameters each day with information about the route. This enhancement will result in a “SMART-GEN” vehicle that will maximize efficiency by automating the process to determine the ideal times and locations to use the E-GEN to add electricity to the batteries.

Locations and Facilities

Our company headquarters and R & D facility is located at 100 Commerce Drive, Loveland, Ohio, a Cincinnati suburb. We occupy a 45,000 sq. ft. facility that allows for the manufacture of 5,000 electric powertrain kits per year. Powertrains are delivered to the Workhorse facility in Indiana or shipped to our dealer network for onsite installation in conversion vehicles. On October 28, 2016 the Company purchased its operating facilities in Loveland, Ohio. The total purchase price was $2.5 million with $1.7 million financed with a financial institution. The note carries an interest rate of 6.5% accruing monthly with a maturity date of November 1, 2026.

Our truck assembly facility is located in Union City, Indiana. This facility consists of three buildings with 250,000 square feet of manufacturing and office space on 47 acres.

5

In March of 2013, we purchased the former Workhorse Custom Chassis assembly plant in Union City, Indiana. With this acquisition, we became an Original Equipment Manufacturer (OEM) of Class 3-6 commercial-grade, medium-duty truck chassis marketed under the Workhorse® brand.

Ownership and operation of this plant enables us to build new chassis with gross vehicle weight capacity of between 10,000 and 26,000 pounds.

At the same time, the Company intends to partner with engine suppliers and body fabricators to offer fleet-specific, custom, purpose-built chassis that provide total cost of ownership solutions that are superior to the competition.

In addition to building our own chassis, we design and produce battery-electric powertrains that can be installed in new Workhorse chassis or installed as repower packages to convert used Class 3-6 medium-duty vehicles from diesel or gasoline power to electric power. Our approach is to provide battery-electric powertrains utilizes proven, automotive-grade, mass-produced parts in its architecture coupled with in-house control software that it has developed over the last five years.

The Workhorse Custom Chassis acquisition included other important assets including the Workhorse brand and logo, intellectual property, schematics, logistical support from UpTime Parts (a Navistar subsidiary).

Marketing

Our sales team is focused on the goal of securing purchase orders from commercial transportation companies. These purchases will give us additional data toward chassis demand related to electric and extended range electric vehicles.

Our priority is to establish the commercial delivery van as our core business. We intend to be the best choice for a vehicle in this segment regardless of the fuel type that the customer chooses. Our sales plan is to meet with the top potential customers and obtain purchase orders for new electric and extended range electric vehicles for their production vehicle requirements.

As the last mile delivery service space expands and non-traditional customers enter, Workhorse is reaching to those potential new customers as part of their supply chain enhancement. This market is comprised of a higher quantity of smaller delivery vehicles, such as the Workhorse N-GEN platform.

Finally, since our competitive advantage in the marketplace is our ability to provide purpose-built solutions to customers that have unique requirements at relatively low-volume, we have submitted proposals to companies for purpose-built vehicle applications.

6

Strategic Relationships

Panasonic: Workhorse Group has signed an agreement with the rechargeable battery division of Panasonic Industrial Devices Sales Co. of America for the supply of 18650 cylindrical Panasonic lithium-ion batteries for Workhorse’s battery-electric, medium-duty trucks.

Ryder: On April 27, 2017, the Company entered into an agreement with Ryder to serve as the primary distributor, except with respect to certain exclusive accounts, in the United States, Mexico and Canada. Ryder will also serve as the sole and exclusive provider of certain repair services and the sole and exclusive distributor of certain vehicle parts in the United States, Canada and Mexico.

BMW: Workhorse has partnered with BMW where BMW provides the internal combustion engine used in the range extended vehicle applications as a source for on board battery recharging. BMW provides the engine, service support and technical advice necessary for vehicle certification. The engine currently used in production is the same engine used in the i3 passenger car.

Prefix: Michigan-based Prefix Corporation began in 1979 developing innovative design and engineering solutions for the automotive industry. Workhorse relies on Prefix’s complementary capabilities in the areas of complete prototype design, build and finishing to more rapidly advance product development.

Research and Development

The majority of our research and development is conducted in-house at our facilities near Cincinnati, Ohio. Additionally, we contract with engineering firms to assist with validation and certification requirements as well as specific vehicle integration tasks.

Competitive Companies

The commercial vehicle market, specifically in the last mile delivery segment, is highly competitive and we expect it to become even more so in the future as additional companies launch competing vehicle offerings. The commercial alternative fueled vehicle market, however, is less developed and less competitive. There are two primary competitors in the medium-duty vehicle segment in the US market: Ford and Freightliner. Neither has disclosed any plans to offer 100% EVs or electric range extended vehicles (EREV) in this segment. Ford is vertically integrated building a complete vehicle or chassis including Ford engine and transmission. They provide a chassis as a strip-chassis (which is similar to the Workhorse product) or they provide it with a cab. Freightliner provides a chassis as a strip-chassis, which is similar to the Workhorse Truck chassis.

We believe the most dramatic difference between Workhorse and the other competitors in the medium duty truck market is our ability to offer customers purpose-built solutions that meet the needs of their unique requirements at a competitive price. While there are many electric car companies from abroad, there are only a few foreign companies that have vehicles in the category of medium-duty trucks.

We believe that the primary competitive factors within the medium-duty commercial vehicle market are:

| ● | the difference in the initial purchase prices of electric vehicles and comparable vehicles powered by internal combustion engines, both including and excluding the impact of government and other subsidies and incentives designed to promote the purchase of electric vehicles; |

| ● | the total cost of vehicle ownership over the vehicle’s expected life, which includes the initial purchase price and ongoing operational and maintenance costs; |

| ● | vehicle quality, performance and safety; |

| ● | government regulations and economic incentives promoting fuel efficiency and alternate forms of energy; |

| ● | the quality and availability of service for the vehicle, including the availability of replacement parts. |

7

GOVERNMENT REGULATION

Our electric vehicles are designed to comply with a significant number of governmental regulations and industry standards, some of which are evolving as new technologies are deployed. Government regulations regarding the manufacture, sale and implementation of products and systems similar to our electric vehicles are subject to future change. We cannot predict what impact, if any, such changes may have upon our business.

Emission and fuel economy standards

Government regulation related to climate change is in effect at the U.S. federal and state levels. The U.S. Environmental Protection Agency (“EPA”) and the National Highway Traffic Safety Administration, or NHTSA, issued a final rule for greenhouse gas emissions and fuel economy requirements for trucks and heavy-duty engines on August 9, 2011, which is applicable in model years 2018 through 2020. NHTSA and EPA also issued a final rule on August 16, 2016 increasing the stringency of these standards for model years 2021 through 2027.

The rules provide emission standards for CO2 and fuel consumption standards for three main categories of vehicles: (i) combination tractors, (ii) heavy-duty pickup trucks and vans and (iii) vocational vehicles. We believe that the Workhorse vehicles would be considered “vocational vehicles” and "heavy-duty pickup trucks and vans" under the rules. According to the EPA and NHTSA, vocational vehicles consist of a wide variety of truck and bus types, including delivery, refuse, utility, dump, cement, transit bus, shuttle bus, school bus, emergency vehicles, motor homes and tow trucks, and are characterized by a complex build process, with an incomplete chassis often built with an engine and transmission purchased from other manufacturers, then sold to a body manufacturer.

The EPA and NHTSA rule also establishes multiple flexibility and incentive programs for manufacturers of alternatively fueled vehicles, such as the Workhorse vehicles, including an engine averaging, banking and trading, or ABT, program, a vehicle ABT program and additional credit programs for early adoption of standards or deployment of advanced or innovative technologies. The ABT programs will allow for emission and/or fuel consumption credits to be averaged, banked or traded within defined groupings of the regulatory subcategories. The additional credit programs will allow manufacturers of engines and vehicles to be eligible to generate credits if they demonstrate improvements in excess of the standards established in the rule prior to the model year the standards become effective or if they introduce advanced or innovative technology engines or vehicles.

The Clean Air Act requires that we obtain a Certificate of Conformity issued by the EPA and a California Executive Order issued by CARB with respect to emissions for our vehicles. The Certificate of Conformity is required for vehicles sold in states covered by the Clean Air Act’s standards and the Executive Order is required for vehicles sold in states that have sought and received a waiver from the EPA to utilize California standards. The California standards for emissions control for certain regulated pollutants for new vehicles and engines sold in California are set by CARB. States that have adopted the California standards as approved by EPA also recognize the Executive Order for sales of vehicles.

Manufacturers who sell vehicles in states covered by federal requirements under the Clean Air Act without a Certificate of Conformity may be subject to penalties of up to $44,539 per violation and be required to recall and remedy any vehicles sold with emissions in excess of Clean Air Act standards. In 2013, we received approval from CARB to sell the E-100 in California based on our own emissions tests.

Vehicle safety and testing

The National Traffic and Motor Vehicle Safety Act of 1966, or the Safety Act, regulates motor vehicles and motor vehicle equipment in the United States in two primary ways. First, the Safety Act prohibits the sale in the United States of any new vehicle or equipment that does not conform to applicable motor vehicle safety standards established by NHTSA. Meeting or exceeding many safety standards is costly, in part because the standards tend to conflict with the need to reduce vehicle weight in order to meet emissions and fuel economy standards. Second, the Safety Act requires that defects related to motor vehicle safety be remedied through safety recall campaigns. A manufacturer is obligated to recall vehicles if it determines that the vehicles do not comply with a safety standard. Should we or NHTSA determine that either a safety defect or noncompliance exists with respect to any of our vehicles, the cost of such recall campaigns could be substantial.

8

Battery safety and testing

Our battery pack configurations are designed to conform to mandatory regulations that govern transport of “dangerous goods,” which includes lithium-ion batteries, which may present a risk in transportation. The governing regulations, which are issued by PHMSA, are based on the UN Recommendations on the Safe Transport of Dangerous Goods Model Regulations, and related UN Manual of Tests and Criteria. The requirements for shipments of these goods vary by mode of transportation, such as ocean vessel, rail, truck and air.

Our battery suppliers have completed the applicable transportation test for our prototype and production battery packs demonstrating our compliance with the UN Manual of Tests and Criteria, including:

| ● | altitude simulation, which involves simulating air transport; |

| ● | thermal cycling, which involves assessing cell and battery seal integrity; |

| ● | vibration, which involves simulating vibration during transport; |

| ● | shock, which involves simulating possible impacts during transport; |

| ● | external short circuit, which involves simulating an external short circuit; and |

| ● | overcharge, which involves evaluating the ability of a rechargeable battery to withstand overcharging. |

Vehicle dealer and distribution regulation

Certain states’ laws require motor vehicle manufacturers and dealers to be licensed in such states in order to conduct manufacturing and sales activities. To date, we are registered as both a motor vehicle manufacturer and dealer in Indiana and Ohio as well as a dealer in California, New York and Chicago. We have not yet sought formal clarification of our ability to manufacture or sell our vehicles in any other states.

Intellectual Property

We have two pending trademark applications and ten issued trademark registrations (US and foreign). We also intend to pursue additional foreign trademark registrations. We have two pending (one non-provisional and one provisional) U.S. patent applications, and seven existing patents, two of which are design patents. We also plan to pursue appropriate foreign patent protection on those inventions, if available. The following is a summary of our patents:

| Country | Status | Serial Number | Application Date | Patent Number | Issue/Grant Date | Expiration Date | Title | |||||||||||

| United States | G | 13/283,663 | 10/28/2011 | 8,541,915 | 9/24/2013 | 12/16/2031 | DRIVE MODULE AND MANIFOLD FOR ELECTRIC MOTOR DRIVE ASSEMBLY | |||||||||||

| Canada | G | 2523653 | 10/17/2005 | 2523653 | 12/22/2009 | 10/17/2025 | VEHICLE CHASSIS ASSEMBLY | |||||||||||

| United States | G | 11/252,220 | 10/17/2005 | 7,717,464 | 5/18/2010 | 9/6/2026 | Vehicle Chassis Assembly | |||||||||||

| United States | G | 11/252,219 | 10/17/2005 | 7,559,578 | 7/14/2009 | 9/6/2026 | Vehicle Chassis Assembly | |||||||||||

| United States | G | 29/243,074 | 11/18/2005 | D561,078 | 2/5/2008 | 2/5/2022 | Vehicle Header | |||||||||||

| United States | G | 29/243,129 | 11/18/2005 | D561,079 | 2/5/2008 | 2/5/2022 | Vehicle Header | |||||||||||

| United States | G | 14/606,497 | 1/27/2015 | 9,481,256 | 11/1/2016 | 5/3/2035 | ONBOARD GENERATOR DRIVE SYSTEM FOR ELECTRIC VEHICLES | |||||||||||

| United States | F | 14/989,870 | 1/7/2016 | PACKAGE DELIVERY BY MEANS OF AN AUTOMATED MULTICOPTER UAS/UAV DISPATCHED FROM A CONVENTIONAL DELIVERY VEHICLE | ||||||||||||||

| United States | F | 62/513,677 | 6/1/2017 | 6/1/2018 | AUXILIARY POWER SYSTEM FOR ROTORCRAFT WITH FOLDING PROPELLER ARMS AND CRUMPLE ZONE LOADING GEAR | |||||||||||||

9

Employees

We currently have 83 full-time and 9 part-time employees located in Loveland, Ohio and 26 full-time employees located in Union City, Indiana. We also contract for hire with approximately three outside consultants and contractors.

Our results of operations have not resulted in profitability and we may not be able to achieve profitability going forward.

We have incurred net losses amounting to $104.3 million for the period from inception (February 20, 2007) through December 31, 2017. We have had net losses in each quarter since our inception. We expect that we will continue to incur net losses for the foreseeable future. We may incur significant losses in the future for a number of reasons, including the other risks described in this report, and we may encounter unforeseen expenses, difficulties, complications, delays and other unknown events. Accordingly, we may not be able to achieve or maintain profitability. Our management is developing plans to alleviate the negative trends and conditions described above and there is no guarantee that such plans will be successfully implemented. Our business plan is focused on providing sustainable and cost-effective solutions to the commercial transportation sector, but is still unproven. There is no assurance that even if we successfully implement our business plan, that we will be able to curtail our losses. If we incur additional significant operating losses, our stock price may decline, perhaps significantly.

We have yet to achieve positive cash flow and, given our projected funding needs, our ability to generate positive cash flow is uncertain.

We have had negative cash flow from operating activities of $38.7 million and $19.0 million for the years ended December 31, 2017 and 2016, respectively. We anticipate that we will continue to have negative cash flow from operating and investing activities for the foreseeable future as we expect to incur increased research and development, sales and marketing, and general and administrative expenses and make significant capital expenditures in our efforts to increase sales and ramp up operations at our Union City facility. Our business also will at times require significant amounts of working capital to support our growth, particularly as we acquire inventory to support our existing production as well as an anticipated increase in production. An inability to generate positive cash flow for the foreseeable future may adversely affect our ability to raise needed capital for our business on reasonable terms, diminish supplier or customer willingness to enter into transactions with us, and have other adverse effects that may decrease our long-term viability. There can be no assurance we will achieve positive cash flow in the foreseeable future.

10

We need access to additional financing in 2018 and beyond, which may not be available to us on acceptable terms or at all. If we cannot access additional financing when we need it and on acceptable terms, our business may fail.

Our business plan to design, produce, sell and service commercial electric vehicles through our Union City facility will require substantial continued capital investment. Our research and development activities will also require substantial continued investment. For the year ended December 31, 2017, our independent registered public accounting firm issued a report on our 2017 financial statements that contained an explanatory paragraph stating that the lack of sales, negative working capital and stockholders’ deficit, raise substantial doubt about our ability to continue as a going concern. For example, our existing capital resources will be insufficient to fund our operations through the first half of 2018. Through December 31, 2018, we expect that we will need funding to be used in our research and development activities, inventory funding and working capital. The additional funding will allow us to continue to deliver vehicles associated with existing and expected orders, further develop our N-GEN platform resulting in a “production ready vehicle” and further develop our W-15 Pickup Truck resulting in a “production intent vehicle”. Unless and until we are able to generate a sufficient amount of revenue, reduce our costs and/or enter a strategic relationship, we expect to finance future cash needs through public and/or private offerings of equity securities and/or debt financings. We do not currently have any committed future funding. If we are not able to obtain additional financing and/or substantially increase revenue from sales, we will be unable to continue as a going concern. As a result, we may have to liquidate our assets and may receive less than the value at which those assets are carried on our consolidated financial statements, and investors will likely lose a substantial part or all of their investment. We cannot be certain that additional financing will be available to us on favorable terms when required, or at all, particularly given that we do not now have a committed credit facility with any government or financial institution. Further, if there remains doubt about our ability to continue as a going concern, investors or other financing sources may be unwilling to provide additional funding on acceptable terms or at all. If we cannot obtain additional financing when we need it and on terms acceptable to us, we will not be able to continue as a going concern.

The development of our business in the near future is contingent upon the implementation of orders from UPS and other key customers for the purchase of Workhorse vehicles and if we are unable to perform under these orders, our business may fail.

On June 4, 2014, the Company entered into a Vehicle Purchase Agreement with United Parcel Service Inc. (“UPS”) which outlined the relationship by which the Company would sell vehicles to UPS. To date, we have received six separate orders totaling up to 1,405 vehicles from UPS. The sixth and most recent order is from Q1 2018. We have entered into various purchase orders with UPS relating to the delivery of the vehicles ordered. There is no guarantee that the Company will be able to perform under these orders and if it does perform, that UPS will purchase additional vehicles from the Company. Also, there is no assurance that UPS will not terminate its agreement with the Company pursuant to the termination provisions therein. Further, if the Company is not able to raise the required capital to purchase required parts and pay certain vendors, the Company may not be able to comply with UPS’s deadlines. Accordingly, despite the receipt of the orders from UPS, there is no assurance, due to the Company’s financial constraints and status as a development stage company, that the Company will be able to deliver such vehicles or that it will receive additional orders whether from UPS or other potential customers.

If we are unable to perform under our orders with UPS, the Company business will be significantly negatively impacted.

11

Our limited operating history makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

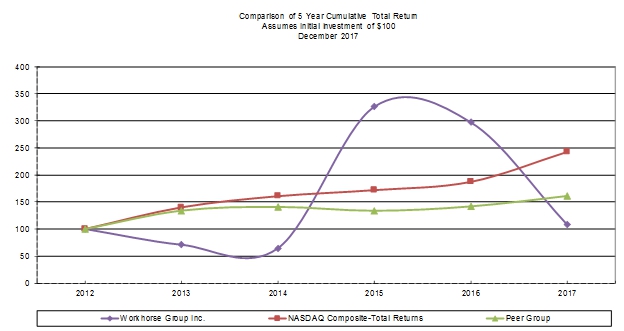

While our revenue has increased from $6.4 million in 2016 to $10.8 million in 2017, a significant portion of our activities are still focused on research and development. We have a limited operating history and have generated limited, but improving, revenue. As we begin to fully implement our manufacturing capabilities, it is difficult, if not impossible, to forecast our future results based upon our historical data. Because of the uncertainties related to our lack of historical operations, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in revenues or expenses. If we make poor budgetary decisions as a result of unreliable historical data, we could be less profitable or incur losses, which may result in a decline in our stock price.

We offer no financing on our vehicles. As such, our business is dependent on cash sales, which may adversely affect our growth prospects.

While most of our current customers are well-established companies with significant purchasing power, many of our potential smaller and medium-sized customers may need to rely on credit or leasing arrangements to gain access to our vehicles. Unlike some of our competitors who provide credit or leasing services for the purchase of their vehicles, we do not provide, and currently do not have commercial arrangements with a third party that provides, such financial services. We believe the current limited availability of credit or leasing solutions for our vehicles could adversely affect our revenues and market share in the commercial electric vehicle market.

Our business, prospects, financial condition and operating results will be adversely affected if we cannot reduce and adequately control the costs and expenses associated with operating our business, including our material and production costs.

We incur significant costs and expenses related to procuring the materials, components and services required to develop and produce our electric vehicles. We have secured supply agreements for our critical components including our batteries. However, these are dependent on volume to ensure that they are available at a competitive price. Thus, our current cost projections are higher than the projected revenue stream that such vehicles will produce, excluding vehicles purchased under voucher programs, such the Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP) offered in California. As a result, we currently lose money on each medium-duty vehicle sold without an associated voucher. We continually work on cost-down initiatives to reduce our cost structure so that we may effectively compete. If we do not reduce our costs and expenses, our net losses will continue which will negatively impact our business and stock price.

Increases in costs, disruption of supply or shortage of lithium-ion cells could harm our business.

We may experience increases in the cost or a sustained interruption in the supply or shortage of lithium-ion cells. Any such increase, supply interruption or shortage could materially and negatively impact our business, prospects, financial condition and operating results. The prices for these lithium-ion cells can fluctuate depending on market conditions and global demand for these materials and could adversely affect our business and operating results. We are exposed to multiple risks relating to lithium-ion cells including:

| ● | the inability or unwillingness of current battery manufacturers to build or operate battery cell manufacturing plants to supply the numbers of lithium-ion cells we may require going forward; | |

| ● | disruption in the supply of cells due to quality issues or recalls by battery cell manufacturers; | |

| ● | an increase in the cost of raw materials used in the cells; and | |

| ● | fluctuations in the value of the Japanese yen against the U.S. dollar in the event our purchasers of lithium-ion cells are denominated in Japanese yen. |

12

Our business is dependent on the continued supply of battery cells for the battery packs used in our vehicles. While we believe several sources of the battery cells are available for such battery cells, we have fully qualified only Panasonic for the supply of the cells used in such battery packs and have very limited flexibility in changing cell suppliers. Any disruption in the supply of battery cells could disrupt production of our vehicles until such time as a different supplier is fully qualified. Furthermore, fluctuations or shortages in petroleum, tariff or trade issues and other economic or tax conditions may cause us to experience significant increases in freight charges. Substantial increases in the prices for the battery cells or prices charged to us, would increase our operating costs, and could reduce our margins if we cannot recoup the increased costs through increased vehicle prices. Any attempts to increase vehicle prices in response to increased costs in our battery cells could result in cancellations of vehicle orders and therefore materially and adversely affect our brand, image, business, prospects and operating results.

The demand for commercial electric vehicles depends, in part, on the continuation of current trends resulting from dependence on fossil fuels. Extended periods of low diesel or other petroleum-based fuel prices could adversely affect demand for our vehicles, which would adversely affect our business, prospects, financial condition and operating results.

We believe that much of the present and projected demand for commercial electric vehicles results from concerns about volatility in the cost of petroleum-based fuel, the dependency of the United States on oil from unstable or hostile countries, government regulations and economic incentives promoting fuel efficiency and alternative forms of energy, as well as the belief that climate change results in part from the burning of fossil fuels. If the cost of petroleum-based fuel decreased significantly, the outlook for the long-term supply of oil to the United States improved, the government eliminated or modified its regulations or economic incentives related to fuel efficiency and alternative forms of energy, or if there is a change in the perception that the burning of fossil fuels negatively impacts the environment, the demand for commercial electric vehicles could be reduced, and our business and revenue may be harmed.

Diesel and other petroleum-based fuel prices have been extremely volatile, and we believe this continuing volatility will persist. Lower diesel or other petroleum-based fuel prices over extended periods of time may lower the perception in government and the private sector that cheaper, more readily available energy alternatives should be developed and produced. If diesel or other petroleum-based fuel prices remain at deflated levels for extended periods of time, the demand for commercial electric vehicles may decrease, which would have an adverse effect on our business, prospects, financial condition and operating results.

Our future growth is dependent upon the willingness of operators of commercial vehicle fleets to adopt electric vehicles and on our ability to produce, sell and service vehicles that meet their needs. This often depends upon the cost for an operator adopting electric vehicle technology as compared to the cost of traditional internal combustion technology. When the price of oil is low, as it recently has been, it is difficult to convince commercial fleet operations to change to more expensive electric vehicles.

Our growth is dependent upon the adoption of electric vehicles by operators of commercial vehicle fleets and on our ability to produce, sell and service vehicles that meet their needs. The entry of commercial electric vehicles into the medium-duty commercial vehicle market is a relatively new development, particularly in the United States, and is characterized by rapidly changing technologies and evolving government regulation, industry standards and customer views of the merits of using electric vehicles in their businesses. This process has been slow as without including the impact of government or other subsidies and incentives, the purchase prices for our commercial electric vehicles currently is higher than the purchase prices for diesel-fueled vehicles. Our growth has also been negatively impacted by the relatively low price of oil over the last few years.

13

If the market for commercial electric vehicles does not develop as we expect or develops more slowly than we expect, our business, prospects, financial condition and operating results will be adversely affected.

As part of our sales efforts, we must educate fleet managers as to the economical savings we believe they will benefit from during the life of the vehicle. As such, we believe that operators of commercial vehicle fleets should consider a number of factors when deciding whether to purchase our commercial electric vehicles (or commercial electric vehicles generally) or vehicles powered by internal combustion engines, particularly diesel-fueled or natural gas-fueled vehicles. We believe these factors include:

| ● | the difference in the initial purchase prices of commercial electric vehicles and vehicles with comparable GVWs powered by internal combustion engines, both including and excluding the impact of government and other subsidies and incentives designed to promote the purchase of electric vehicles; | |

| ● | the total cost of ownership of the vehicle over its expected life, which includes the initial purchase price and ongoing operating and maintenance costs; | |

| ● | the availability and terms of financing options for purchases of vehicles and, for commercial electric vehicles, financing options for battery systems; | |

| ● | the availability of tax and other governmental incentives to purchase and operate electric vehicles and future regulations requiring increased use of nonpolluting vehicles; | |

| ● | government regulations and economic incentives promoting fuel efficiency and alternate forms of energy; | |

| ● | fuel prices, including volatility in the cost of diesel; | |

| ● | the cost and availability of other alternatives to diesel fueled vehicles, such as vehicles powered by natural gas; | |

| ● | corporate sustainability initiatives; | |

| ● | commercial electric vehicle quality, performance and safety (particularly with respect to lithium-ion battery packs); | |

| ● | the quality and availability of service for the vehicle, including the availability of replacement parts; | |

| ● | the limited range over which commercial electric vehicles may be driven on a single battery charge; | |

| ● | access to charging stations and related infrastructure costs, and standardization of electric vehicle charging systems; | |

| ● | electric grid capacity and reliability; and | |

| ● | macroeconomic factors. |

If, in weighing these factors, operators of commercial vehicle fleets determine that there is not a compelling business justification for purchasing commercial electric vehicles, particularly those that we produce and sell, then the market for commercial electric vehicles may not develop as we expect or may develop more slowly than we expect, which would adversely affect our business, prospects, financial condition and operating results.

If our customers are unable to efficiently and effectively integrate our electric vehicles into their existing commercial fleets our sales may suffer and our business, prospects, financial condition and operating results may be adversely affected.

Our sales strategy involves a comprehensive plan for the pilot and roll-out of our electric vehicles, as well as the ongoing replacement of existing commercial vehicles with our electric vehicles, that is tailored to the individual needs of our customers. If we are unable to develop and execute fleet integration strategies or fleet management support services that meet our customers’ unique circumstances with minimal disruption to their businesses, our customers may not realize the economic benefits they expect from our electric vehicles. If this were to occur, our customers may not order additional vehicles from us, which could adversely affect our business, prospects, financial condition and operating results.

14

We currently do not have long-term supply contracts with guaranteed pricing which exposes us to fluctuations in component, materials and equipment prices. Substantial increases in these prices would increase our operating costs and could adversely affect our business, prospects, financial condition and operating results.

Because we currently do not have long-term supply contracts with guaranteed pricing, we are subject to fluctuations in the prices of the raw materials, parts and components and equipment we use in the production of our vehicles. Substantial increases in the prices for such raw materials, components and equipment would increase our operating costs and could reduce our margins if we cannot recoup the increased costs through increased vehicle prices. Any attempts to increase the announced or expected prices of our vehicles in response to increased costs could be viewed negatively by our customers and could adversely affect our business, prospects, financial condition and operating results.

If we are unable to scale our operations at our Union City facility in an expedited manner from our limited low volume production to high volume production, our business, prospects, financial condition and operating results will be adversely affected.

We are currently assembling our orders at our Union City facility which has been acceptable for our historical orders. To satisfy increased demand, we will need to quickly scale operations in our Union City facility as well as scale our supply chain including access to batteries. Such a substantial and rapid increase in operations will be extremely difficult and will strain our management capabilities. Our business, prospects, financial condition and operating results could be adversely affected if we experience disruptions in our supply chain, if we cannot obtain materials of sufficient quality at reasonable prices or if we are unable to scale our Union City facility.

We depend upon key personnel and need additional personnel. The loss of key personnel or the inability to attract additional personnel may adversely affect our business and results of operations.

Our success depends on the continuing services of our CEO, Stephen Burns and top management. On May 19, 2017, Mr. Burns and the Company entered into an Executive Retention Agreement whereby Mr. Burns was retained as Chief Executive Officer in consideration of an annual salary of $325,000. Further, the Company entered Executive Retention Agreements with Duane Hughes as President and Chief Operating Officer, Paul Gaitan as Chief Financial Officer and Julio Rodriguez as Chief Information Officer. The loss of any of these individuals could have a material and adverse effect on our business operations. Additionally, the success of our operations will largely depend upon our ability to successfully attract and maintain competent and qualified key management personnel. As with any company with limited resources, there can be no guarantee that we will be able to attract such individuals or that the presence of such individuals will necessarily translate into profitability for our company. Our inability to attract and retain key personnel may materially and adversely affect our business operations. Any failure by our management to effectively anticipate, implement, and manage the changes required to sustain our growth would have a material adverse effect on our business, financial condition, and results of operations.

15

We face intense competition. Some of our competitors have substantially greater financial or other resources, longer operating histories and greater name recognition than we do and could use their greater resources and/or name recognition to gain market share at our expense or could make it very difficult for us to establish market share.

Companies currently competing in the fleet logistics market offering alternative fuel medium-duty trucks include Ford Motor Company and Freightliner. Ford and Freightliner are currently selling alternative fuel fleet vehicles including hybrids. Ford and Freightliner have substantially more financial resources, established market positions, long-standing relationships with customers and dealers, and who have more significant name recognition, technical, marketing, sales, financial and other resources than we do. Although we believe that HorseFly, our unmanned aerial system (UAS), is unique in the marketplace in that it currently does not have any competitors when it comes to a UAS that works in combination with a truck, there are better financed competitors in this emerging industry, including Google and Amazon. While we are seeking to partner with existing delivery companies to improve their efficiencies in the last mile of delivery, our competitors are seeking to redefine the delivery model using drones from a central location requiring extended flight patterns. Our competitors’ new aerial delivery model would essentially eliminate traditional package delivery companies. Our model is focused on coupling our delivery drone with delivery trucks supplementing the existing model and providing shorter term flight patterns. Google and Amazon have more significant financial resources, established market positions, long-standing relationships with customers, more significant name recognition and a larger scope of resources including technical, marketing and sales than we do.

The market for personal VTOL (vertical takeoff and landing) aircraft is new, rapidly evolving, characterized by rapidly changing technologies, price competition, additional competitors, evolving government regulation and industry standards, frequent new vehicle announcements and changing consumer demands and behaviors. The market is highly competitive, and the SureFly design is competing with experimental aircraft from large original equipment manufacturers, or OEMs, small OEMs, other aviation related companies, technology companies and entrepreneurs. Currently, there are several VTOL aircraft being developed that have some similarity to SureFly, including eHang and Volocopter. Many of our competitors are, in some ways, more advanced than we are.

The resources available to our competitors to develop new products and introduce them into the marketplace exceed the resources currently available to us. As a result, our competitors may be able to compete more aggressively and sustain that competition over a longer period than we can. This intense competitive environment may require us to make changes in our products, pricing, licensing, services, distribution, or marketing to develop a market position. Each of these competitors has the potential to capture significant market share in our target markets which could have an adverse effect on our position in our industry and on our business and operating results.

If we are unable to keep up with advances in electric vehicle technology, we may suffer a decline in our competitive position.

There are companies in the electric vehicle industry that have developed or are developing vehicles and technologies that compete or will compete with our vehicles. We cannot assure that our competitors will not be able to duplicate our technology or provide products and services similar to ours more efficiently. If for any reason we are unable to keep pace with changes in electric vehicle technology, particularly battery technology, our competitive position may be adversely affected. We plan to upgrade or adapt our vehicles and introduce new models to continue to provide electric vehicles that incorporate the latest technology. However, there is no assurance that our research and development efforts will keep pace with those of our competitors.

Our electric vehicles compete for market share with vehicles powered by other vehicle technologies that may prove to be more attractive than ours.

Our target market currently is serviced by manufacturers with existing customers and suppliers using proven and widely accepted fuel technologies. Additionally, our competitors are working on developing technologies that may be introduced in our target market. If any of these alternative technology vehicles can provide lower fuel costs, greater efficiencies, greater reliability or otherwise benefit from other factors resulting in an overall lower total cost of ownership, this may negatively affect the commercial success of our vehicles or make our vehicles uncompetitive or obsolete.

16

We currently have a limited number of customers, with whom we do not have long-term agreements, and expect that a significant portion of our future sales will be from a limited number of customers. The loss of any of these customers could materially harm our business.

A significant portion of our projected future revenue is expected to be generated from a limited number of fleet customers. Additionally, much of our business model is focused on building relationships with a few large fleet customers. Currently, we have no contracts with customers that include long-term commitments or minimum volumes that ensure future sales of vehicles. As such, a customer may take actions that negatively affect us for reasons that we cannot anticipate or control, such as reasons related to the customer’s financial condition, changes in the customer’s business strategy or operations or as the result of the perceived performance or cost-effectiveness of our vehicles. The loss of or a reduction in sales or anticipated sales to our most significant customers would have a material adverse effect on our business, prospects, financial condition and operating results.

Changes in the market for electric vehicles could cause our products to become obsolete or lose popularity.

The modern electric vehicle industry is in its infancy and has experienced substantial change in the last few years. To date, demand for electric vehicles has been slower than forecasted by industry experts. As a result, growth in the electric vehicle industry depends on many factors outside our control, including, but not limited to:

| ● | continued development of product technology, especially batteries; | |

| ● | the environmental consciousness of customers; | |

| ● | the ability of electric vehicles to successfully compete with vehicles powered by internal combustion; engines | |

| ● | limitation of widespread electricity shortages; and | |

| ● | whether future regulation and legislation requiring increased use of non-polluting vehicles is enacted. |

We cannot assume that growth in the electric vehicle industry will continue. Our business will suffer if the electric vehicle industry does not grow or grows more slowly than it has in recent years or if we are unable to maintain the pace of industry demands.

President Trump’s administration may create regulatory uncertainty for the alternative energy sector and may materially harm our business, financial condition and operating results.

President Trump’s administration, may create regulatory uncertainty in the alternative energy sector. During the election campaign, President Trump made comments suggesting that he was not supportive of various clean energy programs and initiatives designed to curtail global warming. Since taking office, President Trump has released his America First Energy Plan which relies on fossil fuels, cancelled U.S. participation in the Paris Climate Agreement and signed several executive orders relating to oil pipelines. It remains unclear what specifically President Trump would or would not do with respect to these programs and initiatives, and what support he would have for any potential changes to such legislative programs and initiatives in the Unites States Congress, regardless of the fact that both the House of Representatives and Senate are controlled by the Republican Party. If President Trump and/or the United States Congress take action or publicly speak out about the need to eliminate or further reduce legislation, regulations and incentives supporting alternative energy or take action to further support the use of fossil fuels, such actions may result in a decrease in demand for alternative energy in the United States and may materially harm our business, financial condition and operating results.

The unavailability, reduction, elimination or adverse application of government subsidies, incentives and regulations could have an adverse effect on our business, prospects, financial condition and operating results.

We believe that, currently, the availability of government subsidies and incentives including those available in New York, California and Chicago is an important factor considered by our customers when purchasing our vehicles, and that our growth depends in part on the availability and amounts of these subsidies and incentives. Any reduction, elimination or discriminatory application of government subsidies and incentives because of budgetary challenges, policy changes, the reduced need for such subsidies and incentives due to the perceived success of electric vehicles or other reasons may result in the diminished price competitiveness of the alternative fuel vehicle industry.

17

Certain regulations and programs that encourage sales of electric vehicles could be eliminated or applied in a way that adversely impacts sales of our commercial electric vehicles, either currently or at any time in the future. For example, the U.S. federal government and many state governments are experiencing political change and facing fiscal crises, which could result in the elimination of programs, subsidies and incentives that encourage the purchase of electric vehicles. If government subsidies and incentives to produce and purchase electric vehicles were no longer available to us or to our customers, or the amounts of such subsidies and incentives were reduced, our business and results of operations would be adversely affected.

We may be unable to keep up with changes in electric vehicle technology and, as a result, may suffer a decline in our competitive position.

Our current products are designed for use with, and are dependent upon, existing electric vehicle technology. As technologies change, we plan to upgrade or adapt our products to continue to provide products with the latest technology. However, our products may become obsolete or our research and development efforts may not be sufficient to adapt to changes in or to create the necessary technology. Thus, our potential inability to adapt and develop the necessary technology may harm our competitive position.

The failure of certain key suppliers to provide us with components could have a severe and negative impact upon our business.

We have secured supply agreements for our critical components, including our batteries. However, the agreements are dependent on volume to ensure that they are available at a competitive price. Further, we rely on a small group of suppliers to provide us with components for our products. If these suppliers become unwilling or unable to provide components or if we are unable to meet certain volume requirements in our existing supply agreements, there are a limited number of alternative suppliers who could provide them and the price for them could be substantially higher. Changes in business conditions, wars, governmental changes, and other factors beyond our control or which we do not presently anticipate could negatively affect our ability to receive components from our suppliers. Further, it could be difficult to find replacement components if our current suppliers fail to provide the parts needed for these products. A failure by our major suppliers to provide these components could severely restrict our ability to manufacture our products and prevent us from fulfilling customer orders in a timely fashion.

Product liability or other claims could have a material adverse effect on our business.

The risk of product liability claims, product recalls, and associated adverse publicity is inherent in the manufacturing, marketing, and sale of electrical vehicles. Although we have product liability insurance for our consumer and commercial products, that insurance may be inadequate to cover all potential product claims. We also carry liability insurance on our products. Any product recall or lawsuit seeking significant monetary damages either in excess of our coverage, or outside of our coverage, may have a material adverse effect on our business and financial condition. We may not be able to secure additional product liability insurance coverage on acceptable terms or at reasonable costs when needed. A successful product liability claim against us could require us to pay a substantial monetary award. Moreover, a product recall could generate substantial negative publicity about our products and business and inhibit or prevent commercialization of other future product candidates. We cannot provide assurance that such claims and/or recalls will not be made in the future.

We may have to devote substantial resources to implementing a retail product distribution network.

Dealers are often hesitant to provide their own financing to contribute to our product distribution network. Thus, we anticipate that we may have to provide financing or other consignment sale arrangements for dealers. A capital investment such as this presents many risks, foremost among them being that we may not realize a significant return on our investment if the network is not profitable. Our inability to collect receivables from dealers could cause us to suffer losses. Additionally, the amount of time that our management will need to devote to this project may divert them from performing other functions necessary to assure the success of our business. We recently established a non-exclusive distribution agreement with Ryder to lower this risk.

18

Regulatory requirements may have a negative impact upon our business.

While our vehicles are subject to substantial regulation under federal, state, and local laws, we believe that our vehicles are or will be materially in compliance with all applicable laws. However, to the extent the laws change, or if we introduce new vehicles in the future, some or all of our vehicles may not comply with applicable federal, state, or local laws. Further, certain federal, state, and local laws and industrial standards currently regulate electrical and electronics equipment. Although standards for electric vehicles are not yet generally available or accepted as industry standards, our products may become subject to federal, state, and local regulation in the future. Compliance with these regulations could be burdensome, time consuming, and expensive.