UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT

Commission file number: 000-53704

WORKHORSE GROUP INC.

(Name of registrant as specified in its charter)

| Nevada | 26-1394771 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

| 100 Commerce Drive | ||

| Loveland, Ohio 45140 | 513-360-4704 | |

| (Address of principal executive offices) | (Registrant’s telephone number) |

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE EXCHANGE ACT:

| Title of each Class: | Name of Each Exchange |

| Common Stock, $0.001 par value per share | The NASDAQ Stock Market LLC |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE EXCHANGE ACT:

None.

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2016, the last business day of the Registrant’s most recently completed second fiscal quarter, the market value of our common stock held by non-affiliates was $111,346,964.

The number of shares of the Registrant’s common stock, $0.001 par value per share, outstanding as of March 14, 2017, was 35,956,697.

TABLE OF CONTENTS

| PART I | ||

| Item 1. | Business | 1 |

| Item 1A. | Risk Factors | 10 |

| Item 1B. | Unresolved Staff Comments | 22 |

| Item 2. | Properties | 23 |

| Item 3. | Legal Proceedings | 23 |

| Item 4. | Mine Safety Disclosures | 23 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 24 |

| Item 6. | Selected Financial Data | 26 |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 27 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 31 |

| Item 8. | Financial Statements and Supplementary Data | F-1 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 32 |

| Item 9A. | Controls and Procedures | 32 |

| Item 9B. | Other Information | 32 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 33 |

| Item 11. | Executive Compensation | 39 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 46 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 48 |

| Item 14. | Principal Accounting Fees and Services | 48 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules | 49 |

| Signatures | 52 |

Forward-Looking Statements

The discussions in this Annual Report contain forward-looking statements reflecting our current expectations that involve risks and uncertainties. When used in this Report, the words “anticipate”, expect”, “plan”, “believe”, “seek”, “estimate” and similar expressions are intended to identify forward-looking statements. These are statements that relate to future periods and include, but are not limited to, statements about the features, benefits and performance of our products, our ability to introduce new product offerings and increase revenue from existing products, expected expenses including those related to selling and marketing, product development and general and administrative, our beliefs regarding the health and growth of the market for our products, anticipated increase in our customer base, expansion of our products functionalities, expected revenue levels and sources of revenue, expected impact, if any, of legal proceedings, the adequacy of liquidity and capital resource, and expected growth in business. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, but are not limited to, market acceptance for our products, our ability to attract and retain customers for existing and new products, our ability to control our expenses, our ability to recruit and retain employees, legislation and government regulation, shifts in technology, global and local business conditions, our ability to effectively maintain and update our product and service portfolio, the strength of competitive offerings, the prices being charged by those competitors and the risks discussed elsewhere herein and our ability to raise capital under acceptable terms. These forward-looking statements speak only as of the date hereof. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

All references in this Form 10-K that refer to the “Company”, “WORKHORSE GROUP”, “Workhorse”, “we,” “us” or “our” are to WORKHORSE GROUP INC. and unless otherwise differentiated, its wholly-owned subsidiaries, Workhorse Technologies Inc., Workhorse Motor Works Inc and Workhorse Properties Inc.

PART I

ITEM 1. BUSINESS

Overview

We are a technology company focused on providing sustainable

and cost-effective solutions to the commercial transportation sector. As an American manufacturer we design and build high performance

battery-electric electric vehicles and aircraft that make movement of people and goods more efficient and less harmful to the

environment. As part of our solution, we also develop cloud-based, real-time telematics performance monitoring systems that enable

fleet operators to optimize energy and route efficiency. Although we operate as a single unit through our subsidiaries, we approach

our development through two divisions, Automotive and Aviation.

Automotive

Medium-Duty Delivery Vehicles

Medium-duty electric delivery vans are currently in production and are in use by our customers on U.S. roads. Our delivery customers include companies such as UPS, FedEx Express and Alpha Baking. Data from our in-house developed telematics system demonstrates our vehicles on the road are averaging approximately a 500% increase in fuel economy as compared to conventional gasoline-based trucks of the same size and duty cycle.

In addition to improved fuel economy, we are anticipating that the performance of our vehicles on-route will reduce long-term vehicle maintenance expense by approximately 50% as compared to fossil-fueled trucks.

We estimate that our E-GEN Range-Extended Electric delivery vans will save over $150,000 in fuel and maintenance savings over the 20-year life of the vehicle. Due to the positive return-on-investment we are able to command a premium price for our vehicles from major fleet buyers. Fleet buyers are able to achieve a four-year or better return-on-investment (without government incentives), which justifies the higher acquisition cost of our vehicles.

We believe that we are the only medium-duty battery-electric OEM in the U.S. Our goal is to continue to increase sales and production to a point that will allow us to achieve gross margin profitability of the delivery van platform.

Our battery-electric delivery vans provide customers with additional benefits, including:

| ● | Low Total Cost-of-Ownership |

| ● | Gaining a competitive edge to increase market share |

| ● | Improving profitability created by |

| o | Lower maintenance costs |

| o | Reduced fuel expenses |

| ● | Increasing the number of deliveries per day through more efficient delivery methods |

| ● | Strengthening sustainability programs |

| ● | Improving safety and driver experience |

In March of 2013, we purchased the former Workhorse Custom Chassis assembly plant in Union City, Indiana from Navistar International (NAV: NYSE). With this acquisition, we acquired the capability to be an Original Equipment Manufacturer (OEM) of Class 3-6 commercial-grade, medium-duty truck chassis, to be marketed under the Workhorse® brand.

| 1 |

The Workhorse Custom Chassis acquisition includes other important assets including the Workhorse brand and logo, intellectual property, schematics, logistical support from Up-Time Parts (a Navistar subsidiary) and access to a network of 400-plus sales and service outlets across North America. We believe the combination of our assembly capability, coupled with our battery-electric product development expertise gives Workhorse a unique opportunity to manufacture at scale in the U.S.

W-15 Pickup Truck

The success of our value selling equation to fleet buyers of medium-duty vehicles encouraged us to bring this same philosophy to the much higher volume segment of light-duty trucks. Our first product offering in the light-duty truck environment is our W-15 Range-Extended Electric Pickup Truck, which is presently under development.

To date, we have received letters of intent for 2,150 W-15 pickup trucks from fleets. We plan on unveiling a working concept version of the W-15 at the Advanced Clean Transportation conference in Long Beach, CA on May 1, 2017.

To capture further efficiencies and economies-of-scale we are designing our light-duty vehicles to take advantage of our existing supply chain repurposing the use of the critical components such as Panasonic Li-ion cells, the BMW engines as our range extender, our in-house developed vehicle control system software and our Metron Telematics performance monitoring system. In addition, we are also using composite carbon fiber body panels on the W-15 which dramatically reduce our tooling costs, reduce vehicle weight and are completely rustproof.

To realize further efficiencies, we intend to assemble the W-15 at our existing 250,000 square foot facility in Union City, Indiana. This plant has the capability to produce 60,000 vehicles per year. The battery packs will be built in our Loveland, Ohio battery pack plant which also serves as our corporate headquarters.

Post Office Replenishment Program

Workhorse, with our partner VT Hackney, is one of five awardees that the United States Postal Service selected to build prototype vehicles for USPS Next Generation Delivery Vehicle project. The Post Office has stated that the number of vehicles to be replaced in the project is approximately 180,000. We are on track to deliver our prototypes to the USPS by the September 2017 deadline. The Post Office has stated that they intend to test the prototypes for six months and select a winning bid(s) following the testing process. We have designed our Post Office truck such that it can be built on the same line as the W-15 in Union City, Indiana.

Aviation

Delivery Drones

Our HorseFly Delivery Drone is a custom designed, purpose-built drone that is fully integrated in our electric trucks. We have a patent pending on this architecture and we believe we are the only company in the world with a working drone/truck system. The HorseFly delivery drone and truck system is designed to work within the FAA Rule 107 that permits the use of commercial drones in U.S. airspace under certain conditions.

UPS conducted a successful real world test with us in February 2017 and it received worldwide news coverage. The knowledge we have gained in building electric delivery trucks for last-mile delivery has led us to believe that a drone/truck delivery system can have significant cost savings in the parcel delivery ecosphere.

As stated in UPS’s press release issued on February 21, 2017, a reduction of just one mile per driver per day over one year can save UPS up to $50 million. Rural delivery routes are the most expensive to serve due to the time and vehicle expenses required to complete each delivery. In this test, the drone made one delivery while the driver continued down the road to make another. This is a possible role UPS envisions for drones in the future.

| 2 |

Manned Multicopter

We are leveraging our knowledge of high-voltage battery packs, electric motor controls and range extending generators to design a multi-copter that can carry a pilot and passenger. Several companies are now developing similar aircraft; however, we believe that our range-extended truck experience combined with our technical aviation development experience will give us competitive advantages and speed-to-market with such an aircraft.

Technology

Batteries Are Key

The battery pack is key to the design, development, and manufacture of advanced electric-vehicle power trains. Where some other EV manufacturers purchase their batteries in a plug-and-play pack, we build our own battery packs. This keeps the intellectual property related to the design and production of the pack in-house and avoids the issues that occur when a battery supplier fails. And it also enables us to pay less for our batteries and pack than do our competitors thus our all-electric truck is less expensive than competitive vehicles. We use the Panasonic or LG Chem 18650 cells and design the pack around these commodity cells.

In-House Software Development is Essential

Our power trains encompass the complete motor assemblies, computers, and software required for vehicle electrification. We use off-the-shelf, proven components and combine them with our proprietary software.

Innovation is the Future

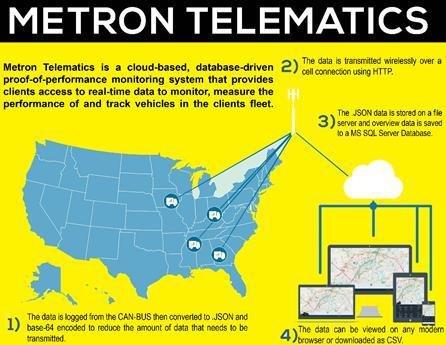

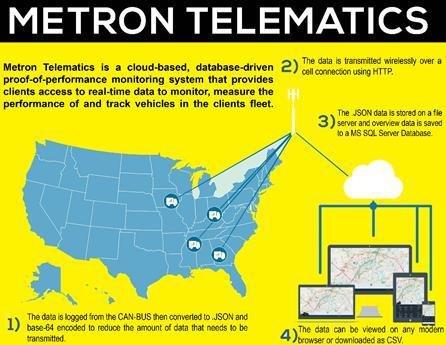

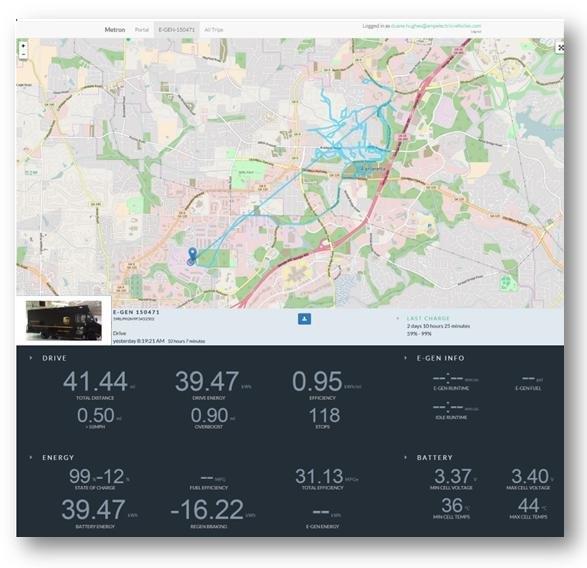

Additionally, we have developed a cloud-based, remote management system to manage and track the performance of all of the vehicles that we deploy in order to provide a 21st Century solution for fleet managers.

| 3 |

The telematics system and associated hardware installed the Workhorse vehicles is designed to monitor the CAN network traffic for specific signals. These signals are uploaded along with GPS data to a Workhorse server facility where the data signals are tracked at ten (10) second intervals while driving and during the E-GEN electricity generating process and at sixty (60) seconds during a plug-in charge. The real-time data is stored in a database as it arrives and delivers updates to clients connected through the web interface.

| 4 |

Clients are given login credentials (username and password) to the telematics website where they can monitor the performance and location of the vehicles. Group privileges can be configured to limit access to client-specific vehicles securing the vehicle data so clients can only view their vehicle data. Administrator privileges allow all data for all clients to be monitored and viewed.

As a parameter-based system, we can set route-specific parameters to better manage the battery-provided power with the additional power generated through the E-GEN process (not applicable to E-100). In an upcoming release, we will add the ability to integrate Metron Telematics with the client’s internal telematics system and automatically update the parameters each day with information about the route. This enhancement will result in a “SMART-GEN” vehicle that will maximize efficiency by automating the process to determine the ideal times and locations to use the E-GEN to add electricity to the batteries.

Locations and Facilities

Our company headquarters and R & D facility is located at 100 Commerce Drive, Loveland, Ohio, a Cincinnati suburb. We occupy a 45,500 sq. ft. facility that allows for the manufacture of 1,000 electric power train kits per year. Power trains will be delivered to the Workhorse facility in Indiana or shipped to our dealer network for onsite installation in conversion vehicles. On October 28, 2016 the Company purchased its operating facilities in Loveland, Ohio. The total purchase price was $2.5 million with $1.7 million financed with a financial institution. The note carries an interest rate of 6.5% accruing monthly with a maturity date of January 1, 2027.

Workhorse Group Inc. Location

Our truck assembly facility is located in Union City, Indiana. This facility consists of three buildings with 270,000 square feet of manufacturing and office space on 46 acres.

Workhorse Facility

In March of 2013, we purchased the former Workhorse Custom Chassis assembly plant in Union City, Indiana. With this acquisition, we became an Original Equipment Manufacturer (OEM) of Class 3-6 commercial-grade, medium-duty truck chassis to be marketed under the Workhorse® brand.

| 5 |

Ownership and operation of this plant enables us to build new chassis with gross vehicle weight capacity of between 10,000 and 26,000 pounds and to offer them in four different fuel variants—electric, gas, propane, and CNG. We plan to offer well- known Workhorse chassis as well as a new, 88” track W88 truck chassis that will be offered to fleet purchasing managers at price points that are both attractive and cost competitive.

At the same time, the Company intends to partner with engine suppliers and body fabricators to offer fleet-specific, custom, purpose-built chassis that provide total cost of ownership solutions that are superior to the competition.

In addition to building our own chassis, we design and produce battery-electric power trains that can be installed in new Workhorse chassis or installed as repower packages to convert used Class 3-6 medium-duty vehicles from diesel or gasoline power to electric power. Our approach is to provide battery-electric power trains utilizes proven, automotive-grade, mass-produced parts in its architecture coupled with in-house control software that it has developed over the last five years.

The Workhorse Custom Chassis acquisition includes other important assets including the Workhorse brand and logo, intellectual property, schematics, logistical support from UpTime Parts (a Navistar subsidiary) and, perhaps most importantly, a network of 400 plus sales and service outlets across North America. We believe the combination of Workhorse’s chassis assembly capability, coupled with its ability to offer an array of fuel choices, gives Workhorse a unique opportunity in the marketplace.

Marketing

Our sales team is focused on a targeted list of high profile, former purchasers, and current buyers of the Workhorse chassis with the goal of securing purchase orders from these companies. These purchase orders will give us the first look at next year’s chassis demand related to electric and extended range electric vehicles.

Our priority is to establish the commercial step van as our core business. We intend to be the best choice for a vehicle in this segment regardless of the fuel type that the customer chooses. Our sales plan is to meet with the top potential customers and obtain purchase orders for new electric and extended range electric vehicles for their production vehicle requirements.

Finally, since our competitive advantage in the marketplace is our ability to provide purpose-built solutions to customers that have unique requirements at relatively low-volume, we have submitted proposals to companies for purpose-built vehicle applications.

| 6 |

Strategic Relationships

Panasonic: Workhorse Group has signed an agreement with the rechargeable battery division of Panasonic Industrial Devices Sales Co. of America for the supply of “18650” cylindrical Panasonic lithium-ion batteries for Workhorse’s battery-electric, medium-duty trucks.

Morgan Olsen, Utilimaster, ECO, and other up-fitters or body fabricators: All of these companies build bodies customized for the needs of their customers and mated to chassis that are available to them from the short list of chassis suppliers. The functionality and configuration the end-user receives in the finished product is limited by the available chassis/powertrain. Workhorse will work with these organizations to provide chassis that not only best fit the needs of the end user customer but also provide the customer with a competitive advantage in their specific industry or application.

Research and Development

The majority of our research and development is conducted in-house at our facilities near Cincinnati, Ohio. Additionally, we contract with engineering firms to assist with validation and certification requirements as well as specific vehicle integration tasks.

Competitive Companies

The medium-duty commercial vehicle market is highly competitive and we expect it to become even more so in the future as additional companies launch competing vehicle offerings. The medium-duty commercial alternatively fueled vehicle market, however, is less developed and competitive. There are two primary competitors in the medium-duty vehicle segment in the US market: Ford and Freightliner. Neither has disclosed any plans to offer 100% EV or EREV vehicles in this segment. Ford is vertically integrated building a complete vehicle or chassis including Ford engine and transmission. They provide a chassis as a strip-chassis (which is similar to the Workhorse product) or they provide it with a cab. Freightliner provides a chassis as a strip-chassis, which is similar to the Workhorse Truck chassis.

We believe the most dramatic difference between Workhorse and the other competitors in the medium duty truck market is our ability to offer customers purpose-built solutions that meet the needs of their unique requirements at a competitive price. While there are many electric car companies from abroad, there are only a few foreign companies that have vehicles in the category of medium-duty trucks.

We believe that the primary competitive factors within the medium-duty commercial vehicle market are:

| ● | the difference in the initial purchase prices of electric vehicles and comparable vehicles powered by internal combustion engines, both including and excluding the impact of government and other subsidies and incentives designed to promote the purchase of electric vehicles; |

| ● | the total cost of vehicle ownership over the vehicle's expected life, which includes the initial purchase price and ongoing operational and maintenance costs; |

| ● | vehicle quality, performance and safety; |

| ● | government regulations and economic incentives promoting fuel efficiency and alternate forms of energy; |

| ● | the quality and availability of service for the vehicle, including the availability of replacement parts. |

| 7 |

GOVERNMENT REGULATION

Our electric vehicles are designed to comply with a significant number of governmental regulations and industry standards, some of which are evolving as new technologies are deployed. Government regulations regarding the manufacture, sale and implementation of products and systems similar to our electric vehicles are subject to future change. We cannot predict what impact, if any, such changes may have upon our business. We believe that our vehicles are in conformity with all applicable laws in all relevant jurisdictions.

Emission and fuel economy standards

Government regulation related to climate change is under consideration at the U.S. federal and state levels. The EPA and the National Highway Traffic Safety Administration, or NHTSA, issued a final rule for greenhouse gas emissions and fuel economy requirements for trucks and heavy-duty engines on August 9, 2011, which will have an initial phase in starting with model year 2014 and a final phase in occurring in model year 2017. NHTSA standards for model year 2014 and 2015 will be voluntary, while mandatory standards will first come into effect in 2016.

The rule provides emission standards for CO2 and fuel consumption standards for three main categories of vehicles: (i) combination tractors, (ii) heavy-duty pickup trucks and vans and (iii) vocational vehicles. We believe that the Workhorse chassis would be considered “vocational vehicles" under the rule. According to the EPA and NHTSA, vocational vehicles consist of a wide variety of truck and bus types, including delivery, refuse, utility, dump, cement, transit bus, shuttle bus, school bus, emergency vehicles, motor homes and tow trucks, and are characterized by a complex build process, with an incomplete chassis often built with an engine and transmission purchased from other manufacturers, then sold to a body manufacturer.

The EPA and NHTSA rule also establishes multiple flexibility and incentive programs for manufacturers of alternatively fueled vehicles, such as the Workhorse E-100 full electric and the E-Gen Electric, including an engine averaging, banking and trading, or ABT, program, a vehicle ABT program and additional credit programs for early adoption of standards or deployment of advanced or innovative technologies. The ABT programs will allow for emission and/or fuel consumption credits to be averaged, banked or traded within defined groupings of the regulatory subcategories. The additional credit programs will allow manufacturers of engines and vehicles to be eligible to generate credits if they demonstrate improvements in excess of the standards established in the rule prior to the model year the standards become effective or if they introduce advanced or innovative technology engines or vehicles.

The Clean Air Act requires that we obtain a Certificate of Conformity issued by the EPA and a California Executive Order issued by CARB with respect to emissions for our vehicles. The Certificate of Conformity is required for vehicles sold in states covered by the Clean Air Act's standards and the Executive Order is required for vehicles sold in states that have sought and received a waiver from the EPA to utilize California standards. The California standards for emissions control for certain regulated pollutants for new vehicles and engines sold in California are set by CARB. States that have adopted the California standards as approved by EPA also recognize the Executive Order for sales of vehicles.

Manufacturers who sell vehicles in states covered by federal requirements under the Clean Air Act without a Certificate of Conformity may be subject to penalties of up to $37,500 per violation and be required to recall and remedy any vehicles sold with emissions in excess of Clean Air Act standards. In 2013, we received approval from CARB to sell the E-100 in California based on our own emissions tests.

Vehicle safety and testing

The National Traffic and Motor Vehicle Safety Act of 1966, or the Safety Act, regulates motor vehicles and motor vehicle equipment in the United States in two primary ways. First, the Safety Act prohibits the sale in the United States of any new vehicle or equipment that does not conform to applicable motor vehicle safety standards established by NHTSA. Meeting or exceeding many safety standards is costly, in part because the standards tend to conflict with the need to reduce vehicle weight in order to meet emissions and fuel economy standards. Second, the Safety Act requires that defects related to motor vehicle safety be remedied through safety recall campaigns. A manufacturer is obligated to recall vehicles if it determines that the vehicles do not comply with a safety standard. Should we or NHTSA determine that either a safety defect or noncompliance exists with respect to any of our vehicles, the cost of such recall campaigns could be substantial.

| 8 |

Battery safety and testing

Our battery packs conform to mandatory regulations that govern transport of "dangerous goods," which includes lithium-ion batteries, which may present a risk in transportation. The governing regulations, which are issued by PHMSA, are based on the UN Recommendations on the Safe Transport of Dangerous Goods Model Regulations, and related UN Manual of Tests and Criteria. The requirements for shipments of these goods vary by mode of transportation, such as ocean vessel, rail, truck and air.

Our battery module suppliers have completed the applicable transportation tests for our prototype and production battery packs demonstrating our compliance with the UN Manual of Tests and Criteria, including:

| ● | altitude simulation, which involves simulating air transport; |

| ● | thermal cycling, which involves assessing cell and battery seal integrity; |

| ● | vibration, which involves simulating vibration during transport; |

| ● | shock, which involves simulating possible impacts during transport; |

| ● | external short circuit, which involves simulating an external short circuit; and |

| ● | overcharge, which involves evaluating the ability of a rechargeable battery to withstand overcharging. |

Vehicle dealer and distribution regulation

Certain states' laws require motor vehicle manufacturers and dealers to be licensed in such states in order to conduct manufacturing and sales activities. To date, we are registered as both a motor vehicle manufacturer and dealer in Indiana and Ohio as well as a dealer in California and Chicago. We have not yet sought formal clarification of our ability to manufacture or sell our vehicles in any other states.

Intellectual Property

We have five pending trademark applications and nine issued trademark registrations (US and foreign). We also intend to pursue additional foreign trademark registrations. We have two pending non-provisional U.S. patent application, one pending provisional patent application, and six existing patents, two of which are design patents. We also plan to pursue appropriate foreign patent protection on those inventions, if available. The following is a summary of our patents:

| Country | Status | Serial Number | Application Date | Patent Number | Issue /Grant Date | Title | Expiration Date | |||||||||||||

| Canada | Granted | 2523653 | 10/17/2005 | 2523653 | 12/22/2009 | Vehicle Chassis Assembly | 10/17/2025 | |||||||||||||

| United States | Granted | 11/252,220 | 10/17/2005 | 7,717,464 | 5/18/2010 | Vehicle Chassis Assembly | 9/6/2026 | |||||||||||||

| United States | Granted | 11/252,219 | 10/17/2005 | 7,559,578 | 7/14/2009 | Vehicle Chassis Assembly | 9/6/2026 | |||||||||||||

| United States | Granted | 29/243,074 | 11/18/2005 | D561,078 | 2/5/2008 | Vehicle Header | 2/5/2022 | |||||||||||||

| United States | Granted | 29/243,129 | 11/18/2005 | D561,079 | 2/5/2008 | Vehicle Header | 2/5/2022 | |||||||||||||

| United States | Granted | 13/283,663 | 10/28/2011 | 8,541,915 | 9/24/2013 | Drive Module And Manifold For Electric Motor Drive Assembly | 12/16/2031 | |||||||||||||

| United States | Filed | 14/606,497 | 1/27/2015 | NA | NA | Onboard Generator Drive System For Electric Vehicles | ||||||||||||||

| United States | Filed | 62 | 1/9/2015 | NA | NA | Multi-Copter UAS/UAV Dispatched from a Conventional Delivery Vehicle | ||||||||||||||

| 9 |

Employees

We currently have 60 full-time and 15 part-time employees located in Loveland, Ohio and 19 full-time employees located in Union City, Indiana. We also contract for hire with approximately four outside consultants and contractors.

ITEM 1A. RISK FACTORS

Our results of operations have not resulted in profitability and we may not be able to achieve profitability going forward.

We have incurred net losses amounting to $63.1 million for the period from inception (February 20, 2007) through December 31, 2016. We have had net losses in each quarter since our inception. We expect that we will continue to incur net losses for the foreseeable future. We may incur significant losses in the future for a number of reasons, including the other risks described in this report, and we may encounter unforeseen expenses, difficulties, complications, delays and other unknown events. Accordingly, we may not be able to achieve or maintain profitability. Our management is developing plans to alleviate the negative trends and conditions described above and there is no guarantee that such plans will be successfully implemented. Our business plan has changed from concentrating on the electric passenger vehicle market to the electric medium duty trucks, and has been further focused on providing sustainable and cost-effective solutions to the commercial transportation sector, but is still unproven. There is no assurance that even if we successfully implement our business plan, that we will be able to curtail our losses. If we incur additional significant operating losses, our stock price may decline, perhaps significantly.

We have yet to achieve positive cash flow and, given our projected funding needs, our ability to generate positive cash flow is uncertain.

We have had negative cash flow from operating activities of $19.1 million and $8.2 million for the year ended December 31, 2016 and 2015 respectively. We anticipate that we will continue to have negative cash flow from operating and investing activities for the foreseeable future as we expect to incur increased research and development, sales and marketing, and general and administrative expenses and make significant capital expenditures in our efforts to increase sales and commence operations at our Union City facility. Our business also will at times require significant amounts of working capital to support our growth, particularly as we acquire inventory to support our anticipated increase in production. An inability to generate positive cash flow for the foreseeable future may adversely affect our ability to raise needed capital for our business on reasonable terms, diminish supplier or customer willingness to enter into transactions with us, and have other adverse effects that may decrease our long-term viability. There can be no assurance we will achieve positive cash flow in the foreseeable future.

| 10 |

We need access to additional financing in 2017 and beyond, which may not be available to us on acceptable terms or at all. If we cannot access additional financing when we need it and on acceptable terms, our business may fail.

Our business plan to design, produce, sell and service commercial electric vehicles through our Union City facility will require substantial continued capital investment. Our research and development activities will also require substantial continued investment. For the year ended December 31, 2016, our independent registered public accounting firm issued a report on our 2016 financial statements that contained an explanatory paragraph stating that the lack of sales, negative working capital and stockholders’ deficit, raise substantial doubt about our ability to continue as a going concern. For example, our existing capital resources, will be insufficient to fund our operations beyond the end of the fourth quarter of 2017. Accordingly, we will need additional financing. We will also need additional financing beyond 2017. If we are not able to obtain additional financing and/or substantially increase revenue from sales, we will be unable to continue as a going concern. As a result, we may have to liquidate our assets and may receive less than the value at which those assets are carried on our consolidated financial statements, and investors will likely lose a substantial part or all of their investment. We cannot be certain that additional financing will be available to us on favorable terms when required, or at all, particularly given that we do not now have a committed credit facility with any government or financial institution. Further, if there remains doubt about our ability to continue as a going concern, investors or other financing sources may be unwilling to provide additional funding on acceptable terms or at all. If we cannot obtain additional financing when we need it and on terms acceptable to us, we will not be able to continue as a going concern.

The development of our business in the near future is contingent upon the implementation of orders from UPS and other key customers for the purchase of E-GENs and if we are unable to perform under these orders, our business may fail.

On June 4, 2014, the Company entered into a Vehicle Purchase Agreement with United Parcel Service Inc. (“UPS”) which outlined the relationship by which the Company would sell vehicles to UPS. To date, we have received orders to purchase 343 E-GENs from UPS. We have entered into various purchase orders with UPS relating to the delivery of the vehicles ordered. Currently, the schedule agreed to with UPS requires that we deliver specified numbers of vehicles per month. However, these deadlines are expected to evolve as the individual UPS operations personnel from the seven states are involved in the scheduling. There is no guarantee that the Company will be able to perform under these orders and if it does perform, that UPS will purchase additional vehicles from the Company. Also, there is no assurance that UPS will not terminate its agreement with the Company pursuant to the termination provisions therein. Further, if the Company is not able to raise the required capital to purchase required parts and pay certain vendors, the Company may not be able to comply with UPS’s deadlines. Accordingly, despite the receipt of the orders from UPS, there is no assurance, due to the Company’s financial constraints and status as a development stage company, that the Company will be able to deliver such vehicles or that it will receive additional orders whether from UPS or other potential customers.

If we are unable to perform under our orders with UPS, the Company business will be significantly negatively impacted.

| 11 |

Our limited operating history makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

We have basically been a research and development company since beginning operations in February 2007. We have a limited operating history and have generated limited revenue. As we move more toward a manufacturing environment it is difficult, if not impossible, to forecast our future results based upon our historical data. Because of the uncertainties related to our lack of historical operations, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in revenues or expenses. If we make poor budgetary decisions as a result of unreliable historical data, we could be less profitable or incur losses, which may result in a decline in our stock price.

We offer no financing on our vehicles. As such, our business is dependent on cash sales, which may adversely affect our growth prospects.

While most of our current customers are well-established companies with significant purchasing power, many of our potential smaller and medium-sized customers may need to rely on credit or leasing arrangements to gain access to our vehicles. Unlike some of our competitors who provide credit or leasing services for the purchase of their vehicles, we do not provide, and currently do not have commercial arrangements with a third party that provides, such financial services. We believe the current limited availability of credit or leasing solutions for our vehicles could adversely affect our revenues and market share in the commercial electric vehicle market.

Our business, prospects, financial condition and operating results will be adversely affected if we cannot reduce and adequately control the costs and expenses associated with operating our business, including our material and production costs.

We incur significant costs and expenses related to procuring the materials, components and services required to develop and produce our electric vehicles. We have secured supply agreements for our critical components including our batteries. However, these are dependent on volume to ensure that they are available at a competitive price. Thus, our current cost projections are considerably higher than the projected revenue stream that such vehicles will produce. As a result, we currently lose money on each vehicle we sell and are continually working on initiatives to reduce our cost structure so that we may effectively compete. If we do not reduce our costs and expenses, our net losses will continue which will negatively impact our business and stock price.

Increases in costs, disruption of supply or shortage of lithium-ion cells could harm our business.

We may experience increases in the cost or a sustained interruption in the supply or shortage of lithium-ion cells. Any such increase, supply interruption or shortage could materially and negatively impact our business, prospects, financial condition and operating results. The prices for these lithium-ion cells can fluctuate depending on market conditions and global demand for these materials and could adversely affect our business and operating results. We are exposed to multiple risks relating to lithium-ion cells including:

| ● | the inability or unwillingness of current battery manufacturers to build or operate battery cell manufacturing plants to supply the numbers of lithium-ion cells we may require going forward; | |

| ● | disruption in the supply of cells due to quality issues or recalls by battery cell manufacturers; | |

| ● | an increase in the cost of raw materials used in the cells; and | |

| ● | fluctuations in the value of the Japanese yen against the U.S. dollar in the event our purchasers of lithium-ion cells are denominated in Japanese yen. |

| 12 |

Our business is dependent on the continued supply of battery cells for the battery packs used in our vehicles. While we believe several sources of the battery cells are available for such battery cells, we have fully qualified only Panasonic for the supply of the cells used in such battery packs and have very limited flexibility in changing cell suppliers. Any disruption in the supply of battery cells could disrupt production of our vehicles until such time as a different supplier is fully qualified. Furthermore, fluctuations or shortages in petroleum, tariff or trade issues and other economic or tax conditions may cause us to experience significant increases in freight charges. Substantial increases in the prices for the battery cells or prices charged to us, would increase our operating costs, and could reduce our margins if we cannot recoup the increased costs through increased vehicle prices. Any attempts to increase vehicle prices in response to increased costs in our battery cells could result in cancellations of vehicle orders and therefore materially and adversely affect our brand, image, business, prospects and operating results.

The demand for commercial electric vehicles depends, in part, on the continuation of current trends resulting from dependence on fossil fuels. Extended periods of low diesel or other petroleum-based fuel prices could adversely affect demand for our vehicles, which would adversely affect our business, prospects, financial condition and operating results.

We believe that much of the present and projected demand for commercial electric vehicles results from concerns about volatility in the cost of petroleum-based fuel, the dependency of the United States on oil from unstable or hostile countries, government regulations and economic incentives promoting fuel efficiency and alternative forms of energy, as well as the belief that climate change results in part from the burning of fossil fuels. If the cost of petroleum-based fuel decreased significantly, the outlook for the long-term supply of oil to the United States improved, the government eliminated or modified its regulations or economic incentives related to fuel efficiency and alternative forms of energy, or if there is a change in the perception that the burning of fossil fuels negatively impacts the environment, the demand for commercial electric vehicles could be reduced, and our business and revenue may be harmed.

Diesel and other petroleum-based fuel prices have been extremely volatile, and we believe this continuing volatility will persist. Lower diesel or other petroleum-based fuel prices over extended periods of time may lower the perception in government and the private sector that cheaper, more readily available energy alternatives should be developed and produced. If diesel or other petroleum-based fuel prices remain at deflated levels for extended periods of time, the demand for commercial electric vehicles may decrease, which would have an adverse effect on our business, prospects, financial condition and operating results.

Our future growth is dependent upon the willingness of operators of commercial vehicle fleets to adopt electric vehicles and on our ability to produce, sell and service vehicles that meet their needs. This often depends upon the cost for an operator adopting electric vehicle technology as compared to the cost of traditional internal combustion technology. When the price of oil is low, as it recently has been, it is difficult to convince commercial fleet operations to change to more expensive electric vehicles.

Our growth is dependent upon the adoption of electric vehicles by operators of commercial vehicle fleets and on our ability to produce, sell and service vehicles that meet their needs. The entry of commercial electric vehicles into the medium-duty commercial vehicle market is a relatively new development, particularly in the United States, and is characterized by rapidly changing technologies and evolving government regulation, industry standards and customer views of the merits of using electric vehicles in their businesses. This process has been slow as without including the impact of government or other subsidies and incentives, the purchase prices for our commercial electric vehicles currently is higher than the purchase prices for diesel-fueled vehicles. Our growth has also been negatively impacted by the relatively low price of oil over the last few years.

| 13 |

If the market for commercial electric vehicles does not develop as we expect or develops more slowly than we expect, our business, prospects, financial condition and operating results will be adversely affected.

As part of our sales efforts, we must educate fleet managers as to the economical savings we believe they will benefit from during the life of the vehicle. As such, we believe that operators of commercial vehicle fleets should consider a number of factors when deciding whether to purchase our commercial electric vehicles (or commercial electric vehicles generally) or vehicles powered by internal combustion engines, particularly diesel-fueled or natural gas-fueled vehicles. We believe these factors include:

| ● | the difference in the initial purchase prices of commercial electric vehicles and vehicles with comparable GVWs powered by internal combustion engines, both including and excluding the impact of government and other subsidies and incentives designed to promote the purchase of electric vehicles; | |

| ● | the total cost of ownership of the vehicle over its expected life, which includes the initial purchase price and ongoing operating and maintenance costs; | |

| ● | the availability and terms of financing options for purchases of vehicles and, for commercial electric vehicles, financing options for battery systems; | |

| ● | the availability of tax and other governmental incentives to purchase and operate electric vehicles and future regulations requiring increased use of nonpolluting vehicles; | |

| ● | government regulations and economic incentives promoting fuel efficiency and alternate forms of energy; | |

| ● | fuel prices, including volatility in the cost of diesel; | |

| ● | the cost and availability of other alternatives to diesel fueled vehicles, such as vehicles powered by natural gas; | |

| ● | corporate sustainability initiatives; | |

| ● | commercial electric vehicle quality, performance and safety (particularly with respect to lithium-ion battery packs); | |

| ● | the quality and availability of service for the vehicle, including the availability of replacement parts; | |

| ● | the limited range over which commercial electric vehicles may be driven on a single battery charge; | |

| ● | access to charging stations and related infrastructure costs, and standardization of electric vehicle charging systems; | |

| ● | electric grid capacity and reliability; and | |

| ● | macroeconomic factors. |

If, in weighing these factors, operators of commercial vehicle fleets determine that there is not a compelling business justification for purchasing commercial electric vehicles, particularly those that we produce and sell, then the market for commercial electric vehicles may not develop as we expect or may develop more slowly than we expect, which would adversely affect our business, prospects, financial condition and operating results.

If our customers are unable to efficiently and effectively integrate our electric vehicles into their existing commercial fleets our sales may suffer and our business, prospects, financial condition and operating results may be adversely affected.

Our sales strategy involves a comprehensive plan for the pilot and roll-out of our electric vehicles, as well as the ongoing replacement of existing commercial vehicles with our electric vehicles, that is tailored to the individual needs of our customers. If we are unable to develop and execute fleet integration strategies or fleet management support services that meet our customers’ unique circumstances with minimal disruption to their businesses, our customers may not realize the economic benefits they expect from our electric vehicles. If this were to occur, our customers may not order additional vehicles from us, which could adversely affect our business, prospects, financial condition and operating results.

| 14 |

We currently do not have long-term supply contracts with guaranteed pricing which exposes us to fluctuations in component, materials and equipment prices. Substantial increases in these prices would increase our operating costs and could adversely affect our business, prospects, financial condition and operating results.

Because we currently do not have long-term supply contracts with guaranteed pricing, we are subject to fluctuations in the prices of the raw materials, parts and components and equipment we use in the production of our vehicles. Substantial increases in the prices for such raw materials, components and equipment would increase our operating costs and could reduce our margins if we cannot recoup the increased costs through increased vehicle prices. Any attempts to increase the announced or expected prices of our vehicles in response to increased costs could be viewed negatively by our customers and could adversely affect our business, prospects, financial condition and operating results.

If we are unable to scale our operations at our Union City facility in an expedited manner from our limited low volume production to high volume production, our business, prospects, financial condition and operating results will be adversely affected.

We are currently assembling our orders at our Union City facility which has been acceptable for our historical orders. To satisfy increased demand, we will need to quickly scale operations in our Union City facility as well as scale our supply chain including access to batteries. Such a substantial and rapid increase in operations will be extremely difficult and will strain our management capabilities. Our business, prospects, financial condition and operating results could be adversely affected if we experience disruptions in our supply chain, if we cannot obtain materials of sufficient quality at reasonable prices or if we are unable to scale our Union City facility.

Failure to successfully integrate the Workhorse® brand, logo, intellectual property, patents and assembly plant in Union City, Indiana into our operations could adversely affect our business and results of operations.

As part of our strategy to become an OEM, in March 2013, we acquired Workhorse and the Workhorse Assets including the Workhorse ® brand, logo, intellectual property, patents and assembly plant in Union City, Indiana. The Workhorse acquisition may expose us to operational challenges and risks, including the diversion of management’s attention from our existing business, the failure to retain key Workhorse dealers and our ability to commence operations at the plant in Union City, Indiana. Our ability to sustain our growth and maintain our competitive position may be affected by our ability to successfully integrate the Workhorse Assets.

We depend upon key personnel and need additional personnel. The loss of key personnel or the inability to attract additional personnel may adversely affect our business and results of operations.

Our success depends on the continuing services of Stephen Burns, CEO, and top management. On December 8, 2010, we entered into an employment agreement with Mr. Burns for a term of two years which automatically renews for one year periods unless either of the parties elects to not renew for such period. The loss of any of these individuals could have a material and adverse effect on our business operations. Additionally, the success of our operations will largely depend upon our ability to successfully attract and maintain competent and qualified key management personnel. As with any company with limited resources, there can be no guarantee that we will be able to attract such individuals or that the presence of such individuals will necessarily translate into profitability for our company. Our inability to attract and retain key personnel may materially and adversely affect our business operations. Any failure by our management to effectively anticipate, implement, and manage the changes required to sustain our growth would have a material adverse effect on our business, financial condition, and results of operations.

| 15 |

We face intense competition. Some of our competitors have substantially greater financial or other resources, longer operating histories and greater name recognition than we do and could use their greater resources and/or name recognition to gain market share at our expense or could make it very difficult for us to establish market share.

Companies currently competing in the fleet logistics market offering alternative fuel medium-duty trucks include Ford Motor Company and Freightliner. Ford and Freightliner are currently selling alternative fuel fleet vehicles including hybrids. In the electric medium duty truck market in the United States, we compete with a few other manufacturers, including Electric Vehicles International and Smith Electric Vehicles. Ford and Freightliner have substantially more financial resources, established market positions, long-standing relationships with customers and dealers, and who have more significant name recognition, technical, marketing, sales, financial and other resources than we do. Although we believe that HorseFly™, our unmanned aerial system (UAS), is unique in the marketplace in that it currently does not have any competitors when it comes to a UAS that works in combination with a truck, there are better financed competitors in this emerging industry, including Google and Amazon. While we are seeking to partner with existing delivery companies to improve their efficiencies in the last mile of delivery, our competitors are seeking to redefine the delivery model using drones from a central location requiring extended flight patterns. Our competitors’ new aerial delivery model would essentially eliminate traditional package delivery companies. Our model is focused on coupling our delivery drone with delivery trucks supplementing the existing model and providing shorter term flight patterns. Google and Amazon have more significant financial resources, established market positions, long-standing relationships with customers, more significant name recognition and a larger scope of resources including technical, marketing and sales than we do. The resources available to our competitors to develop new products and introduce them into the marketplace exceed the resources currently available to us. As a result, our competitors may be able to compete more aggressively and sustain that competition over a longer period that we can. This intense competitive environment may require us to make changes in our products, pricing, licensing, services, distribution, or marketing to develop a market position. Each of these competitors has the potential to capture significant market share in our target markets which could have an adverse effect on our position in our industry and on our business and operating results.

If we are unable to keep up with advances in electric vehicle technology, we may suffer a decline in our competitive position.

There are companies in the electric vehicle industry that have developed or are developing vehicles and technologies that compete or will compete with our vehicles. We cannot assure that our competitors will not be able to duplicate our technology or provide products and services similar to ours more efficiently. If for any reason we are unable to keep pace with changes in electric vehicle technology, particularly battery technology, our competitive position may be adversely affected. We plan to upgrade or adapt our vehicles and introduce new models to continue to provide electric vehicles that incorporate the latest technology. However, there is no assurance that our research and development efforts will keep pace with those of our competitors.

Our electric vehicles compete for market share with vehicles powered by other vehicle technologies that may prove to be more attractive than ours.

Our target market currently is serviced by manufacturers with existing customers and suppliers using proven and widely accepted fuel technologies. Additionally, our competitors are working on developing technologies that may be introduced in our target market. If any of these alternative technology vehicles can provide lower fuel costs, greater efficiencies, greater reliability or otherwise benefit from other factors resulting in an overall lower total cost of ownership, this may negatively affect the commercial success of our vehicles or make our vehicles uncompetitive or obsolete.

| 16 |

We currently have a limited number of customers, with whom we do not have long-term agreements, and expect that a significant portion of our future sales will be from a limited number of customers. The loss of any of these customers could materially harm our business.

A significant portion of our projected future revenue, if any, is expected to be generated from a limited number of vehicle customers. Additionally, much of our business model is focused on building relationships with a few large customers. Currently we have no contracts with customers that include long-term commitments or minimum volumes that ensure future sales of vehicles. As such, a customer may take actions that negatively affect us for reasons that we cannot anticipate or control, such as reasons related to the customer’s financial condition, changes in the customer’s business strategy or operations or as the result of the perceived performance or cost-effectiveness of our vehicles. The loss of or a reduction in sales or anticipated sales to our most significant customers would have a material adverse effect on our business, prospects, financial condition and operating results.

Changes in the market for electric vehicles could cause our products to become obsolete or lose popularity.

The modern electric vehicle industry is in its infancy and has experienced substantial change in the last few years. To date, demand for electric vehicles has been slower than forecasted by industry experts. As a result, growth in the electric vehicle industry depends on many factors outside our control, including, but not limited to:

| ● | continued development of product technology, especially batteries; | |

| ● | the environmental consciousness of customers; | |

| ● | the ability of electric vehicles to successfully compete with vehicles powered by internal combustion; engines | |

| ● | limitation of widespread electricity shortages; and | |

| ● | whether future regulation and legislation requiring increased use of non-polluting vehicles is enacted. |

We cannot assume that growth in the electric vehicle industry will continue. Our business will suffer if the electric vehicle industry does not grow or grows more slowly than it has in recent years or if we are unable to maintain the pace of industry demands.

The results of the 2016 United States presidential and congressional elections may create regulatory uncertainty for the alternative energy sector and may materially harm our business, financial condition and operating results.

Donald Trump’s victory in the U.S. presidential election, as well as the Republican Party maintaining control of both the House of Representatives and Senate of the United States in the congressional election, may create regulatory uncertainty in the alternative energy sector. During the election campaign, President Trump made comments suggesting that he was not supportive of various clean energy programs and initiatives designed to curtail global warming. It remains unclear what specifically President Trump would or would not do with respect to these programs and initiatives, and what support he would have for any potential changes to such legislative programs and initiatives in the Unites States Congress, even if both the House of Representatives and Senate are controlled by the Republican Party. If President Trump and/or the United States Congress take action or publicly speak out about the need to eliminate or further reduce legislation, regulations and incentives supporting alternative energy, such actions may result in a decrease in demand for alternative energy in the United States and may materially harm our business, financial condition and operating results.

The unavailability, reduction, elimination or adverse application of government subsidies, incentives and regulations could have an adverse effect on our business, prospects, financial condition and operating results.

We believe that, currently, the availability of government subsidies and incentives including those available in New York, California and Chicago is an important factor considered by our customers when purchasing our vehicles, and that our growth depends in part on the availability and amounts of these subsidies and incentives. Any reduction, elimination or discriminatory application of government subsidies and incentives because of budgetary challenges, policy changes, the reduced need for such subsidies and incentives due to the perceived success of electric vehicles or other reasons may result in the diminished price competitiveness of the alternative fuel vehicle industry.

| 17 |

Certain regulations and programs that encourage sales of electric vehicles could be eliminated or applied in a way that adversely impacts sales of our commercial electric vehicles, either currently or at any time in the future. For example, the U.S. federal government and many state governments are experiencing political change and facing fiscal crises, which could result in the elimination of programs, subsidies and incentives that encourage the purchase of electric vehicles. If government subsidies and incentives to produce and purchase electric vehicles were no longer available to us or to our customers, or the amounts of such subsidies and incentives were reduced, our business and results of operations would be adversely affected.

We may be unable to keep up with changes in electric vehicle technology and, as a result, may suffer a decline in our competitive position.

Our current products are designed for use with, and are dependent upon, existing electric vehicle technology. As technologies change, we plan to upgrade or adapt our products to continue to provide products with the latest technology. However, our products may become obsolete or our research and development efforts may not be sufficient to adapt to changes in or to create the necessary technology. Thus, our potential inability to adapt and develop the necessary technology may harm our competitive position.

The failure of certain key suppliers to provide us with components could have a severe and negative impact upon our business.

We have secured supply agreements for our critical components including our batteries. However, the agreements are dependent on volume to ensure that they are available at a competitive price. Further, we rely on a small group of suppliers to provide us with components for our products. If these suppliers become unwilling or unable to provide components or if we are unable to meet certain volume requirements in our existing supply agreements, there are a limited number of alternative suppliers who could provide them and the price for them could be substantially higher. Changes in business conditions, wars, governmental changes, and other factors beyond our control or which we do not presently anticipate could negatively affect our ability to receive components from our suppliers. Further, it could be difficult to find replacement components if our current suppliers fail to provide the parts needed for these products. A failure by our major suppliers to provide these components could severely restrict our ability to manufacture our products and prevent us from fulfilling customer orders in a timely fashion.

Product liability or other claims could have a material adverse effect on our business.

The risk of product liability claims, product recalls, and associated adverse publicity is inherent in the manufacturing, marketing, and sale of electrical vehicles. Although we have product liability insurance for our consumer and commercial products, that insurance may be inadequate to cover all potential product claims. We also carry liability insurance on our products. Any product recall or lawsuit seeking significant monetary damages either in excess of our coverage, or outside of our coverage, may have a material adverse effect on our business and financial condition. We may not be able to secure additional product liability insurance coverage on acceptable terms or at reasonable costs when needed. A successful product liability claim against us could require us to pay a substantial monetary award. Moreover, a product recall could generate substantial negative publicity about our products and business and inhibit or prevent commercialization of other future product candidates. We cannot provide assurance that such claims and/or recalls will not be made in the future.

We may have to devote substantial resources to implementing a retail product distribution network.

Dealers are often hesitant to provide their own financing to contribute to our product distribution network. Thus, we anticipate that we may have to provide financing or other consignment sale arrangements for dealers. A capital investment such as this presents many risks, foremost among them being that we may not realize a significant return on our investment if the network is not profitable. Our inability to collect receivables from dealers could cause us to suffer losses. Additionally, the amount of time that our management will need to devote to this project may divert them from performing other functions necessary to assure the success of our business.

| 18 |

Regulatory requirements may have a negative impact upon our business.

While our vehicles are subject to substantial regulation under federal, state, and local laws, we believe that our vehicles are or will be materially in compliance with all applicable laws. However, to the extent the laws change, or if we introduce new vehicles in the future, some or all of our vehicles may not comply with applicable federal, state, or local laws. Further, certain federal, state, and local laws and industrial standards currently regulate electrical and electronics equipment. Although standards for electric vehicles are not yet generally available or accepted as industry standards, our products may become subject to federal, state, and local regulation in the future. Compliance with these regulations could be burdensome, time consuming, and expensive.

Our products are subject to environmental and safety compliance with various federal and state regulations, including regulations promulgated by the EPA, NHTSA, and various state boards, and compliance certification is required for each new model year. The cost of these compliance activities and the delays and risks associated with obtaining approval can be substantial. The risks, delays, and expenses incurred in connection with such compliance could be substantial.

Our success may be dependent on protecting our intellectual property rights.

We rely on trade secret protections to protect our proprietary technology as well as several registered patents and one patent application. Our patents relate to the vehicle chassis assembly, vehicle header and drive module and manifold for electric motor drive assembly. Our existing patent application relates to the onboard generator drive system for electric vehicles. Our success will, in part, depend on our ability to obtain additional trademarks and patents. We are working on obtaining patents and trademarks registered with the United States Patent and Trademark Office but have not finalized any as of this date. Although we have entered into confidentiality agreements with our employees and consultants, we cannot be certain that others will not gain access to these trade secrets. Others may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets.

Our business may be adversely affected by union activities.

Although none of our employees are currently represented by a labor union, it is common throughout the automotive industry for many employees at automotive companies to belong to a union, which can result in higher employee costs and increased risk of work stoppages. Our employees may join or seek recognition to form a labor union, or we may be required to become a union signatory. Our production facility in Union City, Indiana was purchased from Navistar. Prior employees of Navistar were union members and our future work force at this facility may be inclined to vote in favor of forming a labor union. Furthermore, we are directly or indirectly dependent upon companies with unionized work forces, such as parts suppliers and trucking and freight companies, and work stoppages or strikes organized by such unions could have a material adverse impact on our business, financial condition or operating results. If a work stoppage occurs, it could delay the manufacture and sale of our trucks and have a material adverse effect on our business, prospects, operating results or financial condition. The mere fact that our labor force could be unionized may harm our reputation in the eyes of some investors and thereby negatively affect our stock price. Consequently, the unionization of our labor force could negatively impact our company’s health.

We may be exposed to liability for infringing upon the intellectual property rights of other companies.

Our success will, in part, depend on our ability to operate without infringing on the proprietary rights of others. Although we have conducted searches and are not aware of any patents and trademarks which our products or their use might infringe, we cannot be certain that infringement has not or will not occur. We could incur substantial costs, in addition to the great amount of time lost, in defending any patent or trademark infringement suits or in asserting any patent or trademark rights, in a suit with another party.

| 19 |

Our electric vehicles make use of lithium-ion battery cells, which, if not appropriately managed and controlled, have occasionally been observed to catch fire or vent smoke and flames. If such events occur in our electric vehicles, we could face liability for damage or injury, adverse publicity and a potential safety recall, any of which would adversely affect our business, prospects, financial condition and operating results.

The battery packs in our electric vehicles use lithium-ion cells, which have been used for years in laptop computers and cell phones. On occasion, if not appropriately managed and controlled, lithium-ion cells can rapidly release the energy they contain by venting smoke and flames in a manner that can ignite nearby materials. Highly publicized incidents of laptop computers and cell phones bursting into flames have focused consumer attention on the safety of these cells. These events also have raised questions about the suitability of these lithium-ion cells for automotive applications. There can be no assurance that a field failure of our battery packs will not occur, which would damage the vehicle or lead to personal injury or death and may subject us to lawsuits. Furthermore, there is some risk of electrocution if individuals who attempt to repair battery packs on our vehicles do not follow applicable maintenance and repair protocols. Any such damage or injury would likely lead to adverse publicity and potentially a safety recall. Any such adverse publicity could adversely affect our business, prospects, financial condition and operating results.

Our facilities could be damaged or adversely affected as a result of disasters or other unpredictable events. Any prolonged disruption in the operations of our facility would adversely affect our business, prospects, financial condition and operating results.

We engineer and assemble our electric vehicles in a facility in Loveland, Ohio and we intend to locate the assembly function to our facility in Union City. Any prolonged disruption in the operations of our facility, whether due to technical, information systems, communication networks, accidents, weather conditions or other natural disaster, or otherwise, whether short or long-term, would adversely affect our business, prospects, financial condition and operating results.

We may be exposed to potential risks relating to our internal controls over financial reporting and our ability to have those controls attested to by our independent auditors.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX 404”), the Securities and Exchange Commission adopted rules requiring smaller reporting companies, such as our company, to include a report of management on the company’s internal controls over financial reporting in their annual reports for fiscal years ending on or after December 15, 2007. We were required to include the management report in annual reports starting with the year ending December 31, 2009. Previous SEC rules required a non-accelerated filer to include an attestation report in its annual report for years ending on or after June 15, 2010. Section 989G of the Dodd-Frank Act added SOX Section 404(c) to exempt from the attestation requirement smaller issuers that are neither accelerated filers nor large accelerated filers under Rule 12b-2. Under Rule 12b-2, subject to periodic and annual reporting criteria, an “accelerated filer” is an issuer with market value of $75 million, but less than $700 million; a “large accelerated filer” is an issuer with market value of $700 million or greater. As a result, the exemption effectively applies to companies with less than $75 million in market capitalization. We expect that this exemption will continue to not apply to us during the year ended December 31, 2017 and we will have to come into compliance with such rules. Attaining compliance with such rules will take substantial management and financial resources, and there will be no assurance that we will be able to do so.

| 20 |

Risks Related to Owning Our Common Stock

If we fail to continue to meet the listing standards of NASDAQ, our common stock may be delisted, which could have a material adverse effect on the liquidity of our common stock.