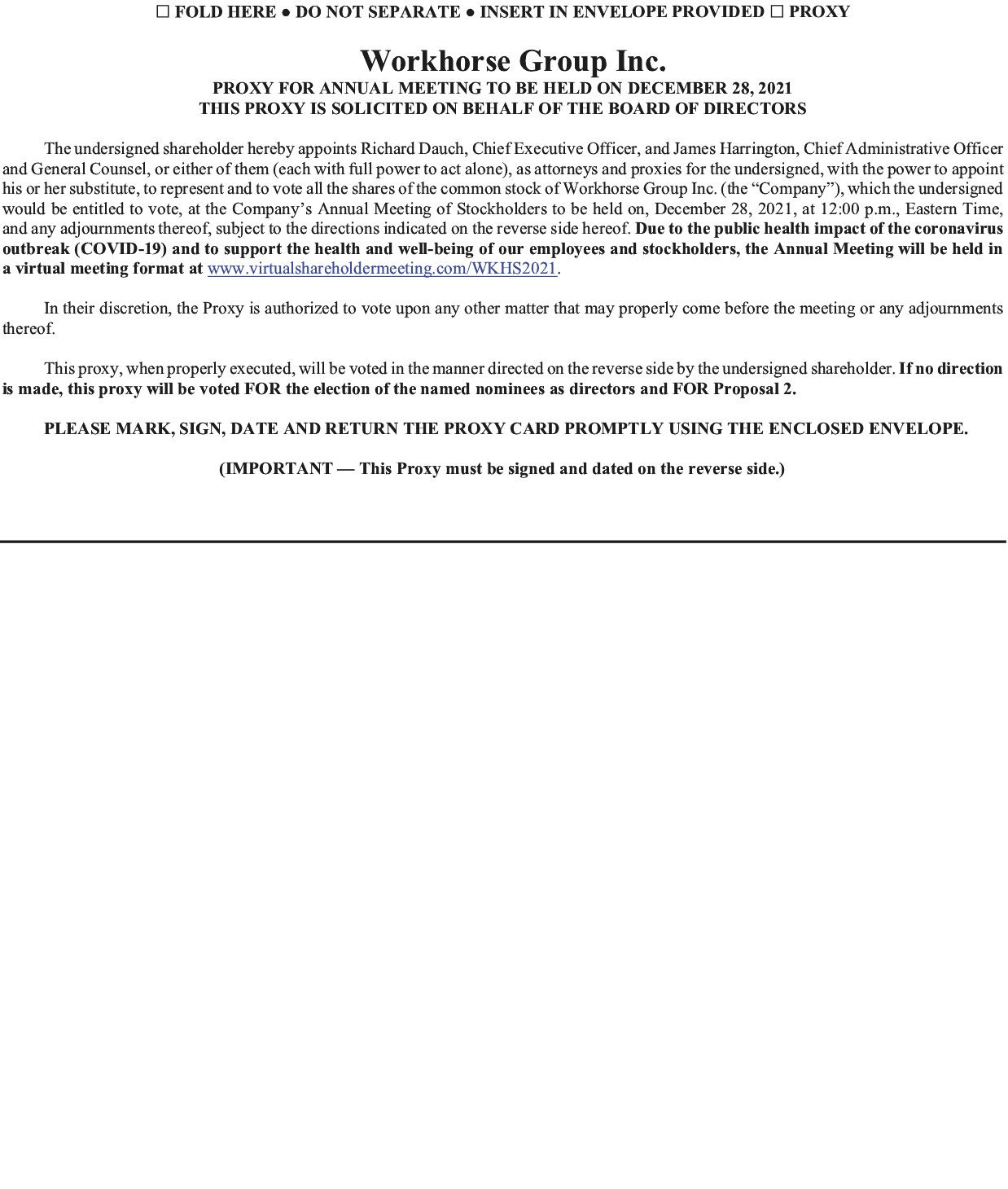

OTHER MATTERS

The Board of Directors knows of no other business which will be presented at the Annual Meeting. If any other matters properly come before the meeting, the persons named in the enclosed Proxy, or their substitutes, will vote the shares represented thereby in accordance with their judgment on such matters.

ADDITIONAL INFORMATION

Transactions with Related Persons

The Company obtains its property and casualty insurance through AssuredPartners NL, LLC (“Assured”). Gerald Budde, a director of the Company, is Vice President, Corporate Finance of AssuredPartners, Inc., the parent company of AssuredPartners Capital, Inc. and its subsidiary, AssuredPartners NL, LLC. The placement of insurance was completed by an agent outside of the Eastern Region (of which Mr. Budde was previously Chief Financial Officer) and Mr. Budde did not participate in any decisions about insurance, nor was he paid any portion of the brokerage fee. Assured earned brokerage fees of approximately $121,000 and $86,000 for the years ended December 31, 2020 and 2019, respectively.

Other than noted above, at no other time during the last two fiscal years has any executive officer, director or any member of these individuals’ immediate families, any corporation or organization with whom any of these individuals is an affiliate or any trust or estate in which any of these individuals serves as a trustee or in a similar capacity or has a substantial beneficial interest been indebted to the Company or was involved in any transaction in which the amount exceeded $120,000 and such person had a direct or indirect material interest.

Procedures for Approval of Related Party Transactions

Our Board of Directors is charged with reviewing and approving all potential related party transactions. All such related party transactions must then be reported under applicable SEC rules. We have not adopted other procedures for review, or standards for approval, of such transactions, but instead review them on a case-by-case basis.

Director Independence

The Board of Directors has determined that Raymond Chess, Gerald Budde, H. Benjamin Samuels, Michael Clark, Harry DeMott, Pamela Mader and Jacqueline Dedo each qualify as independent directors under the listing standards of the Nasdaq.

Annual Reports on Form 10-K

Additional copies of Workhorse’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 may be obtained without charge by writing to the Chief Administrative Officer and General Counsel, Workhorse Group Inc., 100 Commerce Drive, Loveland, Ohio 45140. Workhorse’s Annual Report on Form 10-K can also be found on Workhorse’s website: www.workhorse.com.

Stockholders Proposals for the 2022 Annual Meeting

The Company expects its next annual meeting to occur in May 2022. Accordingly, stockholder proposals intended to be presented at the Company’s 2022 annual meeting must be received by the Company no later than January 4, 2022 (pursuant to Rule 14a-8 of the Exchange Act, this deadline is a reasonable time before we expect to mail proxy statements for our 2022 annual meeting to be eligible for inclusion in the Company’s proxy statement and form of proxy for next year’s meeting). Proposals should be addressed to Workhorse Group Inc., Attn. Chief Administrative Officer and General Counsel, 100 Commerce Drive, Loveland, Ohio 45140.

For any proposal that is not submitted for inclusion in next year’s proxy statement (as described in the preceding paragraph), but is instead sought to be presented directly at the 2022 annual meeting, the federal securities laws require stockholders to give advance notice of such proposals. The required notice must (pursuant to Rule 14a-4 of the Exchange Act) be given a reasonable time before we expect to mail proxy statements for our 2022 annual meeting. Accordingly, with respect to the Company’s 2022 annual meeting of stockholders, notice must be provided to Workhorse Group Inc., Attn. Chief Administrative Officer and General Counsel, 100 Commerce Drive, Loveland, Ohio 45140 no later than January 4, 2022. If a stockholder fails to provide timely notice of a proposal to be presented at the 2022 annual meeting, the chair of the meeting will declare it out of order and disregard any such matter.